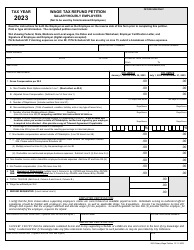

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

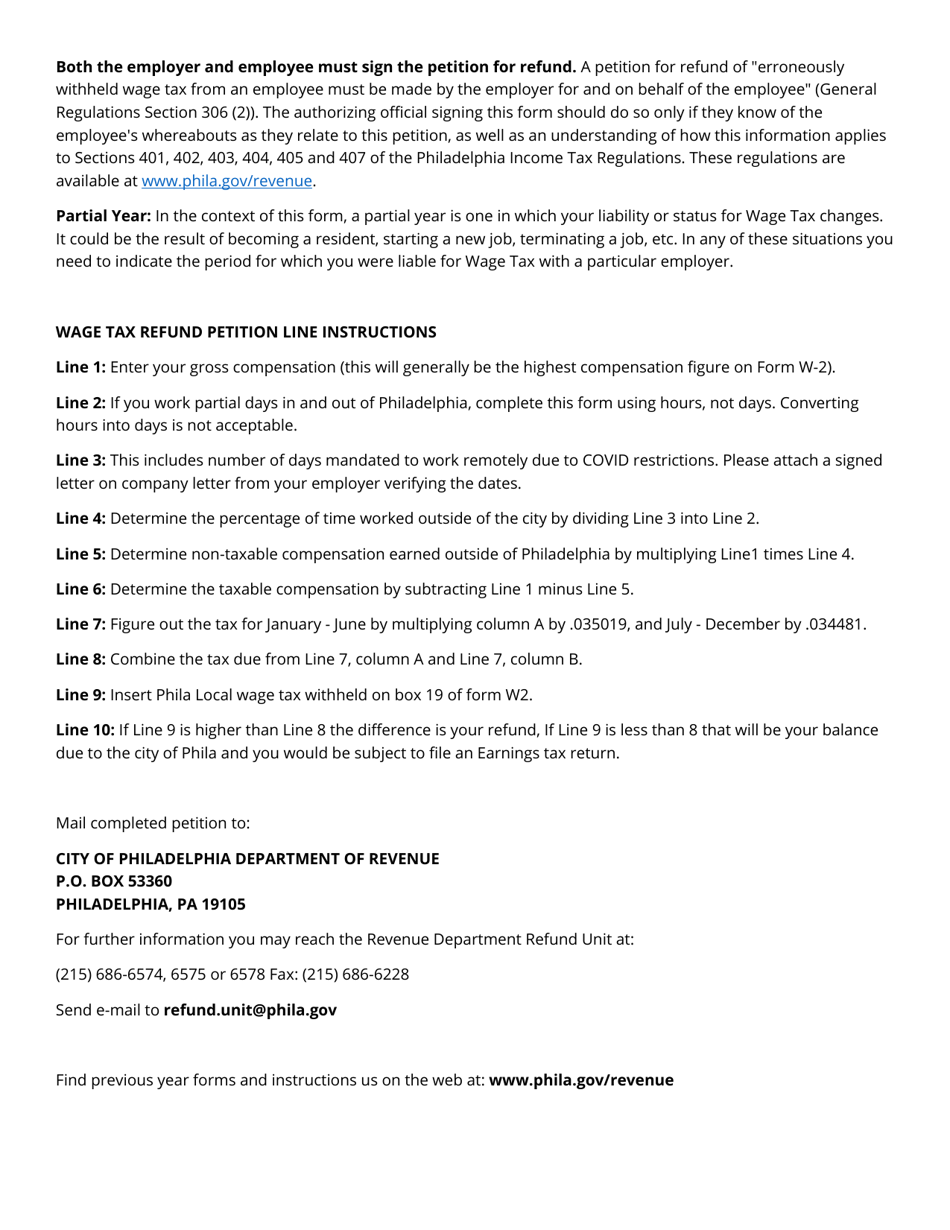

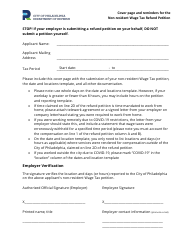

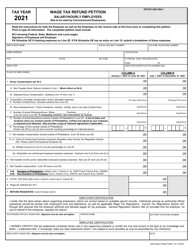

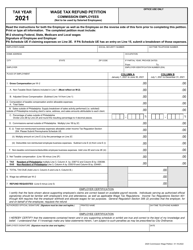

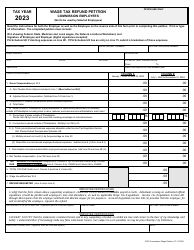

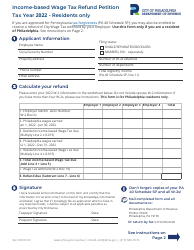

Non-resident Covid - Ez Refund Petition - Salary / Hourly - City of Philadelphia, Pennsylvania

Non-resident Covid - Ez Refund Petition - Salary/Hourly is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is the Non-resident Covid - Ez Refund Petition?

