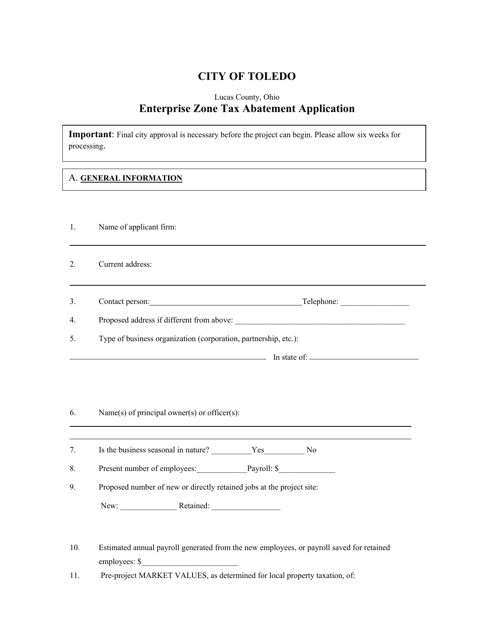

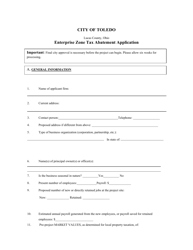

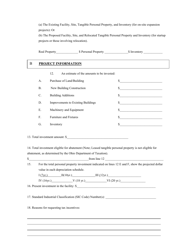

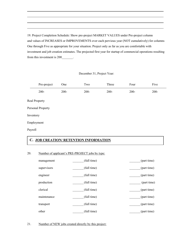

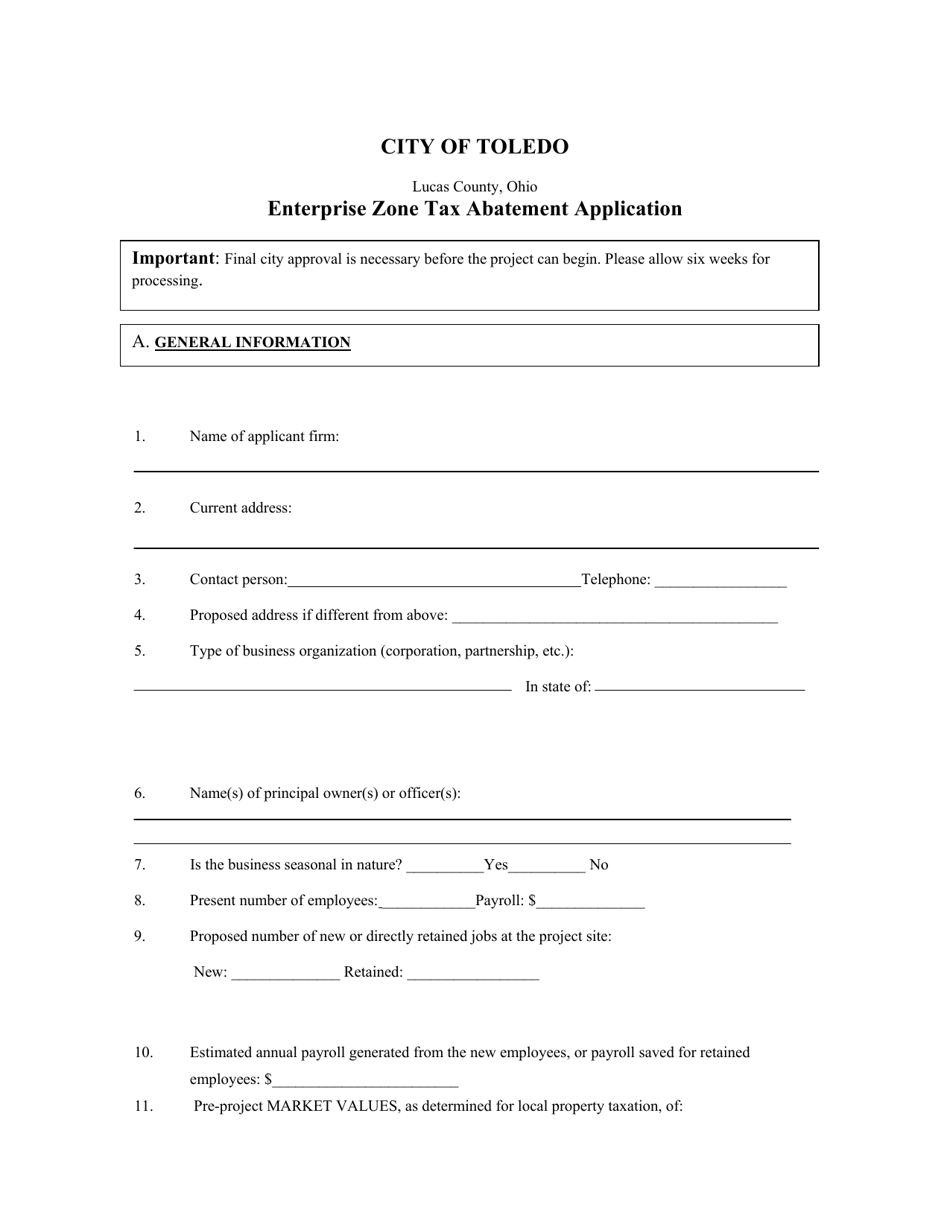

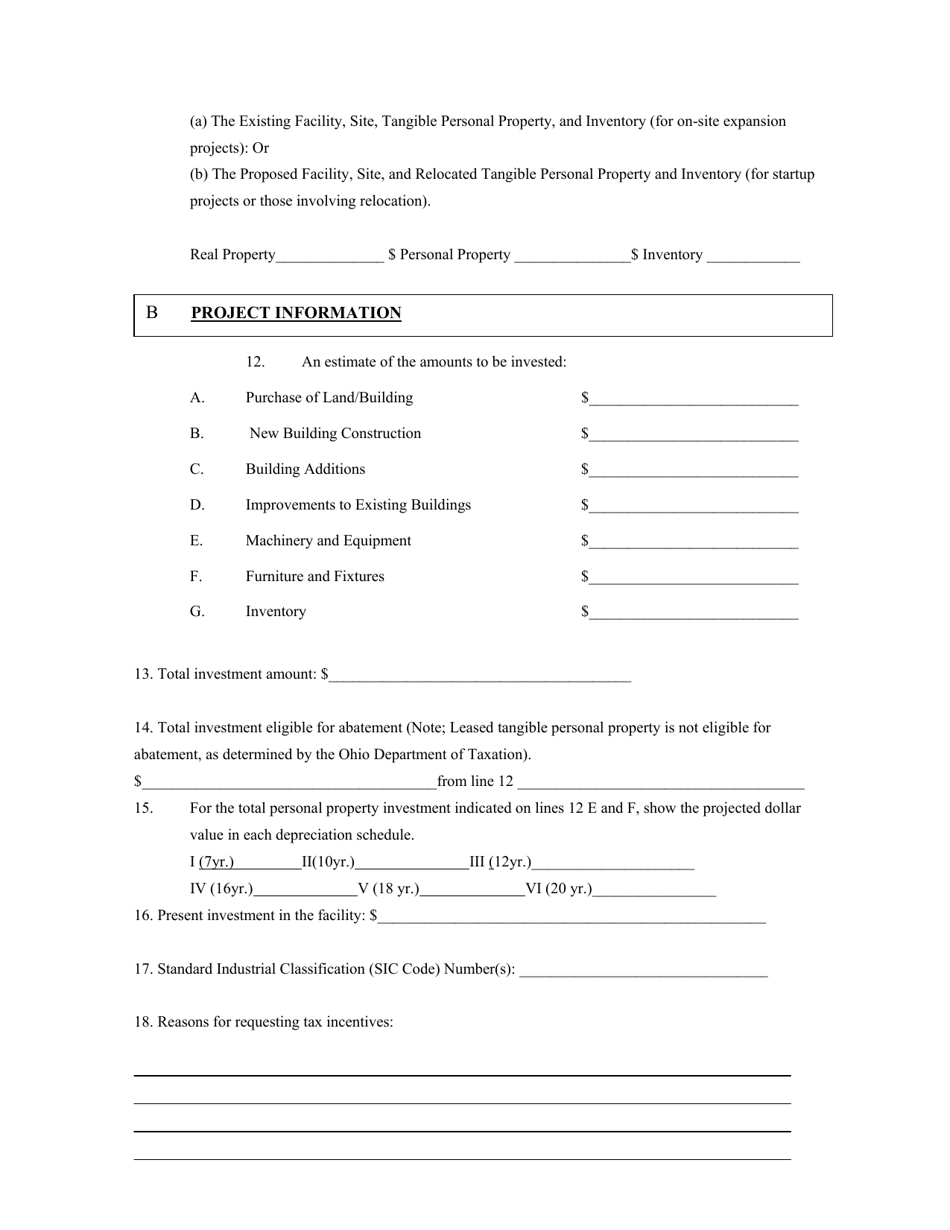

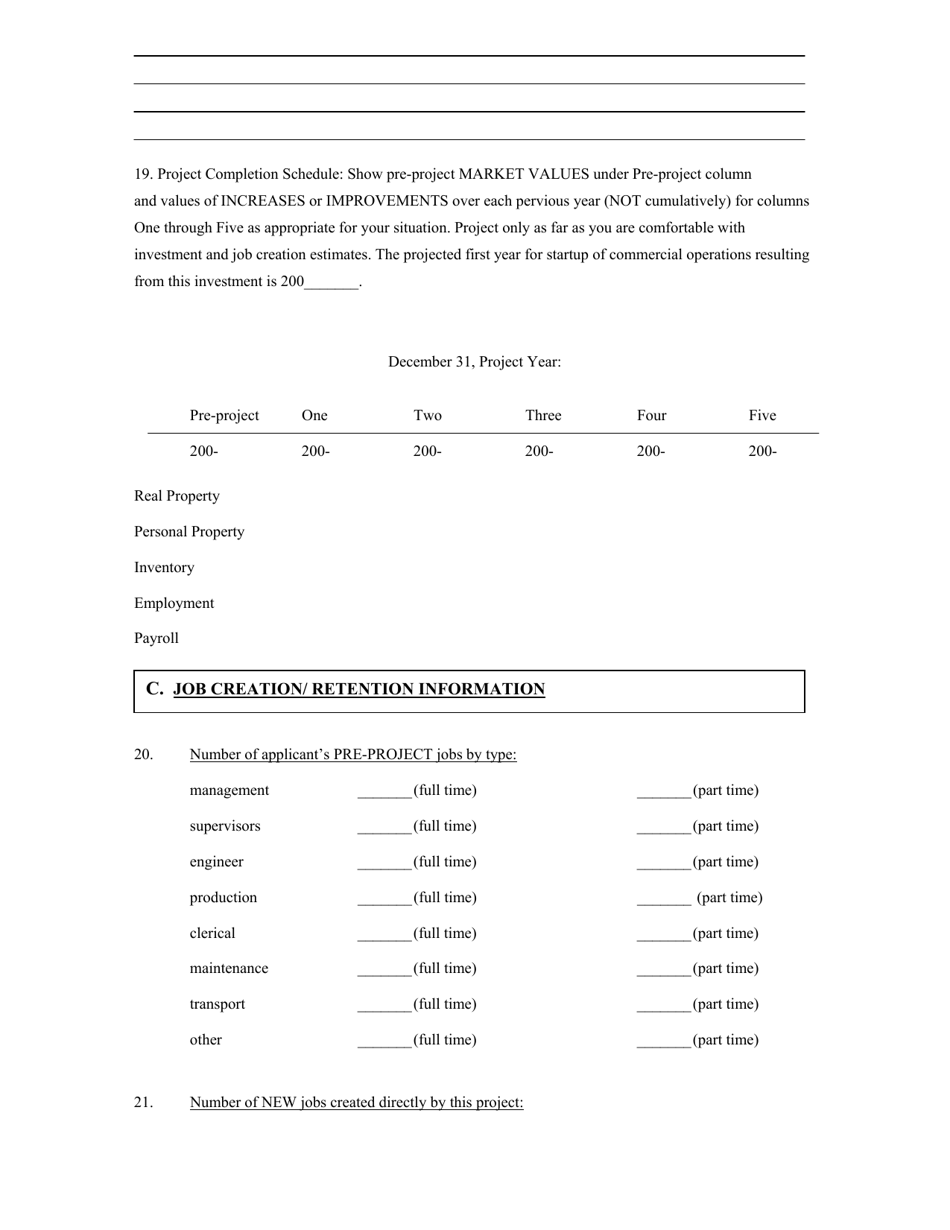

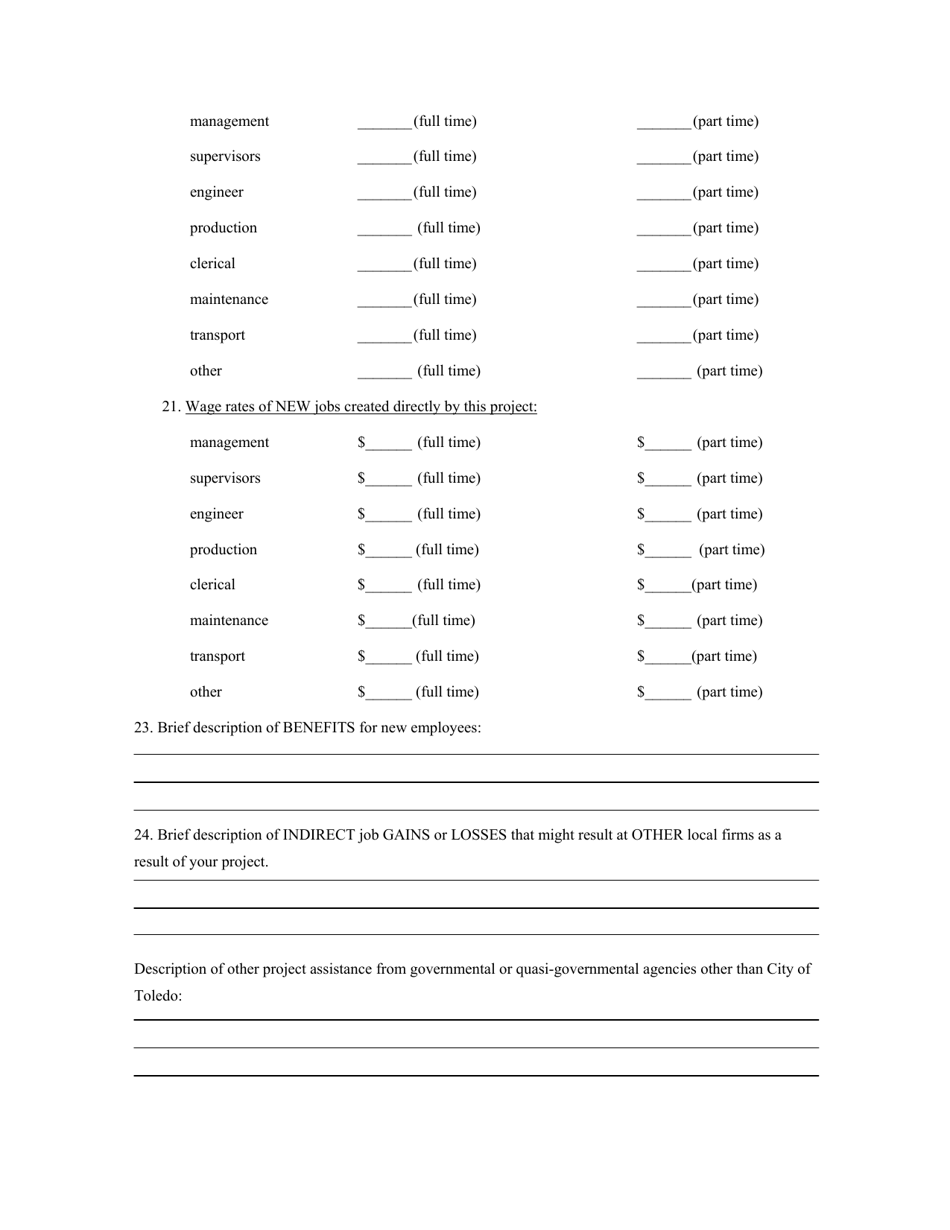

