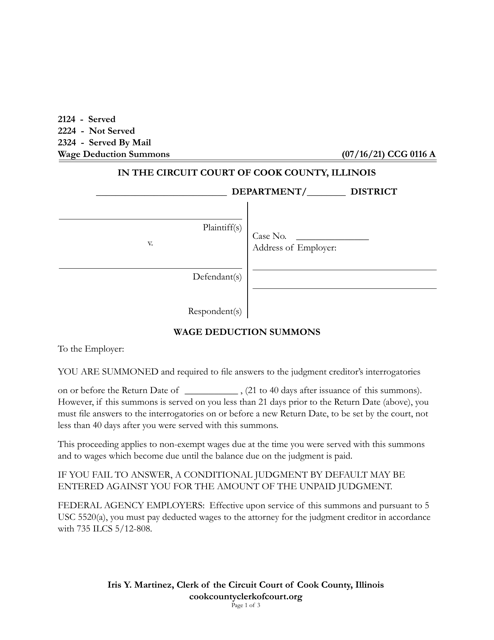

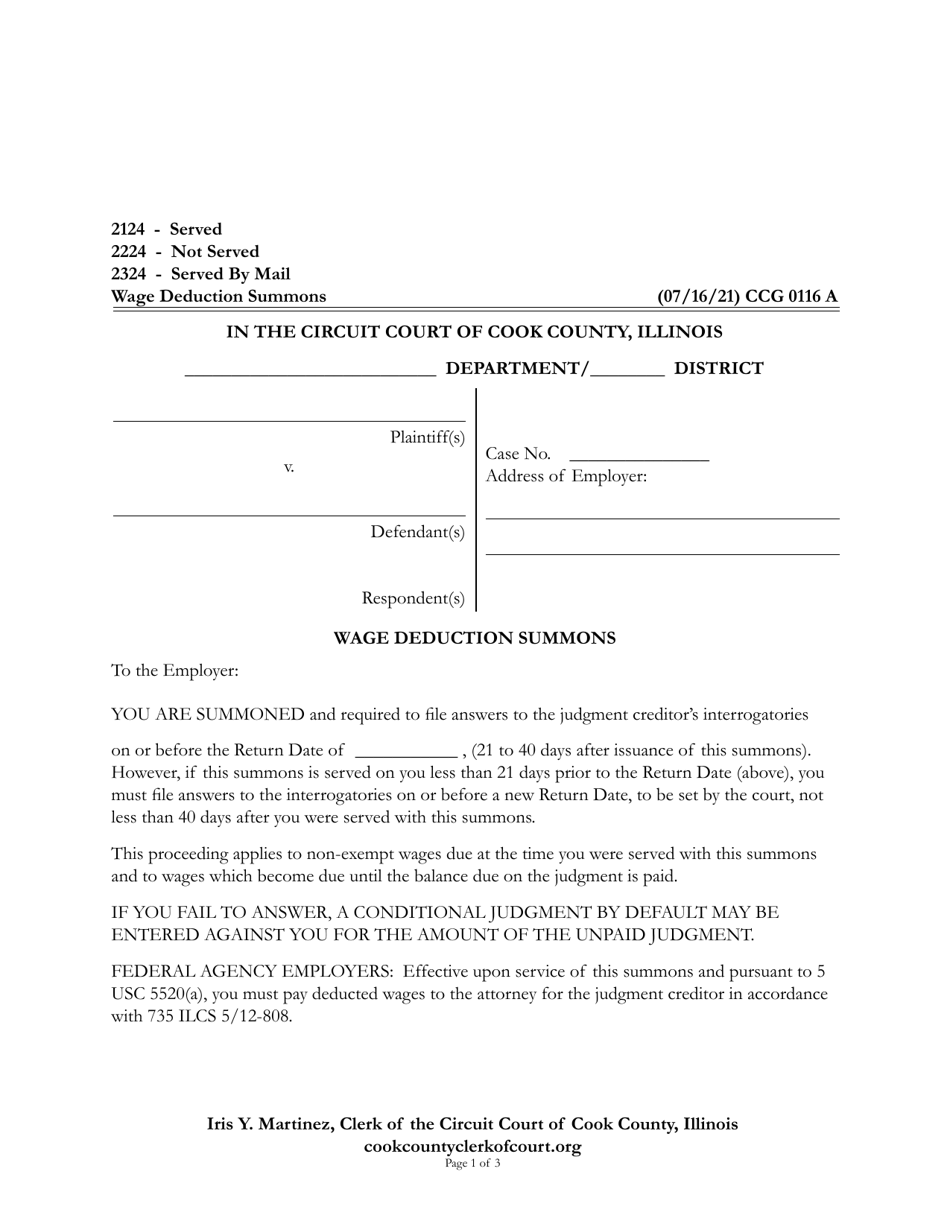

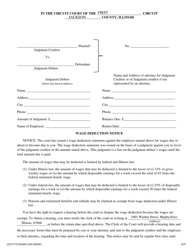

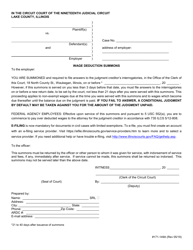

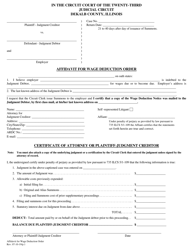

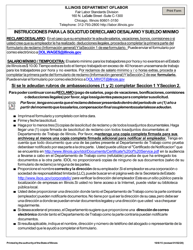

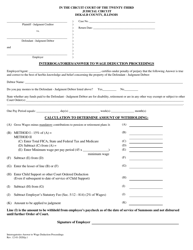

Form CCG0116 Wage Deduction Summons - Cook County, Illinois

What Is Form CCG0116?

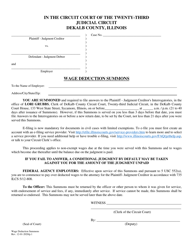

This is a legal form that was released by the Circuit Court - Cook County, Illinois - a government authority operating within Illinois. The form may be used strictly within Cook County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CCG0116?

A: Form CCG0116 is a Wage Deduction Summons.

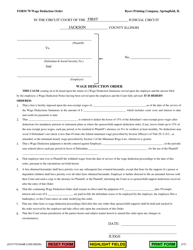

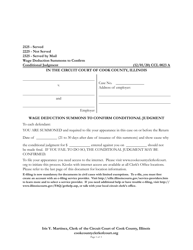

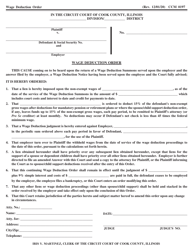

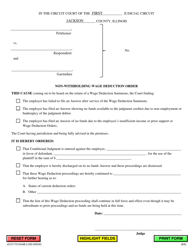

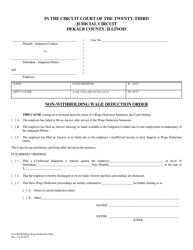

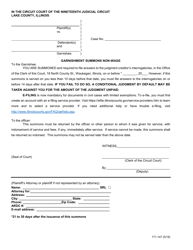

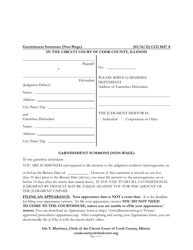

