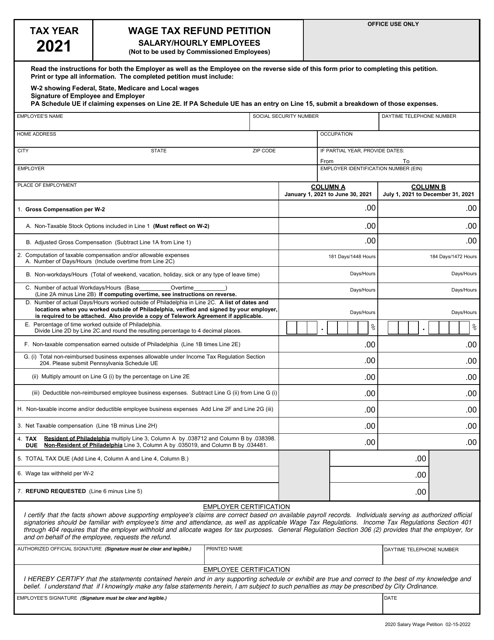

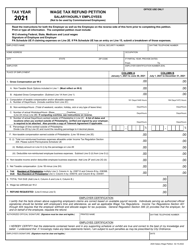

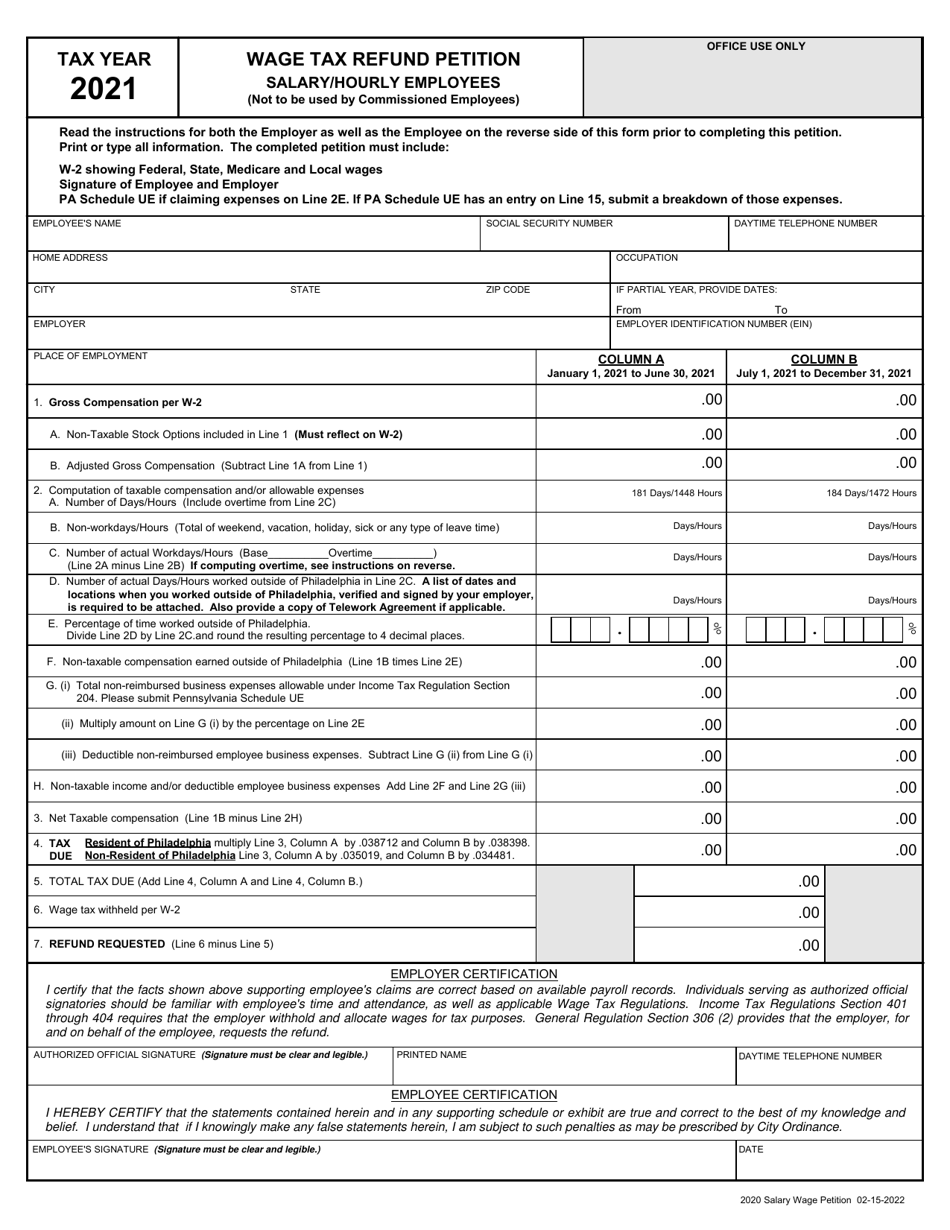

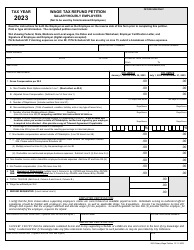

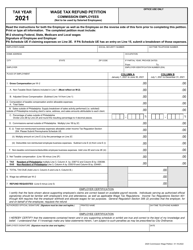

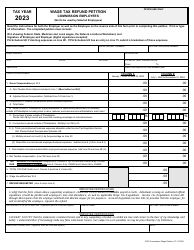

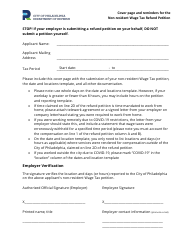

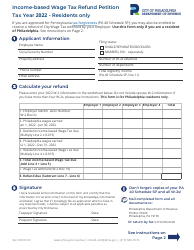

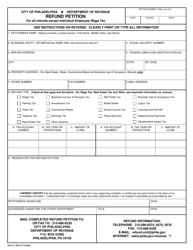

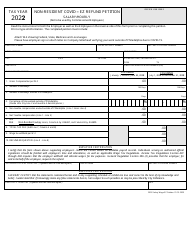

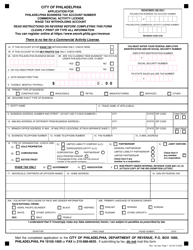

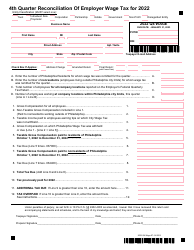

Wage Tax Refund Petition (Salary / Hourly Employees) - City of Philadelphia, Pennsylvania

Wage Tax Refund Petition (Salary/Hourly Employees) is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is the Wage Tax Refund Petition?

A: The Wage Tax Refund Petition is a form that allows salary or hourly employees in the City of Philadelphia, Pennsylvania to request a refund of overpaid wage taxes.

Q: Who can submit a Wage Tax Refund Petition?

A: Any salary or hourly employee who works in the City of Philadelphia, Pennsylvania and believes they have overpaid wage taxes can submit a Wage Tax Refund Petition.

Q: What information do I need to fill out the Wage Tax Refund Petition?

A: You will need to provide information such as your personal details, employer information, wages earned, tax withheld, and any other supporting documentation.

Q: What is the deadline for submitting the Wage Tax Refund Petition?

