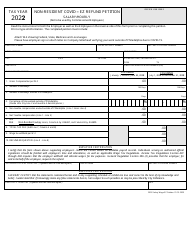

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

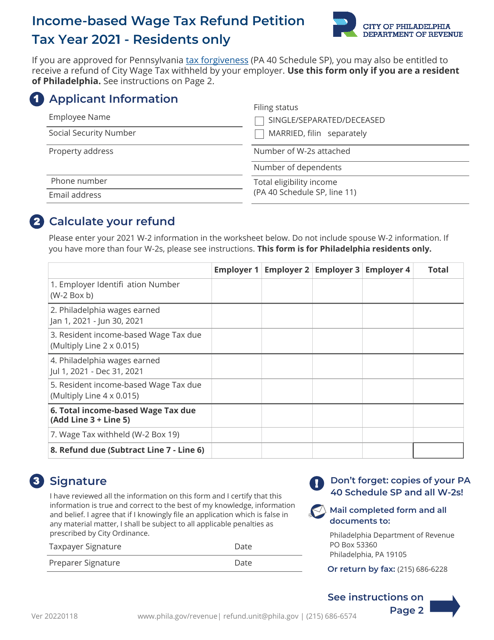

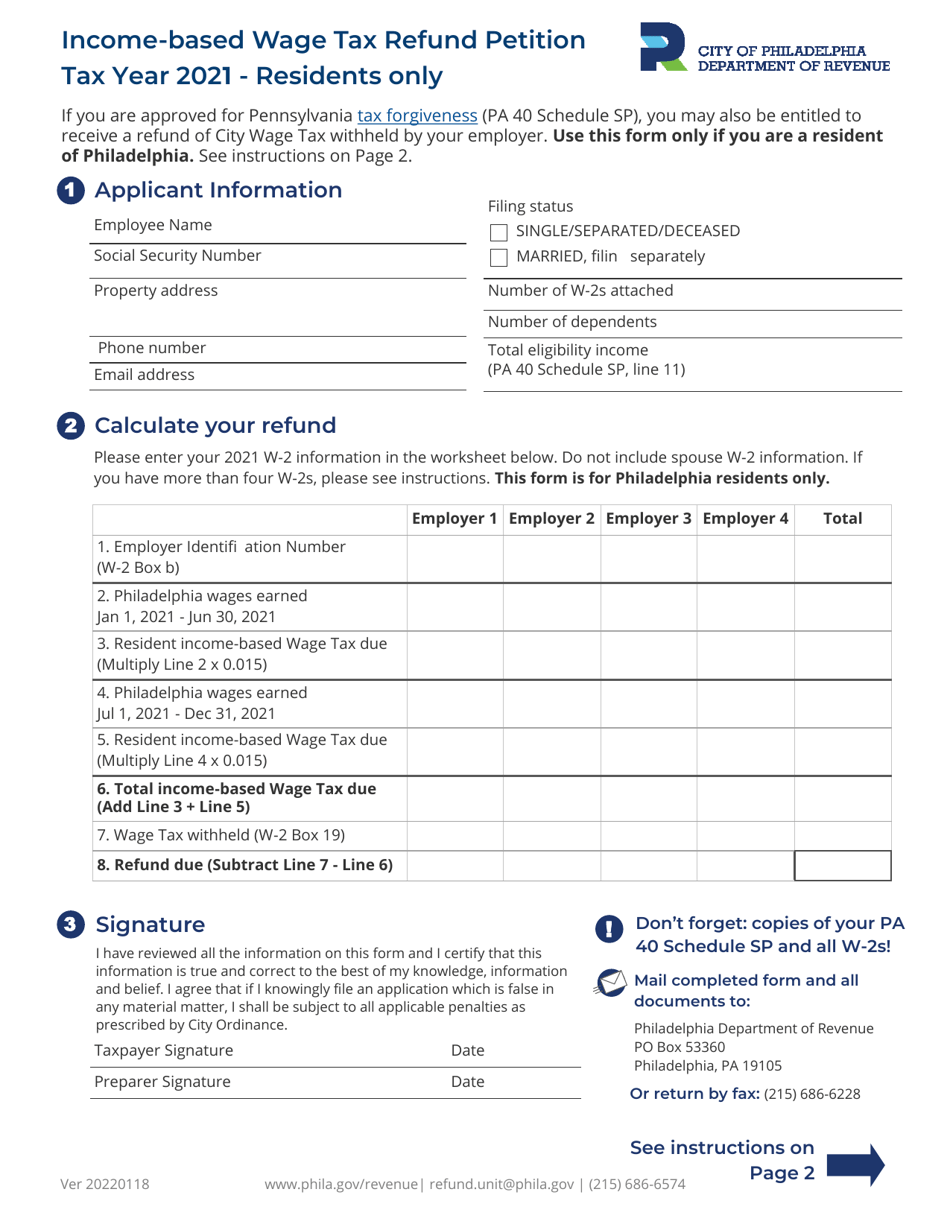

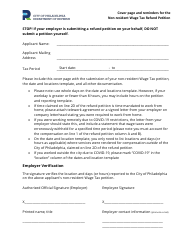

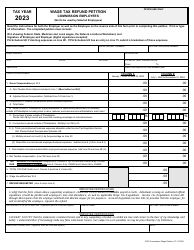

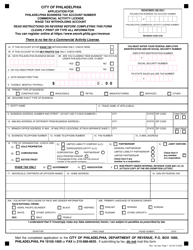

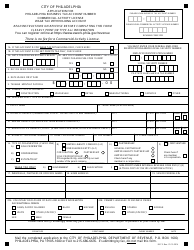

Income-Based Wage Tax Refund Petition - Residents Only - City of Philadelphia, Pennsylvania

Income-Based Wage Tax Refund Petition - Residents Only is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

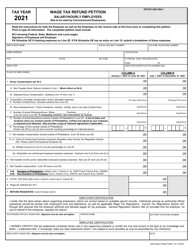

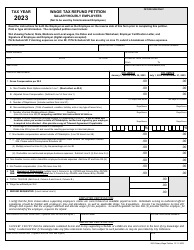

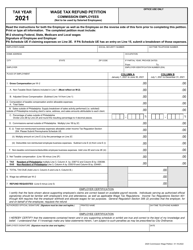

Q: What is the Income-Based Wage Tax Refund Petition?

A: The Income-Based Wage Tax Refund Petition is a form that allows residents of Philadelphia, Pennsylvania to request a refund of wage taxes based on their income.

Q: Who is eligible to file the Income-Based Wage Tax Refund Petition?

A: Only residents of Philadelphia, Pennsylvania are eligible to file the Income-Based Wage Tax Refund Petition.

Q: What is the purpose of the Income-Based Wage Tax Refund Petition?

A: The purpose of the Income-Based Wage Tax Refund Petition is to provide financial relief to low-income residents by refunding a portion of the wage taxes they have paid.

Q: How does the Income-Based Wage Tax Refund Petition work?

