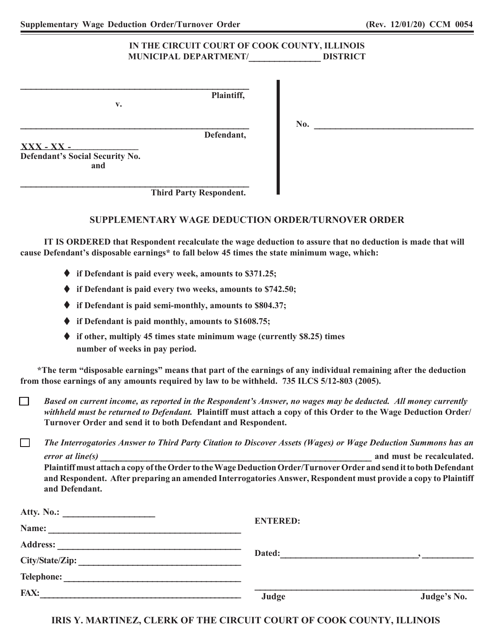

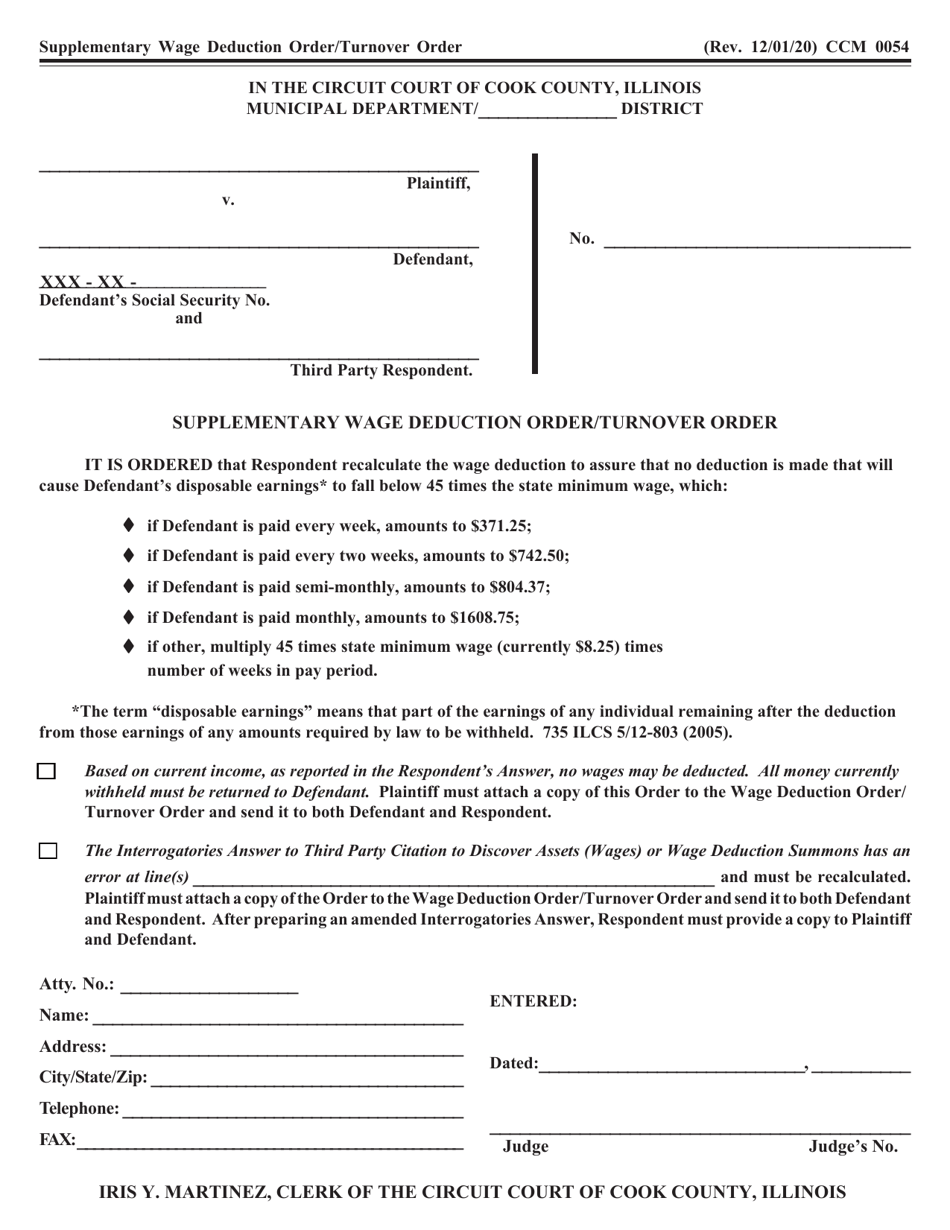

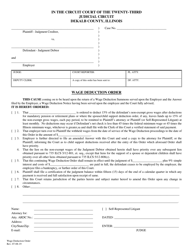

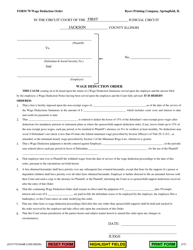

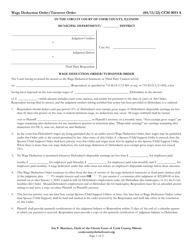

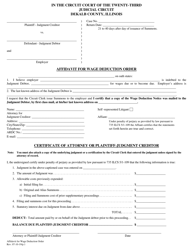

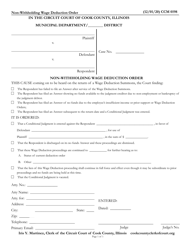

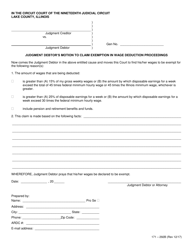

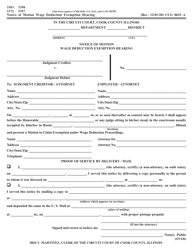

Form CCM0054 Supplementary Wage Deduction Order / Turnover Order - Cook County, Illinois

What Is Form CCM0054?

This is a legal form that was released by the Circuit Court - Cook County, Illinois - a government authority operating within Illinois. The form may be used strictly within Cook County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CCM0054?

A: Form CCM0054 is a Supplementary Wage Deduction Order/Turnover Order.

Q: What is the purpose of Form CCM0054?

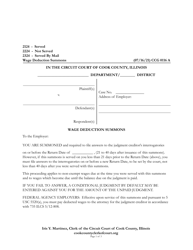

A: The purpose of Form CCM0054 is to authorize the deduction of wages or turnover of assets to satisfy a judgment or support order in Cook County, Illinois.

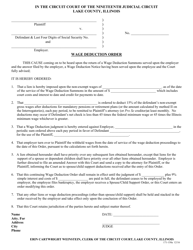

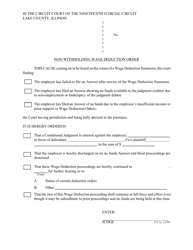

Q: Who can use Form CCM0054?

A: Form CCM0054 can be used by anyone with a judgment or support order in Cook County, Illinois who wants to collect money or assets from a debtor's wages.

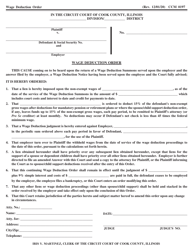

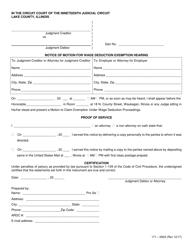

Q: What information is required on Form CCM0054?

A: Form CCM0054 requires information about the debtor, the creditor, the amount owed, and details about the judgment or support order.

