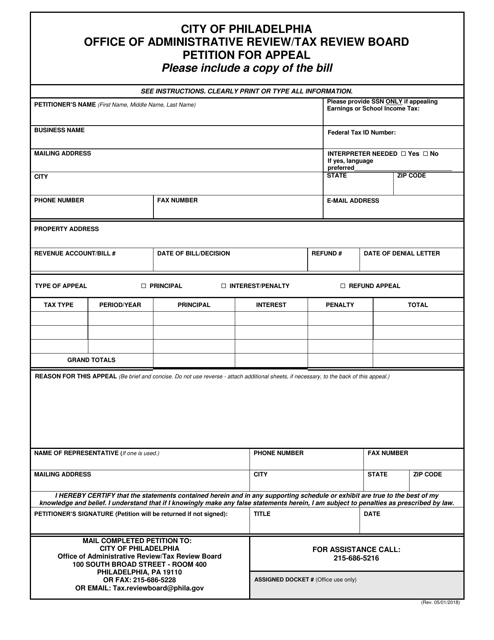

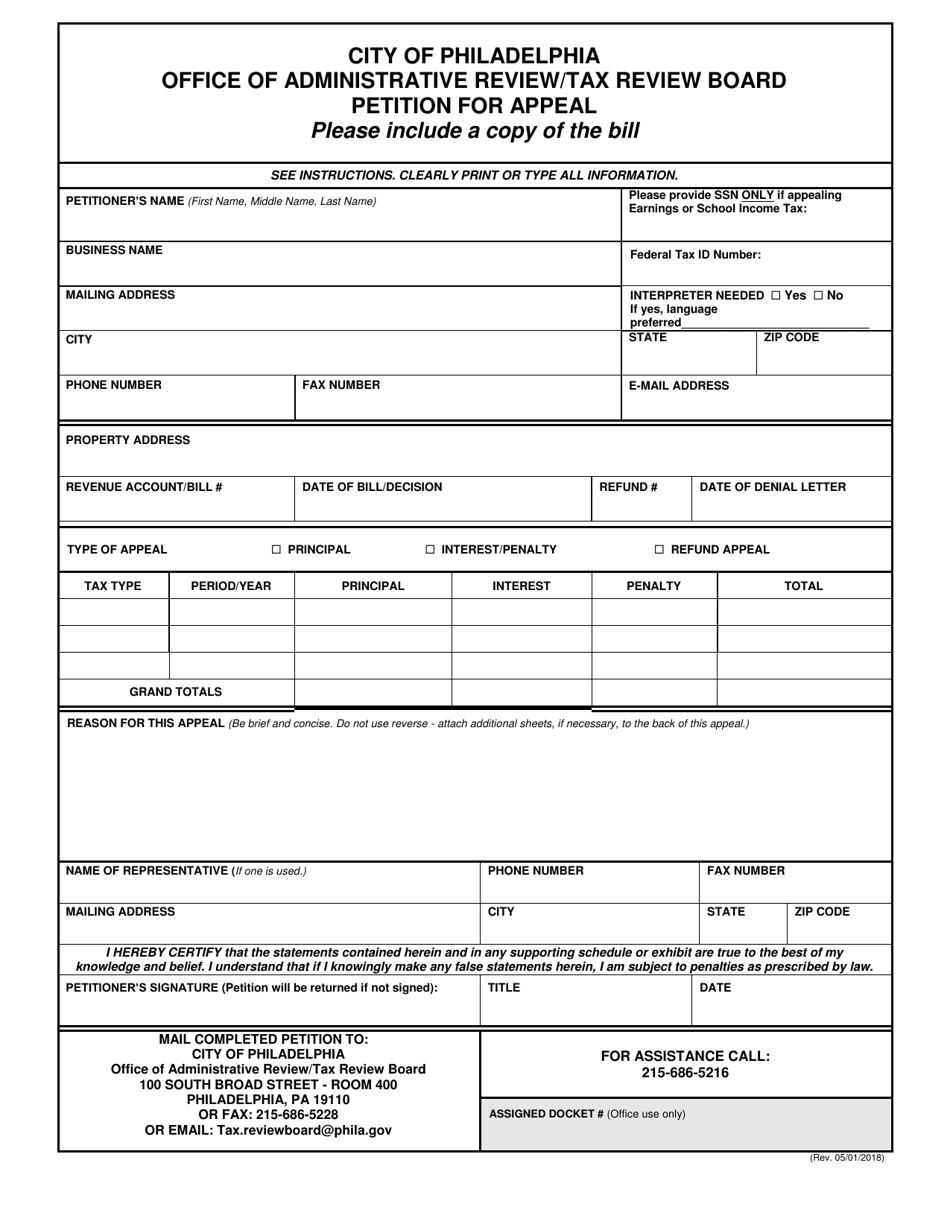

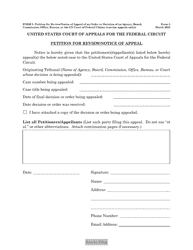

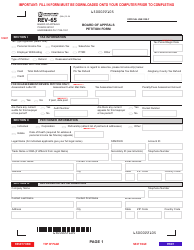

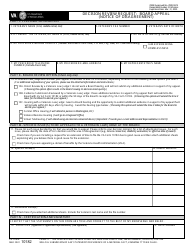

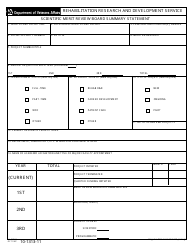

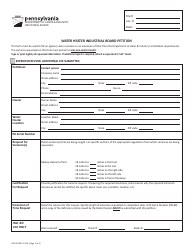

Tax Review Board Petition for Appeal - City of Philadelphia, Pennsylvania

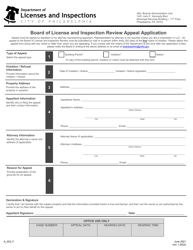

Tax Review Board Petition for Appeal is a legal document that was released by the Office of Administrative Review - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is a Tax Review Board Petition for Appeal?

A: A Tax Review Board Petition for Appeal is a formal request to have a tax decision reviewed by the Tax Review Board in the City of Philadelphia, Pennsylvania.

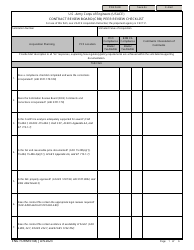

Q: How can I file a Tax Review Board Petition for Appeal in Philadelphia?

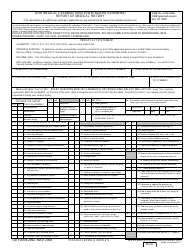

A: To file a Tax Review Board Petition for Appeal in Philadelphia, you need to submit a completed petition form along with any required supporting documentation.

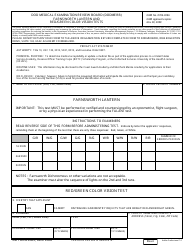

Q: What information should I include in the Tax Review Board Petition for Appeal?

A: In the Tax Review Board Petition for Appeal, you should include details about the tax decision you are appealing, reasons for the appeal, and any supporting evidence.

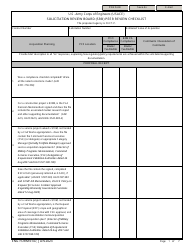

Q: Is there a deadline to file a Tax Review Board Petition for Appeal in Philadelphia?

