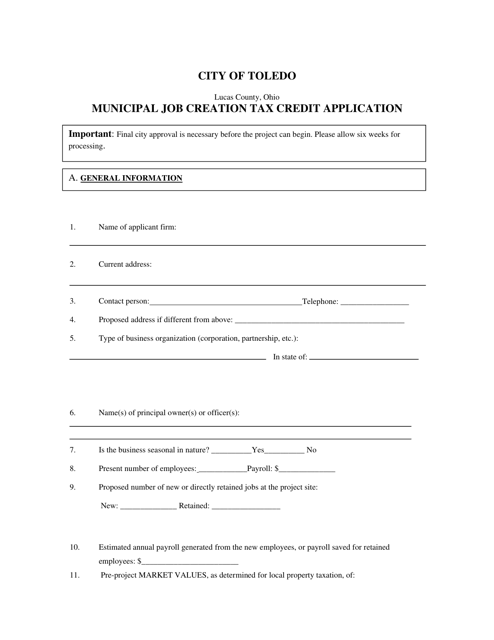

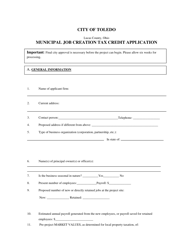

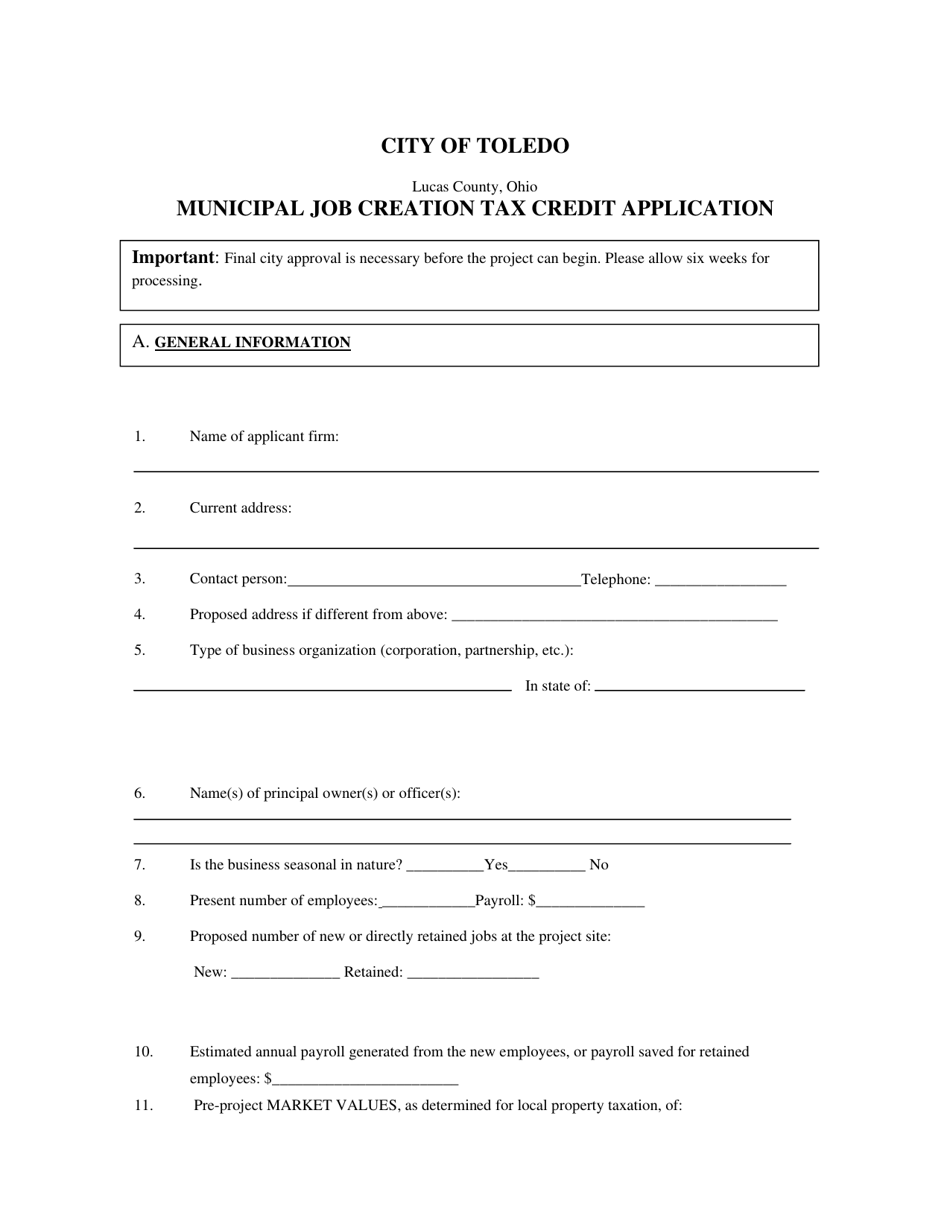

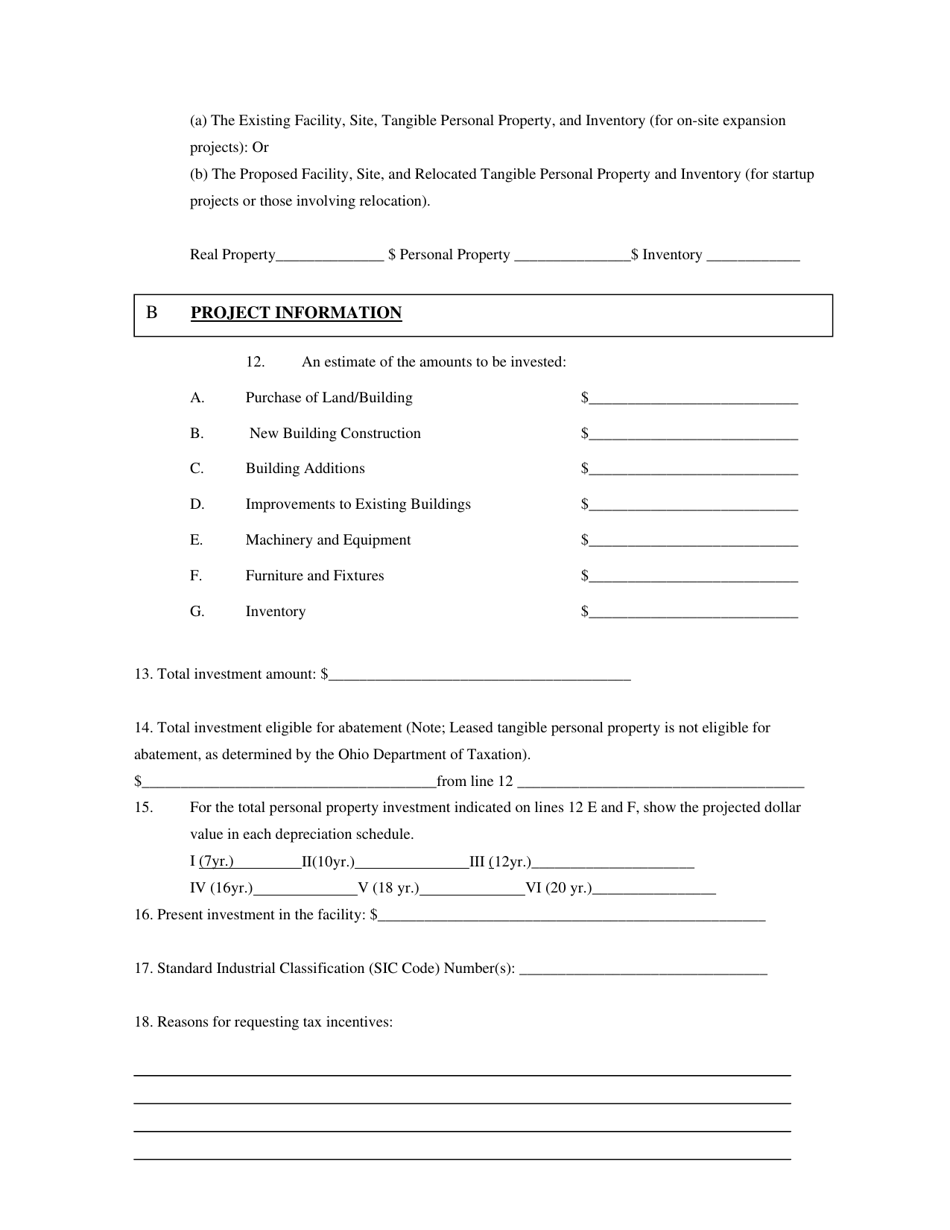

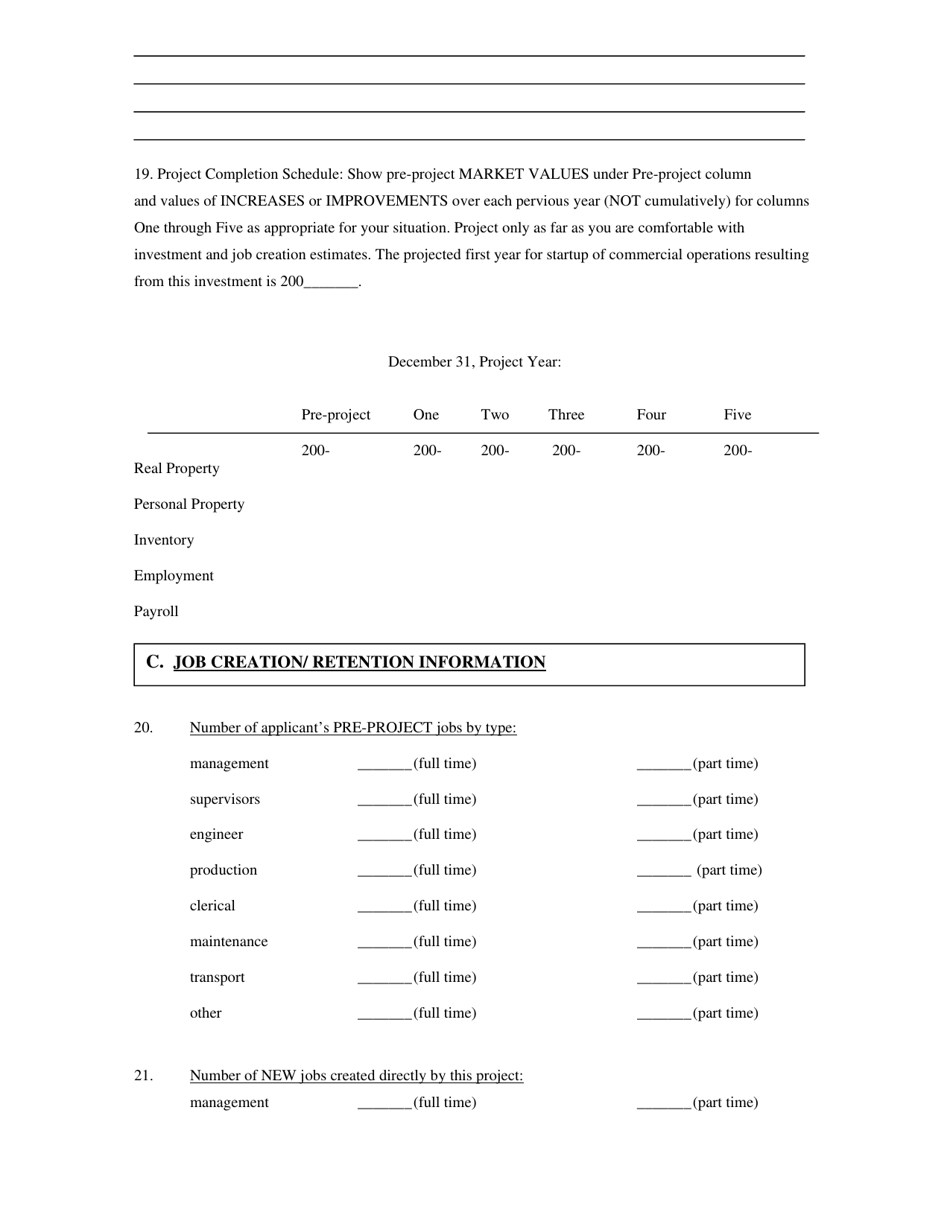

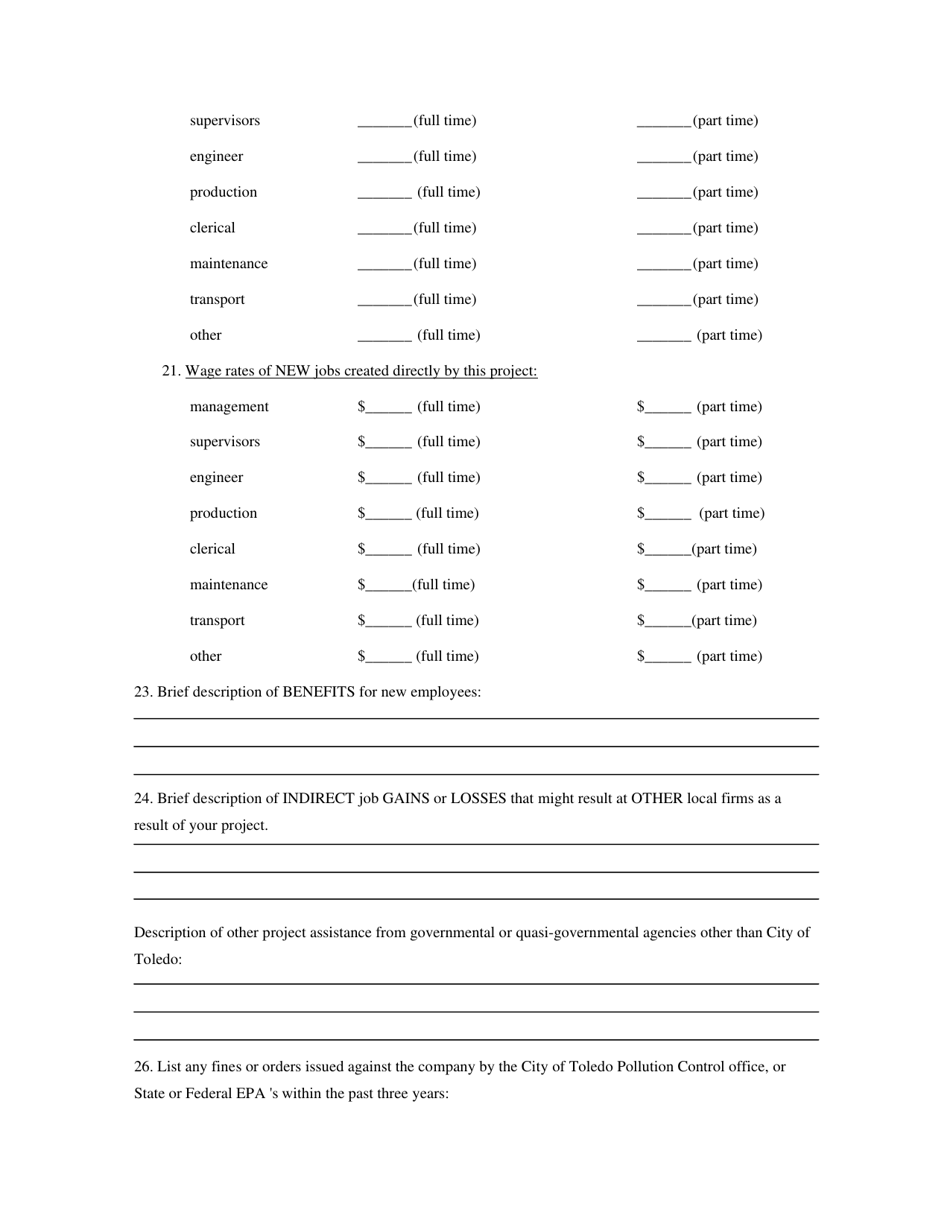

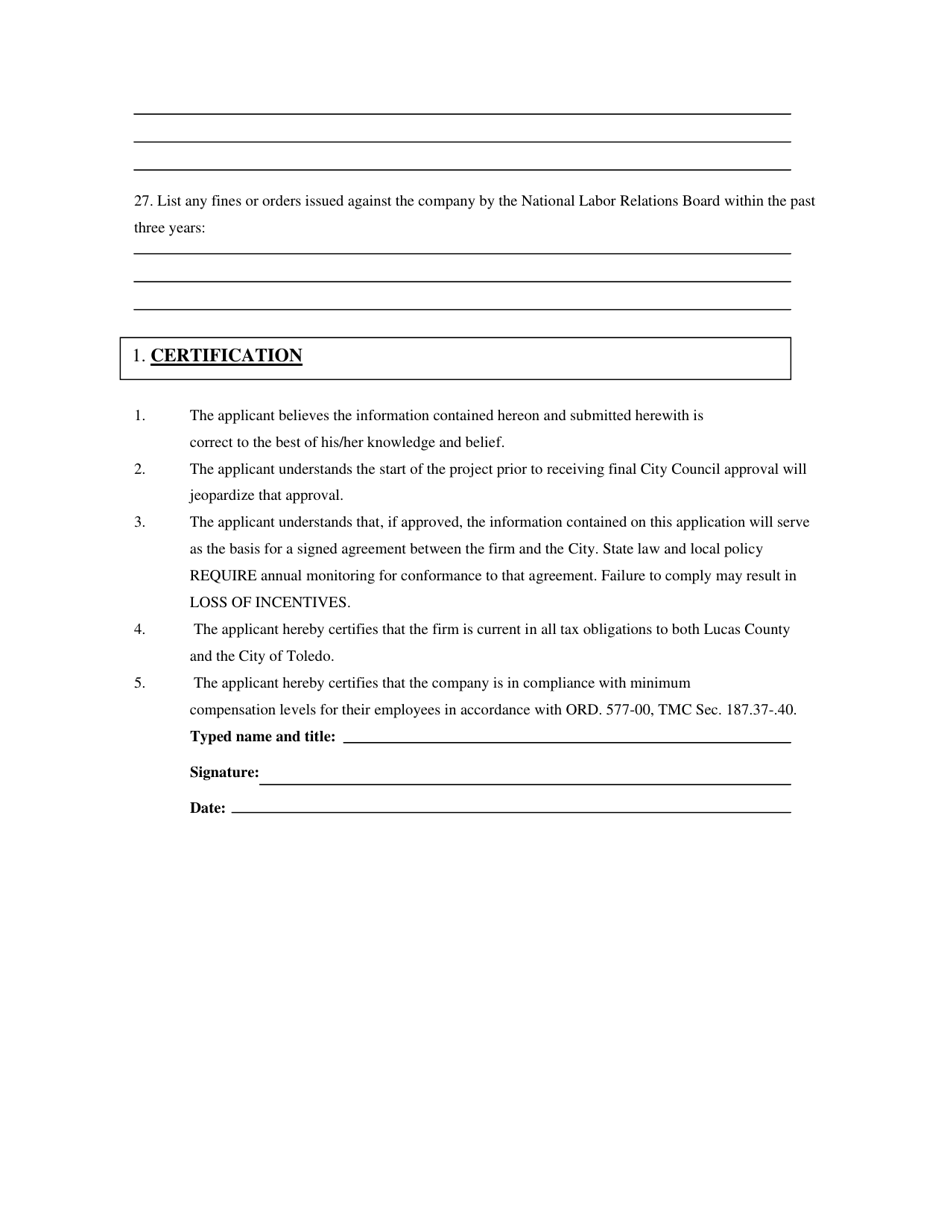

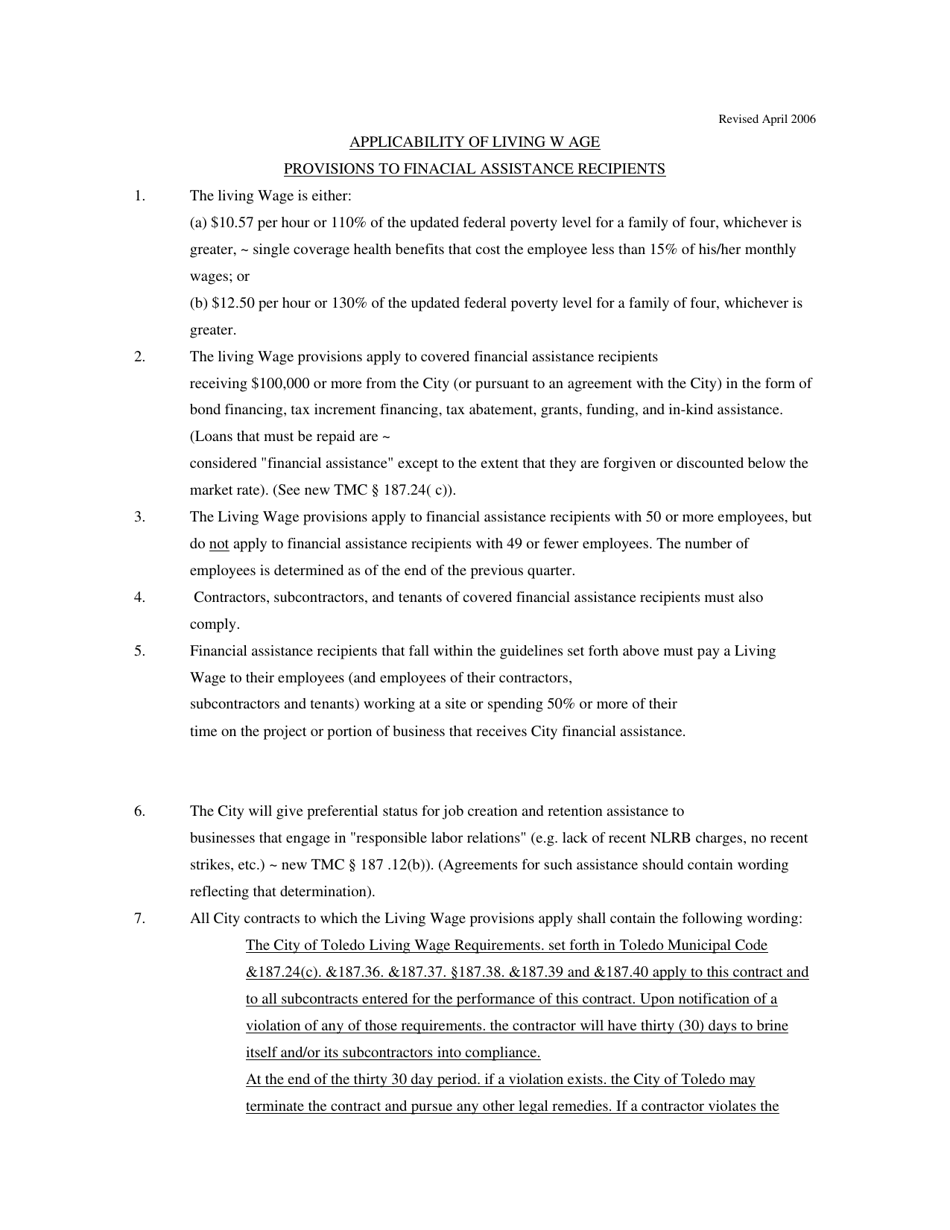

