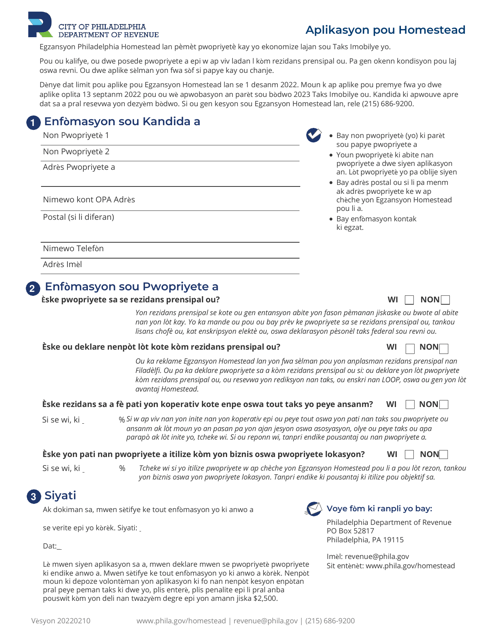

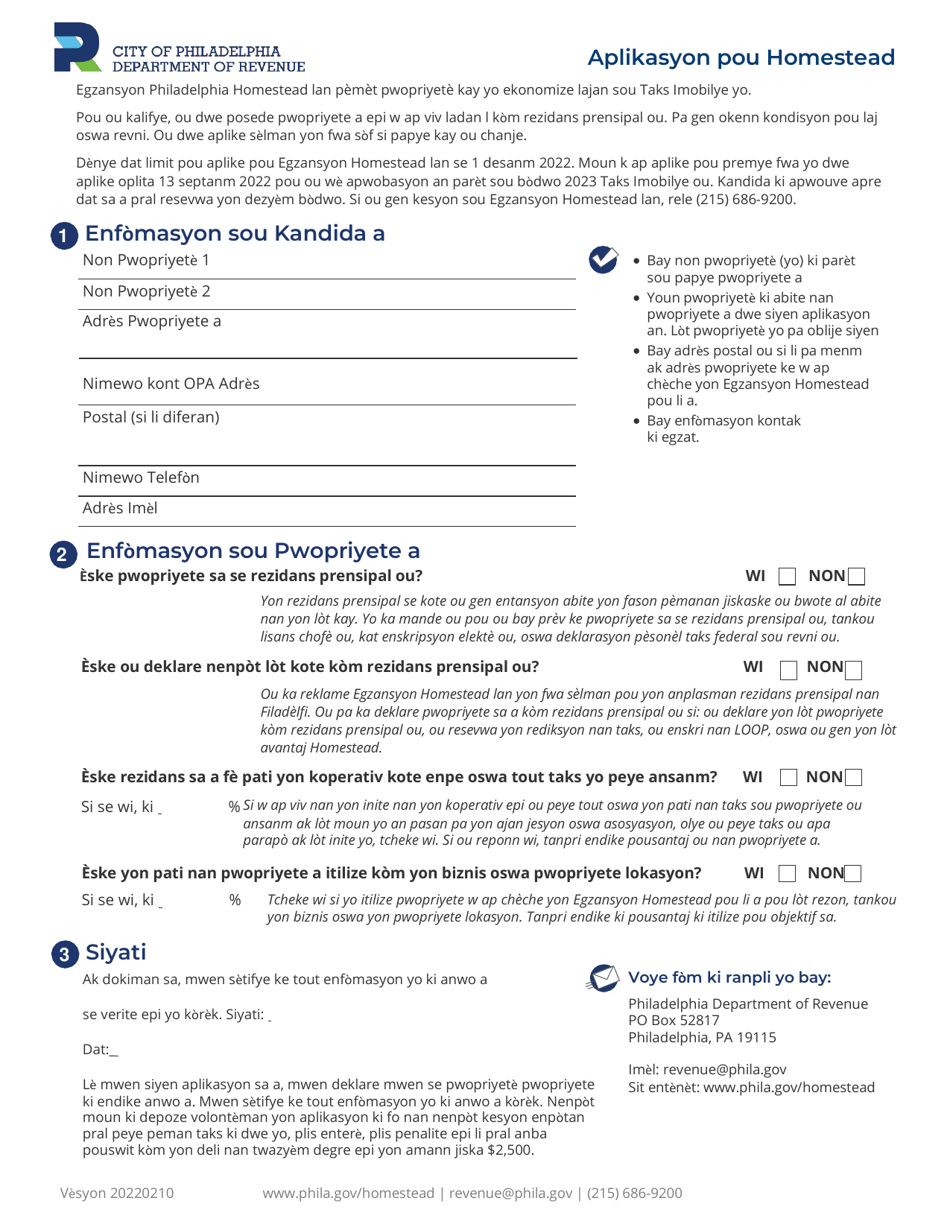

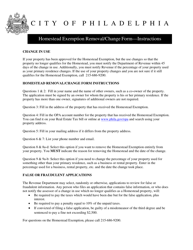

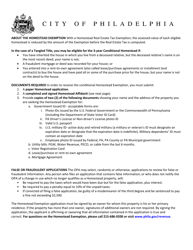

Homestead Exemption Application - City of Philadelphia, Pennsylvania (Haitian Creole)

This is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania.

The form may be used strictly within City of Philadelphia.The document is provided in Haitian Creole.

FAQ

Q: What is the Homestead Exemption Application?

A: The Homestead Exemption Application is a form that allows residents of Philadelphia, Pennsylvania to apply for a reduction in their property taxes.

Q: Who is eligible for the Homestead Exemption?

A: Homeowners in Philadelphia, Pennsylvania who use their property as their primary residence are eligible for the Homestead Exemption.

Q: How can I apply for the Homestead Exemption?

A: You can apply for the Homestead Exemption by filling out the application form and submitting it to the City of Philadelphia.

Q: What does the Homestead Exemption do?

A: The Homestead Exemption reduces the taxable value of your property, which in turn lowers your property taxes.

Q: Do I have to pay a fee to apply for the Homestead Exemption?

A: No, there is no fee to apply for the Homestead Exemption. It is free to eligible homeowners.

Q: What documents do I need to include with my application?

A: You will need to include proof of residency, such as a driver's license or utility bill, along with your completed application form.

Q: When is the deadline to apply for the Homestead Exemption?

A: The deadline to apply for the Homestead Exemption in Philadelphia, Pennsylvania is September 13th of each year.

Form Details:

- Released on February 10, 2022;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.