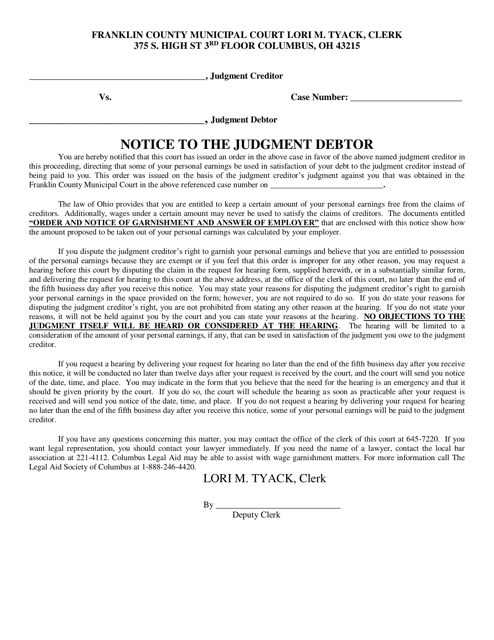

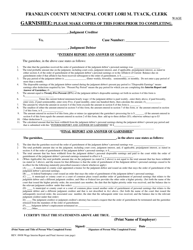

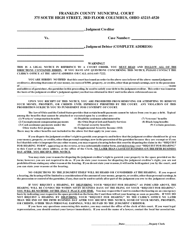

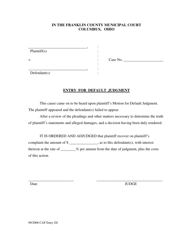

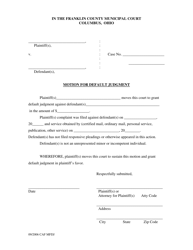

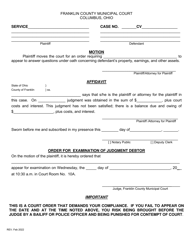

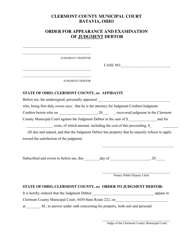

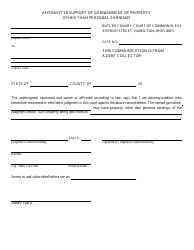

Wage Notice to the Judgment Debtor - Franklin County, Ohio

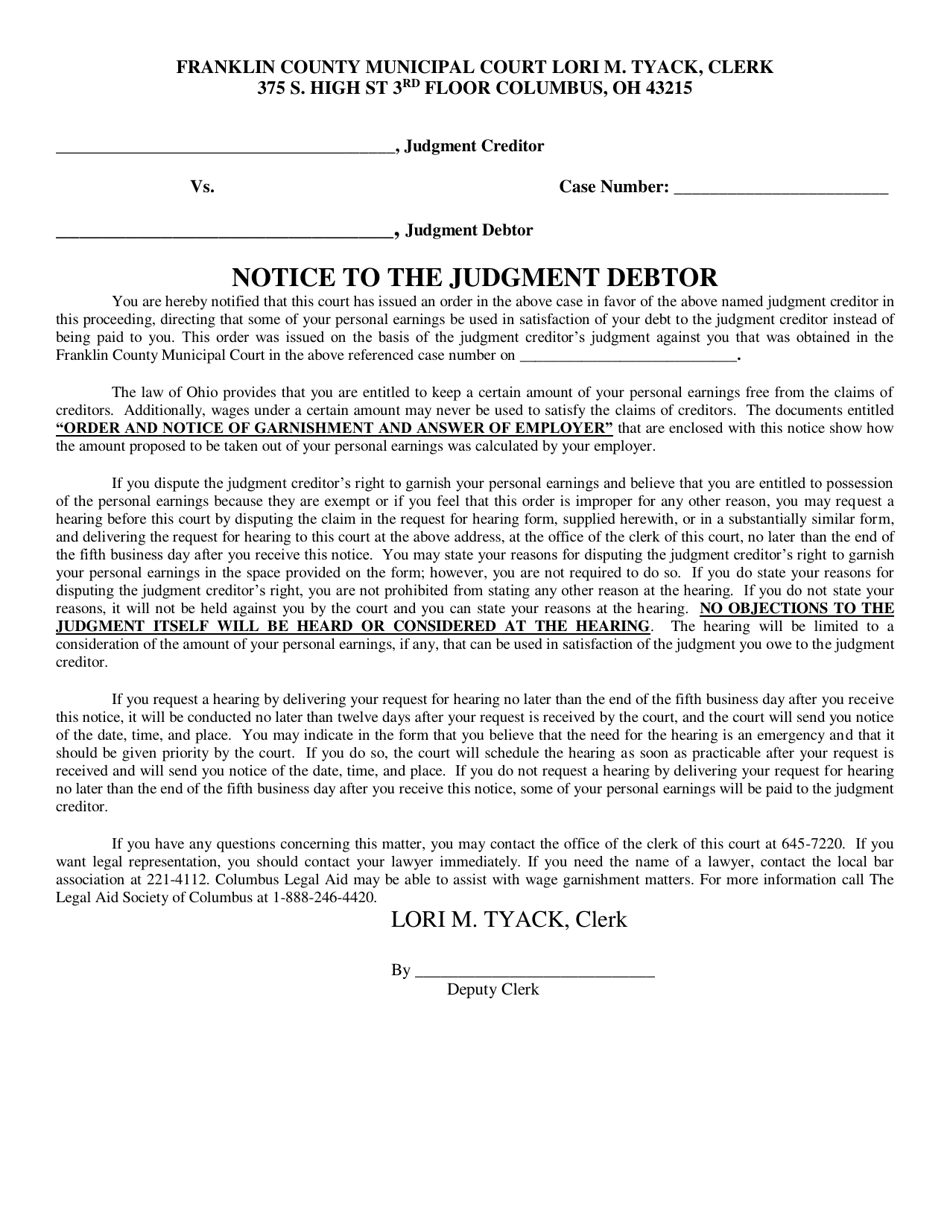

Wage Notice to the Judgment Debtor is a legal document that was released by the Municipal Court - Franklin County, Ohio - a government authority operating within Ohio. The form may be used strictly within Franklin County.

FAQ

Q: What is a Wage Notice to the Judgment Debtor?

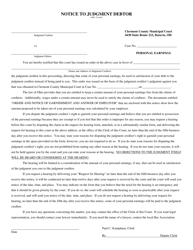

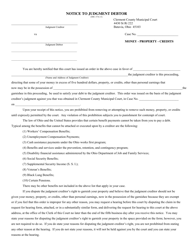

A: A Wage Notice to the Judgment Debtor is a legal document sent to a debtor by the court to notify them of a judgment against them and to inform their employer to withhold a portion of their wages to satisfy the debt.

Q: What is the purpose of a Wage Notice to the Judgment Debtor?

A: The purpose of a Wage Notice to the Judgment Debtor is to enforce a court judgment by directing the debtor's employer to withhold a portion of their wages to satisfy the debt.

Q: Who sends the Wage Notice to the Judgment Debtor?

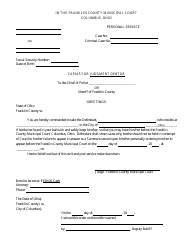

A: The court sends the Wage Notice to the Judgment Debtor.

Q: What should the judgment debtor do upon receiving a Wage Notice?

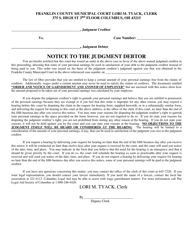

A: Upon receiving a Wage Notice, the judgment debtor should review it carefully and comply with the instructions outlined in the notice.

