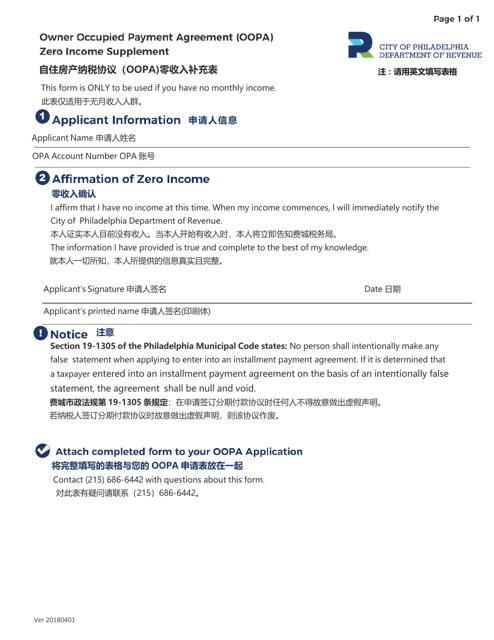

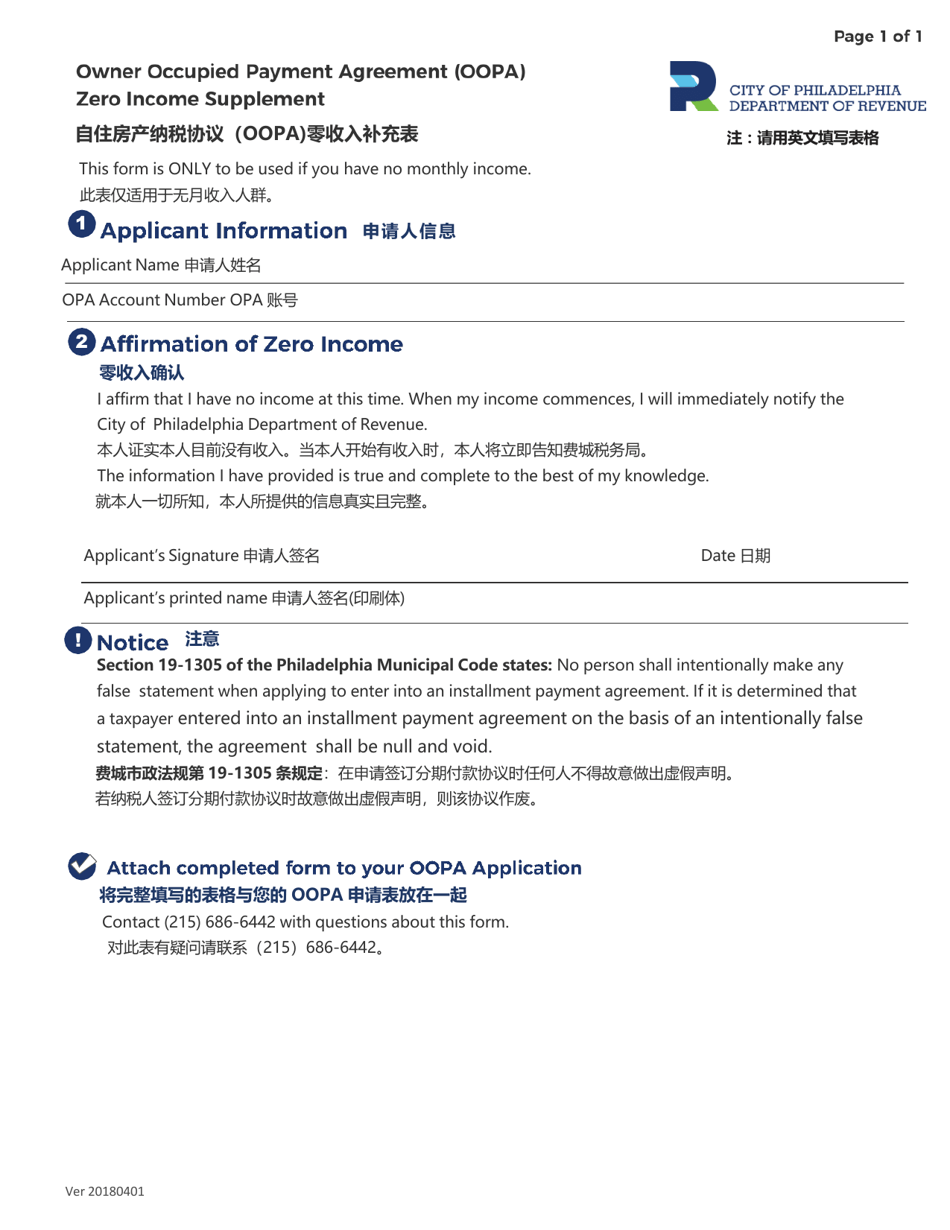

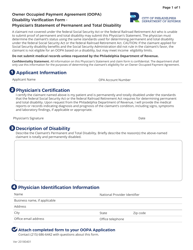

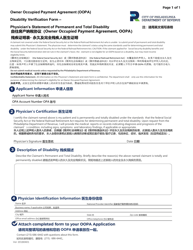

Owner Occupied Payment Agreement (Oopa) Zero Income Worksheet - City of Philadelphia, Pennsylvania (English / Chinese)

Owner Occupied Payment Agreement (Oopa) Zero Income Worksheet is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is the Owner Occupied Payment Agreement (Oopa) Zero Income Worksheet?

A: The Owner Occupied Payment Agreement (OOPA) Zero Income Worksheet is a document used by residents in Philadelphia, Pennsylvania to declare zero income for the purpose of qualifying for a payment plan for property taxes.

Q: Who can use the Owner Occupied Payment Agreement (Oopa) Zero Income Worksheet?

A: Residents in Philadelphia, Pennsylvania who own and occupy their property and have no income can use the OOPA Zero Income Worksheet.

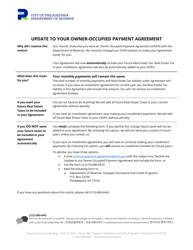

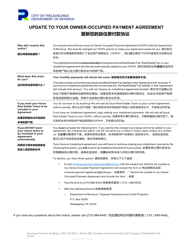

Q: What is the purpose of the Owner Occupied Payment Agreement (Oopa)?

A: The purpose of the Owner Occupied Payment Agreement (OOPA) is to provide eligible property owners in Philadelphia, Pennsylvania with a payment plan option to help them afford their property tax payments.

Q: How does the Owner Occupied Payment Agreement (Oopa) Zero Income Worksheet work?

A: The OOPA Zero Income Worksheet allows residents with zero income to declare their financial situation and qualify for a payment plan based on their ability to pay.

Q: What is the City of Philadelphia, Pennsylvania offering for property tax payment assistance?

A: The City of Philadelphia, Pennsylvania is offering the Owner Occupied Payment Agreement (OOPA) as a payment plan option for eligible property owners who may have difficulty paying their property taxes.

Q: Is the Owner Occupied Payment Agreement (Oopa) available in languages other than English?

A: Yes, the Owner Occupied Payment Agreement (OOPA) is available in both English and Chinese languages for the convenience of Philadelphia residents.

Q: Is the Owner Occupied Payment Agreement (Oopa) only for Philadelphia residents?

A: Yes, the Owner Occupied Payment Agreement (OOPA) is specifically designed for residents of Philadelphia, Pennsylvania.

Q: Can I use the Owner Occupied Payment Agreement (Oopa) if I have some income but still need assistance?

A: Yes, even if you have some income but are still facing financial difficulties, you may be eligible for the OOPA payment plan. The program takes into account your ability to pay.

Form Details:

- Released on April 1, 2018;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.