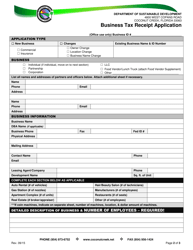

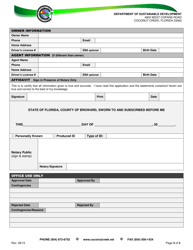

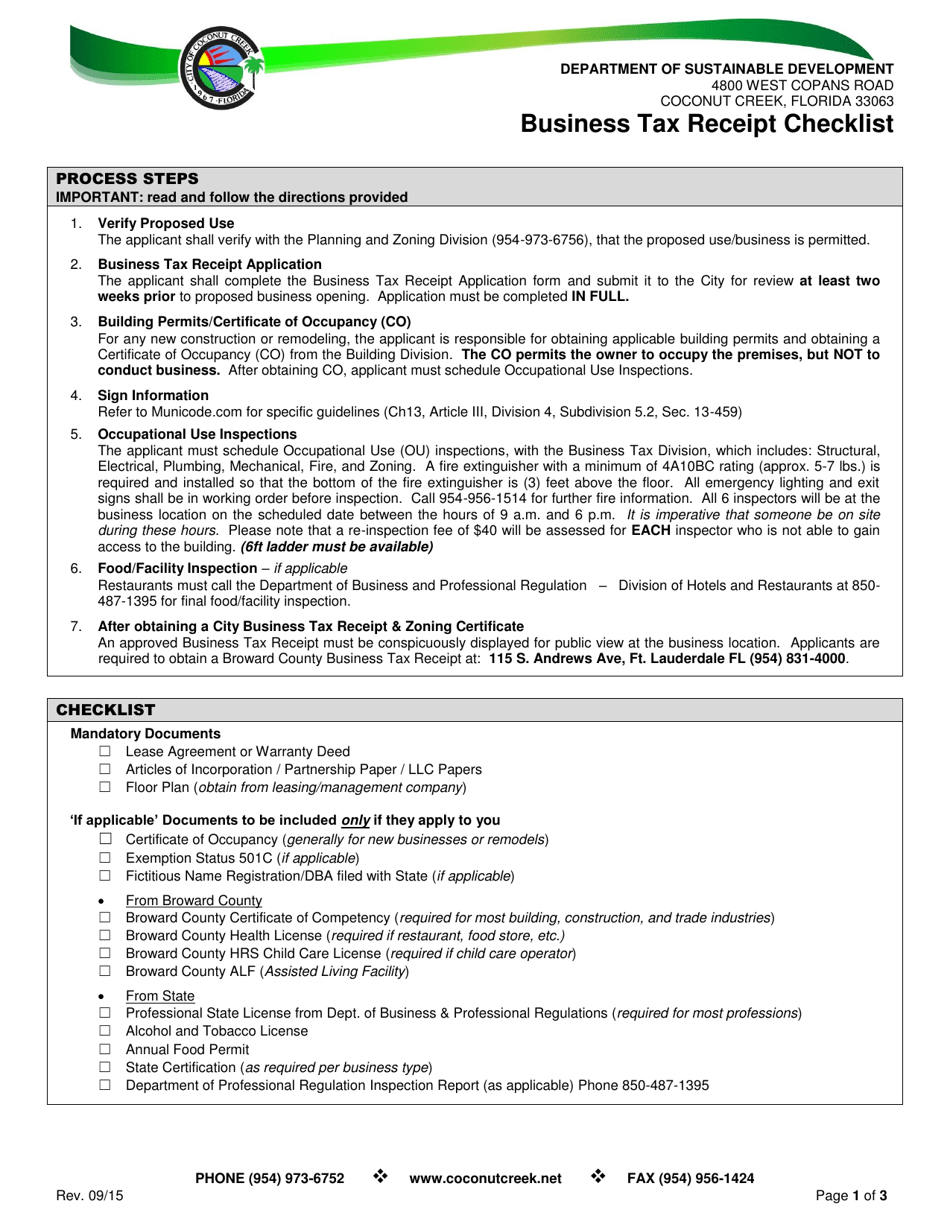

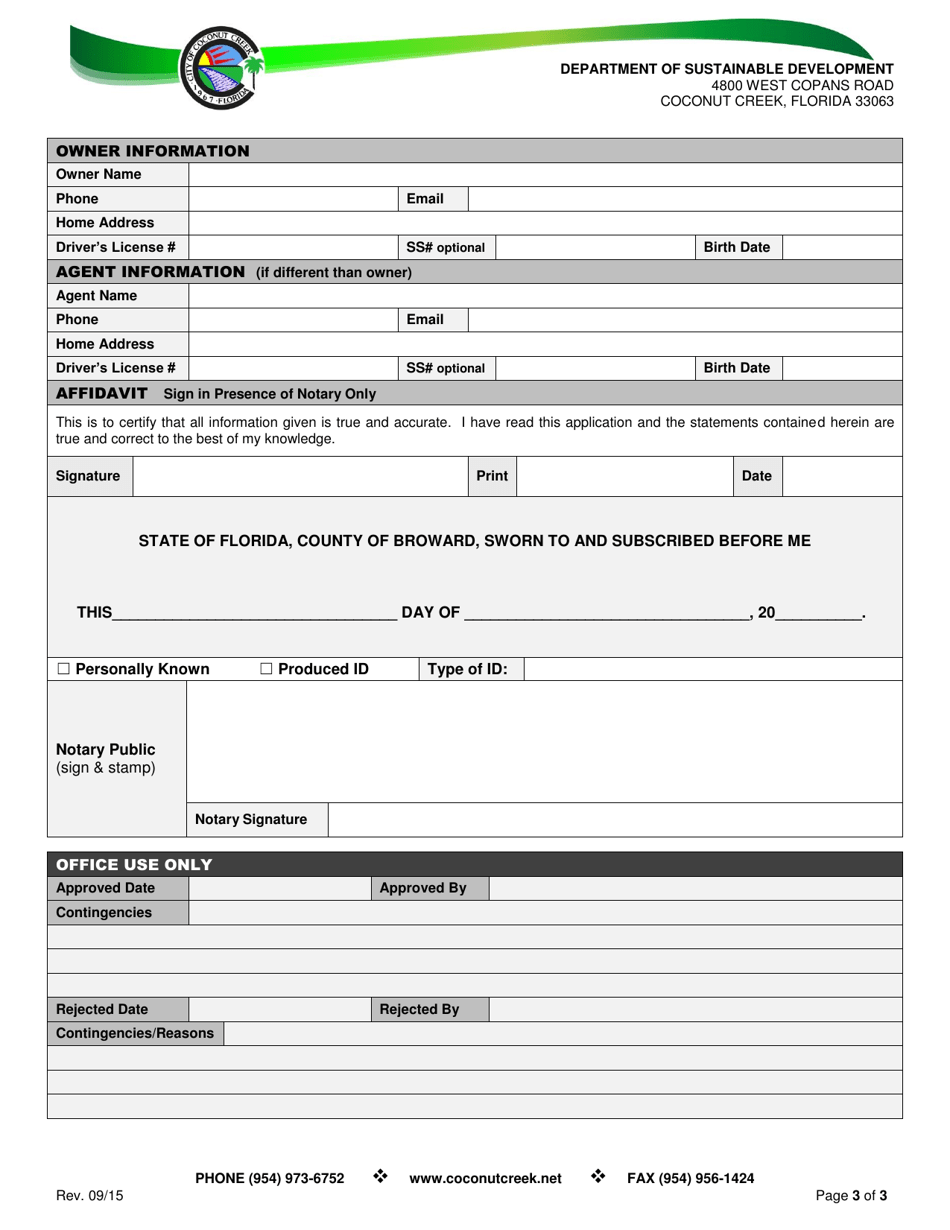

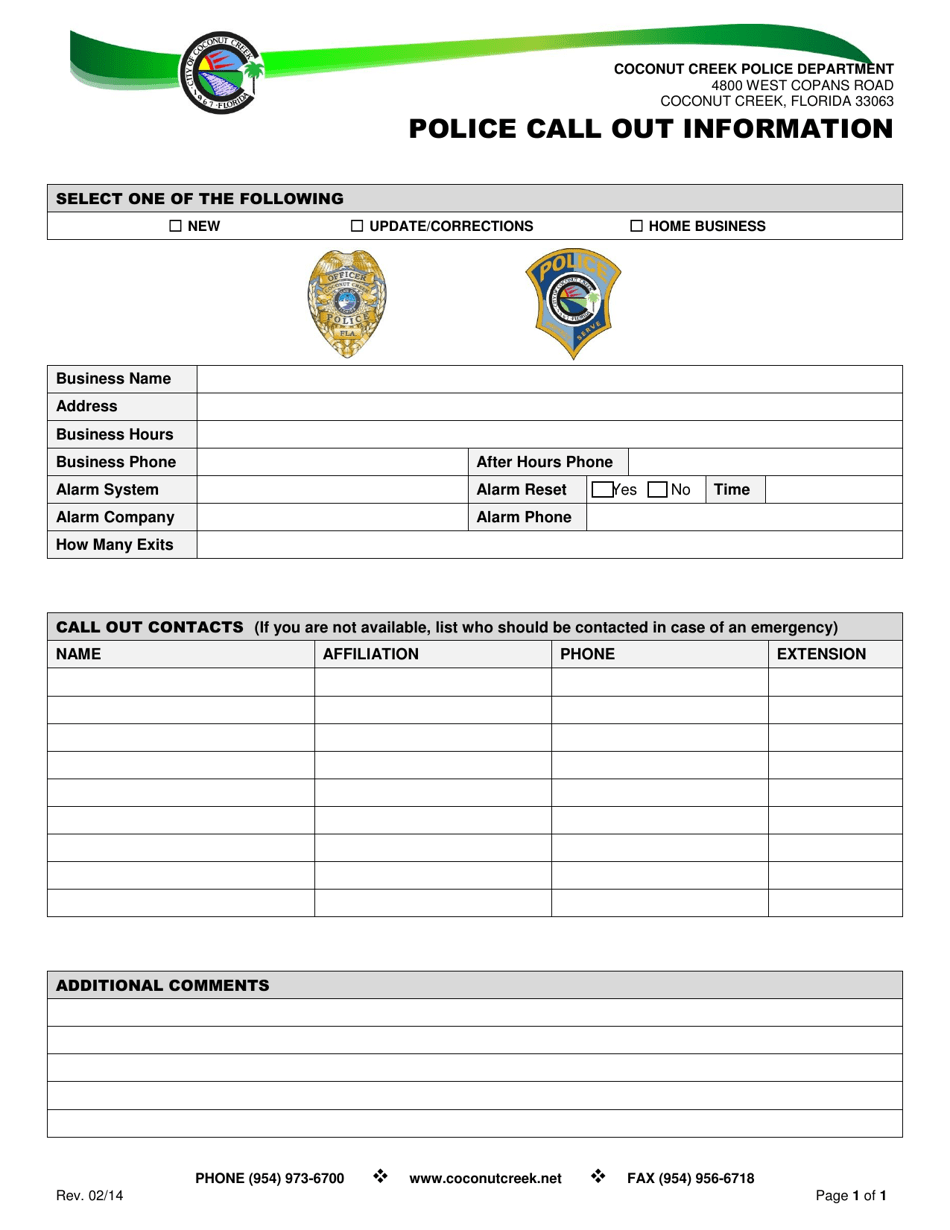

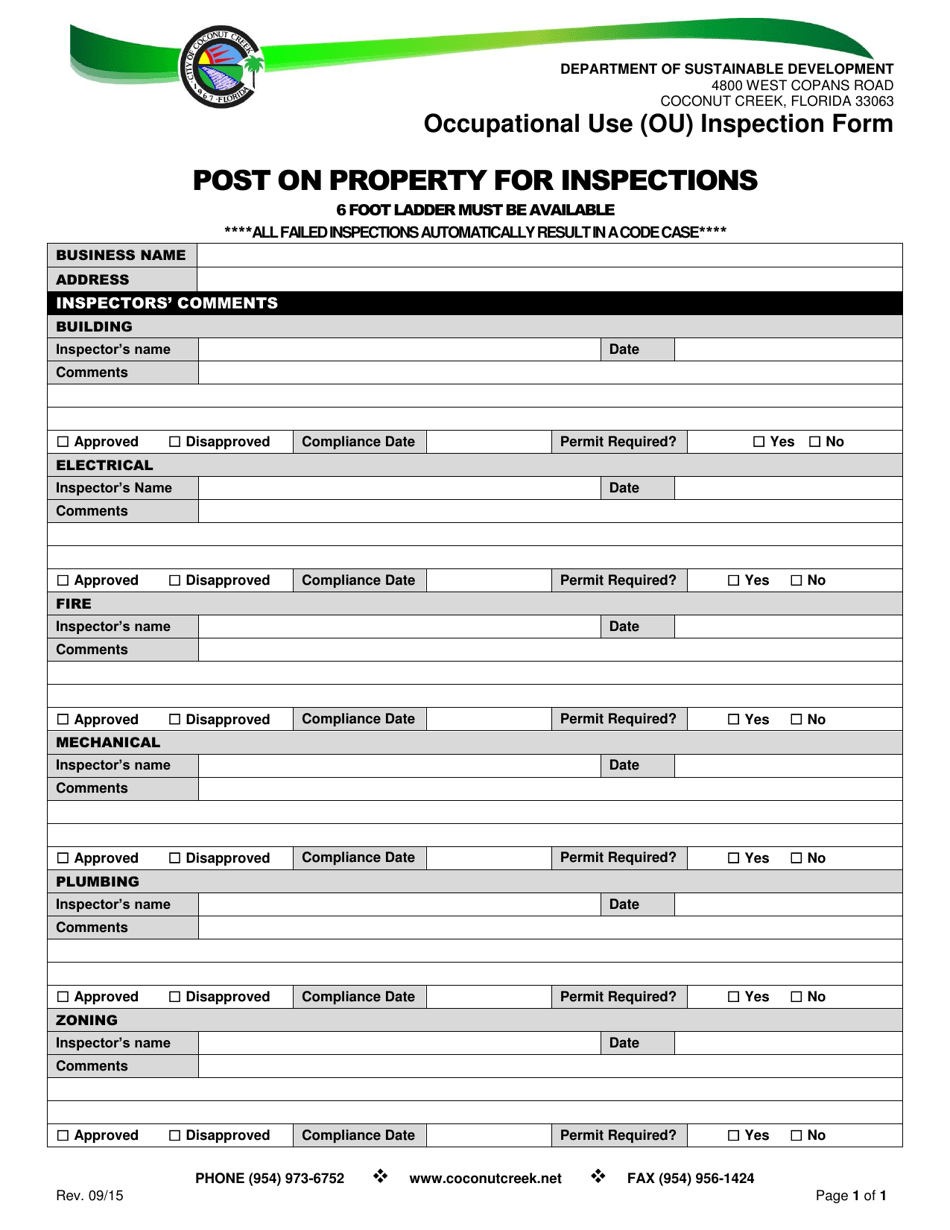

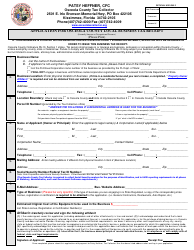

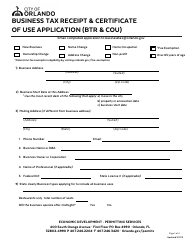

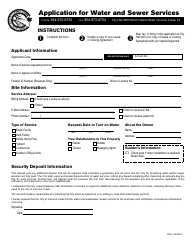

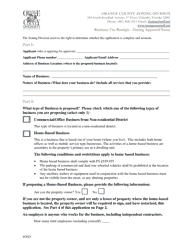

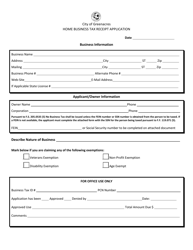

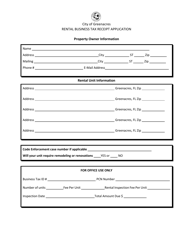