Q: How should I submit Form CCM0054?

A: You should submit Form CCM0054 to the Cook County Sheriff's Office, along with the required supporting documents and a fee.

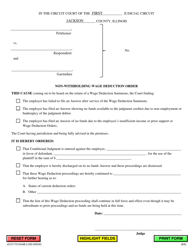

Q: What happens after I submit Form CCM0054?

A: After you submit Form CCM0054, the Cook County Sheriff's Office will serve the debtor's employer with a wage deduction or turnover order.

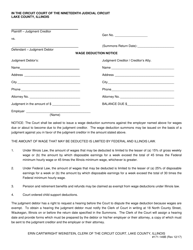

Q: Can the debtor's wages be entirely deducted?

A: No, the debtor's wages cannot be entirely deducted. There are certain limits on the maximum amount that can be deducted from their wages.

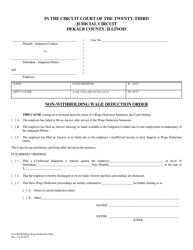

Q: What if the debtor does not have a job?

A: If the debtor is unemployed or does not have a job, it may not be possible to collect money through wage deduction.

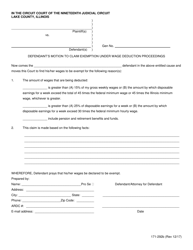

Q: Are there any exemptions to wage deduction?

A: Yes, there are certain exemptions to wage deduction, such as a minimum amount of weekly earnings that cannot be deducted.

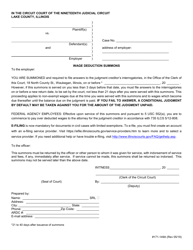

Q: Can the debtor refuse to comply with the wage deduction order?

A: The debtor cannot refuse to comply with the wage deduction order. Failure to comply may result in penalties, including contempt of court charges.

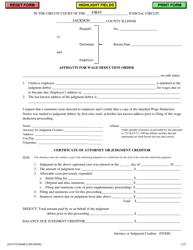

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Circuit Court - Cook County, Illinois;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CCM0054 by clicking the link below or browse more documents and templates provided by the Circuit Court - Cook County, Illinois.