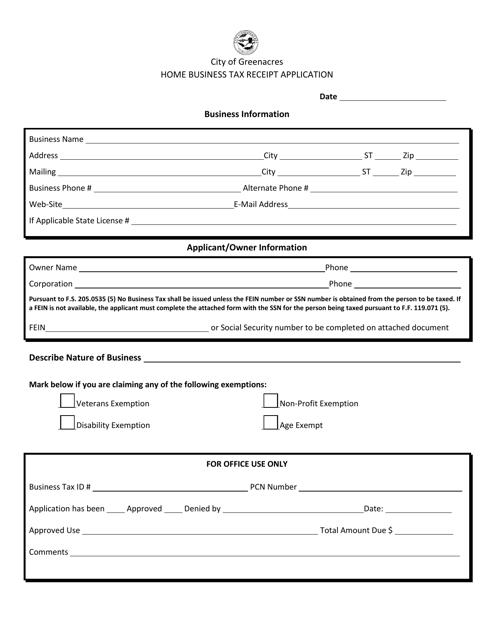

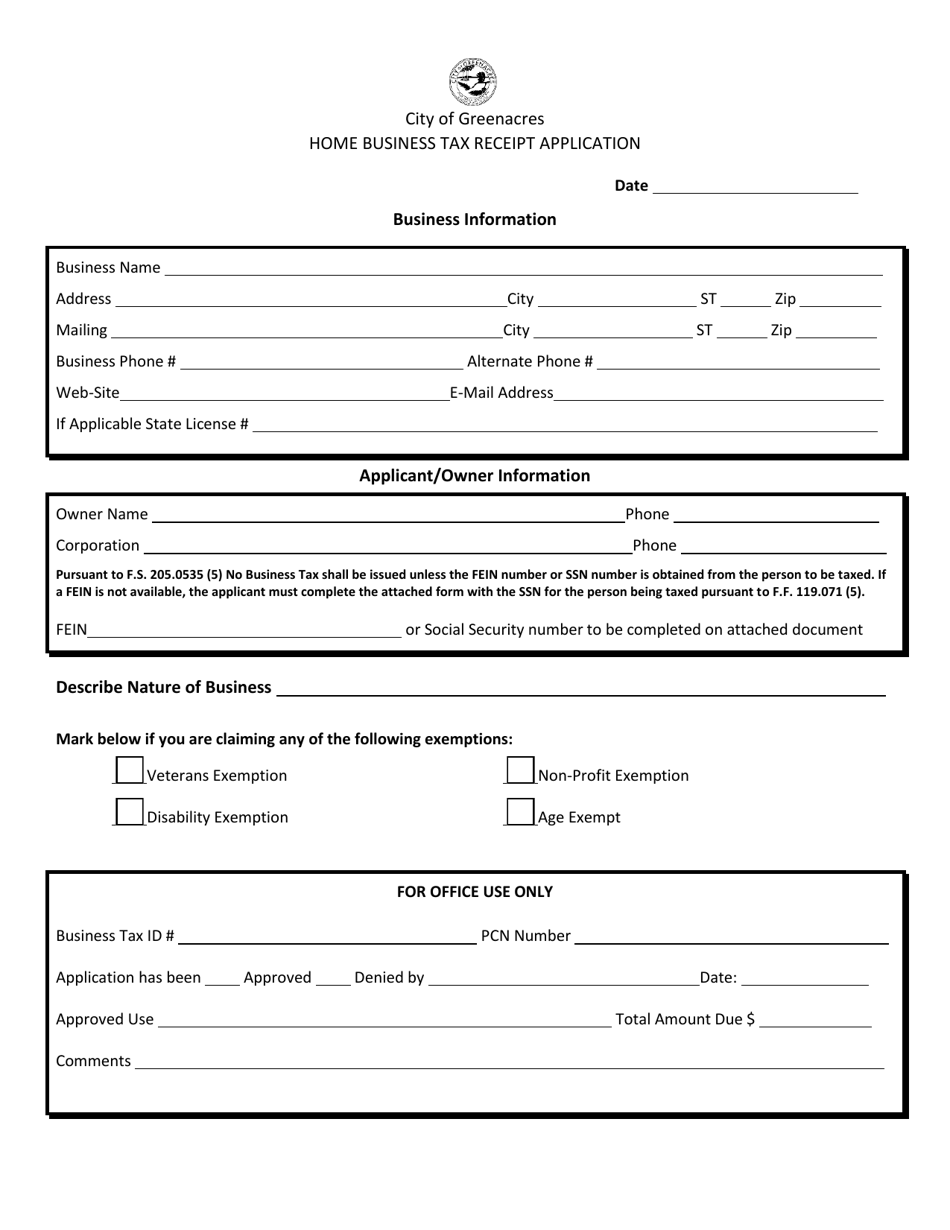

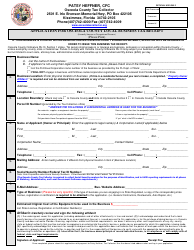

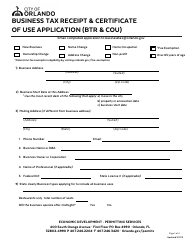

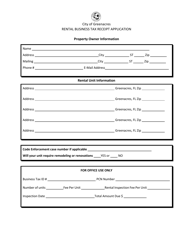

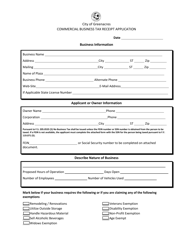

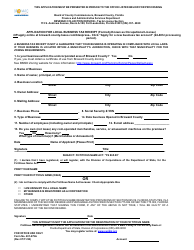

Home Business Tax Receipt Application - City of Greenacres, Florida

Home Business Tax Receipt Application is a legal document that was released by the Development and Neighborhood Services Department - City of Greenacres, Florida - a government authority operating within Florida. The form may be used strictly within City of Greenacres.

FAQ

Q: What is a Home Business Tax Receipt?

A: A Home Business Tax Receipt is a permit required by the City of Greenacres, Florida for individuals operating a business from their residential property.

Q: Why do I need a Home Business Tax Receipt?

A: You need a Home Business Tax Receipt to comply with local regulations and to ensure that your business operations are legal and in accordance with the City's zoning laws.

