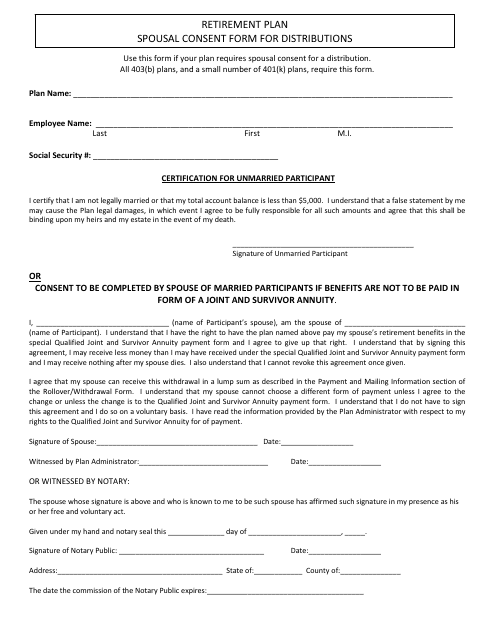

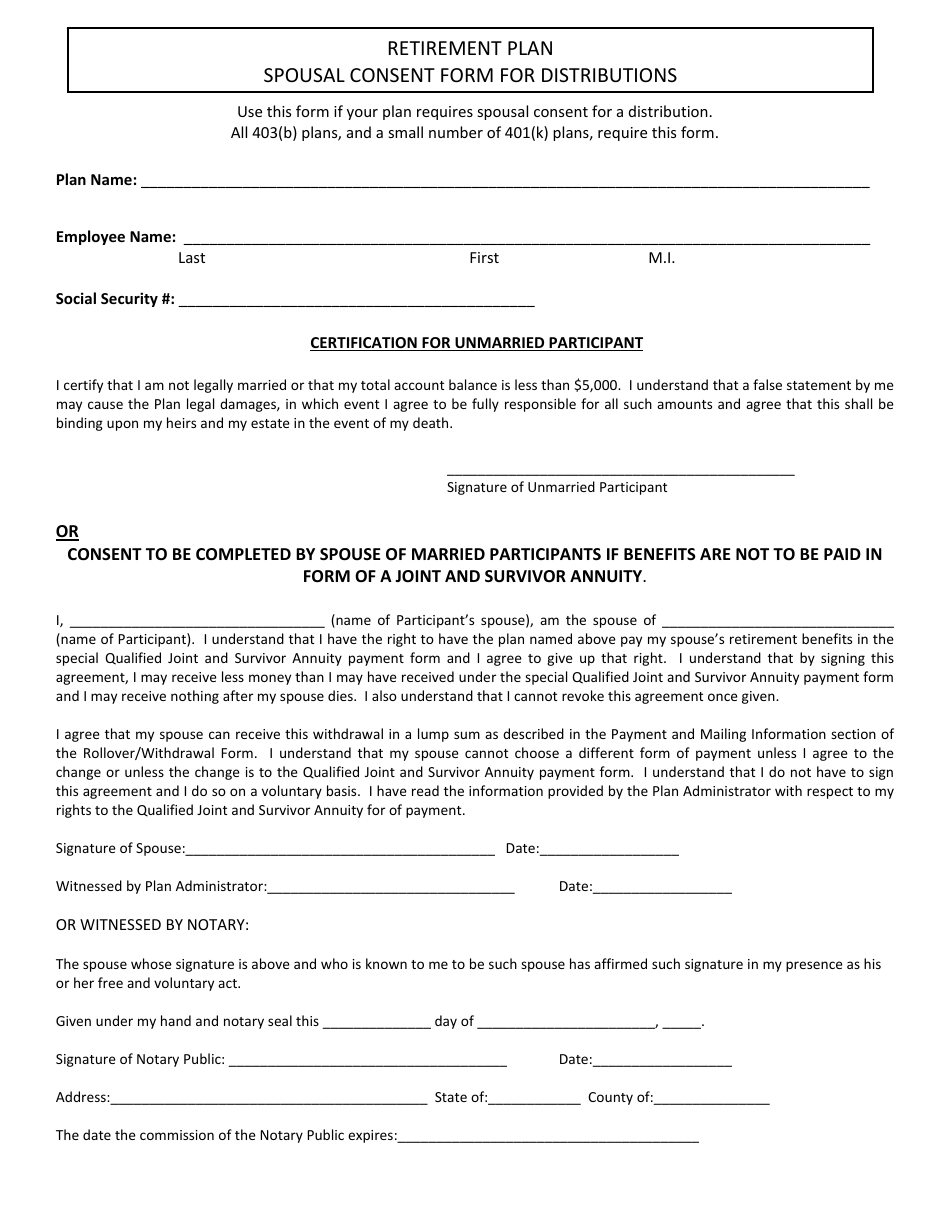

Retirement Plan Spousal Consent Form for Distributions

The Retirement Plan Spousal Consent Form for Distributions is typically required when a retirement plan participant wishes to withdraw a portion of their retirement savings and names someone other than their spouse as the beneficiary. It is used to obtain the spouse's consent and ensure they understand and approve of the distribution. This form is necessary to comply with legal requirements and protect the rights of the spouse in relation to the retirement savings.

The retirement plan participant files the spousal consent form for distributions.

FAQ

Q: What is a Retirement Plan Spousal Consent Form?

A: A Retirement Plan Spousal Consent Form is a document that allows a retirement plan participant to designate a beneficiary other than their spouse for plan distributions.

Q: Why is a Spousal Consent Form needed?

A: A Spousal Consent Form is needed when a retirement plan participant wishes to name a beneficiary other than their spouse for plan distributions, as federal law requires spousal consent for this purpose.

Q: What does the Spousal Consent Form require?

A: The Spousal Consent Form requires the spouse of the retirement plan participant to give written consent to the participant's choice of beneficiary for plan distributions.

Q: Can a retirement plan participant choose any beneficiary without spousal consent?

A: No, a retirement plan participant must obtain spousal consent if they wish to choose a beneficiary other than their spouse for plan distributions.

Q: Is the Spousal Consent Form a legal requirement?

A: Yes, it is a legal requirement under federal law for a retirement plan participant to obtain spousal consent when designating a beneficiary other than their spouse for plan distributions.