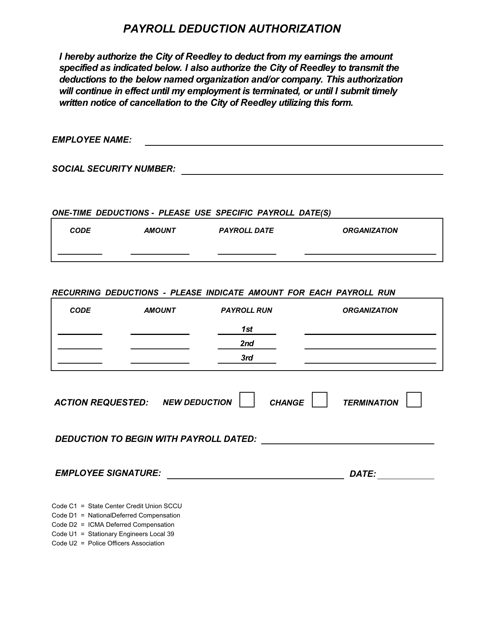

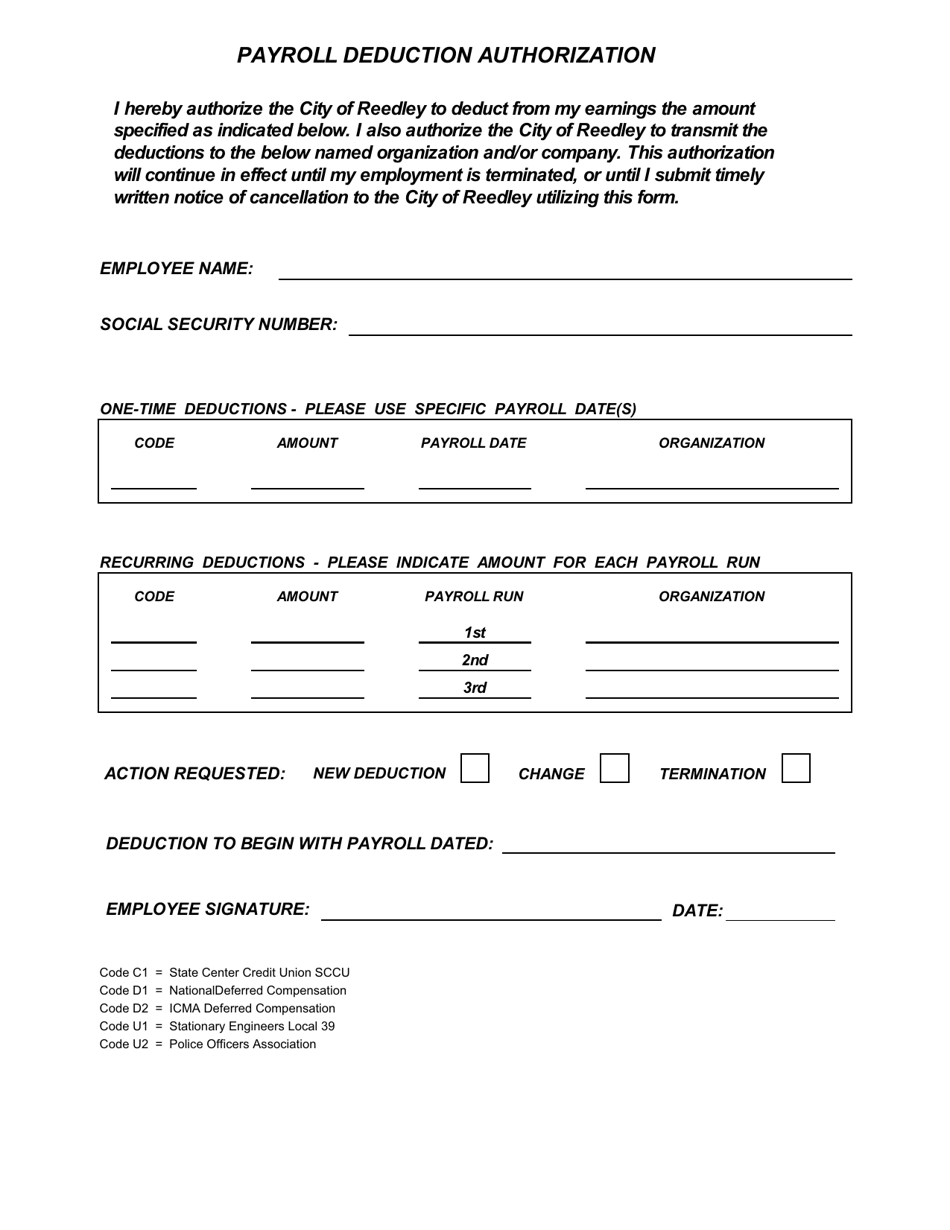

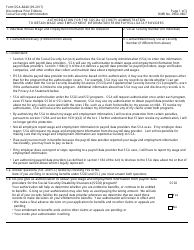

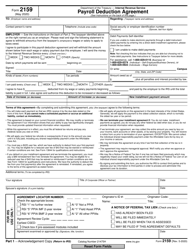

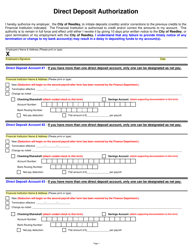

Payroll Deduction Authorization - City of Reedley, California

Payroll Deduction Authorization is a legal document that was released by the Administrative and Finance Services - City of Reedley, California - a government authority operating within California. The form may be used strictly within City of Reedley.

FAQ

Q: What is a payroll deduction authorization?

A: A payroll deduction authorization is a written agreement between an employee and their employer allowing the employer to deduct specific amounts from the employee's paycheck for various purposes.

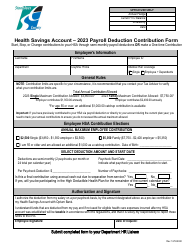

Q: Why would I need a payroll deduction authorization?

A: You may need a payroll deduction authorization if you want to authorize specific deductions from your paycheck, such as for taxes, retirement contributions, healthcare premiums, or charitable donations.

Q: What information is required in a payroll deduction authorization form?

A: A payroll deduction authorization form typically requires your personal information, such as your name, employee ID, and contact details, as well as the specific deductions you want to authorize and the amounts to be deducted.

Q: Can I change or revoke a payroll deduction authorization?

A: Yes, you can usually change or revoke a payroll deduction authorization by submitting a new authorization form to your employer. It's important to check with your employer or Human Resources department for their specific procedures.

Q: Are there any limitations on what deductions can be authorized through a payroll deduction?

A: Yes, there may be certain limitations on what deductions can be authorized through a payroll deduction. These limitations can vary depending on your employer's policies, applicable laws, and any collective bargaining agreements.

Form Details:

- The latest edition currently provided by the Administrative and Finance Services - City of Reedley, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Administrative and Finance Services - City of Reedley, California.