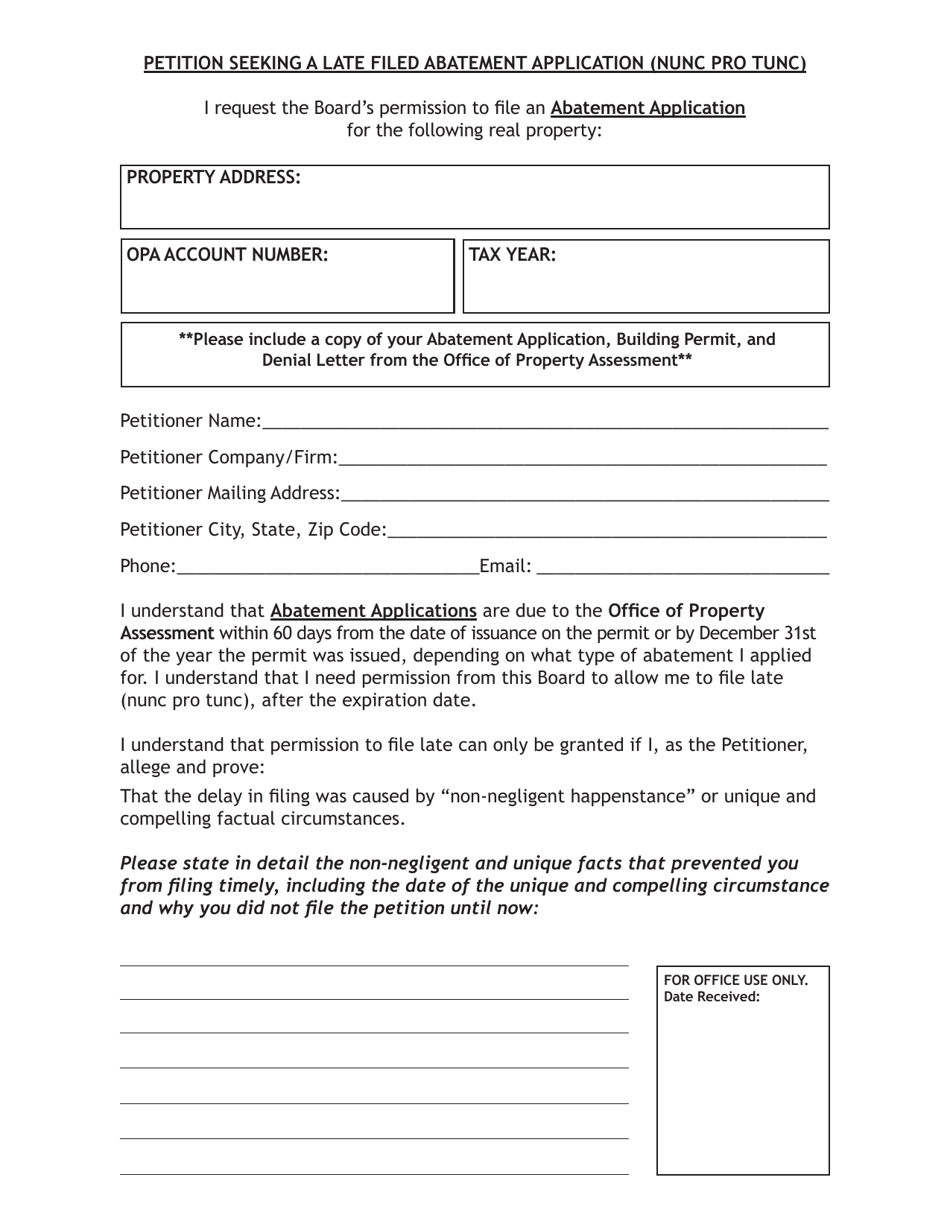

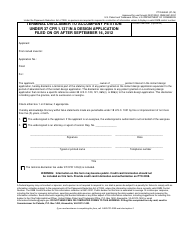

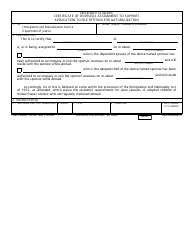

Petition Seeking a Late Filed Abatement Application (Nunc Pro Tunc) - City of Philadelphia, Pennsylvania

Petition Seeking a Late Filed Abatement Application (Nunc Pro Tunc) is a legal document that was released by the Board of Revision of Taxes - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

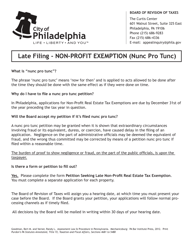

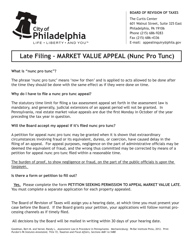

Q: What is a late filed abatement application (nunc pro tunc)?

A: A late filed abatement application (nunc pro tunc) is a petition filed after the deadline for a property tax abatement in the City of Philadelphia, Pennsylvania.

Q: Why would someone file a late filed abatement application?

A: Someone may file a late filed abatement application if they missed the original deadline for a property tax abatement.

Q: What is the City of Philadelphia's property tax abatement?

A: The City of Philadelphia's property tax abatement is a program that provides a temporary reduction or elimination of property taxes on qualifying new construction or improvements.

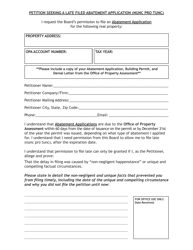

Q: How can I file a late filed abatement application in the City of Philadelphia?

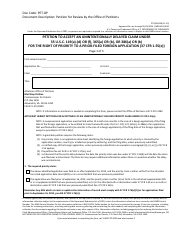

A: To file a late filed abatement application in the City of Philadelphia, you need to submit a petition seeking a late filed abatement application (nunc pro tunc).

Q: What should I include in a petition seeking a late filed abatement application?

A: In a petition seeking a late filed abatement application, you should include the reasons for missing the original deadline and any supporting documentation.

Q: Is there a deadline for filing a late filed abatement application?

A: Yes, there is a deadline for filing a late filed abatement application in the City of Philadelphia. You should consult the City's official guidelines or contact the appropriate department for the specific deadline.

Q: Will filing a late filed abatement application guarantee approval?

A: Filing a late filed abatement application does not guarantee approval. The City of Philadelphia will review your petition and make a determination based on the merits of your case.

Q: Are there any fees associated with filing a late filed abatement application?

A: There may be fees associated with filing a late filed abatement application in the City of Philadelphia. You should consult the City's official guidelines or contact the appropriate department for information on the fees.

Q: Can I appeal if my late filed abatement application is denied?

A: Yes, you can appeal if your late filed abatement application is denied. You should follow the City's official appeal process for property tax abatements.

Form Details:

- The latest edition currently provided by the Board of Revision of Taxes - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Board of Revision of Taxes - City of Philadelphia, Pennsylvania.