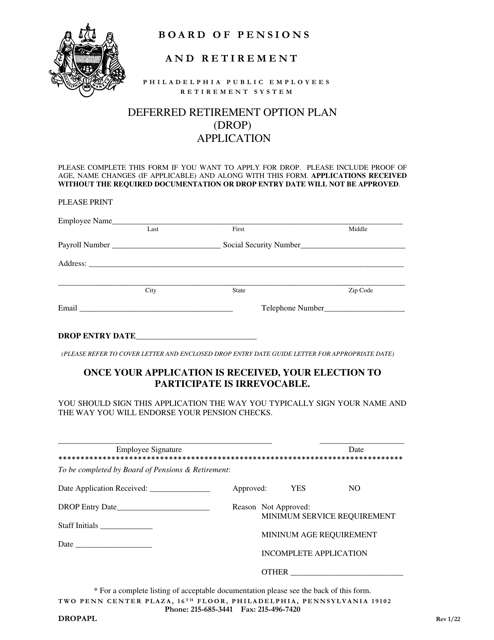

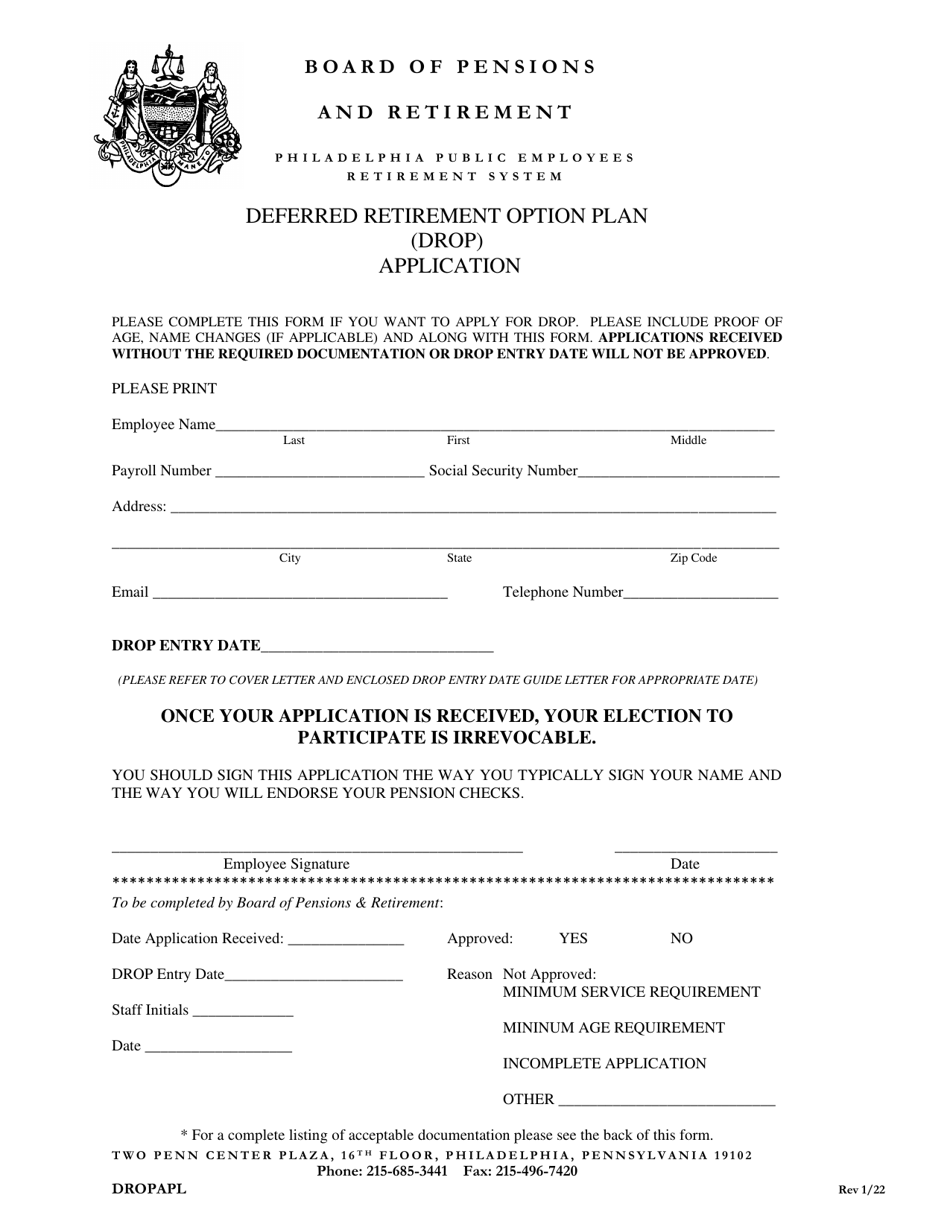

Deferred Retirement Option Plan (Drop) Application - City of Philadelphia, Pennsylvania

Deferred Retirement Option Plan (Drop) Application is a legal document that was released by the Board of Pensions and Retirement - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is the Deferred Retirement Option Plan (DROP)?

A: The Deferred Retirement Option Plan (DROP) is a program offered by the City of Philadelphia for eligible employees to accumulate a lump sum of money while continuing to work beyond their normal retirement date.

Q: Who is eligible for the DROP program in the City of Philadelphia?

A: Eligibility for the DROP program in the City of Philadelphia varies depending on the employee's retirement system. Generally, it is available to members of the Philadelphia Board of Pensions and Retirement and Philadelphia Police and Fire Retirement System who have reached the minimum age and service requirements.