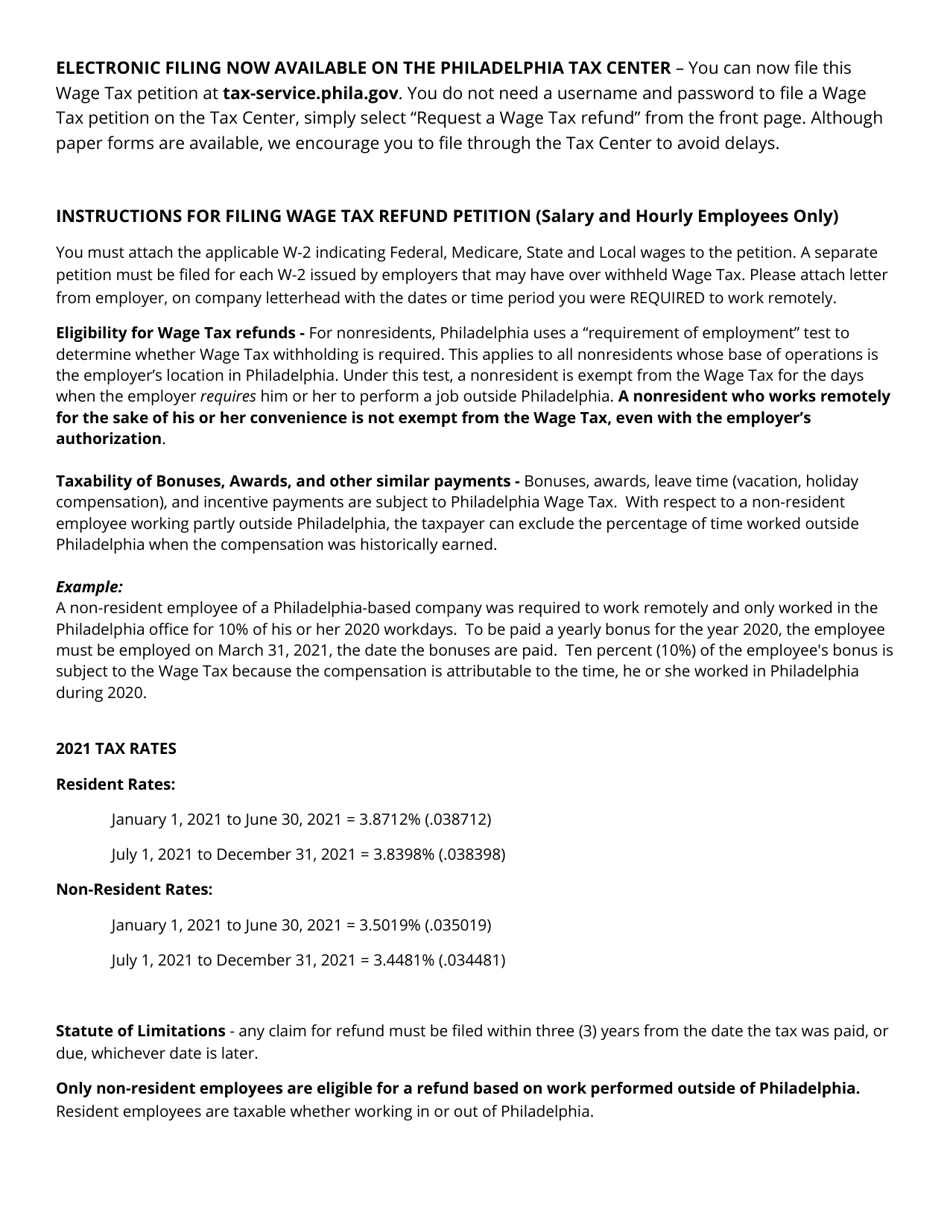

A: The deadline for submitting the Wage Tax Refund Petition is within three years from the due date of the tax return or payment, or within three years from the date the tax was paid, whichever is later.

Q: How long does it take to process the Wage Tax Refund Petition?

A: The processing time for the Wage Tax Refund Petition may vary, but it generally takes around 8-12 weeks to receive a response from the City of Philadelphia's Department of Revenue.

Q: What happens if my Wage Tax Refund Petition is approved?

A: If your Wage Tax Refund Petition is approved, you will receive a refund of the overpaid wage taxes.

Q: What happens if my Wage Tax Refund Petition is denied?

A: If your Wage Tax Refund Petition is denied, you may have the option to appeal the decision within 30 days.

Form Details:

- Released on February 15, 2022;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.