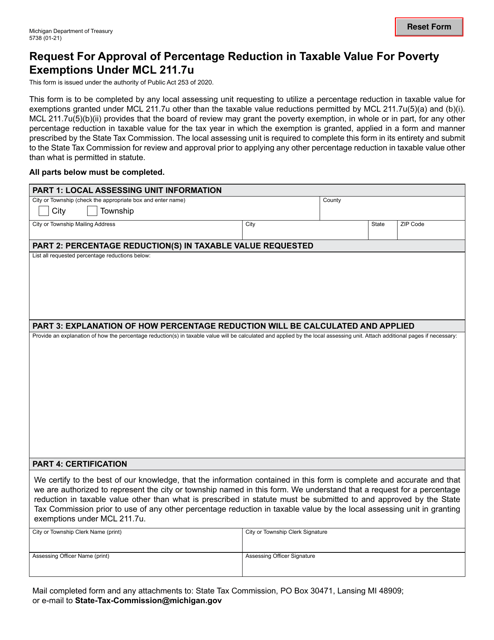

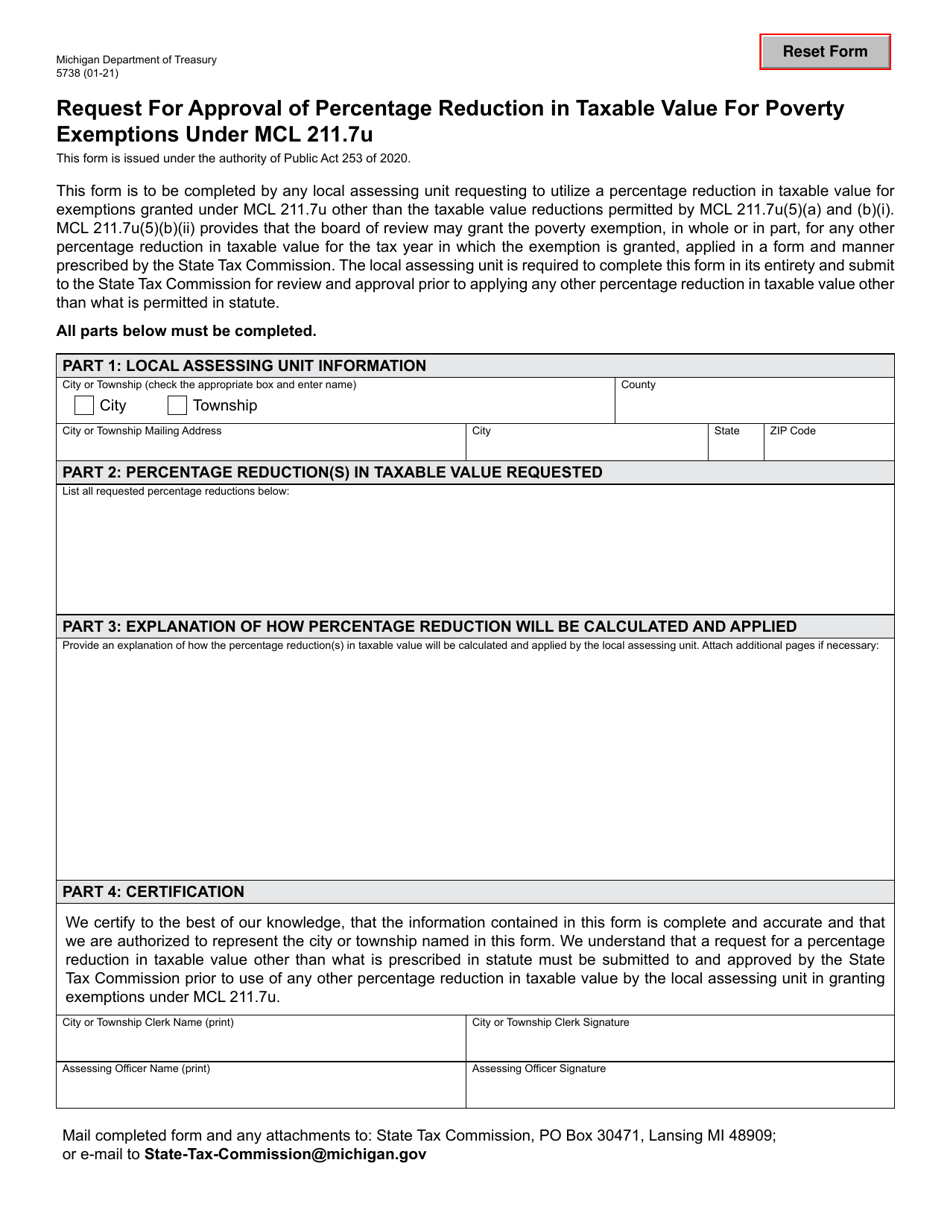

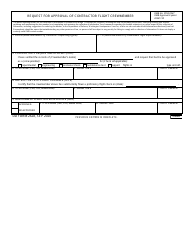

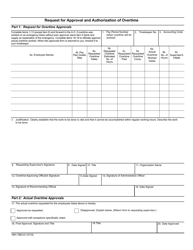

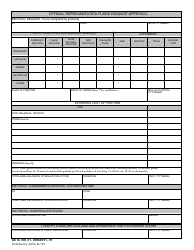

Form 5738 Request for Approval of Percentage Reduction in Taxable Value for Poverty Exemptions Under Mcl 211.7u - Michigan

What Is Form 5738?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

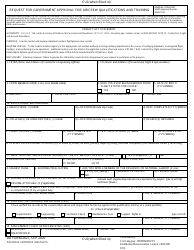

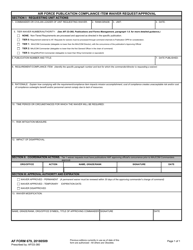

Q: What is Form 5738?

A: Form 5738 is a request form for approval of percentage reduction in taxable value for poverty exemptions in Michigan.

Q: What is the purpose of Form 5738?

A: The purpose of Form 5738 is to apply for a poverty exemption that reduces the taxable value of a property.

Q: Who can use Form 5738?

A: Form 5738 can be used by Michigan residents who meet certain income and asset requirements.

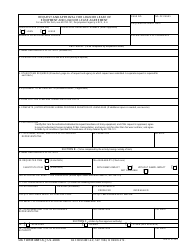

Q: What is the deadline for submitting Form 5738?

A: The deadline for submitting Form 5738 varies depending on the local government unit. It is recommended to contact your local assessor's office for specific deadlines.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

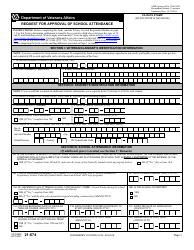

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5738 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.