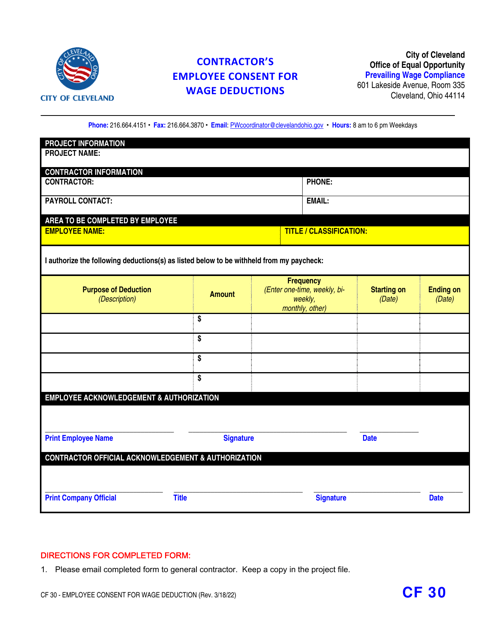

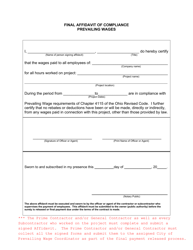

Form CF30 Contractor's Employee Consent for Wage Deductions - City of Cleveland, Ohio

What Is Form CF30?

This is a legal form that was released by the Mayor's Office of Equal Opportunity - City of Cleveland, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Cleveland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CF30?

A: Form CF30 is a Contractor's Employee Consent for Wage Deductions used in Cleveland, Ohio.

Q: Who is the form for?

A: The form is for contractors' employees in Cleveland, Ohio.

Q: What is the purpose of Form CF30?

A: The purpose of Form CF30 is to obtain the employee's consent for wage deductions.

Q: What does Form CF30 authorize?

A: Form CF30 authorizes the employer to make deductions from the employee's wages.

Q: Are there any specific requirements for using Form CF30?

A: Yes, there are specific requirements outlined in the City of Cleveland, Ohio ordinances.

Q: Can an employee refuse to sign Form CF30?

A: Yes, an employee has the right to refuse to sign Form CF30.

Q: What deductions can be made using Form CF30?

A: Deductions such as union dues, benefit contributions, or other authorized deductions can be made using Form CF30.

Q: Is Form CF30 applicable in other cities in Ohio?

A: No, Form CF30 is specific to the City of Cleveland in Ohio.

Form Details:

- Released on March 18, 2022;

- The latest edition provided by the Mayor's Office of Equal Opportunity - City of Cleveland, Ohio;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CF30 by clicking the link below or browse more documents and templates provided by the Mayor's Office of Equal Opportunity - City of Cleveland, Ohio.