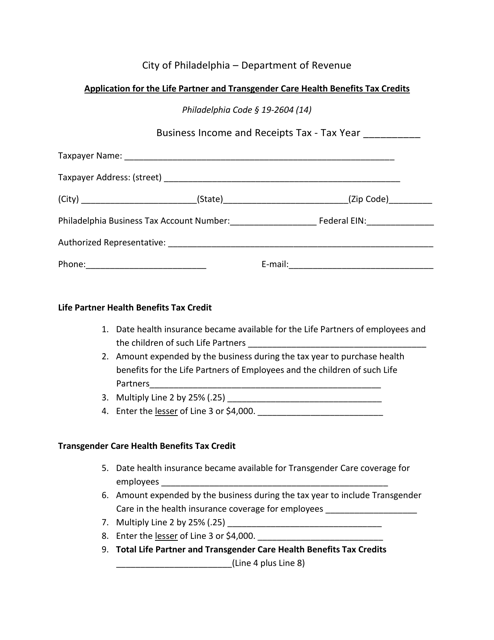

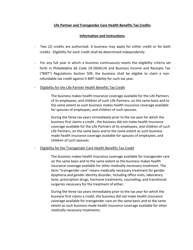

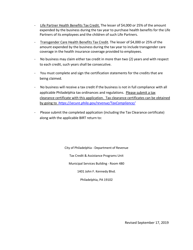

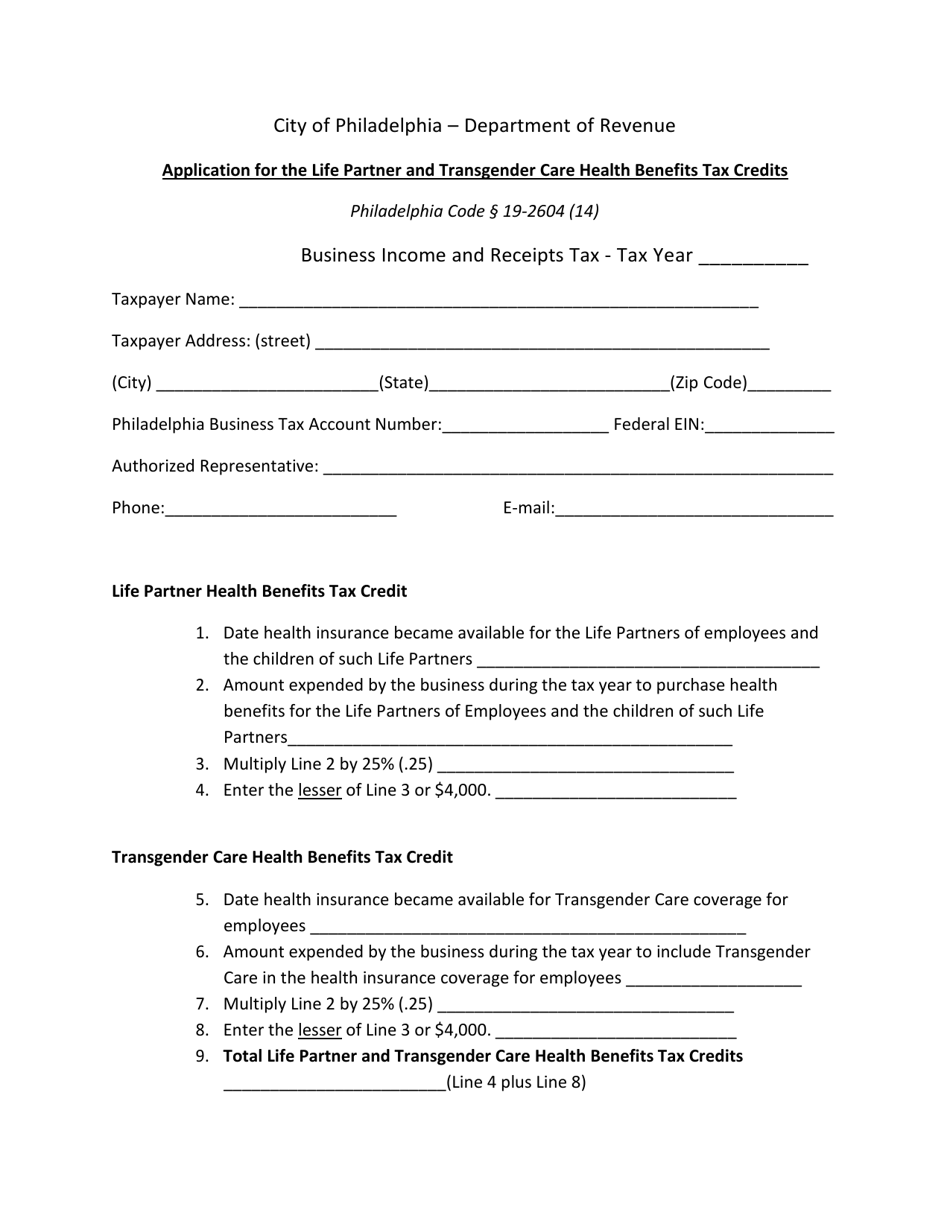

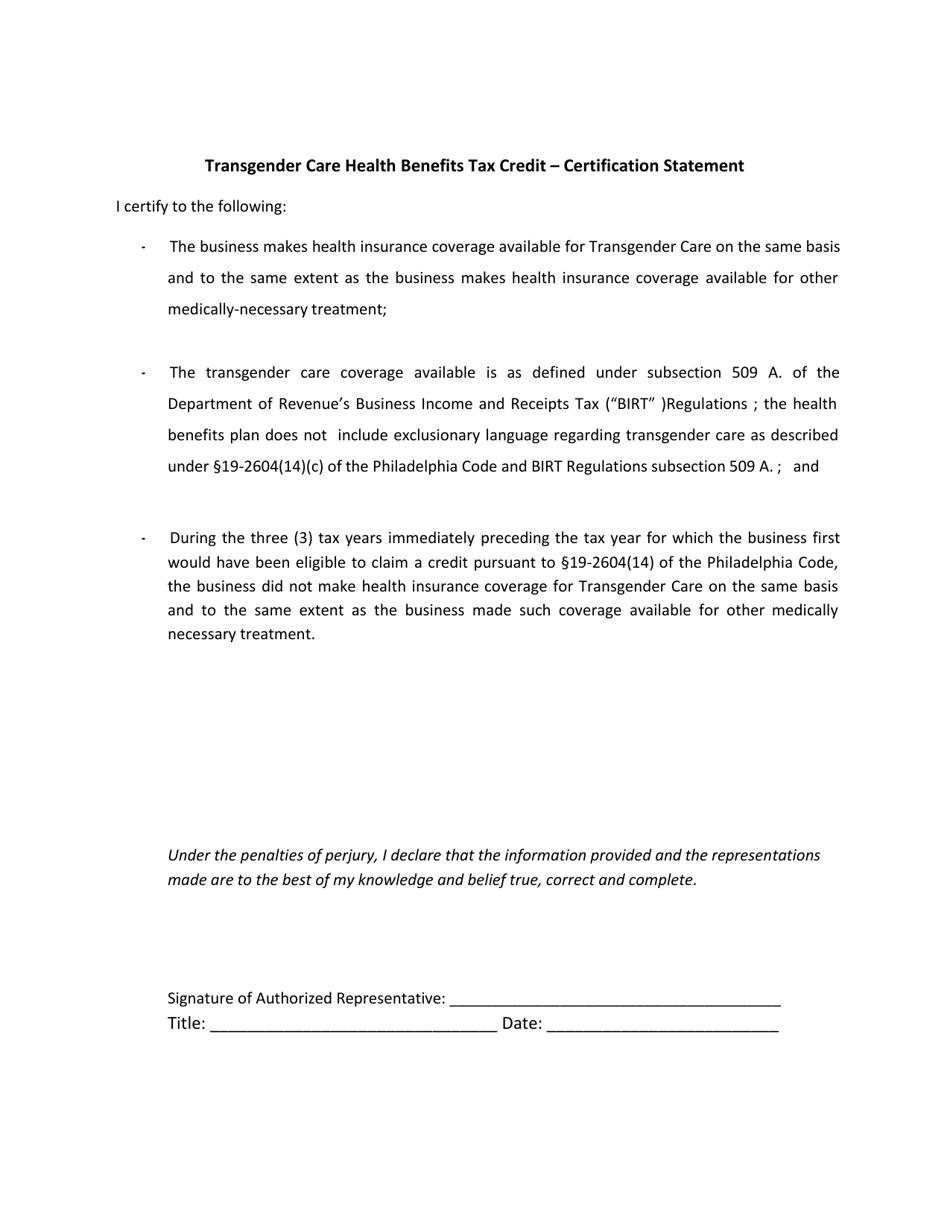

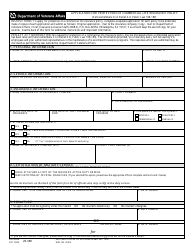

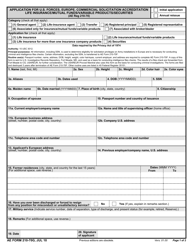

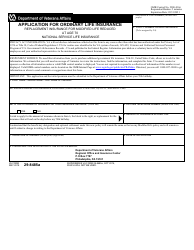

Application for the Life Partner and Transgender Care Health Benefits Tax Credits - City of Philadelphia, Pennsylvania