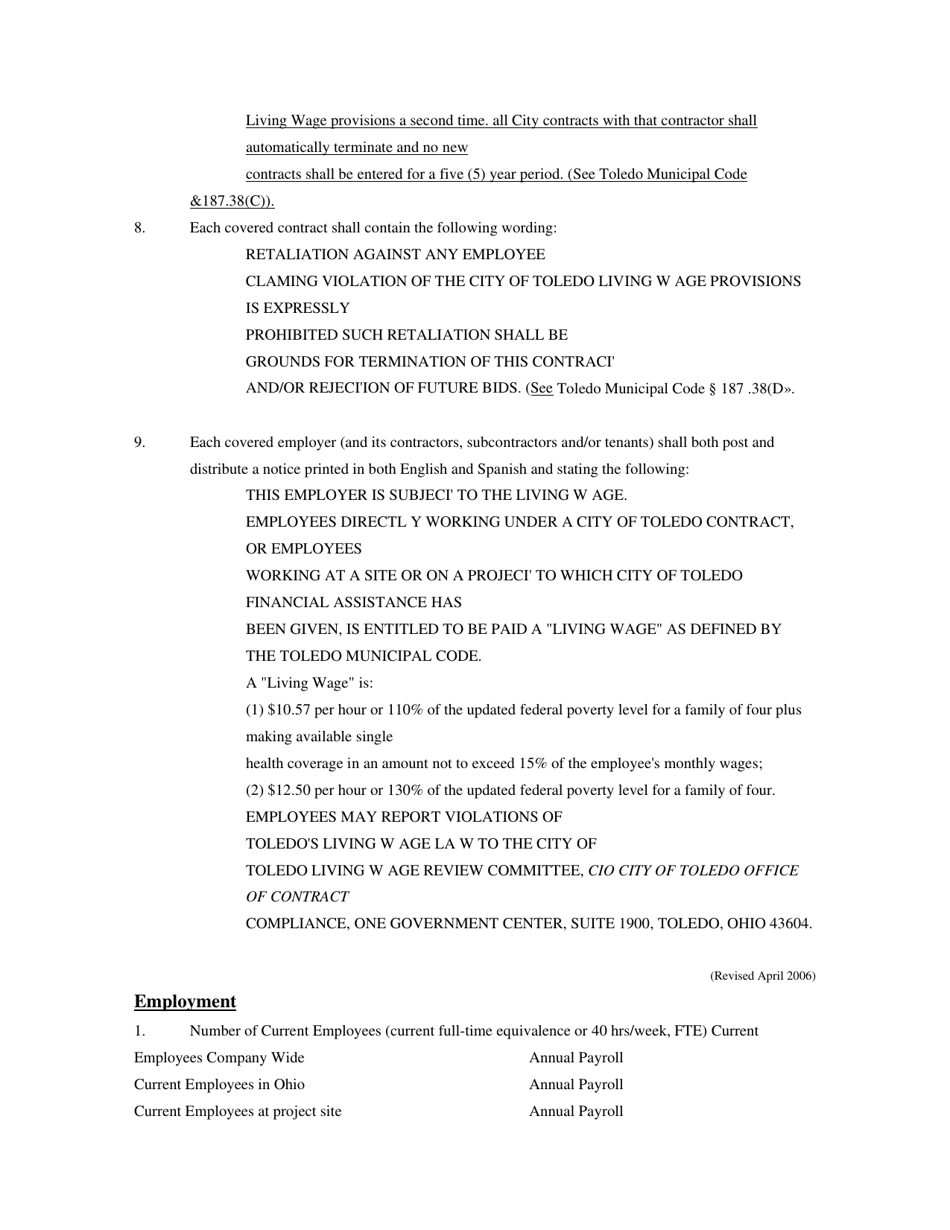

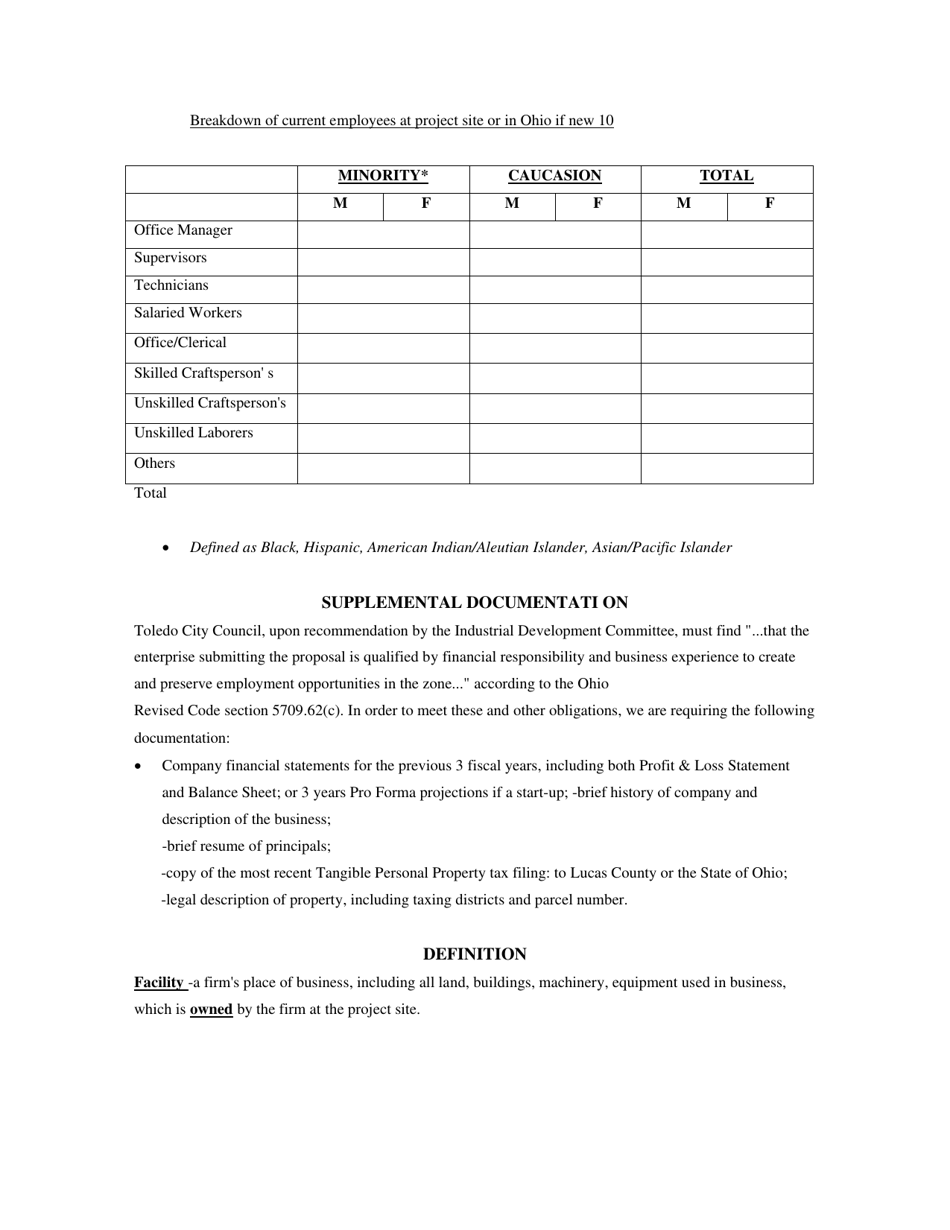

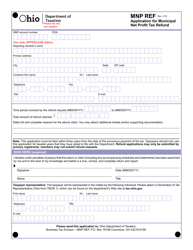

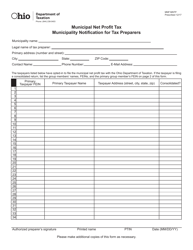

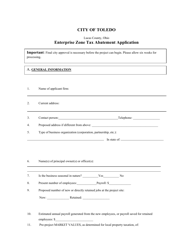

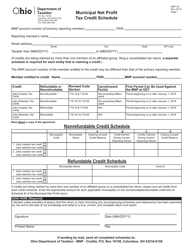

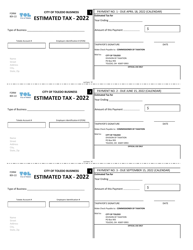

Municipal Job Creation Tax Credit Application - City of Toledo, Ohio

