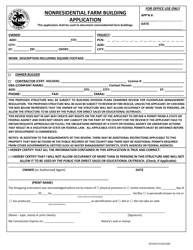

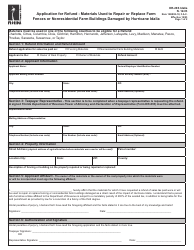

Exemption for Nonresidential Farm Building - Okaloosa County, Florida

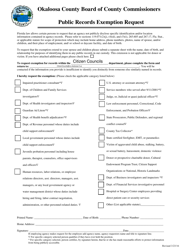

Exemption for Nonresidential Farm Building is a legal document that was released by the Department of Growth Management - Okaloosa County, Florida - a government authority operating within Florida. The form may be used strictly within Okaloosa County.

FAQ

Q: What is the exemption for nonresidential farm buildings in Okaloosa County, Florida?

A: The exemption for nonresidential farm buildings in Okaloosa County, Florida is a property tax exemption.

Q: Who is eligible for the exemption?

A: Farmers who own nonresidential farm buildings in Okaloosa County, Florida are eligible for the exemption.

Q: What is the purpose of this exemption?

A: The purpose of this exemption is to provide property tax relief for farmers and encourage agricultural activities in Okaloosa County, Florida.

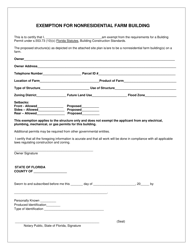

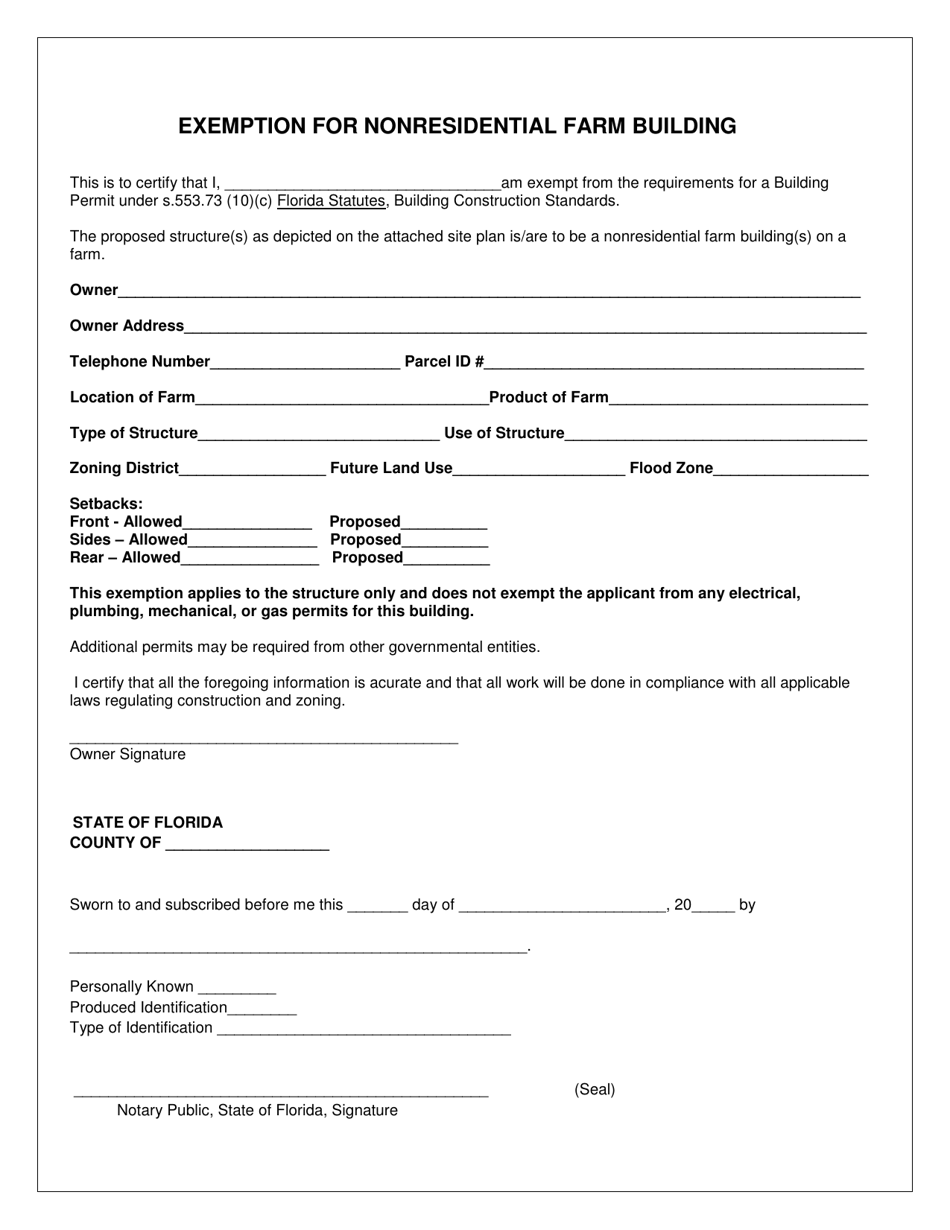

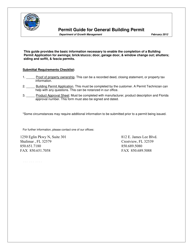

Q: How do I apply for the exemption?