Application for the Life Partner and Transgender Care Health Benefits Tax Credits is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

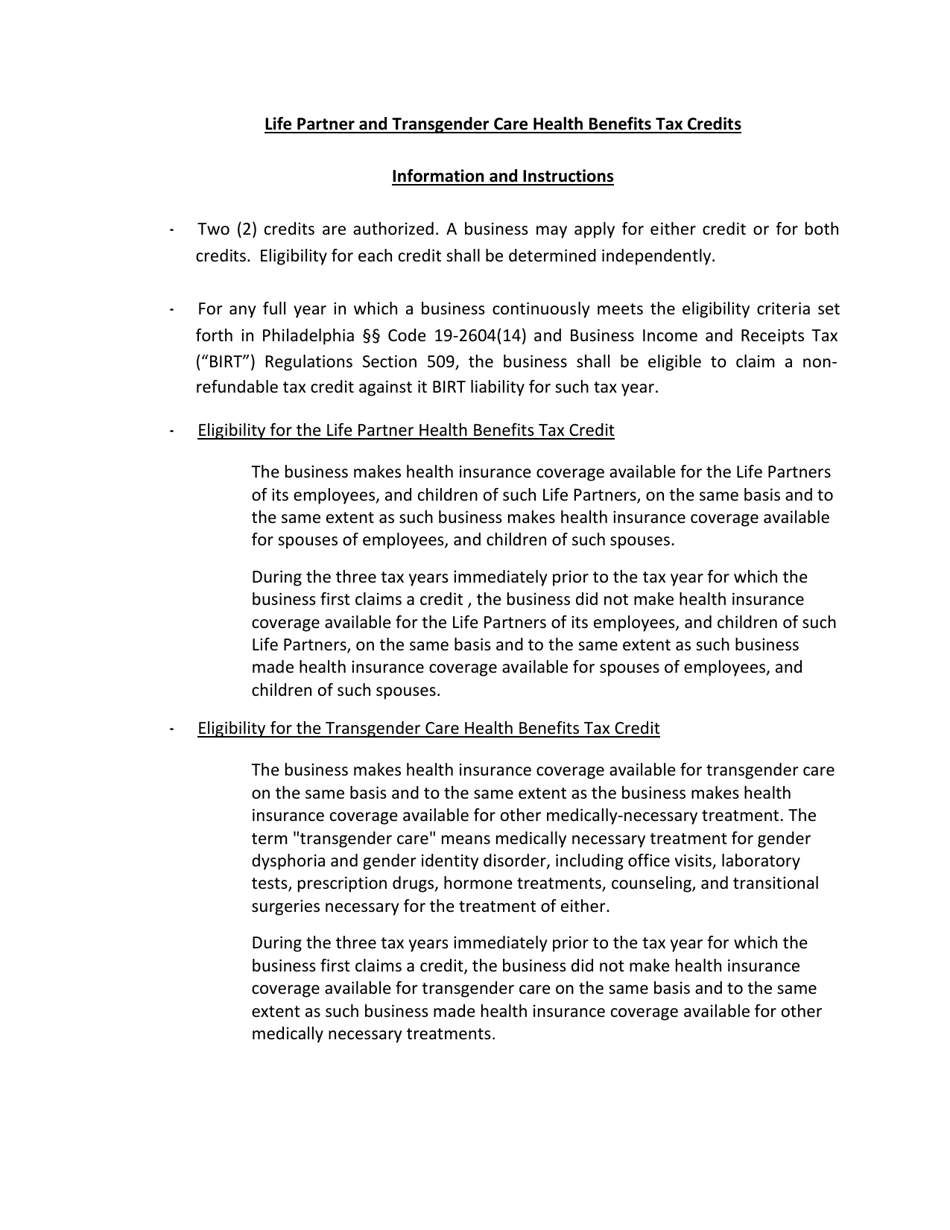

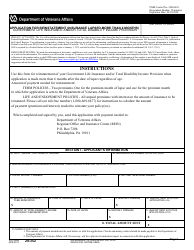

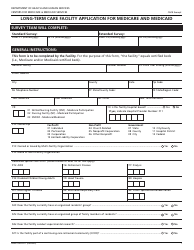

Q: Who can apply for the Life Partner and Transgender Care Health Benefits Tax Credits?