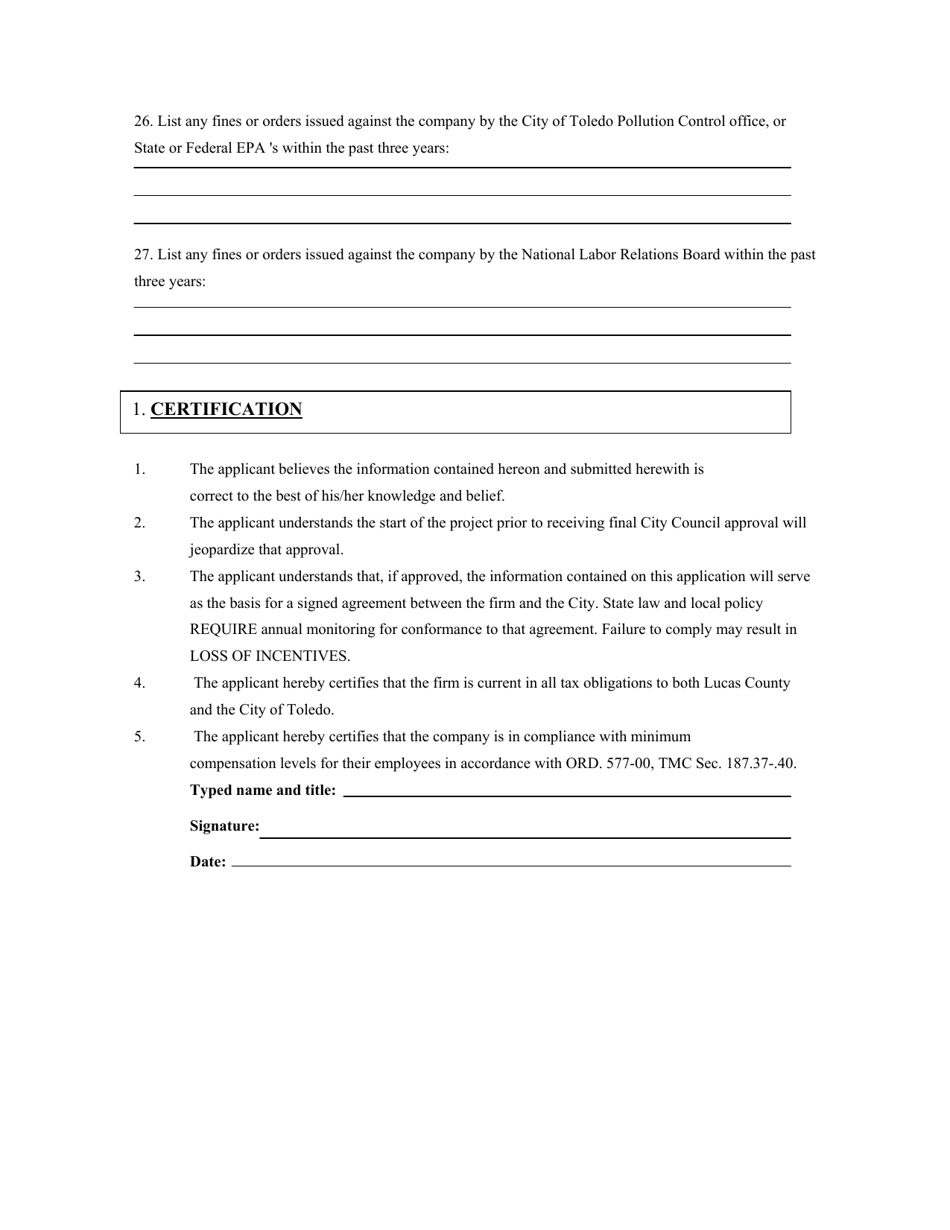

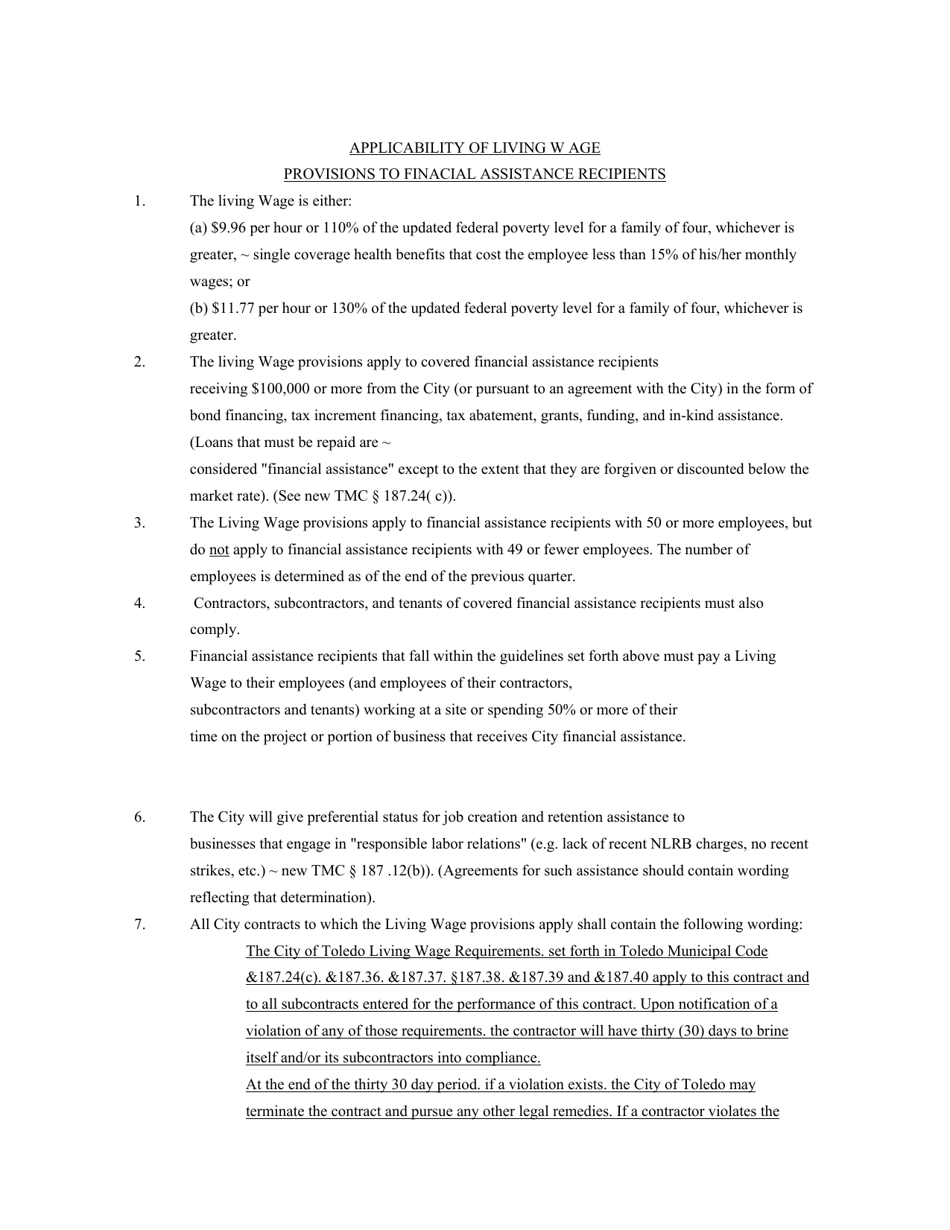

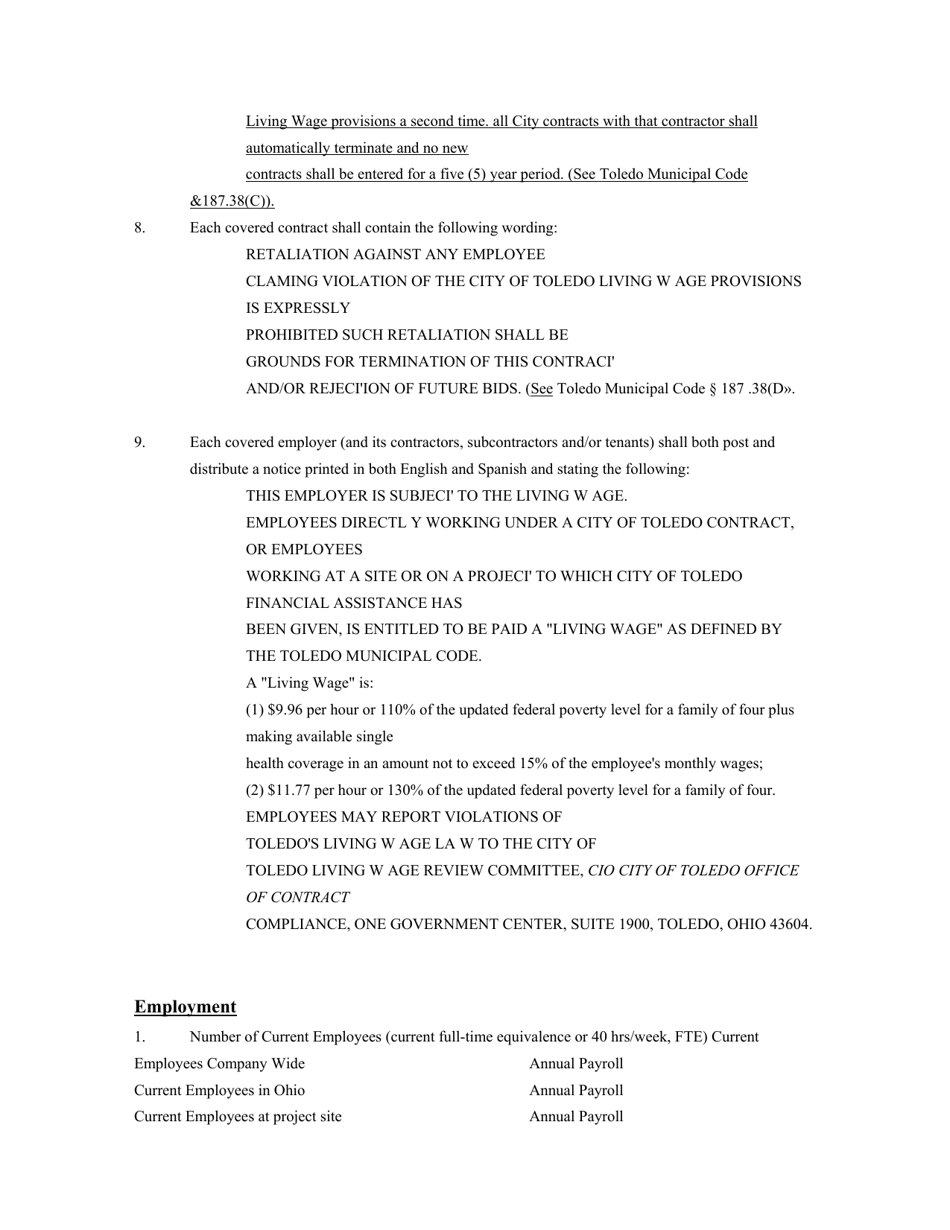

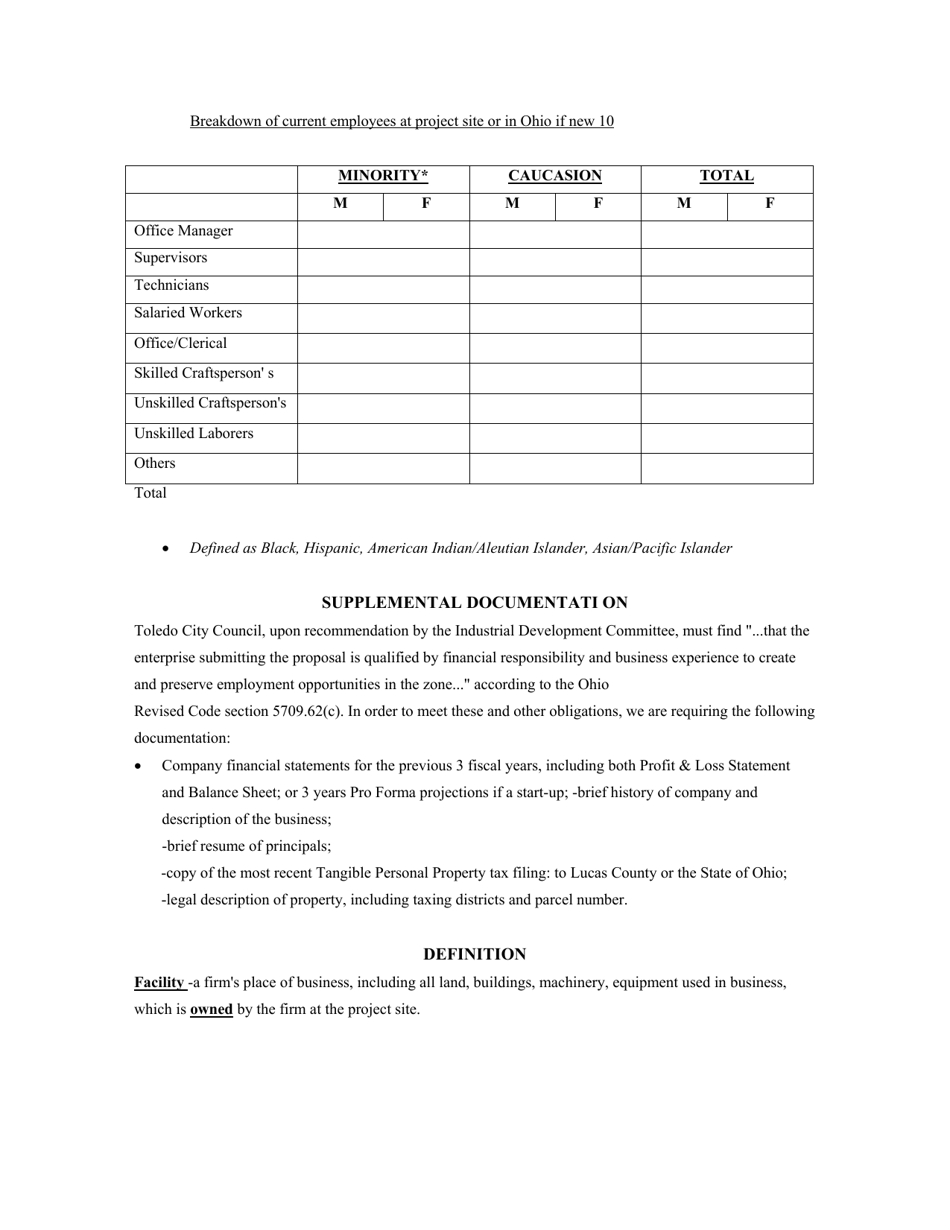

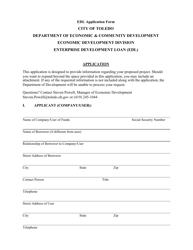

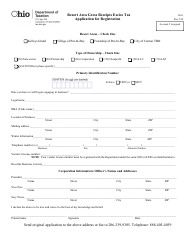

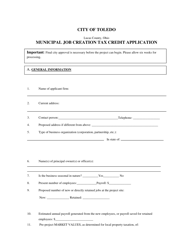

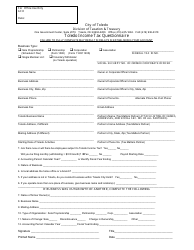