Q: How can I apply for a Home Business Tax Receipt?

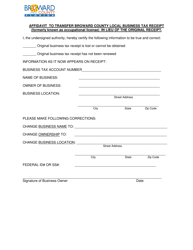

A: You can apply for a Home Business Tax Receipt by completing the application form provided by the City of Greenacres, Florida and submitting it along with the required documents and fees.

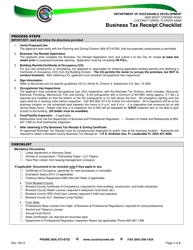

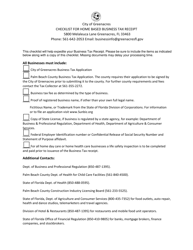

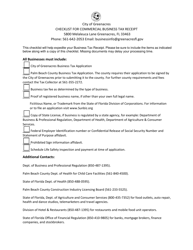

Q: What documents are required for the Home Business Tax Receipt application?

A: The required documents for the Home Business Tax Receipt application may vary, but typically include a completed application form, proof of residency, proof of business ownership, and any other relevant permits or licenses.

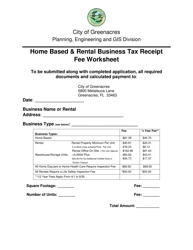

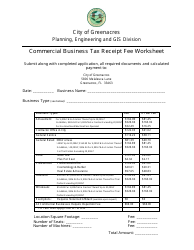

Q: How much does a Home Business Tax Receipt cost?

A: The cost of a Home Business Tax Receipt varies depending on the type of business and the size of your operation. It is best to contact the City of Greenacres, Florida directly for details on the fees.

