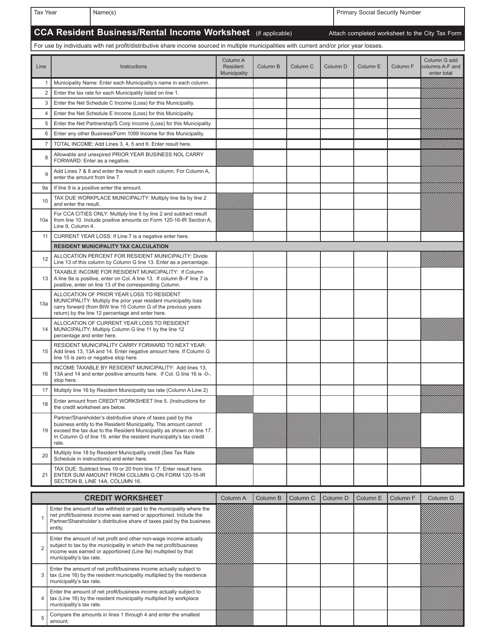

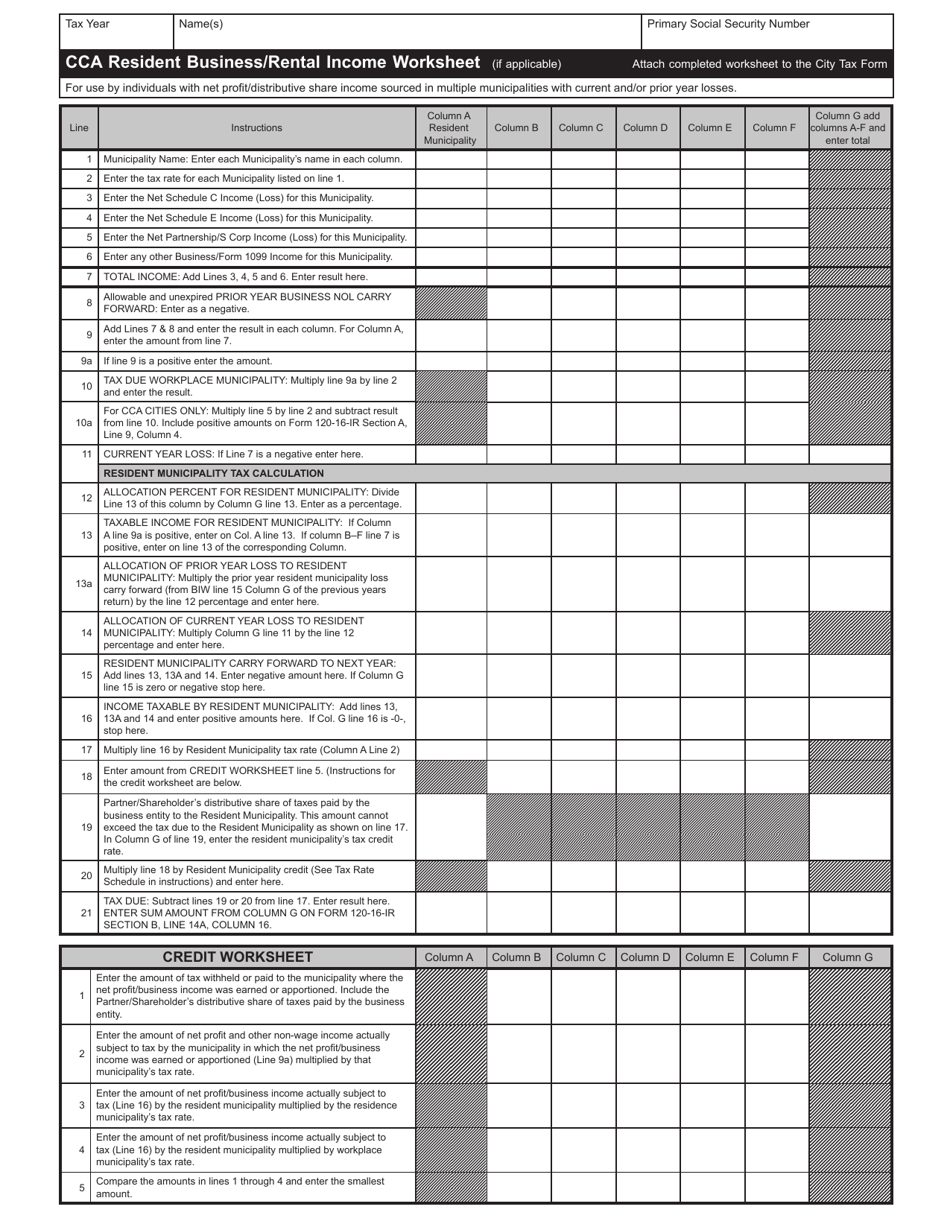

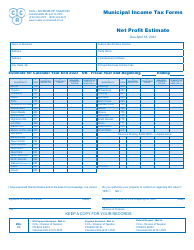

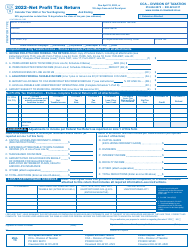

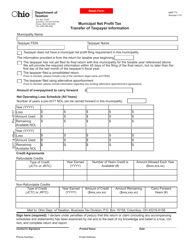

Cca Resident Business / Rental Income Worksheet - City of Cleveland, Ohio

Cca Resident Business/Rental Income Worksheet is a legal document that was released by the Division of Taxation - City of Cleveland, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Cleveland.

FAQ

Q: What is the CCA Resident Business/Rental Income Worksheet?

A: The CCA Resident Business/Rental Income Worksheet is a form used by residents of the City of Cleveland, Ohio to report their business or rental income.

Q: Who needs to complete the CCA Resident Business/Rental Income Worksheet?

A: Residents of the City of Cleveland, Ohio who have business or rental income need to complete the CCA Resident Business/Rental Income Worksheet.

Q: What is the purpose of the CCA Resident Business/Rental Income Worksheet?

A: The purpose of the CCA Resident Business/Rental Income Worksheet is to accurately report and calculate the business or rental income that residents have earned.

Q: What information do I need to complete the CCA Resident Business/Rental Income Worksheet?

A: You will need to gather information about your business or rental income, including income statements, expenses, and any relevant supporting documents.

Q: When is the deadline for submitting the CCA Resident Business/Rental Income Worksheet?

A: The deadline for submitting the CCA Resident Business/Rental Income Worksheet is typically April 15th of each year, coinciding with the deadline for filing federal income taxes.

Q: Are there any penalties for not completing the CCA Resident Business/Rental Income Worksheet?

A: Failure to complete and submit the CCA Resident Business/Rental Income Worksheet can result in penalties and fines imposed by the City of Cleveland, Ohio.

Form Details:

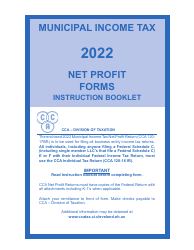

- The latest edition currently provided by the Division of Taxation - City of Cleveland, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Division of Taxation - City of Cleveland, Ohio.