A: To apply for the exemption, you need to fill out an application form and submit it to the Okaloosa County Property Appraiser's Office.

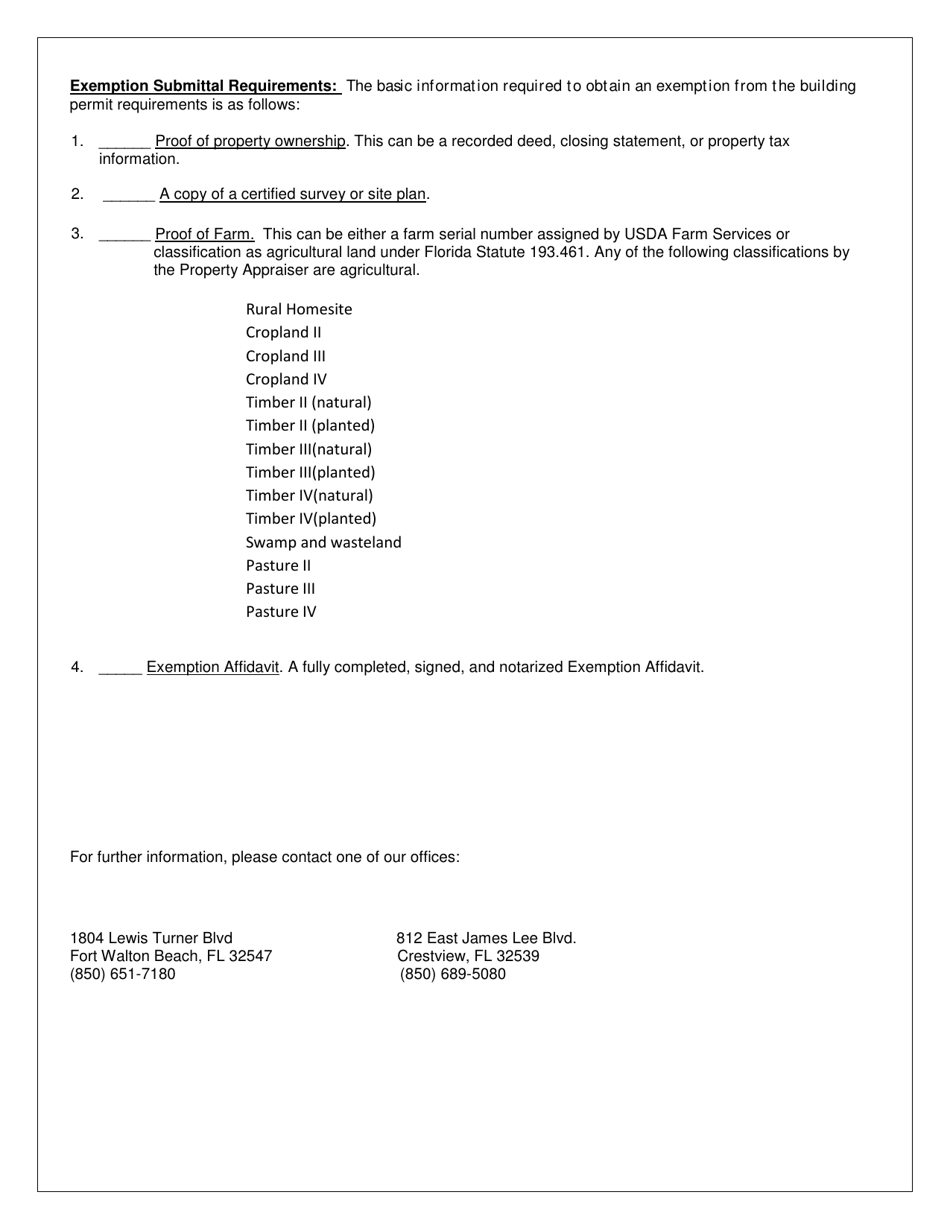

Q: What documents do I need to submit with the application?

A: You may need to submit documents such as proof of farm ownership, building plans, and agricultural classification certification with the application.

Q: Is there a deadline to apply for the exemption?

A: Yes, there is a deadline to apply for the exemption. You need to submit your application by March 1st of the tax year for which you are claiming the exemption.

Form Details:

- Released on May 1, 2012;

- The latest edition currently provided by the Department of Growth Management - Okaloosa County, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Growth Management - Okaloosa County, Florida.