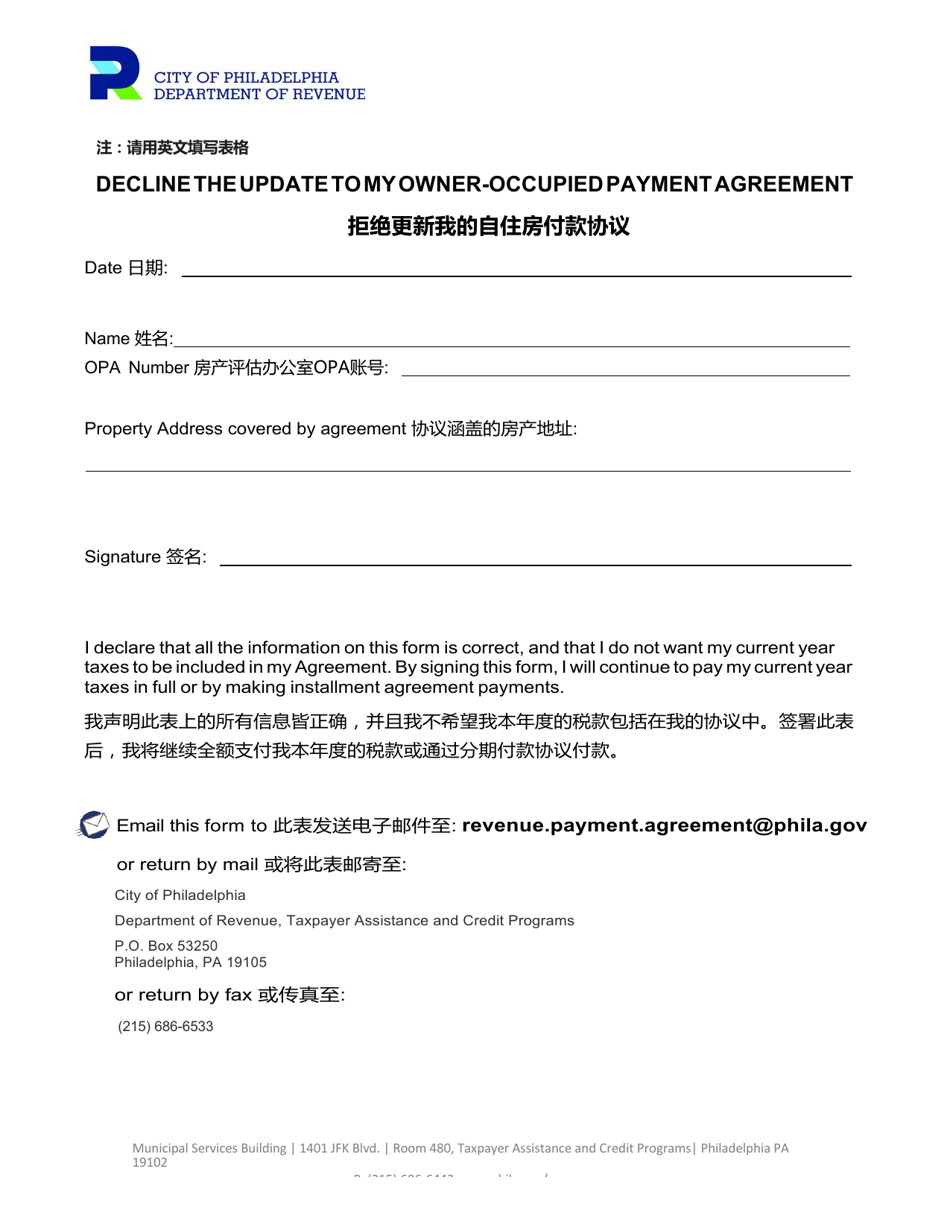

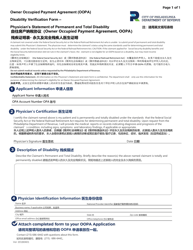

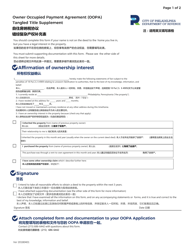

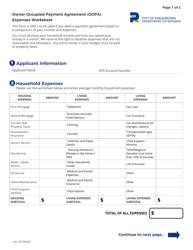

Owner-Occupied Payment Agreement (Oopa) Opt-Out Form - City of Philadelphia, Pennsylvania (English / Chinese)

Owner-Occupied Payment Agreement (Oopa) Opt-Out Form is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

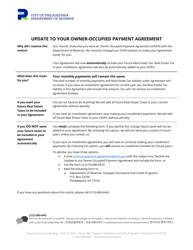

Q: What is an Owner-Occupied Payment Agreement (OOPA)?

A: OOPA is a program offered by the City of Philadelphia that allows eligible homeowners to pay delinquent property taxes in manageable monthly installments.

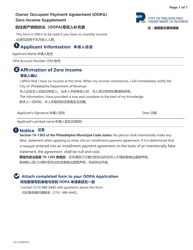

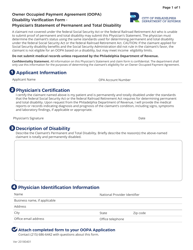

Q: Who is eligible for OOPA?

A: Eligible homeowners must meet certain criteria, such as owning and occupying the property as their primary residence.

Q: What is the Opt-Out Form?

A: The Opt-Out Form allows homeowners to decline participation in the OOPA program.

Q: Is the Opt-Out Form available in other languages?

A: Yes, the Opt-Out Form is available in both English and Chinese.

Q: Can I opt out of OOPA if I have already enrolled?

A: No, once you have enrolled in OOPA, you cannot opt out of the program.

Q: What are the benefits of participating in OOPA?

A: OOPA allows homeowners to avoid foreclosure and make affordable monthly payments to catch up on delinquent property taxes.

Q: Are there any fees associated with OOPA?

A: Yes, homeowners are responsible for paying a nominal participation fee.

Q: Can I enroll in OOPA if I am not a homeowner?

A: No, OOPA is only available to eligible homeowners.

Q: Who can I contact for more information about OOPA?

A: For more information about OOPA, you can contact the Philadelphia Department of Revenue.

Form Details:

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.