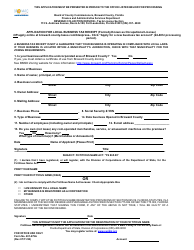

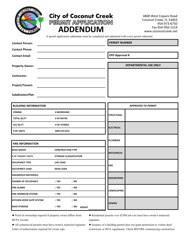

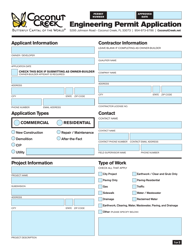

Business Tax Receipt Application - City of Coconut Creek, Florida

Business Tax Receipt Application is a legal document that was released by the Department of Sustainable Development - City of Coconut Creek, Florida - a government authority operating within Florida. The form may be used strictly within City of Coconut Creek.

FAQ

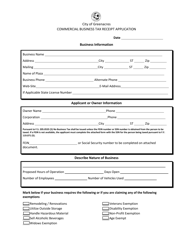

Q: What is a Business Tax Receipt?

A: A Business Tax Receipt is a license required for all businesses operating in the City of Coconut Creek, Florida.

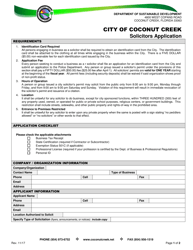

Q: How do I apply for a Business Tax Receipt in Coconut Creek?

A: To apply for a Business Tax Receipt in Coconut Creek, you need to fill out the application form and submit it to the appropriate department.

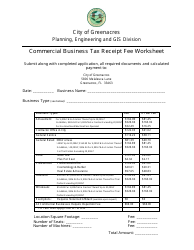

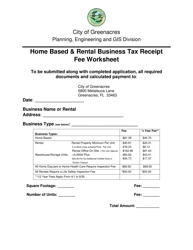

Q: Is there a fee for a Business Tax Receipt in Coconut Creek?

