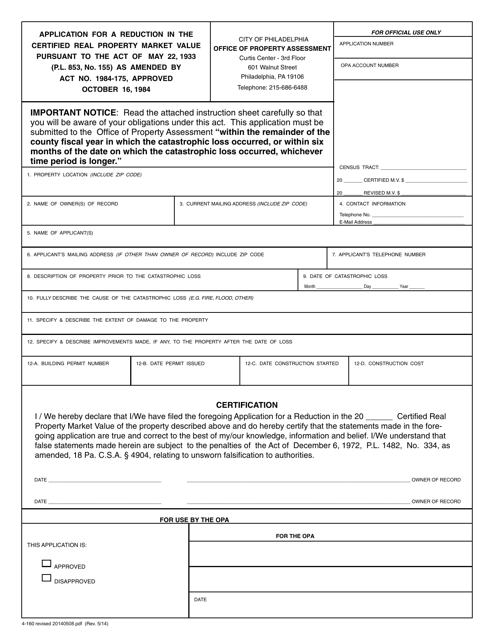

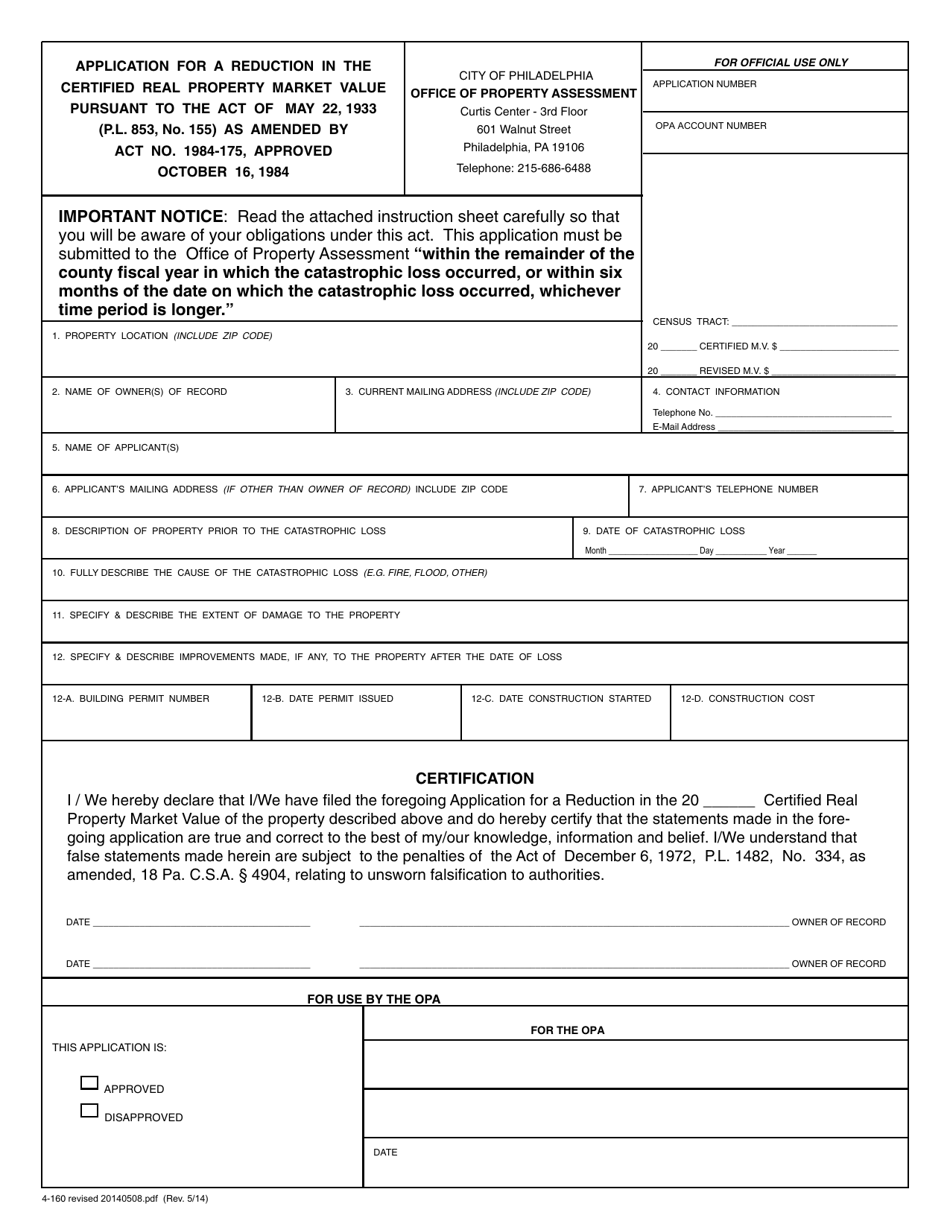

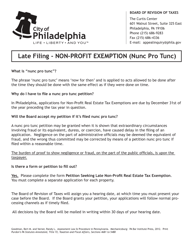

Form 4-160 Application for a Catastrophic Loss Real Estate Tax Adjustment - City of Philadelphia, Pennsylvania

What Is Form 4-160?

This is a legal form that was released by the Office of Property Assessment - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 4-160?

A: Form 4-160 is an application for a Catastrophic Loss Real Estate Tax Adjustment in the City of Philadelphia, Pennsylvania.

Q: What is a Catastrophic Loss Real Estate Tax Adjustment?

A: A Catastrophic Loss Real Estate Tax Adjustment is a reduction in property taxes for properties that have been significantly damaged due to a catastrophic event, such as a fire or flood.

Q: Who can apply for a Catastrophic Loss Real Estate Tax Adjustment in Philadelphia?

A: Property owners in the City of Philadelphia that have experienced significant damage due to a catastrophic event can apply for a Catastrophic Loss Real Estate Tax Adjustment.

Q: How do I apply for a Catastrophic Loss Real Estate Tax Adjustment?

A: To apply for a Catastrophic Loss Real Estate Tax Adjustment in Philadelphia, you need to complete Form 4-160 and submit it to the Office of Property Assessment.

Q: Is there a deadline to apply for a Catastrophic Loss Real Estate Tax Adjustment?

A: Yes, there is a deadline to apply for a Catastrophic Loss Real Estate Tax Adjustment in Philadelphia. It is typically within 30 days of the catastrophic event.

Q: What documents do I need to include with my application?

A: You will need to include documentation of the catastrophic event, such as police or fire department reports, photographs of the damage, and repair estimates or insurance claims.

Q: Will my property taxes be reduced immediately after applying?

A: No, your property taxes will not be reduced immediately after applying for a Catastrophic Loss Real Estate Tax Adjustment. The Office of Property Assessment will review your application and make a determination.

Q: How long does it take to receive a decision on my application?

A: The timeline for receiving a decision on your application for a Catastrophic Loss Real Estate Tax Adjustment can vary, but it is typically within a few months.

Q: What happens if my application is approved?

A: If your application is approved, your property taxes will be adjusted for the tax year in which the catastrophic event occurred.

Q: Can I appeal if my application is denied?

A: Yes, if your application for a Catastrophic Loss Real Estate Tax Adjustment is denied, you have the right to appeal the decision.

Form Details:

- Released on May 1, 2014;

- The latest edition provided by the Office of Property Assessment - City of Philadelphia, Pennsylvania;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4-160 by clicking the link below or browse more documents and templates provided by the Office of Property Assessment - City of Philadelphia, Pennsylvania.