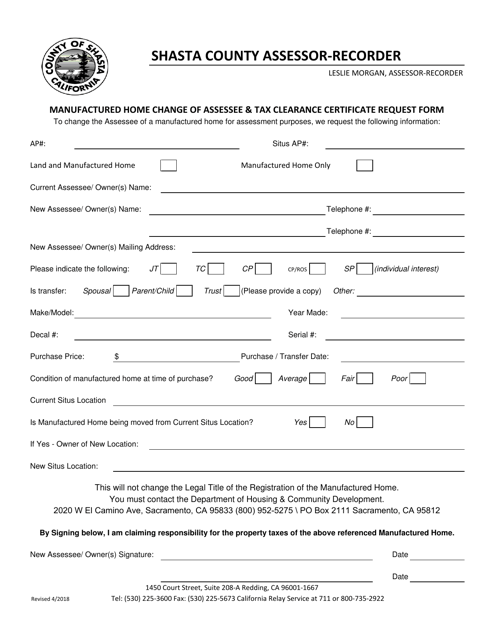

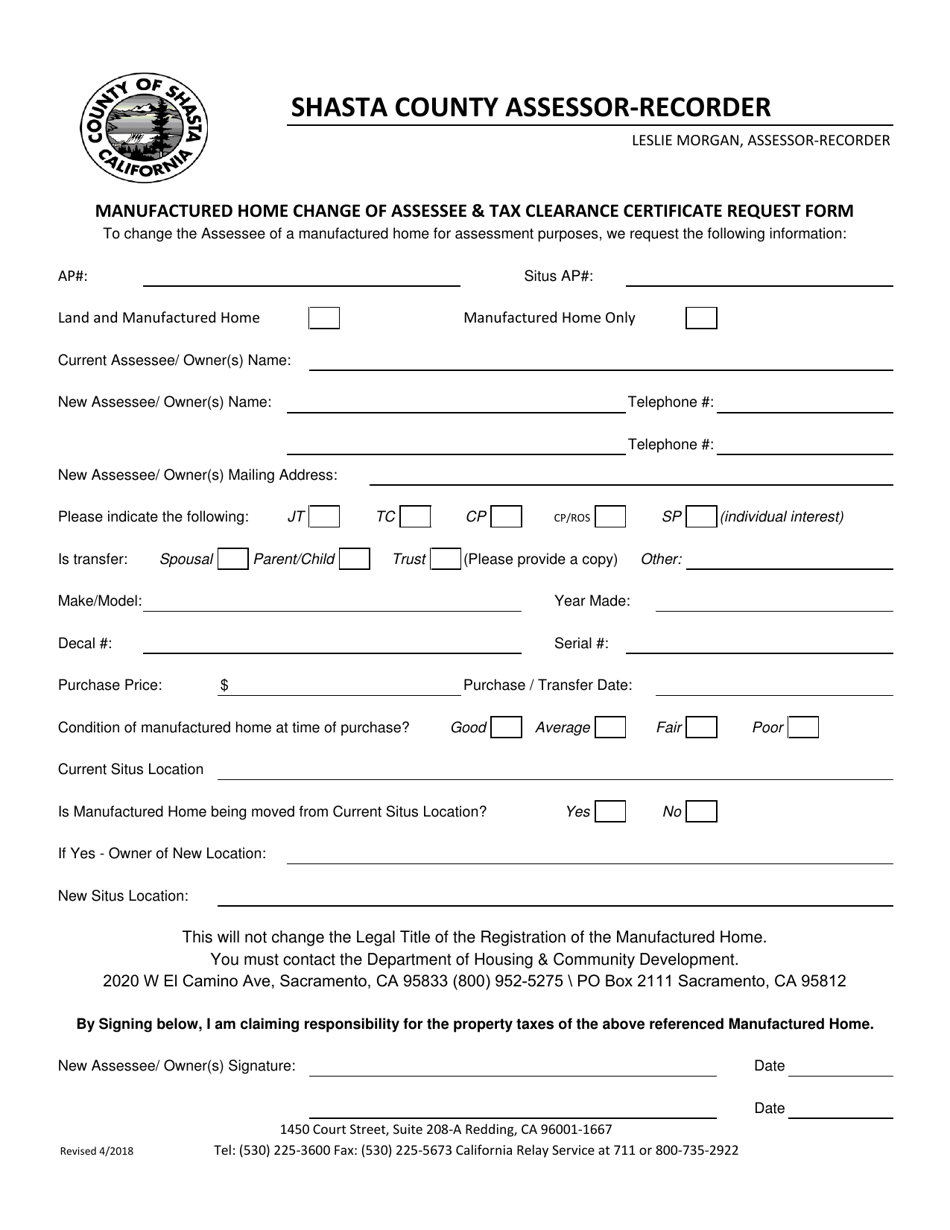

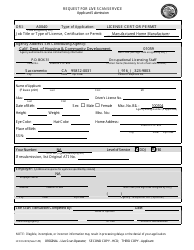

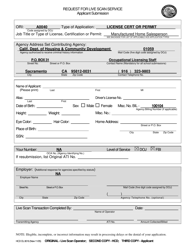

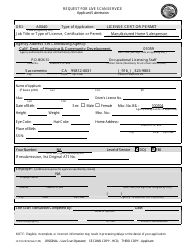

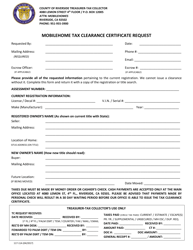

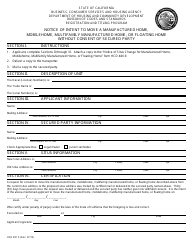

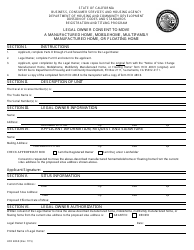

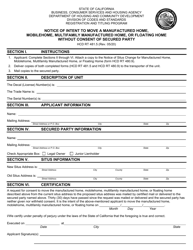

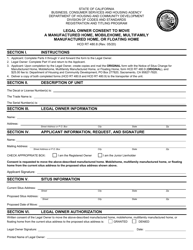

Manufactured Home Change of Assessee & Tax Clearance Certificate Request - Shasta County, California

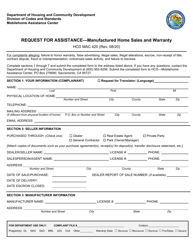

Manufactured Home Change of Assessee & Tax Clearance Certificate Request is a legal document that was released by the Assessor-Recorder's Office - Shasta County, California - a government authority operating within California. The form may be used strictly within Shasta County.

FAQ

Q: What is a manufactured home change of assessee?

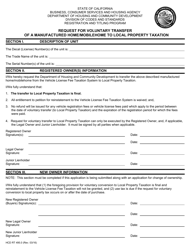

A: A manufactured home change of assessee is the transfer of ownership or change in the person responsible for property taxes on a manufactured home.

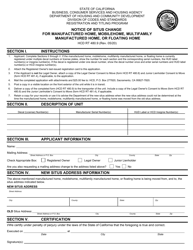

Q: How do I request a tax clearance certificate for a manufactured home in Shasta County, California?

A: You can request a tax clearance certificate for a manufactured home in Shasta County, California by contacting the Assessor's Office and filling out the necessary forms.

Q: Why would I need a tax clearance certificate for a manufactured home?

A: You may need a tax clearance certificate for a manufactured home to provide proof that all property taxes have been paid before transferring or selling the home.

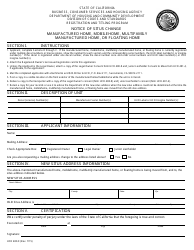

Q: What documents do I need to provide for a manufactured home change of assessee?

A: You may need to provide documents such as the Certificate of Title, bill of sale, and other related documents to complete a manufactured home change of assessee.

Q: Are there any fees associated with a manufactured home change of assessee and tax clearance certificate request in Shasta County, California?

A: Yes, there may be fees associated with a manufactured home change of assessee and tax clearance certificate request in Shasta County, California. It is best to contact the Assessor's Office for specific fee information.

Form Details:

- Released on April 1, 2018;

- The latest edition currently provided by the Assessor-Recorder's Office - Shasta County, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Assessor-Recorder's Office - Shasta County, California.