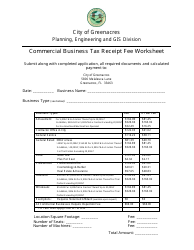

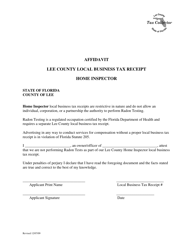

Checklist for Commercial Business Tax Receipt - City of Greenacres, Florida

Checklist for Commercial Business Tax Receipt is a legal document that was released by the Development and Neighborhood Services Department - City of Greenacres, Florida - a government authority operating within Florida. The form may be used strictly within City of Greenacres.

FAQ

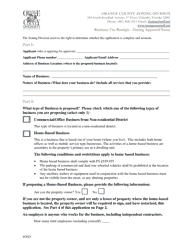

Q: What is a Commercial Business Tax Receipt?

A: A Commercial Business Tax Receipt is a document that allows a business to legally operate within the City of Greenacres, Florida.

Q: Who needs a Commercial Business Tax Receipt?

A: Any business operating within the City of Greenacres, Florida needs a Commercial Business Tax Receipt.

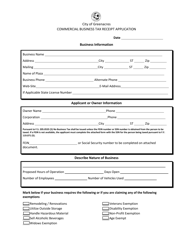

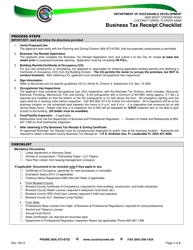

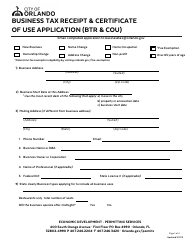

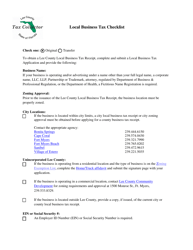

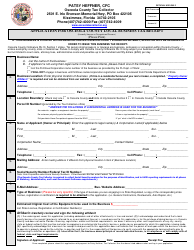

Q: How do I obtain a Commercial Business Tax Receipt in Greenacres?

A: To obtain a Commercial Business Tax Receipt in Greenacres, you need to submit an application and pay the required fee at the City's Finance Department.