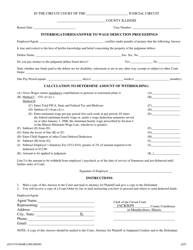

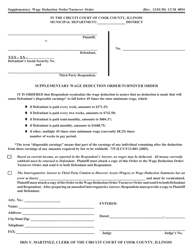

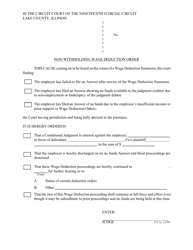

Q: What is a Wage Deduction Summons?

A: A Wage Deduction Summons is a legal document that allows a creditor to collect a debt by garnishing a debtor's wages.

Q: Who issues Form CCG0116?

A: Form CCG0116 is issued by the Cook County, Illinois.

Q: What is the purpose of Form CCG0116?

A: The purpose of Form CCG0116 is to notify an employer to deduct a certain amount from an employee's wages in order to satisfy a debt.

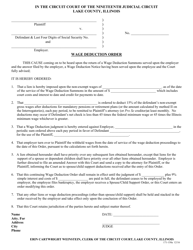

Q: Who is the debtor in a Wage Deduction Summons?

A: The debtor is the person who owes the debt and whose wages are being garnished.

Q: Who is the creditor in a Wage Deduction Summons?

A: The creditor is the person or entity to whom the debt is owed.

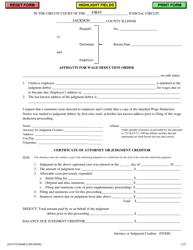

Q: What happens if a debtor ignores a Wage Deduction Summons?

A: If a debtor ignores a Wage Deduction Summons, they may face legal consequences.