A: Residents of Philadelphia, Pennsylvania who have a life partner or receive transgender care health benefits can apply.

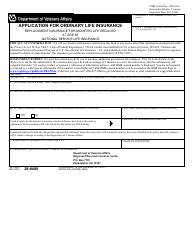

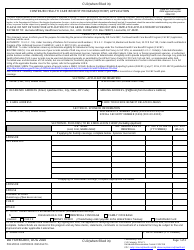

Q: What are the benefits of the Life Partner and Transgender Care Health Benefits Tax Credits?

A: The tax credits help eligible individuals and couples with the costs of life partner and transgender care health benefits.

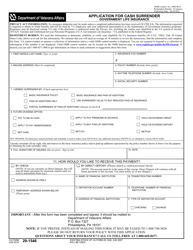

Q: Are the tax credits available to non-residents of Philadelphia, Pennsylvania?

A: No, the tax credits are only available to residents of Philadelphia, Pennsylvania.

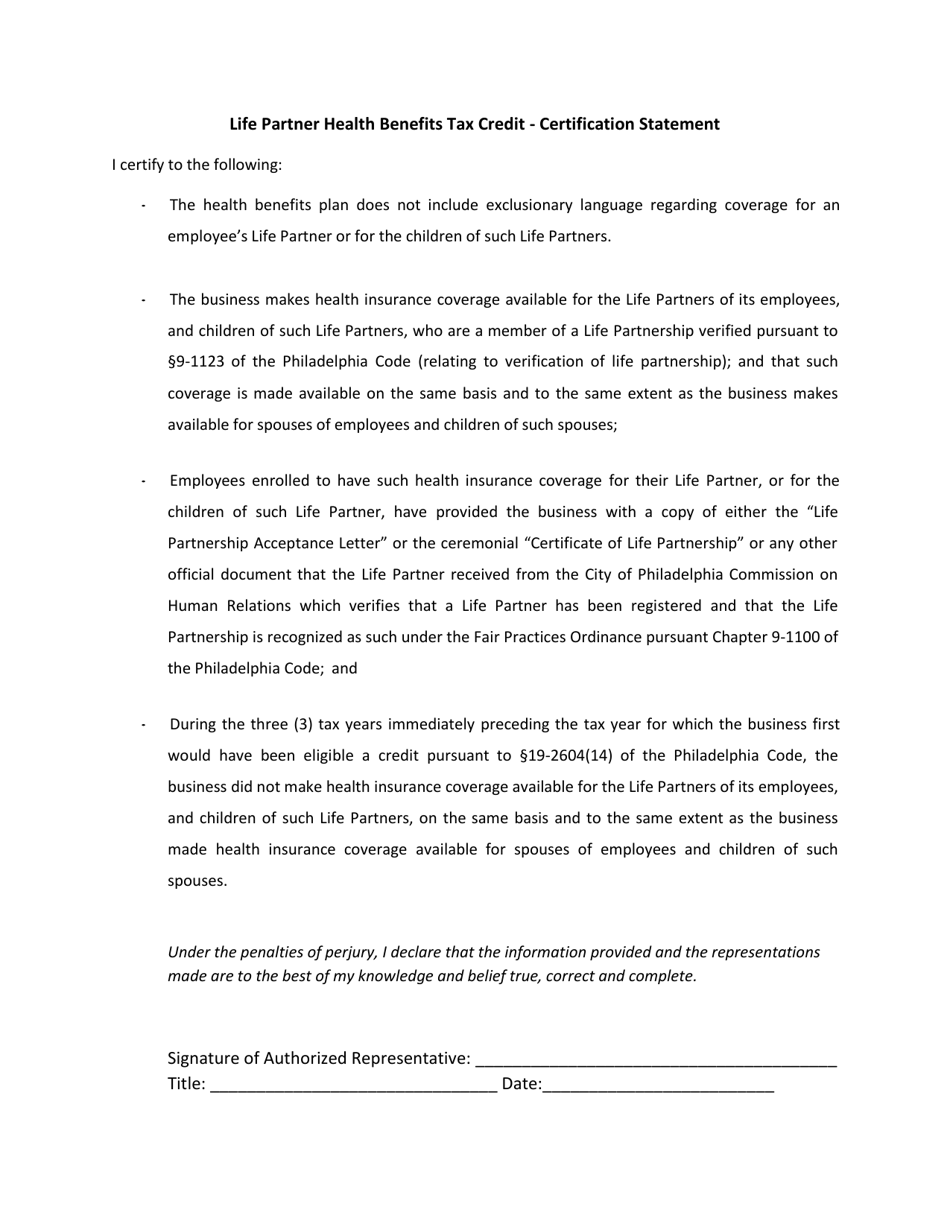

Q: What documentation do I need to apply for the tax credits?