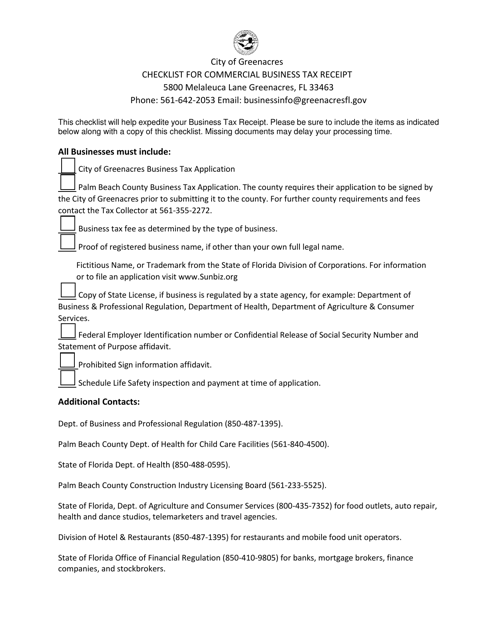

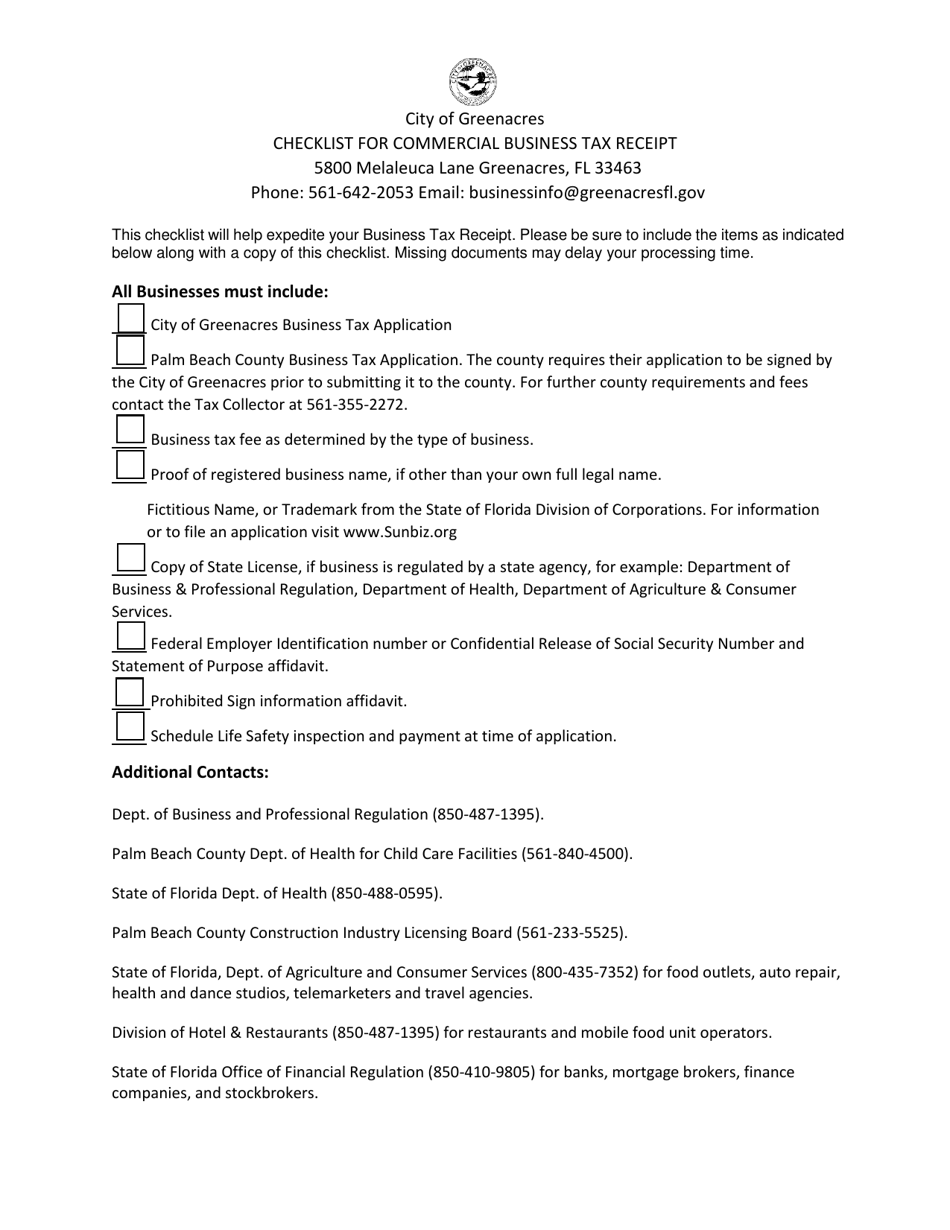

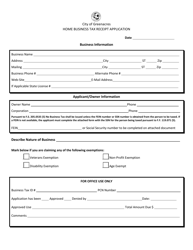

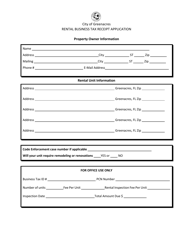

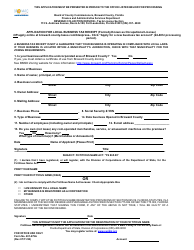

Q: What documents are required to apply for a Commercial Business Tax Receipt?

A: The required documents to apply for a Commercial Business Tax Receipt may vary depending on the type of business, but generally include a completed application, proof of ownership or lease agreement, and proof of valid state registration or licensing.

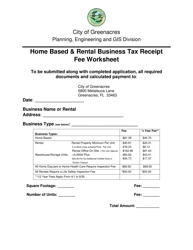

Q: How much does a Commercial Business Tax Receipt cost?

A: The cost of a Commercial Business Tax Receipt in Greenacres, Florida varies depending on the type of business and the number of employees.

Q: Do I need to renew my Commercial Business Tax Receipt?

A: Yes, Commercial Business Tax Receipts in Greenacres, Florida must be renewed annually.

Q: What happens if I operate a business without a Commercial Business Tax Receipt?

A: Operating a business without a Commercial Business Tax Receipt in Greenacres, Florida is a violation of local regulations and can result in penalties or legal action.

Q: Can I transfer my Commercial Business Tax Receipt to a new owner?

A: Yes, under certain circumstances, a Commercial Business Tax Receipt in Greenacres, Florida can be transferred to a new owner. Contact the City's Finance Department for more information.

Q: Are there any exemptions or discounts available for Commercial Business Tax Receipts in Greenacres?

A: Yes, some businesses may be eligible for exemptions or discounts on their Commercial Business Tax Receipts. Contact the City's Finance Department for specific details and requirements.

Q: Can I operate a home-based business with a Commercial Business Tax Receipt?

A: Yes, you can operate a home-based business with a Commercial Business Tax Receipt in Greenacres, Florida, as long as you comply with local zoning and licensing regulations.

Form Details:

- The latest edition currently provided by the Development and Neighborhood Services Department - City of Greenacres, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Development and Neighborhood Services Department - City of Greenacres, Florida.