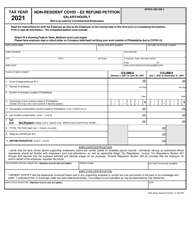

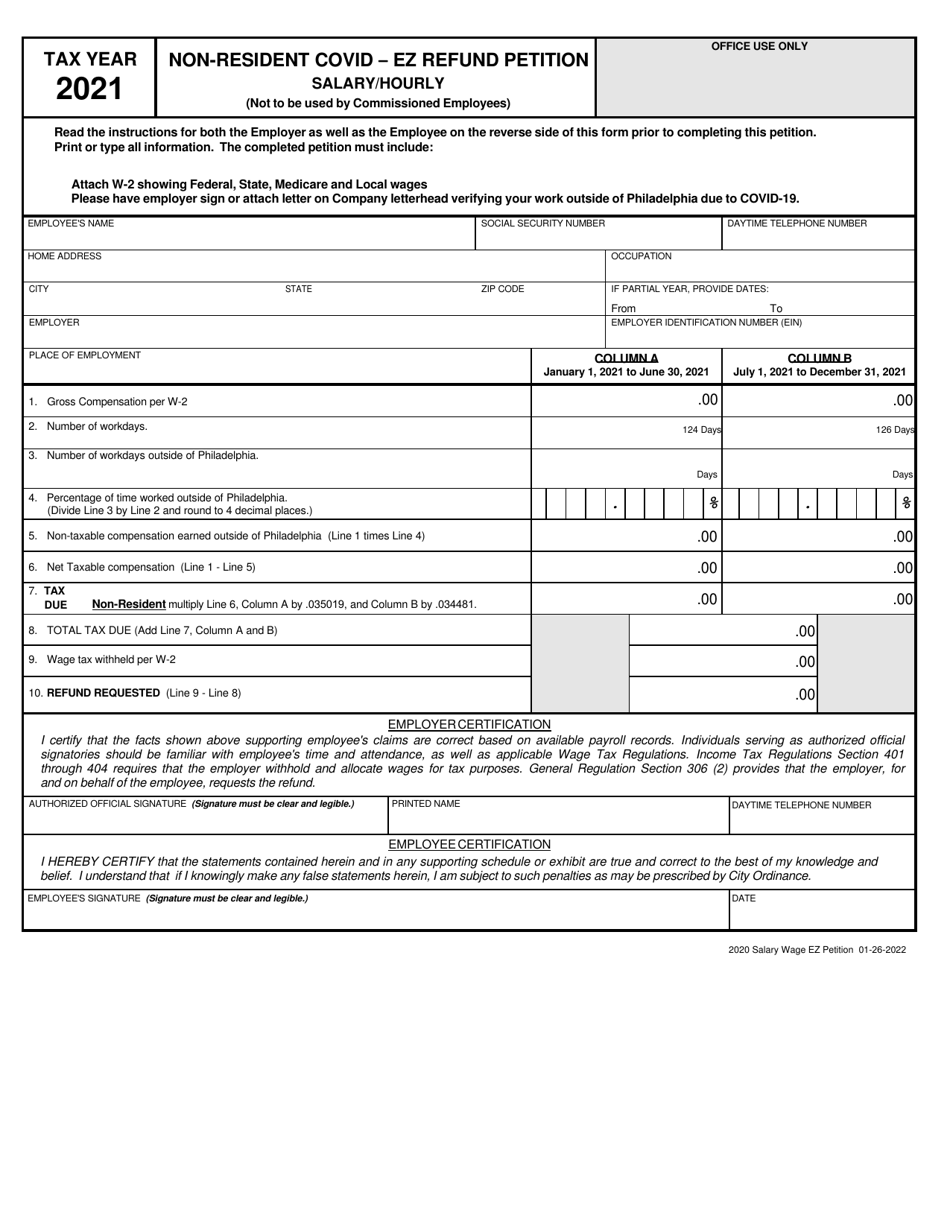

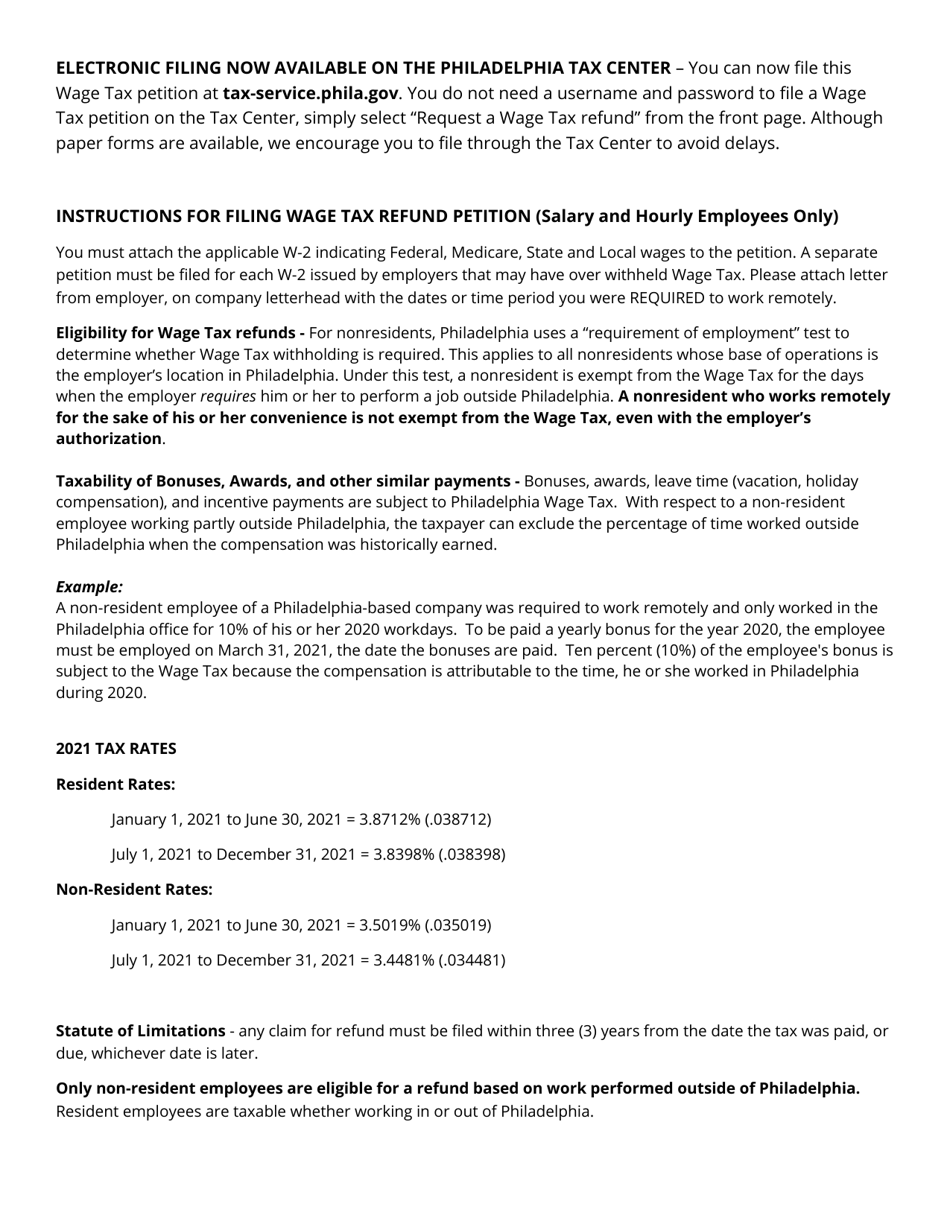

A: The Non-resident Covid - Ez Refund Petition is a program in Philadelphia, Pennsylvania that allows non-residents to request a refund of wage taxes withheld during the Covid-19 pandemic.

Q: Who is eligible for the Non-resident Covid - Ez Refund Petition?

A: Non-residents who had wage taxes withheld from their paychecks during the Covid-19 pandemic in Philadelphia, Pennsylvania are eligible to apply for a refund.

Q: What types of workers are eligible for the refund?

A: Both salaried and hourly workers who are non-residents of Philadelphia, Pennsylvania are eligible for the refund.

Q: How long does it take to receive the refund?

A: The processing time for the refund can vary, but it typically takes a few weeks to receive the refund once your application is approved.

Q: Do I need to provide any documentation with my application?

A: Yes, you will need to provide documentation such as pay stubs or W-2 forms to verify your income and the taxes withheld.

Q: Can I apply for the refund if I am a resident of Philadelphia?

A: No, the Non-resident Covid - Ez Refund Petition is only available for non-residents of Philadelphia, Pennsylvania.

Q: What if I have more questions or need assistance with my application?

A: You can contact the City of Philadelphia's Department of Revenue for assistance with your application or any additional questions you may have.

Form Details:

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.