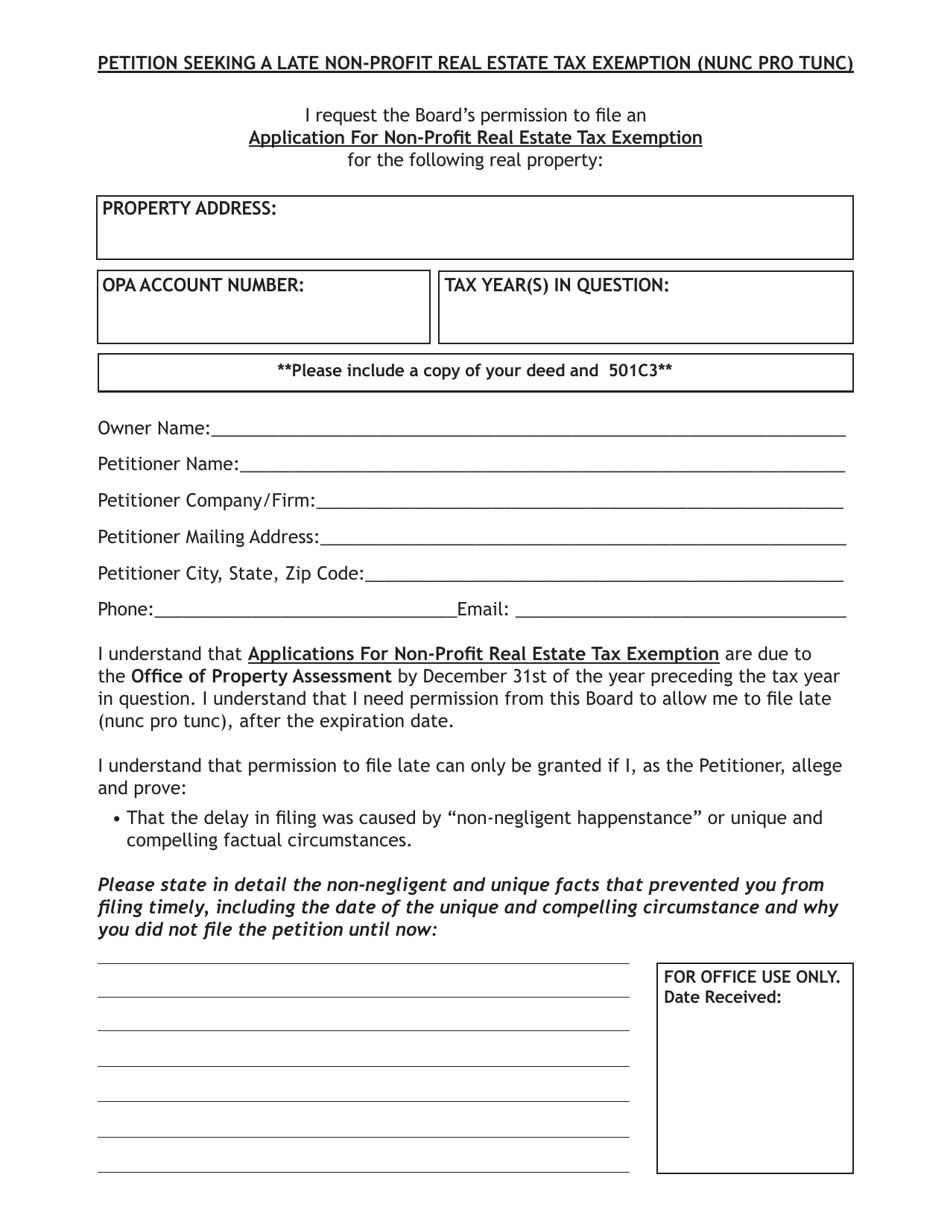

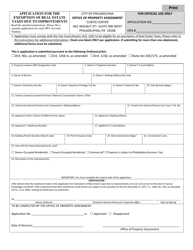

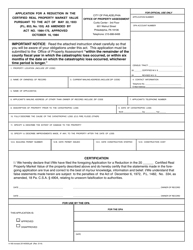

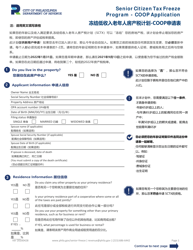

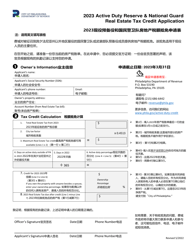

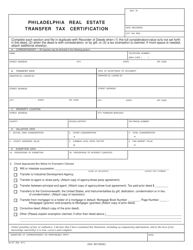

Petition Seeking a Late Non-profit Real Estate Tax Exemption (Nunc Pro Tunc) - City of Philadelphia, Pennsylvania

Petition Seeking a Late Non-profit Real Estate Tax Exemption (Nunc Pro Tunc) is a legal document that was released by the Board of Revision of Taxes - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is a late non-profit real estate tax exemption?

A: A late non-profit real estate tax exemption is a request to exempt a property owned by a non-profit organization from paying real estate taxes, even if the application was submitted after the deadline.

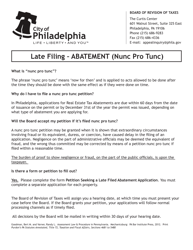

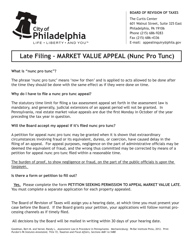

Q: What is a Nunc Pro Tunc petition?

A: A Nunc Pro Tunc petition is a legal term that means 'now for then.' In this context, it refers to a petition filed to request a retroactive exemption from real estate taxes.

Q: Who can file a late non-profit real estate tax exemption petition?

A: Only non-profit organizations that meet the eligibility criteria set by the City of Philadelphia, Pennsylvania, can file a late non-profit real estate tax exemption petition.

Q: What is the purpose of a non-profit real estate tax exemption?

A: The purpose of a non-profit real estate tax exemption is to alleviate the tax burden on non-profit organizations, allowing them to dedicate more resources to their charitable activities.

Q: Are all non-profit organizations eligible for a tax exemption?

A: No, only non-profit organizations that meet specific criteria outlined by the City of Philadelphia, Pennsylvania, are eligible for a real estate tax exemption.

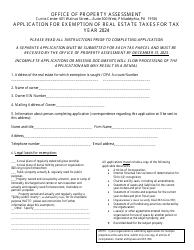

Q: What is the process for filing a late non-profit real estate tax exemption petition?

A: The process for filing a late non-profit real estate tax exemption petition involves submitting a completed application form, supporting documentation, and paying any required fees to the City of Philadelphia.

Q: Are there any deadlines for filing a late non-profit real estate tax exemption petition?

A: Yes, there are specific deadlines for filing a late non-profit real estate tax exemption petition. It is important to consult the City of Philadelphia's guidelines for the current deadlines and requirements.

Q: Is approval guaranteed for a late non-profit real estate tax exemption petition?

A: No, approval for a late non-profit real estate tax exemption petition is not guaranteed. The City of Philadelphia will review each application and make a determination based on the eligibility criteria and supporting documentation.

Q: Can a non-profit organization receive a refund for previous years' real estate taxes if their petition is approved?

A: If a non-profit organization's late non-profit real estate tax exemption petition is approved, they may be eligible for a refund of real estate taxes paid for previous years, depending on the circumstances.

Form Details:

- The latest edition currently provided by the Board of Revision of Taxes - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Board of Revision of Taxes - City of Philadelphia, Pennsylvania.