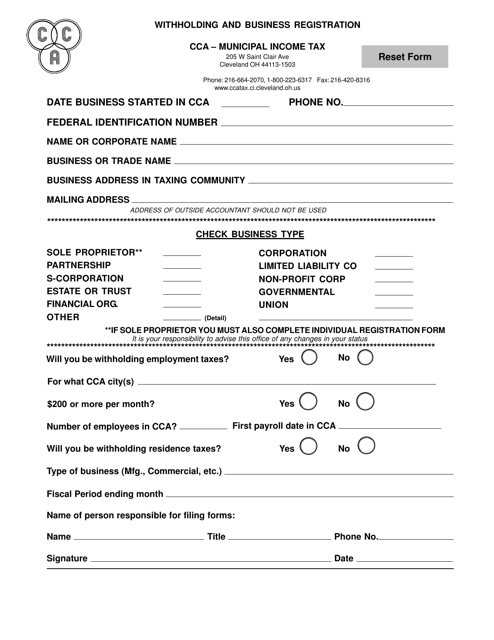

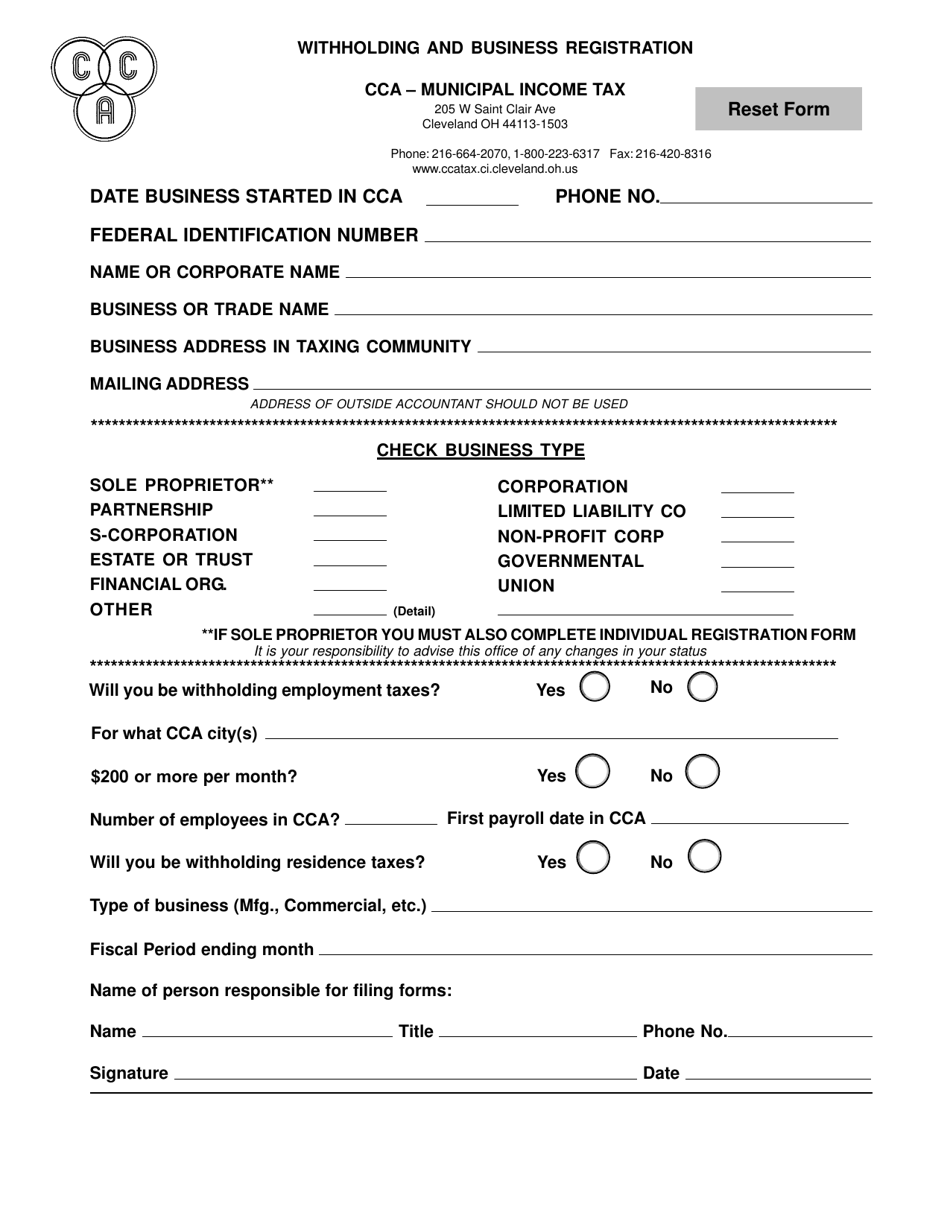

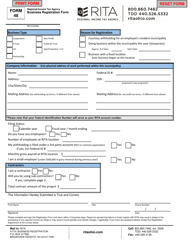

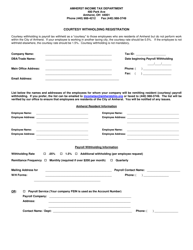

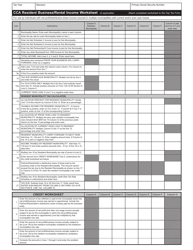

Withholding and Business Registration - City of Cleveland, Ohio

Withholding and Business Registration is a legal document that was released by the Division of Taxation - City of Cleveland, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Cleveland.

FAQ

Q: What is withholding?

A: Withholding refers to the process of deducting taxes from an employee's wages and remitting them to the government.

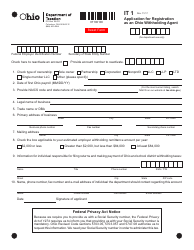

Q: How do I register my business in Cleveland, Ohio?

A: To register your business in Cleveland, Ohio, you need to fill out and submit the appropriate forms to the city's Division of Assessments and Licenses.

Q: What is the Division of Assessments and Licenses?

A: The Division of Assessments and Licenses is the department responsible for handling business registrations and licensing in Cleveland, Ohio.

Q: Do I need to withhold taxes for my employees?

A: Yes, as an employer in the United States, you are generally required to withhold federal, state, and local taxes from your employees' wages.

Q: What are the consequences of not withholding taxes?

A: Failing to withhold taxes can result in penalties, interest, and potential legal consequences. It is important to comply with withholding requirements.

Form Details:

- The latest edition currently provided by the Division of Taxation - City of Cleveland, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Division of Taxation - City of Cleveland, Ohio.