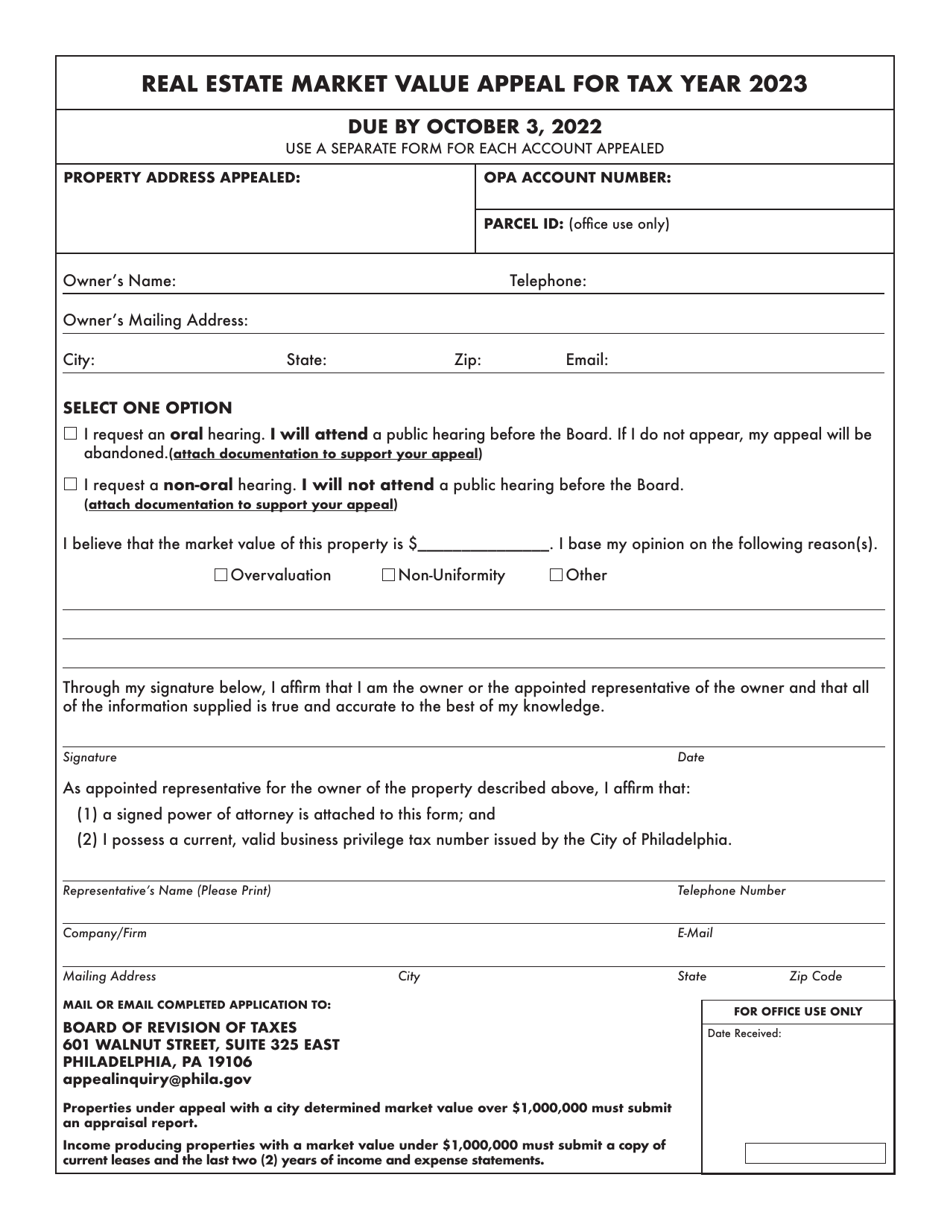

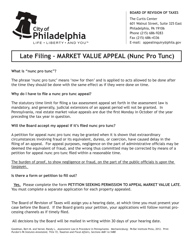

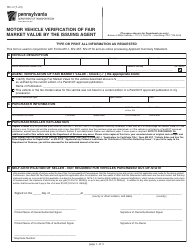

Real Estate Market Value Appeal - City of Philadelphia, Pennsylvania

Real Estate Market Value Appeal is a legal document that was released by the Board of Revision of Taxes - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

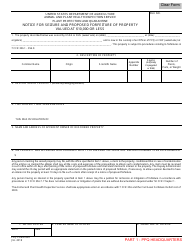

Q: What is a real estate market value appeal?

A: A real estate market value appeal is a process by which property owners can challenge the assessed value of their property for the purpose of property taxes.

Q: Who can file a real estate market value appeal in Philadelphia, Pennsylvania?

A: Property owners in the City of Philadelphia, Pennsylvania can file a real estate market value appeal.

Q: Why would someone file a real estate market value appeal?

A: Someone might file a real estate market value appeal if they believe that the assessed value of their property is inaccurate or unfair, which can affect the amount of property taxes they owe.

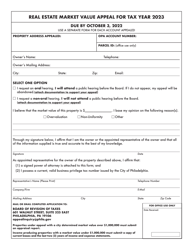

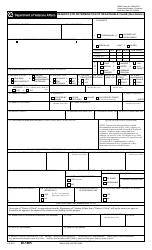

Q: How can someone file a real estate market value appeal in Philadelphia, Pennsylvania?

A: To file a real estate market value appeal in Philadelphia, Pennsylvania, property owners must submit an appeal form to the Office of Property Assessment (OPA), along with any supporting evidence.

Q: When is the deadline to file a real estate market value appeal in Philadelphia, Pennsylvania?

A: The deadline to file a real estate market value appeal in Philadelphia, Pennsylvania is typically the first Monday in October each year.

Q: What happens after someone files a real estate market value appeal?

A: After filing a real estate market value appeal, the OPA will review the appeal and may schedule a hearing to further evaluate the property's assessed value. Property owners will be notified of the outcome of their appeal.

Q: Can a real estate market value appeal result in a lower property tax bill?

A: Yes, if a real estate market value appeal is successful in proving that the assessed value of the property is too high, it can result in a lower property tax bill for the property owner.

Q: Are there any fees associated with filing a real estate market value appeal?

A: Yes, there is a filing fee associated with filing a real estate market value appeal in Philadelphia, Pennsylvania. The fee amount may vary each year.

Q: Can someone hire a professional to assist with a real estate market value appeal?

A: Yes, property owners can hire a professional, such as a real estate appraiser or attorney, to assist with their real estate market value appeal.

Form Details:

- The latest edition currently provided by the Board of Revision of Taxes - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Board of Revision of Taxes - City of Philadelphia, Pennsylvania.