Municipal Tax Credit Application is a legal document that was released by the Department of Finance - City of Toledo, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Toledo.

FAQ

Q: What is the Municipal Job Creation Tax Credit Application?

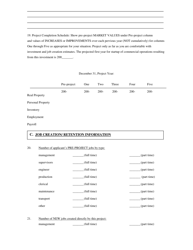

A: The Municipal Job Creation Tax Credit Application is a form used by businesses in Toledo, Ohio to apply for tax credits based on job creation.

Q: Who can apply for the Municipal Job Creation Tax Credit?

A: Businesses operating in Toledo, Ohio can apply for the Municipal Job Creation Tax Credit.

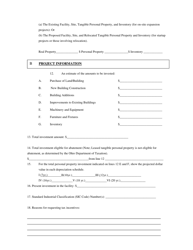

Q: What is the purpose of the tax credit?

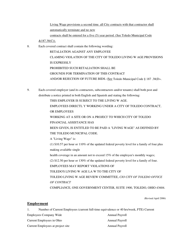

A: The tax credit is designed to incentivize businesses to create jobs in Toledo, Ohio.

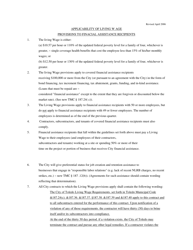

Q: How does the tax credit work?

A: The tax credit provides a financial incentive to businesses by allowing them to reduce their tax liability based on the number of jobs they create.

Q: What are the eligibility criteria for the tax credit?

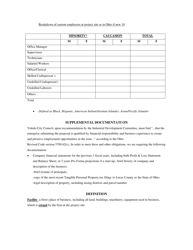

A: Eligibility criteria include creating a minimum number of jobs, meeting wage requirements, and complying with certain reporting requirements.

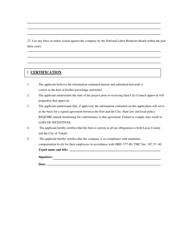

Q: What supporting documents are required with the application?

A: Supporting documents typically include proof of job creation, payroll records, and any relevant financial statements.

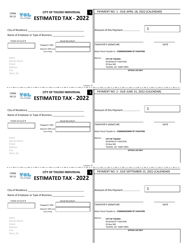

Q: Is there a deadline for submitting the application?

A: Yes, there is usually a deadline for submitting the Municipal Job Creation Tax Credit Application. It is important to check the specific deadline each year.

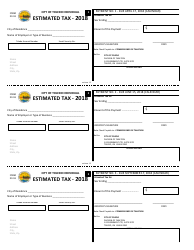

Form Details:

- The latest edition currently provided by the Department of Finance - City of Toledo, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Finance - City of Toledo, Ohio.