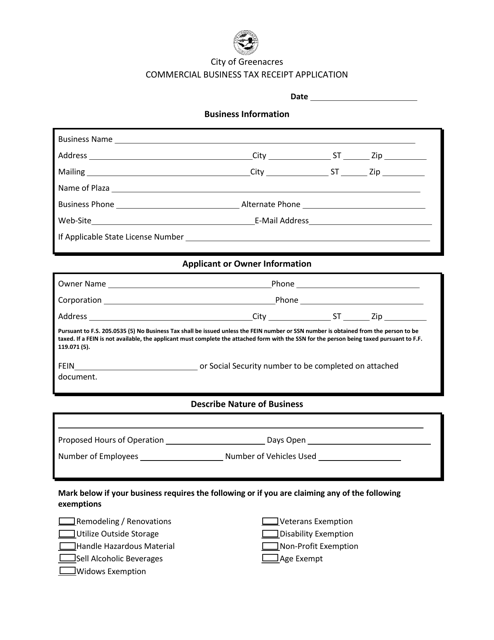

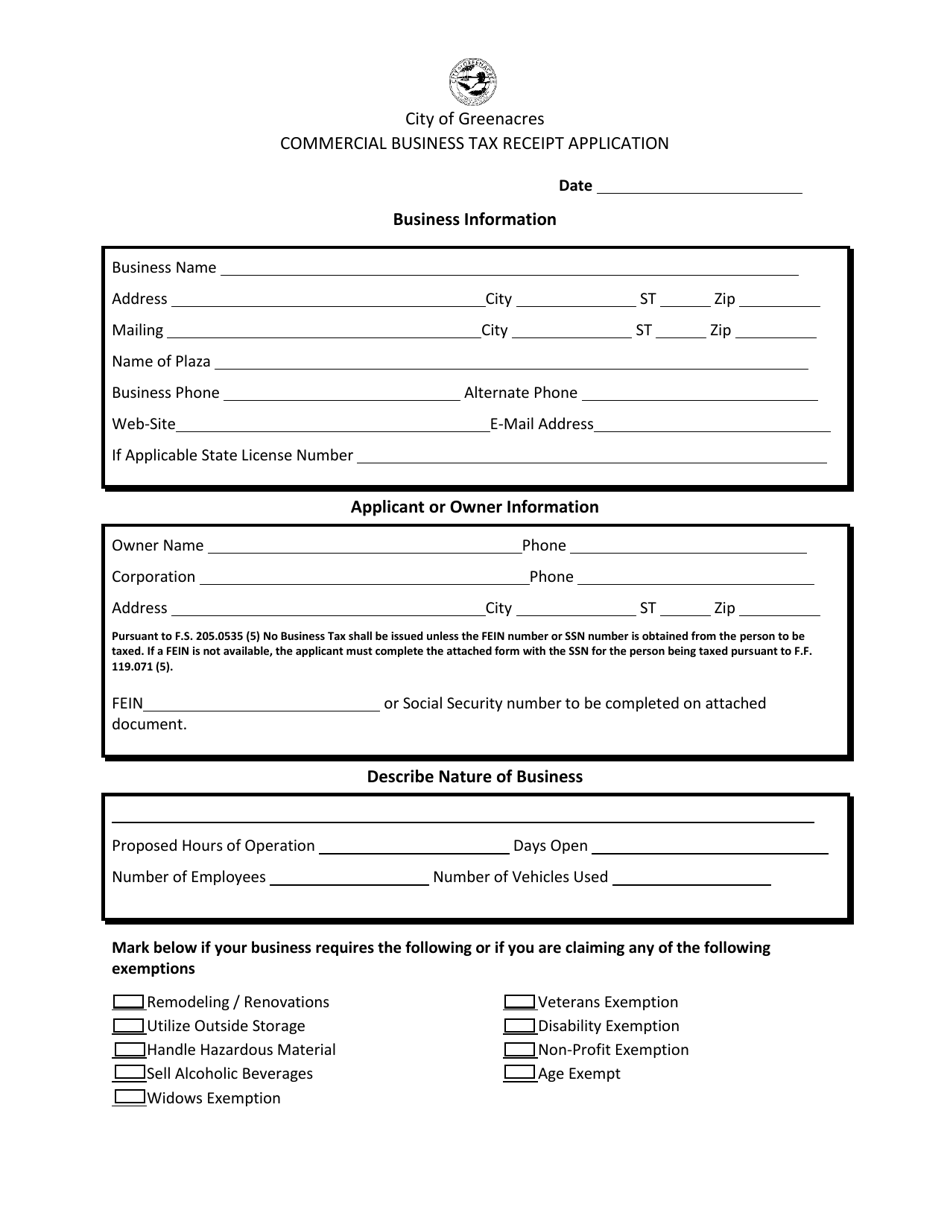

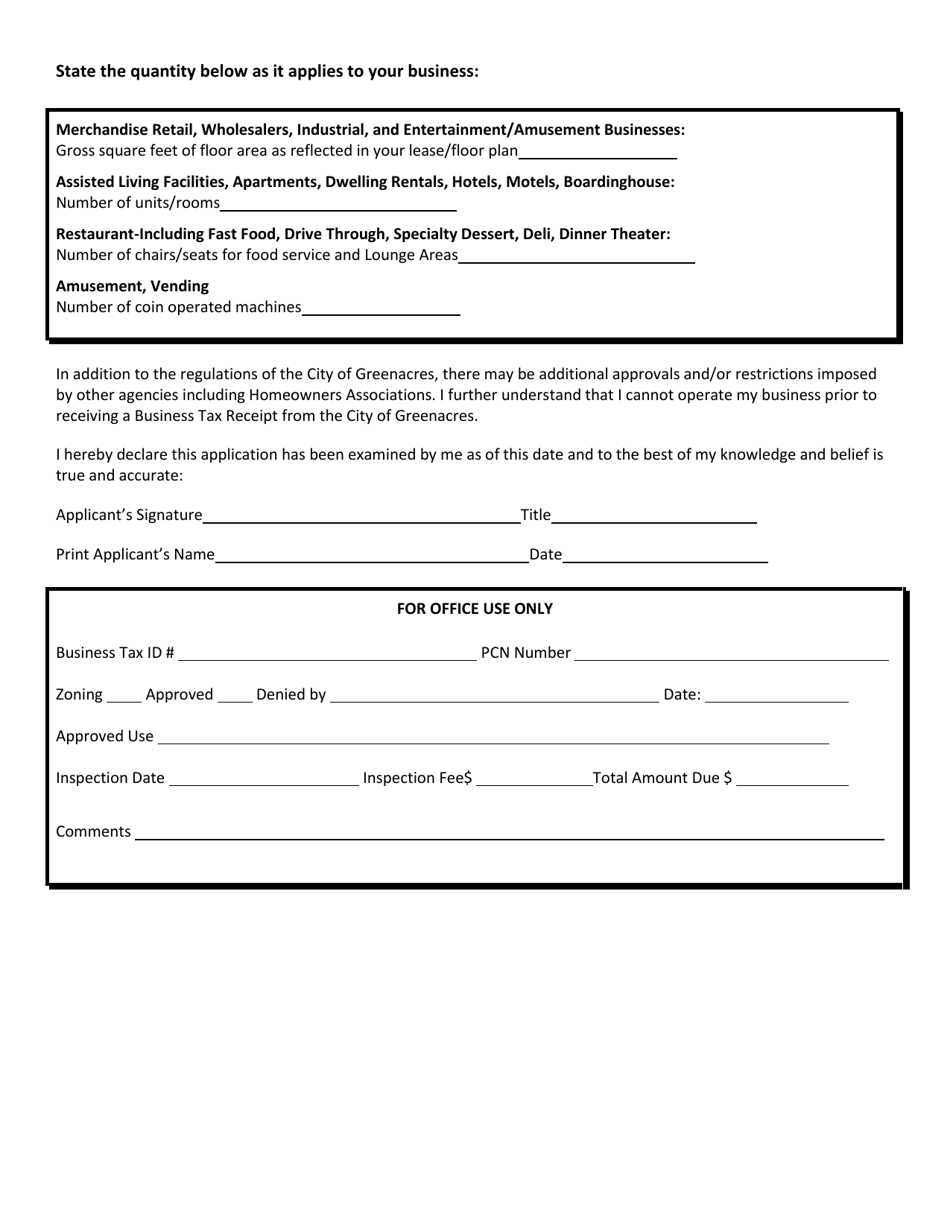

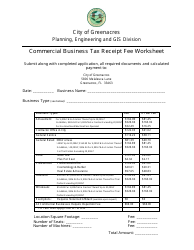

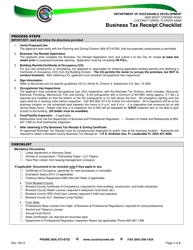

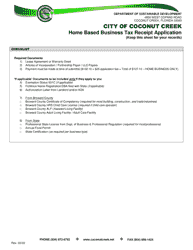

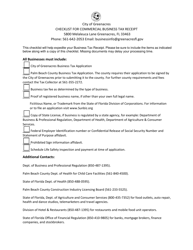

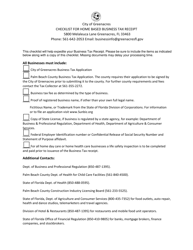

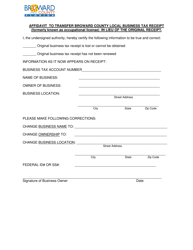

Commercial Business Tax Receipt Application - City of Greenacres, Florida

Commercial Business Tax Receipt Application is a legal document that was released by the Development and Neighborhood Services Department - City of Greenacres, Florida - a government authority operating within Florida. The form may be used strictly within City of Greenacres.

FAQ

Q: What is a Commercial Business Tax Receipt (CBTR)?

A: A CBTR is a license that allows a business to legally operate within the City of Greenacres, Florida.

Q: Who needs to apply for a Commercial Business Tax Receipt?

A: Any person or entity operating a business within the City of Greenacres, Florida needs to apply for a CBTR.

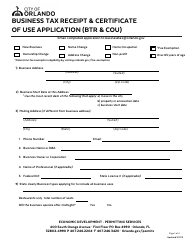

Q: How can I apply for a Commercial Business Tax Receipt in Greenacres, Florida?