Q: What is the purpose of the DROP program?

A: The purpose of the DROP program is to provide an incentive for experienced employees to continue their service while accumulating a lump sum of money, which is paid out upon their final retirement.

Q: How does the DROP program work?

A: Under the DROP program, eligible employees who choose to participate will stop accruing additional pension benefits while continuing to work. Instead, their pension benefits will be deposited into a separate account, earning interest, and paid out as a lump sum upon their final retirement.

Q: Can participants in the DROP program continue to work after their DROP date?

A: No, participants in the DROP program must retire and terminate their employment after their DROP date. They cannot continue working for the City of Philadelphia.

Q: What happens if a participant in the DROP program dies before their final retirement?

A: If a participant in the DROP program dies before their final retirement, the accumulated DROP funds will be paid to their designated beneficiary or estate.

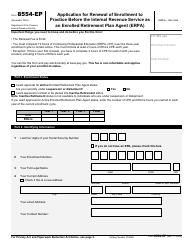

Q: How can an employee apply for the DROP program?

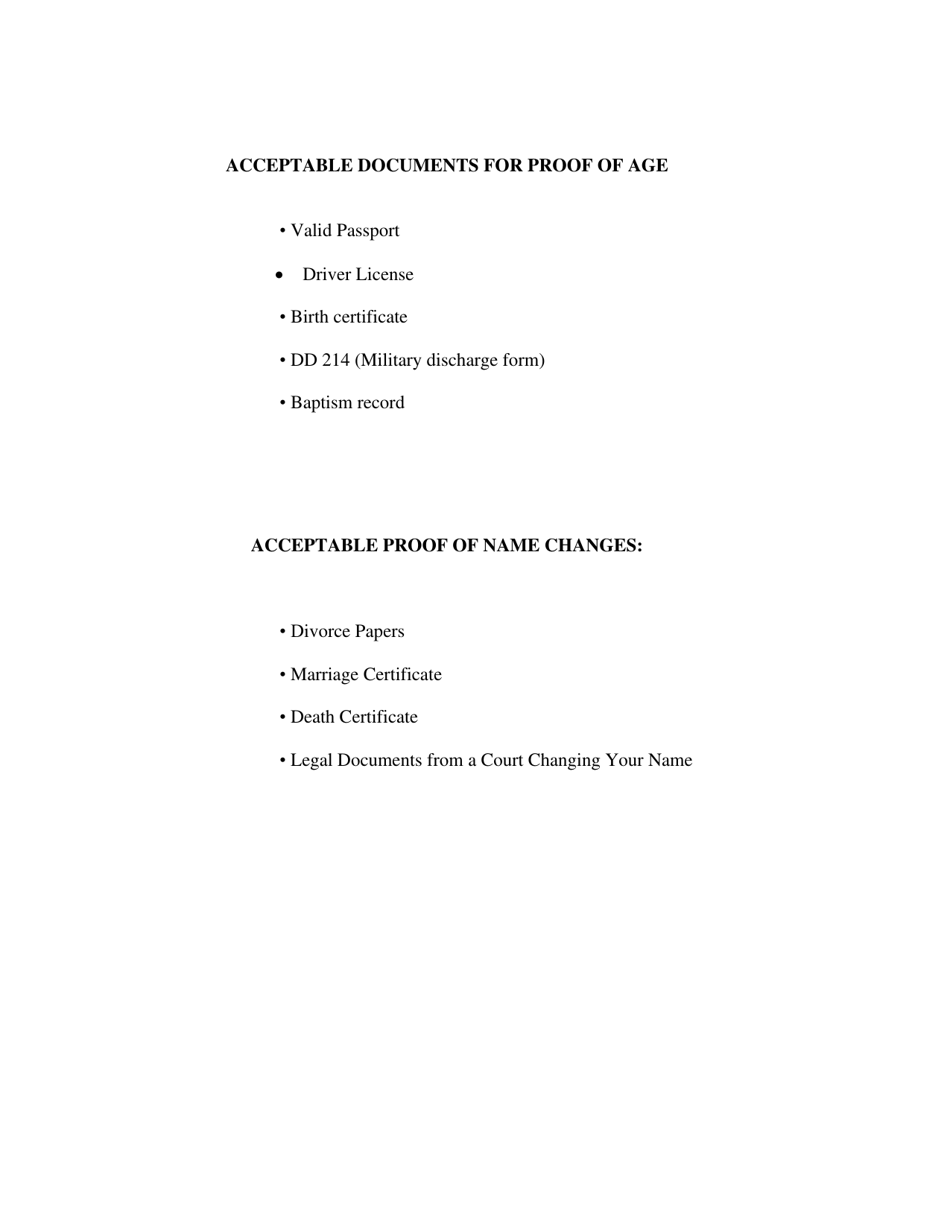

A: Employees who are eligible for the DROP program must submit a DROP application to their respective retirement system. The application will include information about the participant's desired DROP date and other required documentation.

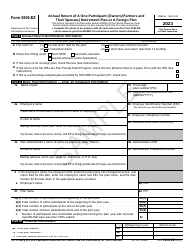

Q: Are there any tax implications associated with the DROP program?

A: Yes, there may be tax implications associated with participating in the DROP program. It is advisable for participants to consult with a tax advisor or accountant to understand the potential tax consequences.

Form Details:

- Released on January 1, 2022;

- The latest edition currently provided by the Board of Pensions and Retirement - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Board of Pensions and Retirement - City of Philadelphia, Pennsylvania.