A: Residents need to complete the petition form and provide documentation of their income. The city determines the refund amount based on the provided information.

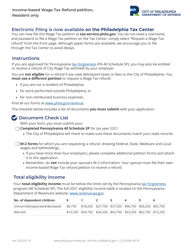

Q: What documentation is required to file the Income-Based Wage Tax Refund Petition?

A: Residents need to provide documentation of their income, such as tax returns, pay stubs, or other proof of income.

Q: How much of the wage taxes can be refunded through the Income-Based Wage Tax Refund Petition?

A: The refund amount varies based on income level. The city will determine the eligible refund amount based on the provided documentation.

Q: When can I file the Income-Based Wage Tax Refund Petition?

A: Residents can file the Income-Based Wage Tax Refund Petition once a year. The exact filing period may vary, so it's best to check with the City of Philadelphia for specific dates.

Q: Is there a deadline to submit the Income-Based Wage Tax Refund Petition?

A: Yes, there is a deadline to submit the Income-Based Wage Tax Refund Petition. Residents should check with the City of Philadelphia for the specific deadline each year.

Q: How long does it take to receive the refund after filing the Income-Based Wage Tax Refund Petition?

A: The processing time for the Income-Based Wage Tax Refund Petition may vary. It is best to contact the City of Philadelphia for an estimate of the processing time.

Form Details:

- Released on January 18, 2022;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.