Enterprise Zone Tax Abatement Application - City of Toledo, Ohio

Enterprise Zone Tax Abatement Application is a legal document that was released by the Department of Finance - City of Toledo, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Toledo.

FAQ

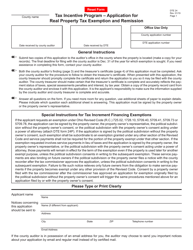

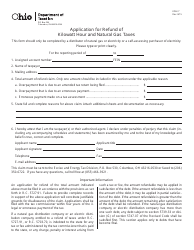

Q: What is an enterprise zone tax abatement?

A: An enterprise zone tax abatement is a program that provides tax incentives for businesses to locate or expand in designated areas.

Q: Who is eligible for the enterprise zone tax abatement in Toledo, Ohio?

A: Businesses that are planning to locate or expand within designated areas in Toledo, Ohio may be eligible for the enterprise zone tax abatement.

Q: What are the benefits of the enterprise zone tax abatement?

A: The benefits of the enterprise zone tax abatement include property tax exemptions or reductions for a certain period of time, which can help businesses save money and encourage economic development in designated areas.

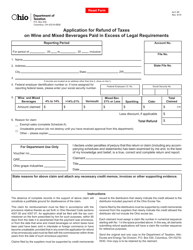

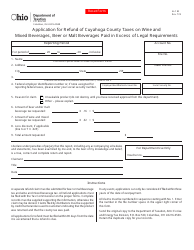

Q: How can businesses apply for the enterprise zone tax abatement in Toledo, Ohio?

A: Businesses can apply for the enterprise zone tax abatement by completing and submitting the Enterprise Zone Tax Abatement Application to the City of Toledo, Ohio.

Q: Are there any requirements or conditions for the enterprise zone tax abatement?

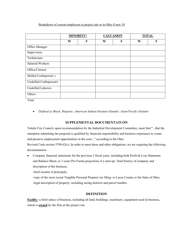

A: Yes, businesses must meet certain requirements and conditions, such as creating or retaining jobs and making new investments in the designated areas, to be eligible for the enterprise zone tax abatement.

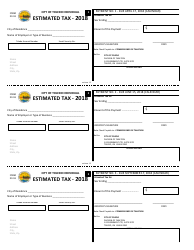

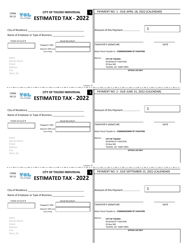

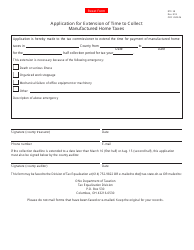

Form Details:

- The latest edition currently provided by the Department of Finance - City of Toledo, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Finance - City of Toledo, Ohio.