A: Yes, there is a deadline to file a Tax Review Board Petition for Appeal in Philadelphia. It must be filed within 30 days from the date of the tax decision you are appealing.

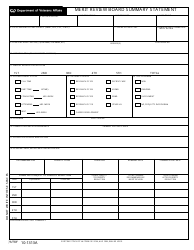

Q: What happens after I file a Tax Review Board Petition for Appeal in Philadelphia?

A: After you file a Tax Review Board Petition for Appeal in Philadelphia, you may be scheduled for a hearing before the board to present your case.

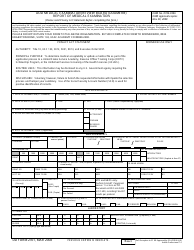

Q: Can I have legal representation during the Tax Review Board Petition for Appeal process in Philadelphia?

A: Yes, you can have legal representation during the Tax Review Board Petition for Appeal process in Philadelphia.

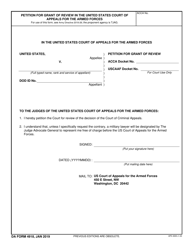

Q: If I disagree with the Tax Review Board's decision in Philadelphia, can I further appeal the decision?

A: Yes, if you disagree with the Tax Review Board's decision in Philadelphia, you can further appeal the decision to the Court of Common Pleas.

Q: Who can file a Tax Review Board Petition for Appeal in Philadelphia?

A: Any taxpayer who has received a tax decision from the City of Philadelphia can file a Tax Review Board Petition for Appeal.

Q: Is there a fee to file a Tax Review Board Petition for Appeal in Philadelphia?

A: Yes, there is a fee to file a Tax Review Board Petition for Appeal in Philadelphia. The fee amount varies depending on the type of tax being appealed.

Form Details:

- Released on May 1, 2018;

- The latest edition currently provided by the Office of Administrative Review - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Office of Administrative Review - City of Philadelphia, Pennsylvania.