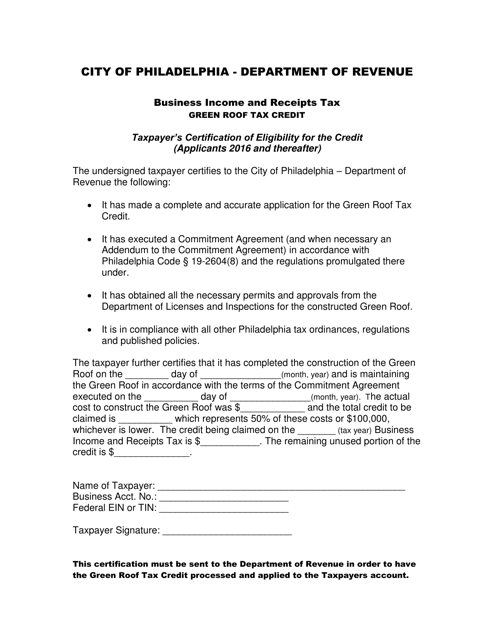

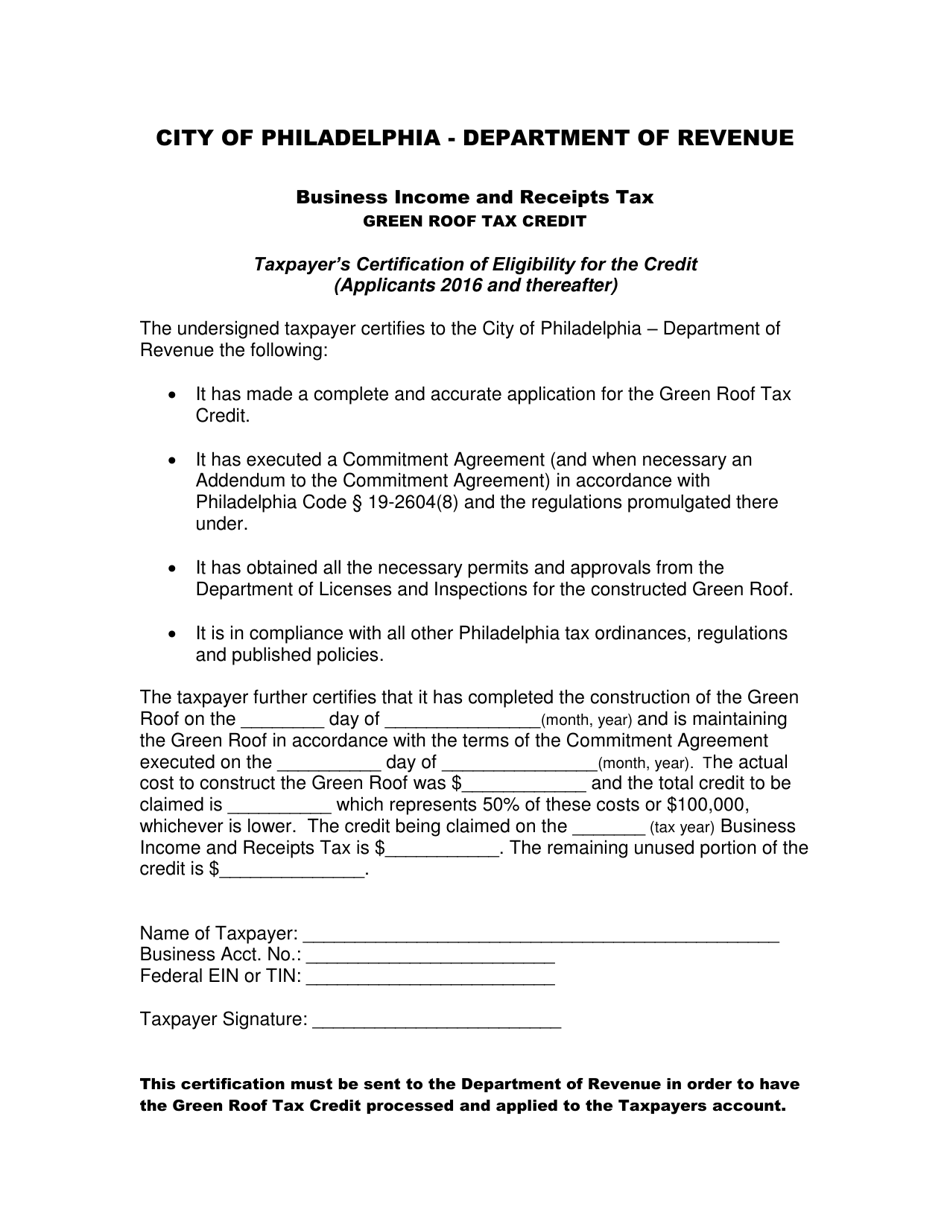

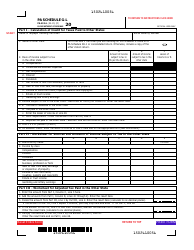

Taxpayer's Certification of Eligibility for the Credit (Applicants 2016 and Thereafter) - Green Roof Tax Credit - City of Philadelphia, Pennsylvania

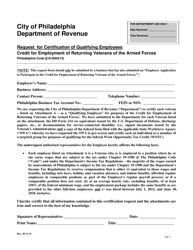

Taxpayer's Certification of Eligibility for the Credit (Applicants 2016 and Thereafter) - Green Roof Tax Credit is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is the Green Roof Tax Credit in Philadelphia, Pennsylvania?

A: The Green Roof Tax Credit is a program in Philadelphia, Pennsylvania that provides tax incentives for installing green roofs on buildings.

Q: Who is eligible for the Green Roof Tax Credit?

A: Property owners in Philadelphia who install eligible green roofs on their buildings are eligible for the tax credit.

Q: What is an eligible green roof?

A: An eligible green roof is a roof that is covered with vegetation and meets certain criteria set by the City of Philadelphia.

Q: How much is the Green Roof Tax Credit?

A: The Green Roof Tax Credit is equal to 25% of the total cost of installing an eligible green roof, up to a maximum credit amount.

Q: How can I apply for the Green Roof Tax Credit?

A: To apply for the Green Roof Tax Credit, you must complete the Taxpayer's Certification of Eligibility for the Credit and submit it to the City of Philadelphia.

Q: Can I receive the Green Roof Tax Credit for multiple properties?

A: Yes, property owners can receive the Green Roof Tax Credit for multiple properties, as long as each property meets the eligibility requirements.

Q: Is the Green Roof Tax Credit available to both residential and commercial properties?

A: Yes, the Green Roof Tax Credit is available to both residential and commercial properties in Philadelphia.

Q: Can I receive the Green Roof Tax Credit if I have already received other incentives or grants for my green roof project?

A: Yes, you can still receive the Green Roof Tax Credit even if you have received other incentives or grants for your green roof project.

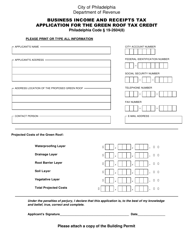

Q: What documentation do I need to provide when applying for the Green Roof Tax Credit?

A: When applying for the Green Roof Tax Credit, you will need to provide documentation such as receipts, invoices, and proof of payment for the eligible green roof installation.

Form Details:

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.