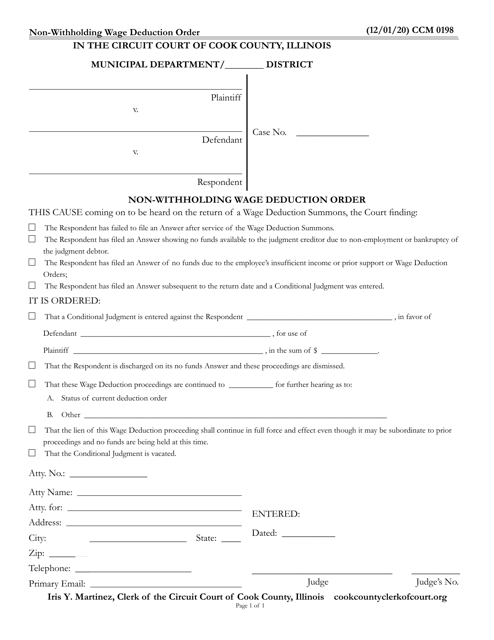

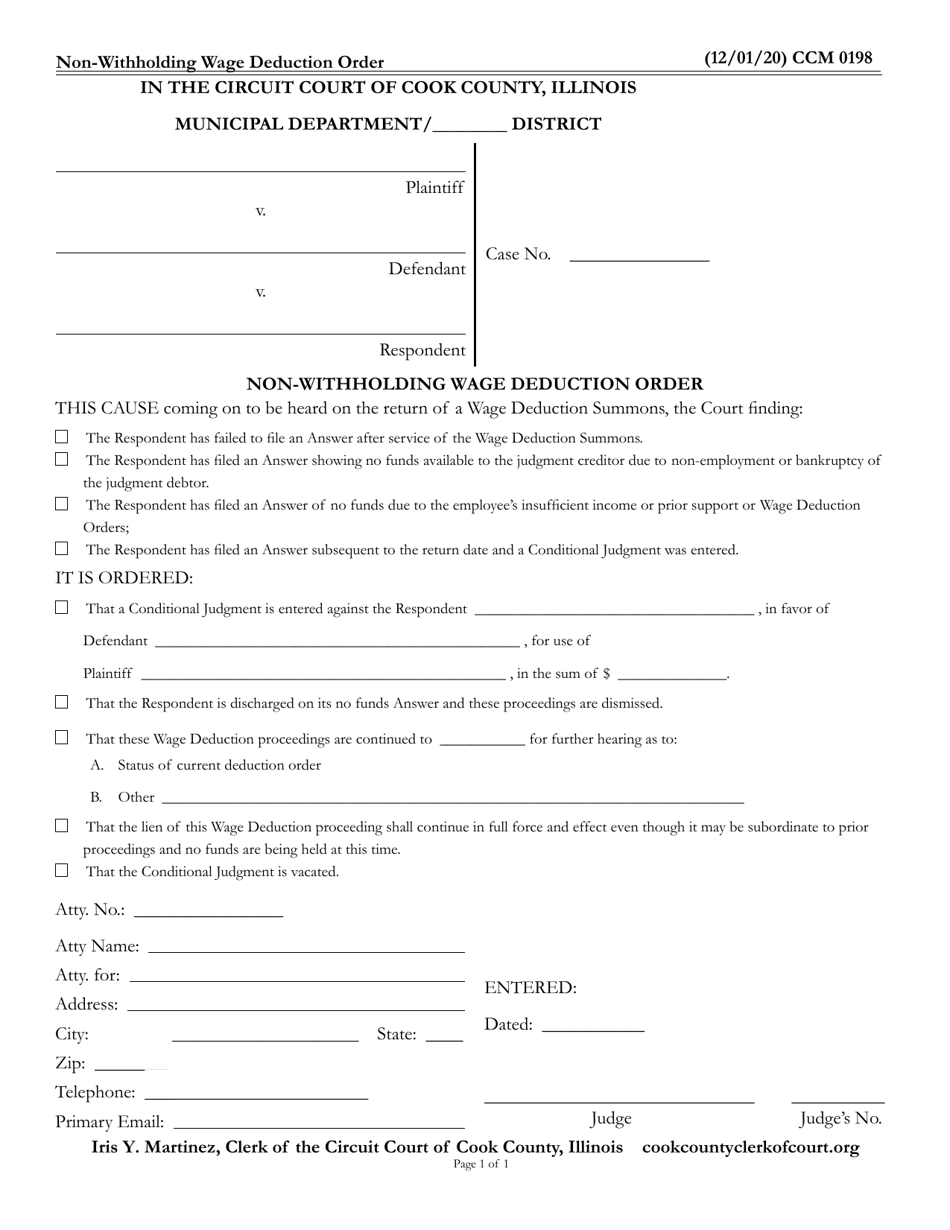

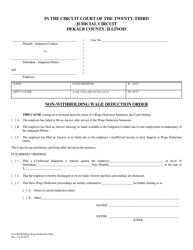

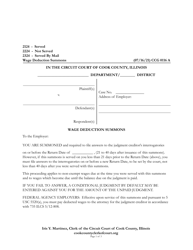

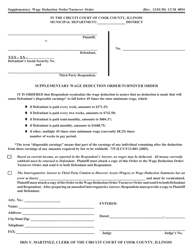

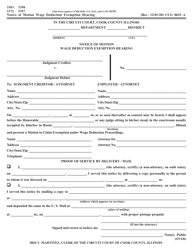

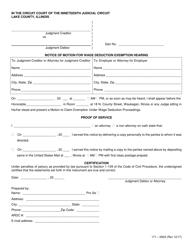

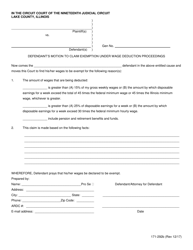

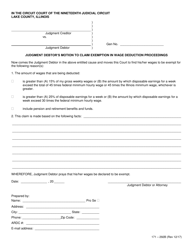

Form CCM0198 Non-withholding Wage Deduction Order - Cook County, Illinois

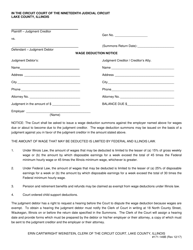

What Is Form CCM0198?

This is a legal form that was released by the Circuit Court - Cook County, Illinois - a government authority operating within Illinois. The form may be used strictly within Cook County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

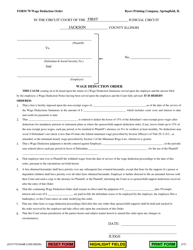

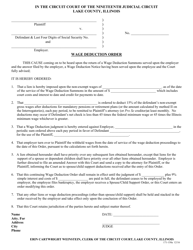

Q: What is the CCM0198 Non-withholding Wage Deduction Order?

A: The CCM0198 Non-withholding Wage Deduction Order is a form used in Cook County, Illinois, to authorize the deduction of certain amounts from an employee's wages.

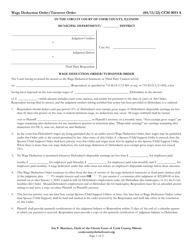

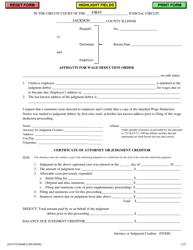

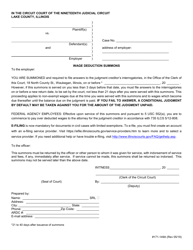

Q: Who can use the CCM0198 Non-withholding Wage Deduction Order?

A: The CCM0198 Non-withholding Wage Deduction Order can be used by individuals who need to authorize the deduction of specific amounts from their wages in Cook County, Illinois.