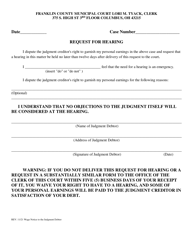

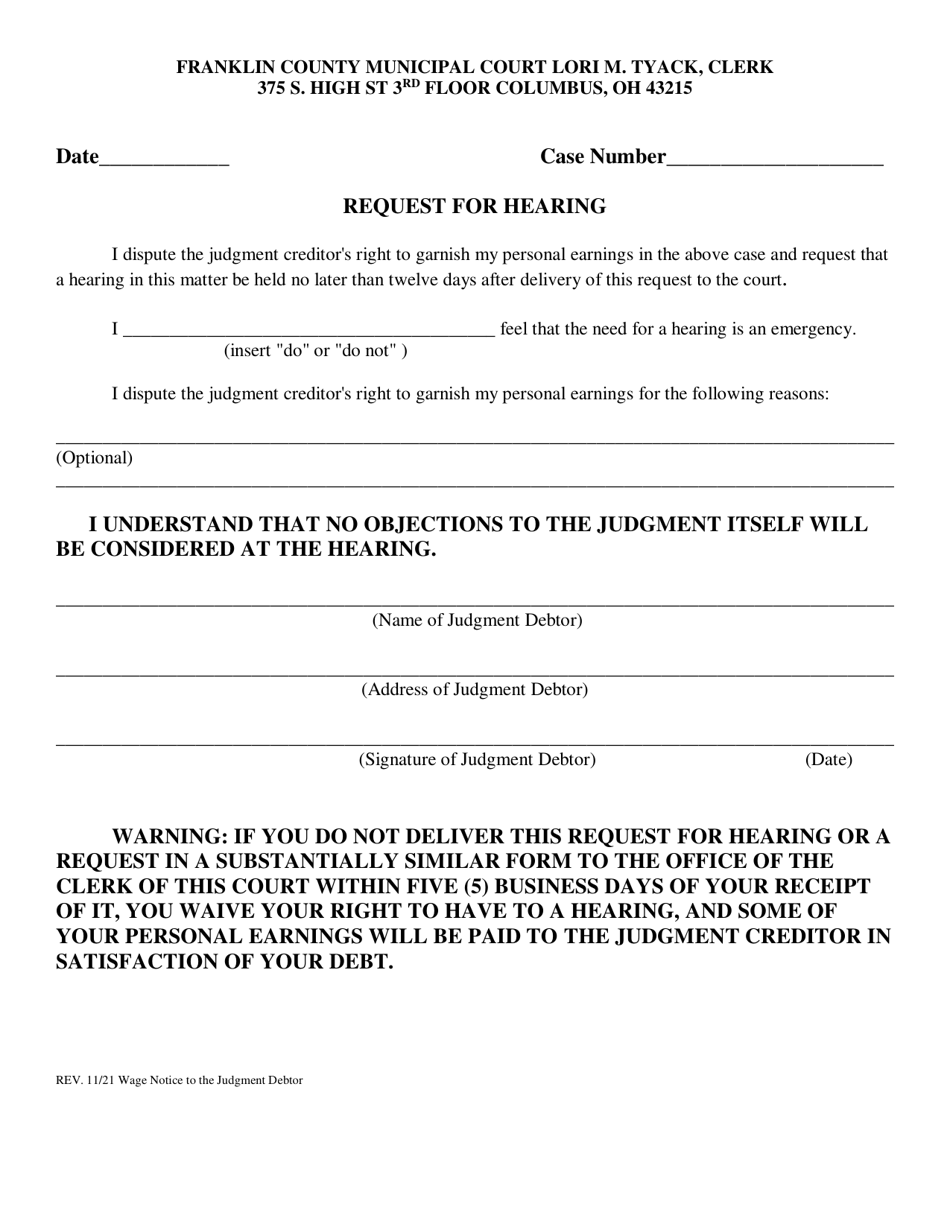

Q: Can a judgment debtor challenge a Wage Notice?

A: Yes, a judgment debtor can challenge a Wage Notice by filing an objection with the court and presenting a valid reason why the wage withholding should not be enforced.

Q: What happens if a judgment debtor fails to comply with a Wage Notice?

A: If a judgment debtor fails to comply with a Wage Notice, they may face legal consequences such as additional fines or penalties.

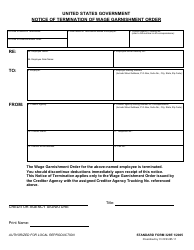

Q: How long does wage garnishment typically last?

A: Wage garnishment can typically last until the debt is fully satisfied or a court order terminates the garnishment.

Q: Is there a maximum amount that can be garnished from a debtor's wages?

A: Yes, federal law sets limits on the amount that can be garnished from a debtor's wages, typically 25% of disposable earnings or the amount by which the debtor's weekly disposable earnings exceed 30 times the federal minimum wage, whichever is lower.

Q: Can a judgment debtor be fired because of wage garnishment?

A: No, federal law prohibits employers from firing an employee due to wage garnishment for a single debt. However, there are no federal protections against termination for multiple wage garnishments.

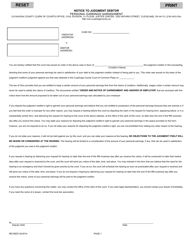

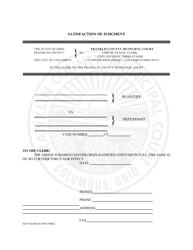

Form Details:

- Released on November 1, 2021;

- The latest edition currently provided by the Municipal Court - Franklin County, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Municipal Court - Franklin County, Ohio.