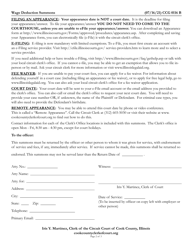

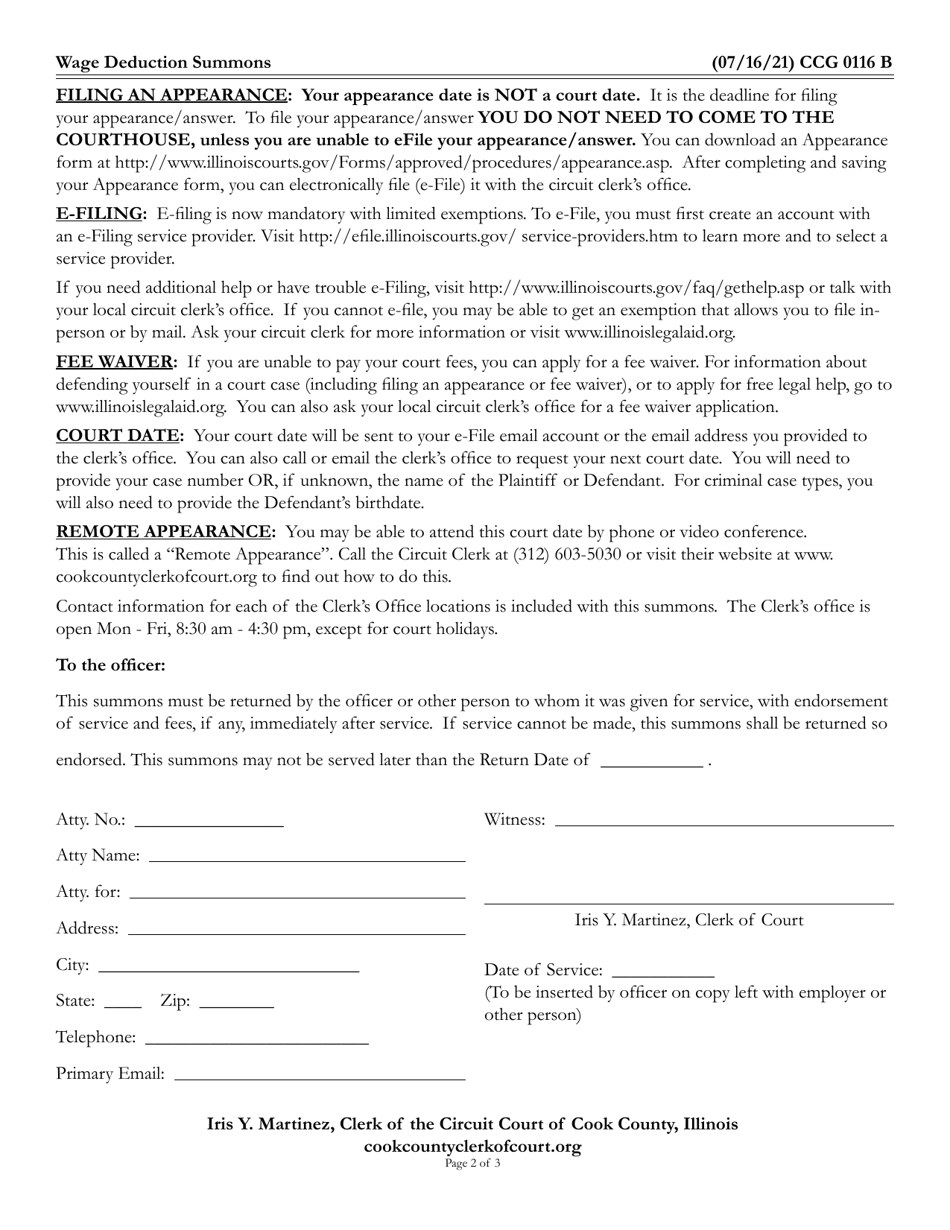

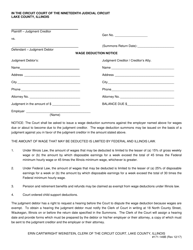

Q: What should an employer do upon receiving Form CCG0116?

A: Upon receiving Form CCG0116, an employer should begin deducting the specified amount from the employee's wages and remit it to the creditor.

Q: Can an employer refuse to comply with Form CCG0116?

A: An employer generally cannot refuse to comply with Form CCG0116, as it is a legally binding document.

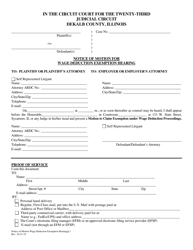

Q: What rights does a debtor have when their wages are being garnished?

A: Debtors have certain rights and protections when their wages are being garnished, which may vary depending on the state and local laws.

Form Details:

- Released on July 16, 2021;

- The latest edition provided by the Circuit Court - Cook County, Illinois;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CCG0116 by clicking the link below or browse more documents and templates provided by the Circuit Court - Cook County, Illinois.