A: You may need to provide documentation such as proof of residency and proof of eligibility for life partner or transgender care health benefits.

Form Details:

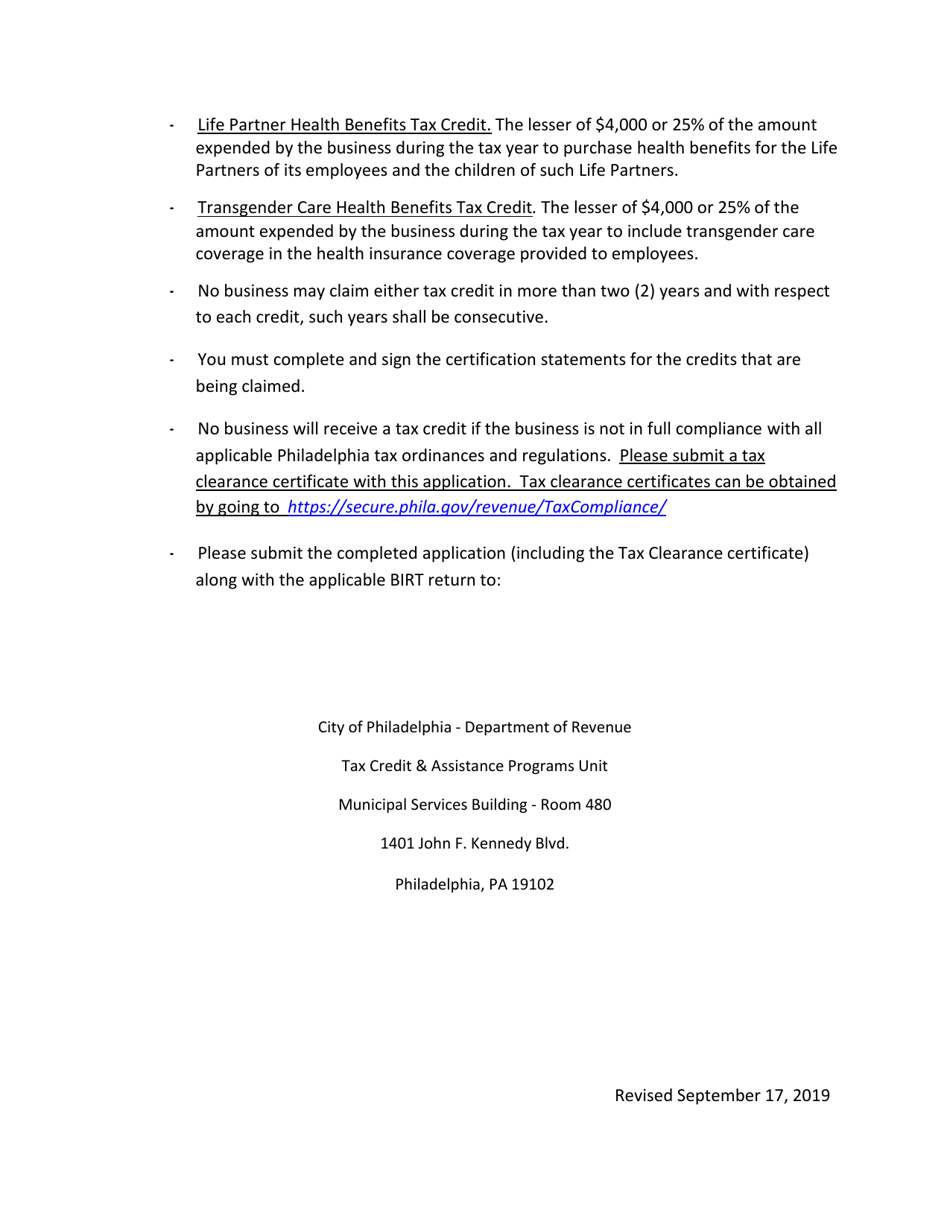

- Released on September 17, 2019;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.