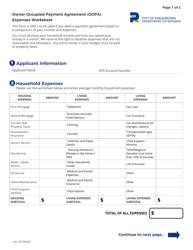

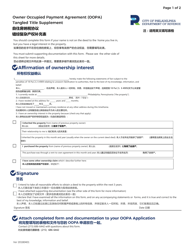

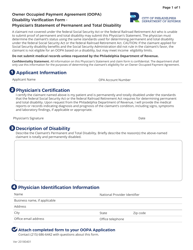

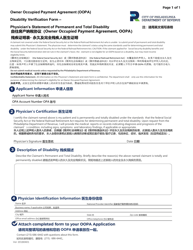

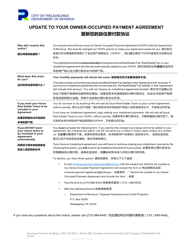

Owner Occupied Payment Agreement (Oopa) Zero Income Worksheet - City of Philadelphia, Pennsylvania

Owner Occupied Payment Agreement (Oopa) Zero Income Worksheet is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

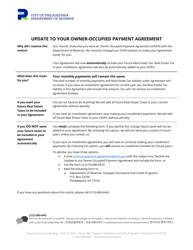

Q: What is the Owner Occupied Payment Agreement (Oopa)?

A: Oopa is a payment agreement offered by the City of Philadelphia, Pennsylvania for homeowners with delinquent property taxes.

Q: What is the Zero Income Worksheet?

A: The Zero Income Worksheet is a form that allows homeowners to declare their zero income status.

Q: Who is eligible for Oopa?

A: Homeowners in Philadelphia with delinquent property taxes may be eligible for Oopa.

Q: How does Oopa work?

A: Oopa allows eligible homeowners to enter into a monthly payment plan to pay off their delinquent property taxes.

Q: What is the purpose of the Zero Income Worksheet?

A: The Zero Income Worksheet is used to determine if a homeowner qualifies for a reduced monthly payment under Oopa due to having no income.

Q: What should I do if I qualify for Oopa?

A: If you qualify for Oopa, you should contact the appropriate city department handling property taxes to begin the application process.

Q: What happens if I don't pay my property taxes in Philadelphia?

A: Failure to pay property taxes in Philadelphia may result in penalties, interest, and potentially the loss of your property.

Q: Can Oopa help me avoid losing my property?

A: Oopa is designed to help homeowners with delinquent property taxes avoid the loss of their property by providing a manageable payment plan.

Q: Are there income limitations for Oopa?

A: There may be income limitations for participation in Oopa. Contact the appropriate city department handling property taxes for more information.

Form Details:

- Released on April 1, 2018;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.