A: You can apply for a CBTR by completing an application form and submitting it to the City of Greenacres, Florida.

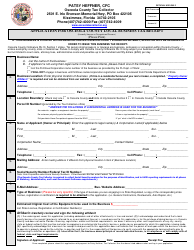

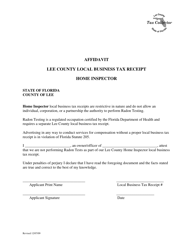

Q: What documents are required to apply for a Commercial Business Tax Receipt in Greenacres, Florida?

A: The required documents may vary depending on the type of business, but generally, you will need a completed application form, proof of ownership or a lease agreement, a state license or certification if applicable, and payment for the required fees.

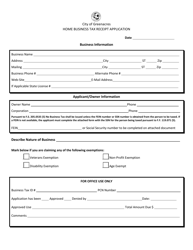

Q: How much does a Commercial Business Tax Receipt application cost in Greenacres, Florida?

A: The fees for a CBTR application in Greenacres, Florida vary depending on the type of business. It is recommended to contact the City of Greenacres for specific fee information.

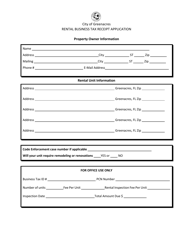

Q: How long does it take to process a Commercial Business Tax Receipt application in Greenacres, Florida?

A: The processing time for a CBTR application in Greenacres, Florida may vary, but it typically takes about 10 business days.

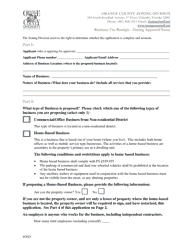

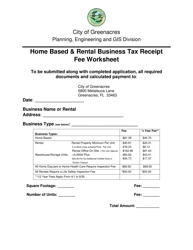

Q: Do I need a Commercial Business Tax Receipt if I operate a home-based business in Greenacres, Florida?

A: Yes, even if your business is operated from your home, you still need to obtain a CBTR from the City of Greenacres, Florida.

Q: Can I transfer my Commercial Business Tax Receipt to a new location within Greenacres, Florida?

A: Yes, you can transfer your CBTR to a new location within Greenacres, Florida. You will need to complete a Transfer of Business Location form and pay the required fees.

Q: Do I need a separate Commercial Business Tax Receipt for each location if I have multiple businesses in Greenacres, Florida?

A: Yes, you will need a separate CBTR for each location if you have multiple businesses in Greenacres, Florida.

Q: How often do I need to renew my Commercial Business Tax Receipt in Greenacres, Florida?

A: CBTRs in Greenacres, Florida are typically renewed annually. The renewal period is from October 1st to September 30th of each year.

Form Details:

- The latest edition currently provided by the Development and Neighborhood Services Department - City of Greenacres, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Development and Neighborhood Services Department - City of Greenacres, Florida.