A: Yes, there is a fee associated with obtaining a Business Tax Receipt in Coconut Creek. The fee amount may vary depending on the type of business.

Q: How long does it take to process a Business Tax Receipt application in Coconut Creek?

A: The processing time for a Business Tax Receipt application in Coconut Creek can vary, but typically takes a few weeks to complete.

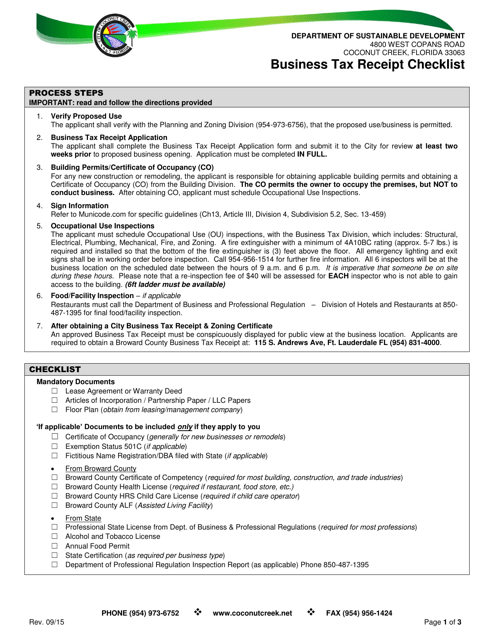

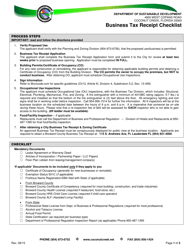

Q: What documents do I need to include with my Business Tax Receipt application in Coconut Creek?

A: You may need to include documents such as proof of identity, proof of ownership or lease agreement, and any required licenses or permits specific to your business type.

Form Details:

- Released on September 1, 2015;

- The latest edition currently provided by the Department of Sustainable Development - City of Coconut Creek, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Department of Sustainable Development - City of Coconut Creek, Florida.