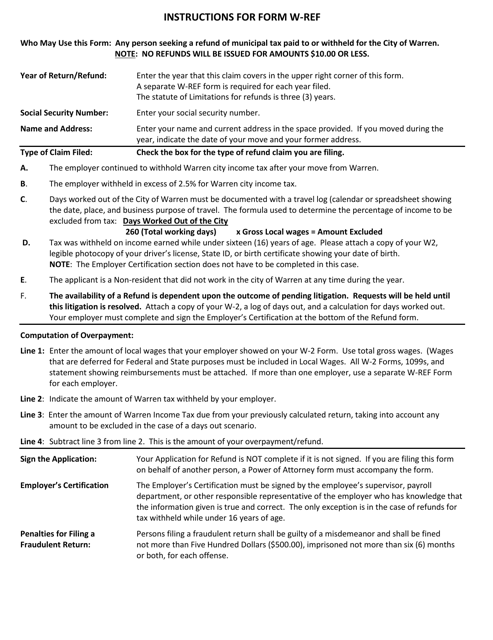

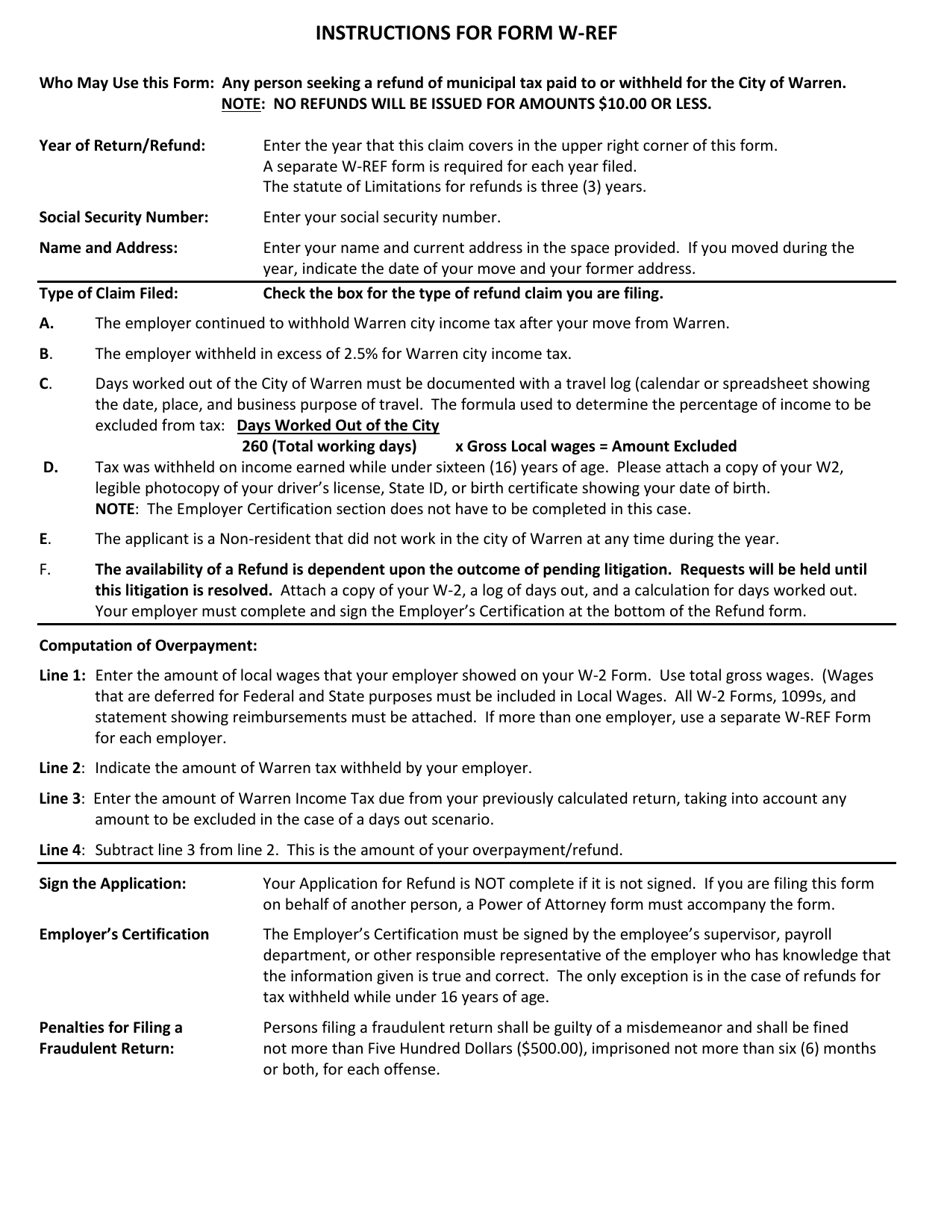

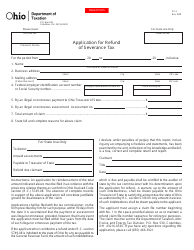

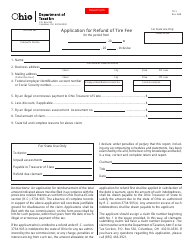

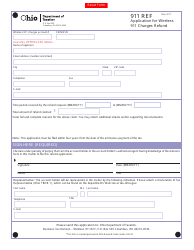

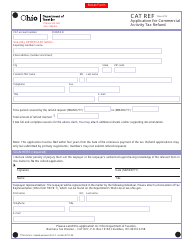

Instructions for Form W-REF Application for Refund - City of Warren, Ohio

This document contains official instructions for Form W-REF , Application for Refund - a form released and collected by the Income Tax Department - City of Warren, Ohio. An up-to-date fillable Form W-REF is available for download through this link.

FAQ

Q: What is Form W-REF?

A: Form W-REF is an application for refund for the City of Warren, Ohio.

Q: Who can use Form W-REF?

A: Anyone who needs to apply for a refund from the City of Warren, Ohio.

Q: What is the purpose of Form W-REF?

A: The purpose of Form W-REF is to request a refund for overpaid taxes or fees to the City of Warren, Ohio.

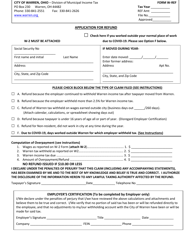

Q: What information is required on Form W-REF?

A: You will need to provide your contact information, details of the overpayment, and any supporting documentation.

Q: How do I submit Form W-REF?

A: You can submit Form W-REF by mail or in person to the City of Warren, Ohio.

Q: How long does it take to process a refund?

A: The processing time for a refund can vary, but it is typically within a few weeks to a couple of months.

Q: What should I do if there is an issue with my refund?

A: If you have an issue with your refund, you should contact the City of Warren, Ohio to resolve it.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Income Tax Department - City of Warren, Ohio.