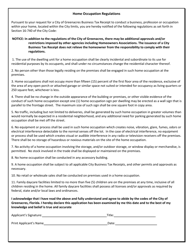

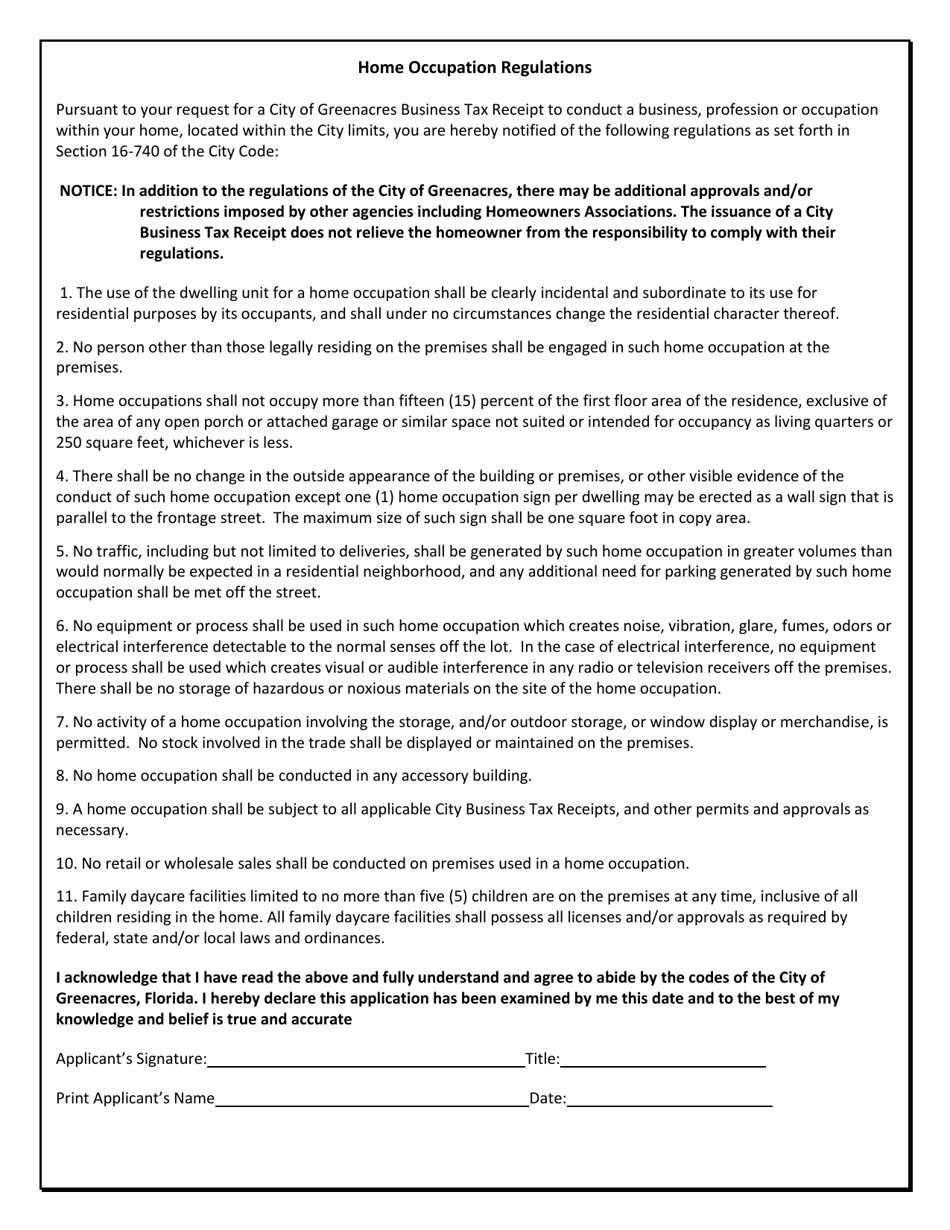

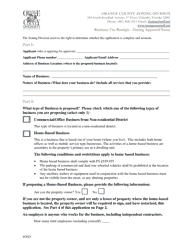

Q: Are there any restrictions on home businesses in Greenacres, Florida?

A: Yes, there are certain restrictions on home businesses in Greenacres, Florida. These may include limitations on signage, parking, noise, and the size or number of employees.

Q: Can I operate any type of business from my home?

A: Not all types of businesses are allowed to operate from residential properties in Greenacres, Florida. It is important to check the City's zoning regulations and consult with the appropriate local authorities to determine if your business is permitted.

Q: Can I run a home-based business without a Home Business Tax Receipt?

A: No, operating a home-based business without a Home Business Tax Receipt is a violation of local regulations and may result in fines or legal consequences. It is essential to obtain the necessary permit before starting your business operations.

Q: How often do I need to renew my Home Business Tax Receipt?

A: The Home Business Tax Receipt needs to be renewed annually. It is your responsibility to ensure timely renewal to avoid any penalties or disruptions to your business.

Q: Who should I contact for more information about the Home Business Tax Receipt application?

A: For more information about the Home Business Tax Receipt application, you can contact the City of Greenacres, Florida directly. They will be able to provide you with the necessary guidance and answer any specific questions you may have.

Form Details:

- The latest edition currently provided by the Development and Neighborhood Services Department - City of Greenacres, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Development and Neighborhood Services Department - City of Greenacres, Florida.