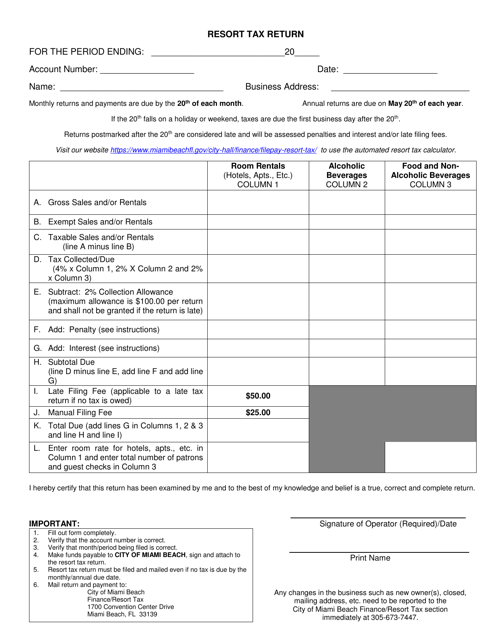

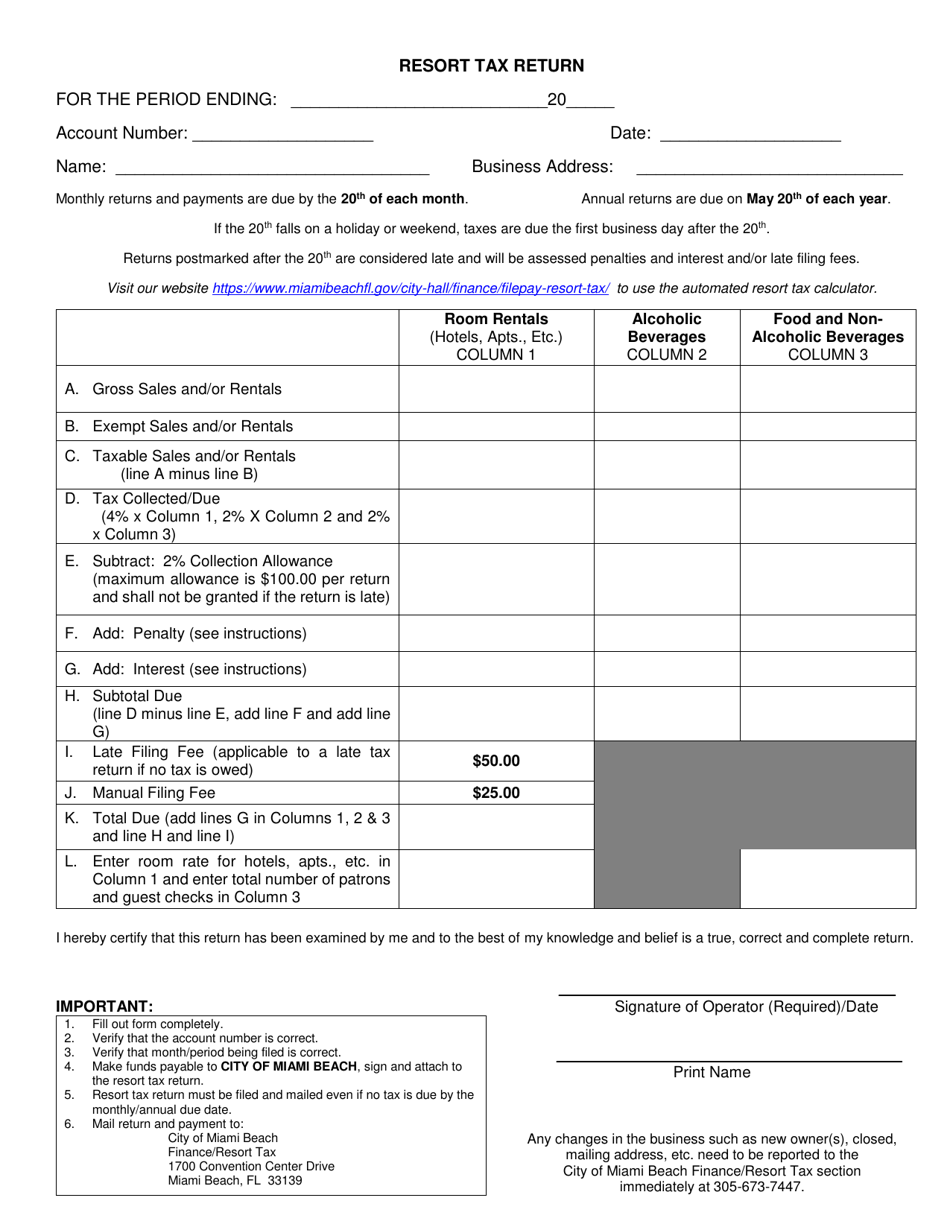

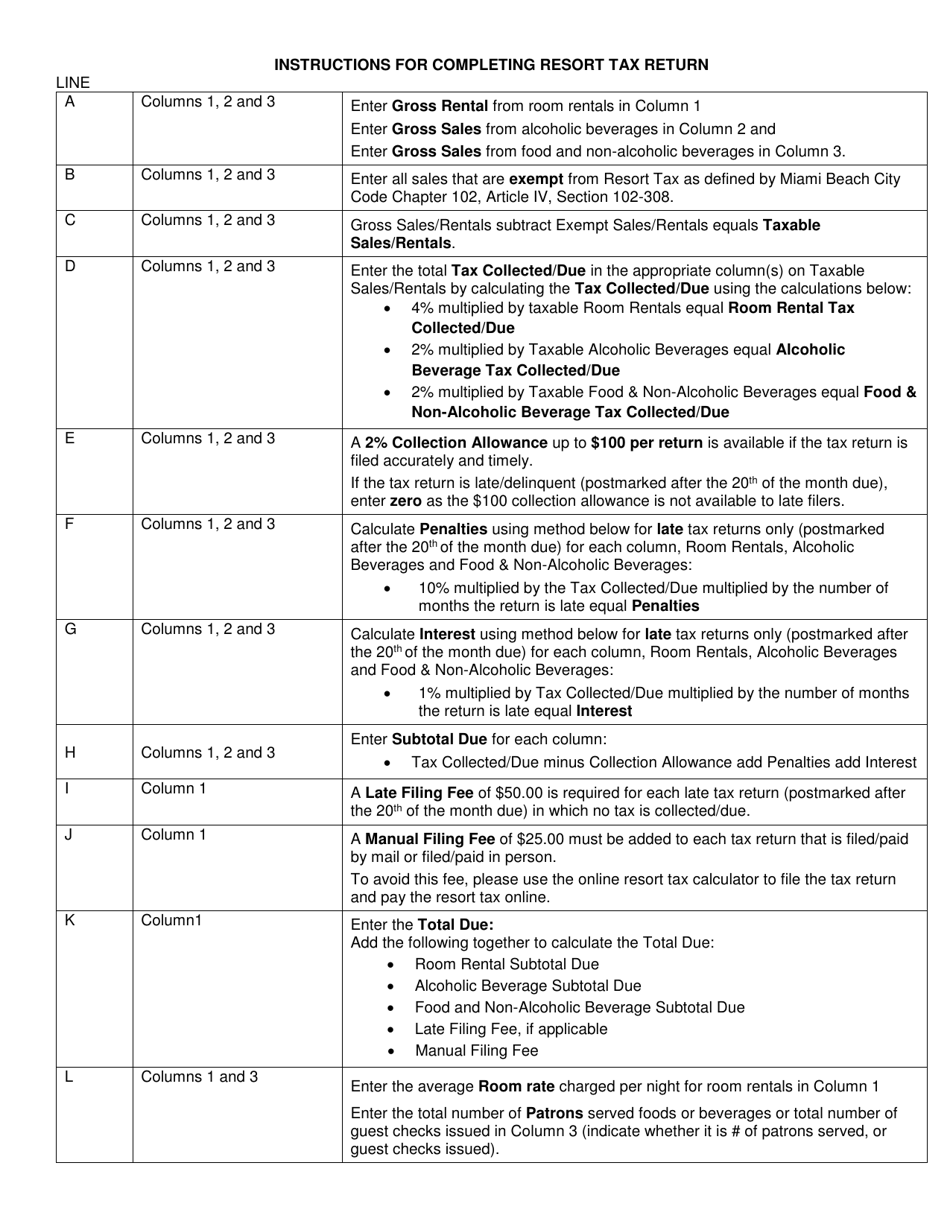

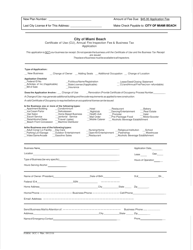

Resort Tax Return - City of Miami Beach, Florida

Resort Tax Return is a legal document that was released by the Finance Department - City of Miami Beach, Florida - a government authority operating within Florida. The form may be used strictly within City of Miami Beach.

FAQ

Q: What is a resort tax return?

A: A resort tax return is a document used to report and pay the resort tax owed by businesses in the city of Miami Beach, Florida.

Q: Who is required to file a resort tax return?

A: Businesses that are engaged in providing transient accommodations, such as hotels, motels, vacation rentals, and short-term rentals, are required to file a resort tax return.

Q: How often is a resort tax return filed?

A: A resort tax return must be filed on a monthly basis.

Q: What is the resort tax rate in Miami Beach, Florida?

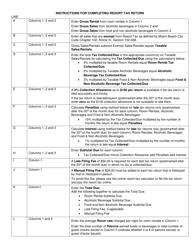

A: The resort tax rate in Miami Beach, Florida is currently 4%.

Q: When is the resort tax return due?

A: The resort tax return and payment are due on or before the 20th day of the following month.

Form Details:

- The latest edition currently provided by the Finance Department - City of Miami Beach, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - City of Miami Beach, Florida.