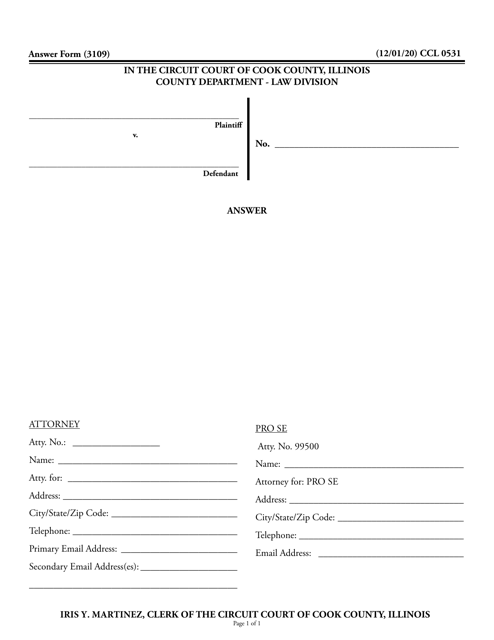

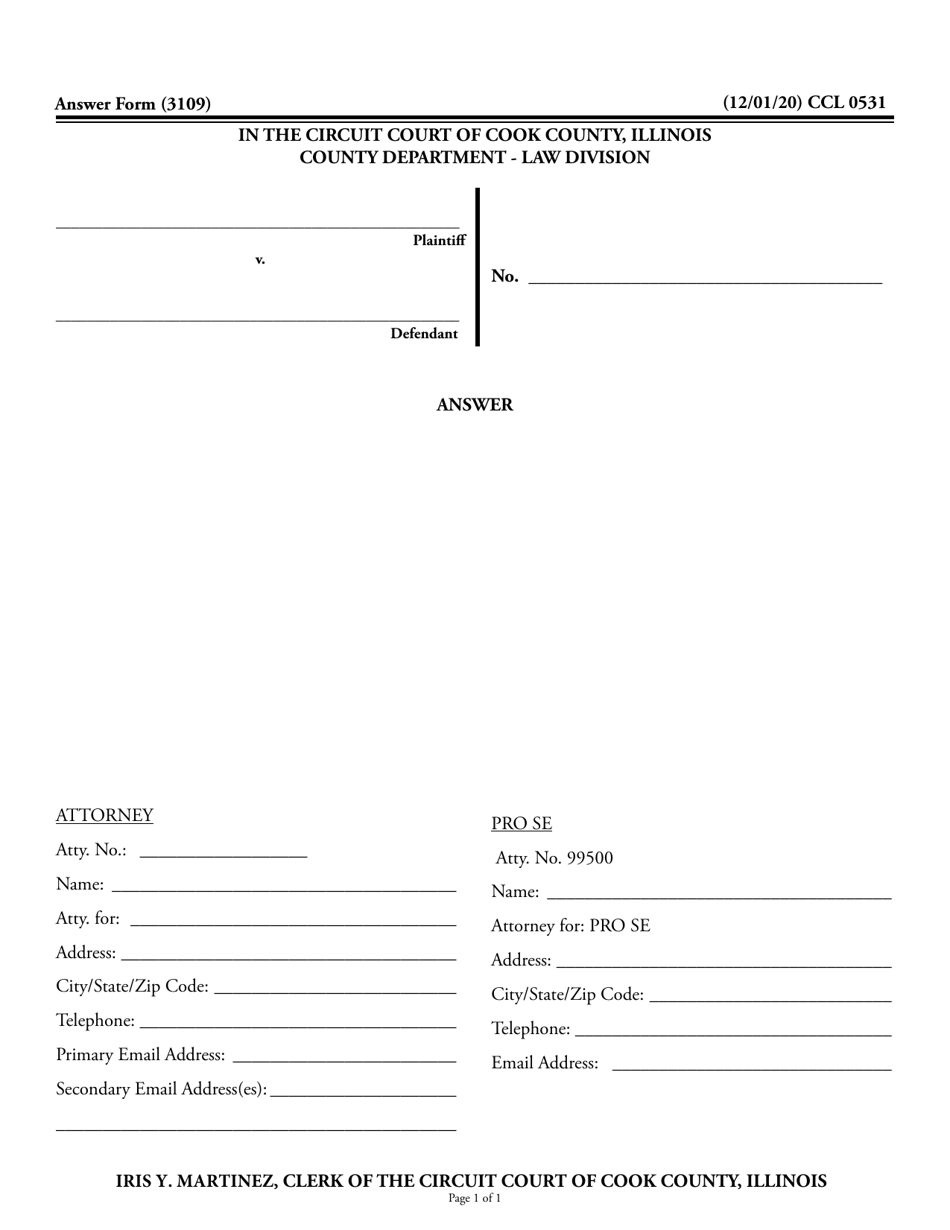

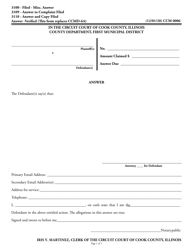

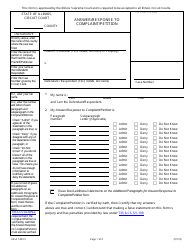

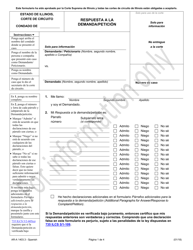

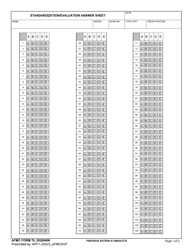

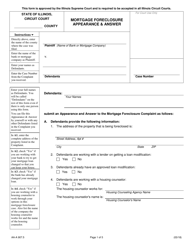

Form CCL0531 Answer - Cook County, Illinois

What Is Form CCL0531?

This is a legal form that was released by the Circuit Court - Cook County, Illinois - a government authority operating within Illinois. The form may be used strictly within Cook County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

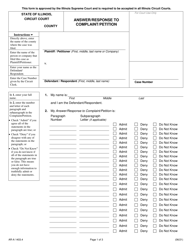

Q: What is Form CCL0531?

A: Form CCL0531 is a form used in Cook County, Illinois.

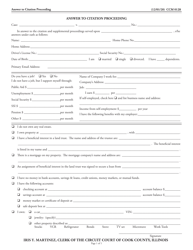

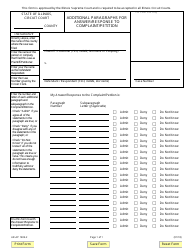

Q: What is the purpose of Form CCL0531?

A: Form CCL0531 is used to report and pay the Cook County Use Tax.

Q: Who needs to file Form CCL0531?

A: Anyone who has made purchases subject to the Cook County Use Tax and has not paid sales tax on those purchases needs to file Form CCL0531.

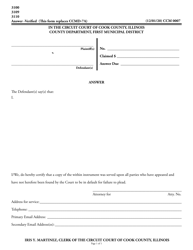

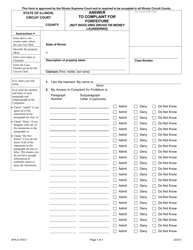

Q: How often should Form CCL0531 be filed?

A: Form CCL0531 needs to be filed quarterly.

Q: What is the deadline for filing Form CCL0531?

A: The deadline for filing Form CCL0531 is the last day of the month following the end of the quarter.

Q: What happens if I fail to file Form CCL0531?

A: If you fail to file Form CCL0531, you may be subject to penalties and interest.

Q: Are there any exemptions to the Cook County Use Tax?

A: Yes, certain purchases, such as those made for resale or those subject to another taxing jurisdiction, may be exempt from the Cook County Use Tax.

Q: Can I e-file Form CCL0531?

A: No, Form CCL0531 cannot be e-filed at this time. It must be filed by mail or in person.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Circuit Court - Cook County, Illinois;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CCL0531 by clicking the link below or browse more documents and templates provided by the Circuit Court - Cook County, Illinois.