This version of the form is not currently in use and is provided for reference only. Download this version of

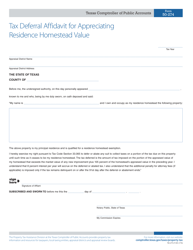

Form 33.06

for the current year.

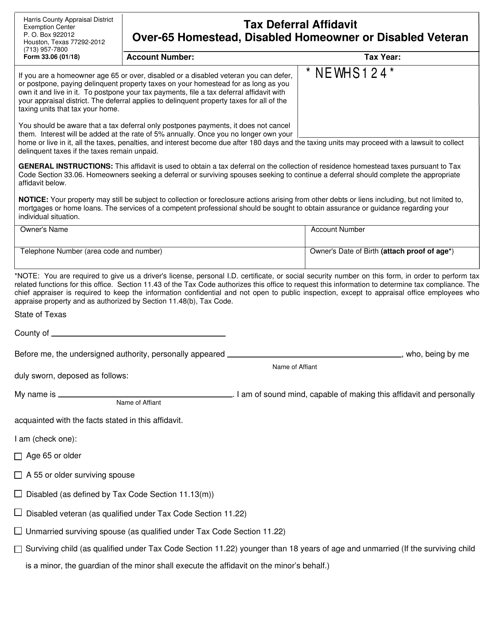

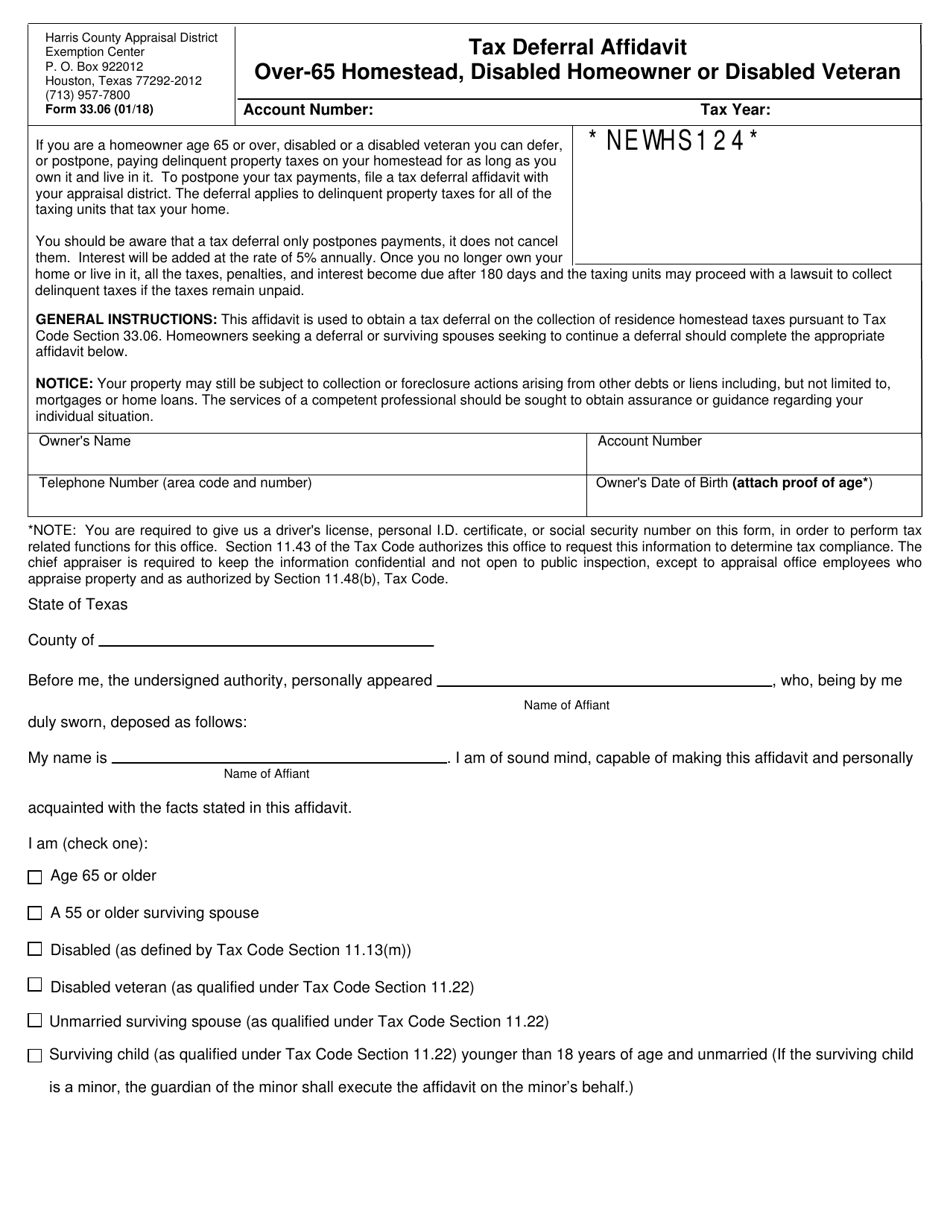

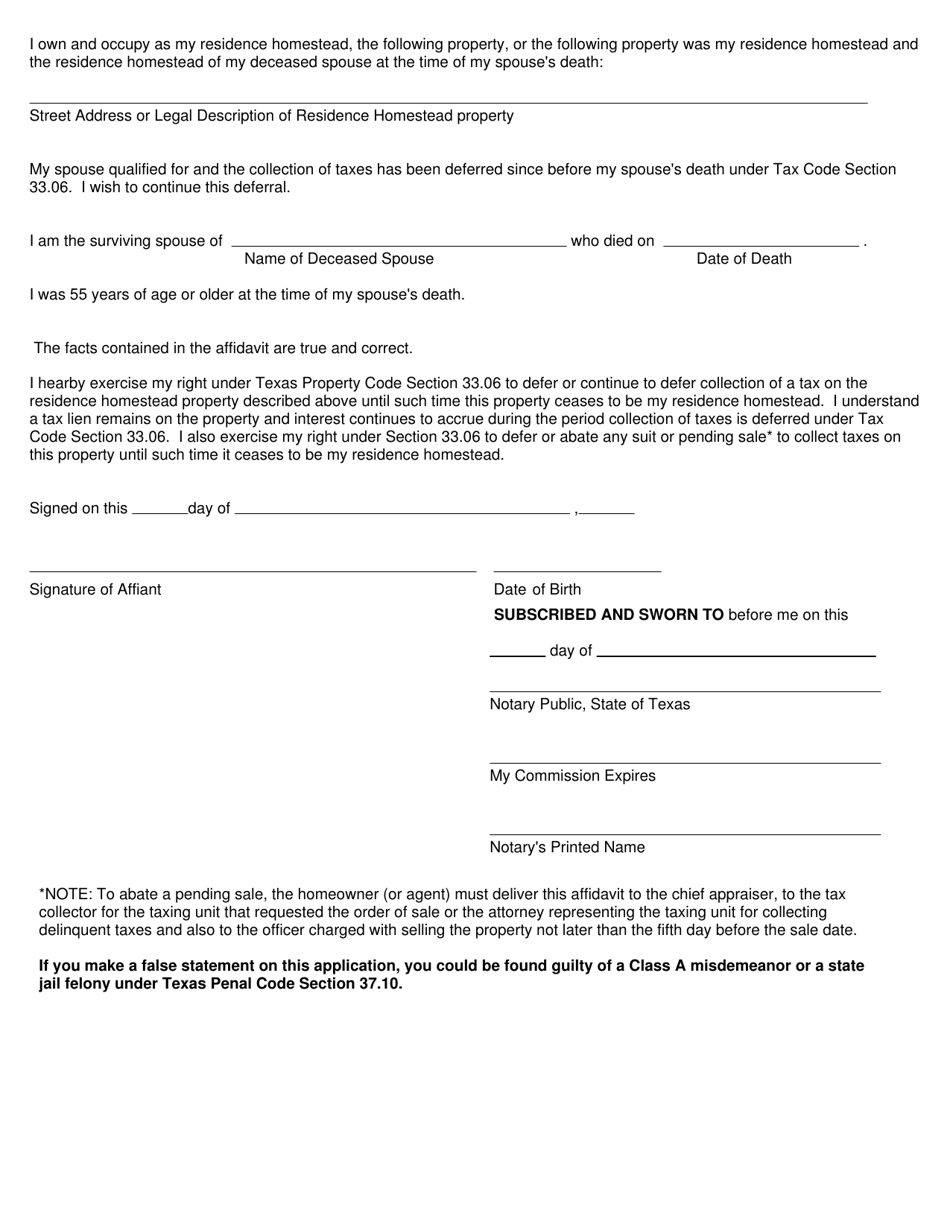

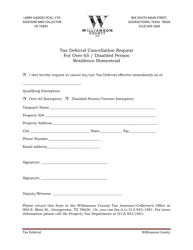

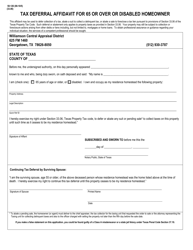

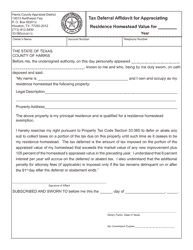

Form 33.06 Tax Deferral Affidavit - Over-65 Homestead, Disabled Homeowner or Disabled Veteran - Harris County, Texas

What Is Form 33.06?

This is a legal form that was released by the Tax Office - Harris County, Texas - a government authority operating within Texas. The form may be used strictly within Harris County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form 33.06 Tax Deferral Affidavit?