Q: What does the Non-withholding Wage Deduction Order allow deductions for?

A: The Non-withholding Wage Deduction Order allows deductions for various purposes, such as child support, spousal support, and other court-ordered payments.

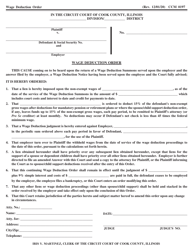

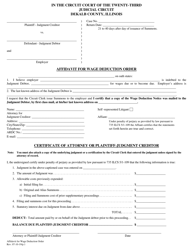

Q: Are there any fees associated with submitting the Non-withholding Wage Deduction Order?

A: There may be filing fees associated with submitting the Non-withholding Wage Deduction Order form. You should check with the Cook County Circuit Court Clerk's Office for the most up-to-date information.

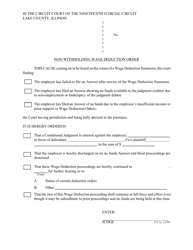

Q: Can I cancel or modify the Non-withholding Wage Deduction Order?

A: Yes, you can cancel or modify the Non-withholding Wage Deduction Order by filing a new form with the Cook County Circuit Court Clerk's Office.

Q: What should I do if I have questions or need assistance with the Non-withholding Wage Deduction Order form?

A: If you have questions or need assistance with the Non-withholding Wage Deduction Order form, you should contact the Cook County Circuit Court Clerk's Office for guidance and support.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Circuit Court - Cook County, Illinois;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CCM0198 by clicking the link below or browse more documents and templates provided by the Circuit Court - Cook County, Illinois.