A: Form 33.06 Tax Deferral Affidavit is a document used in Harris County, Texas.

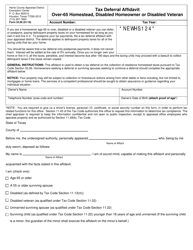

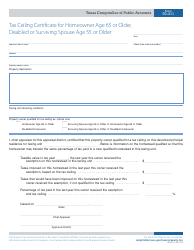

Q: Who is eligible for this form?

A: The form is specifically for over-65 homeowners, disabled homeowners, or disabled veterans in Harris County, Texas.

Q: What does the form allow for?

A: The form allows eligible individuals to defer the payment of property taxes on their homestead.

Q: How does the tax deferral work?

A: The tax deferral postpones the payment of property taxes, which will accrue a lien on the property.

Q: Is there any interest charged during the deferral?

A: Yes, interest will be charged on the deferred property taxes.

Q: Are there any limitations on the deferral?

A: Yes, the deferral cannot exceed 85% of the assessed value of the homestead.

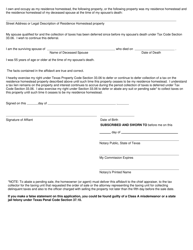

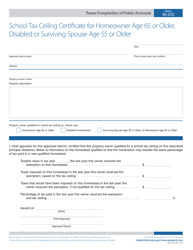

Q: What happens to the deferred taxes when the property is sold?

A: The deferred taxes, including interest, must be paid when the property is sold or transferred.

Q: Is there a deadline to submit the form?

A: Yes, the form must be filed with the Harris County Appraisal District by January 31st of the year following the year the taxes were deferred.

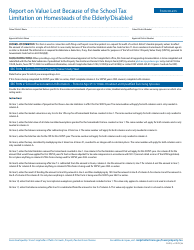

Q: Can I use this form if I'm not in Harris County, Texas?

A: No, this form is specifically for Harris County, Texas.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Tax Office - Harris County, Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 33.06 by clicking the link below or browse more documents and templates provided by the Tax Office - Harris County, Texas.