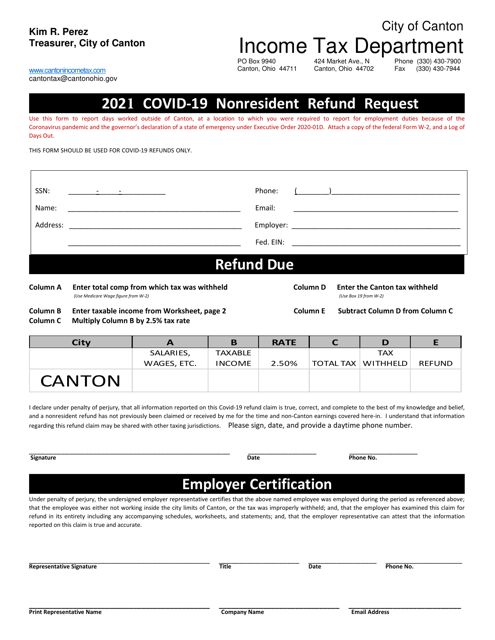

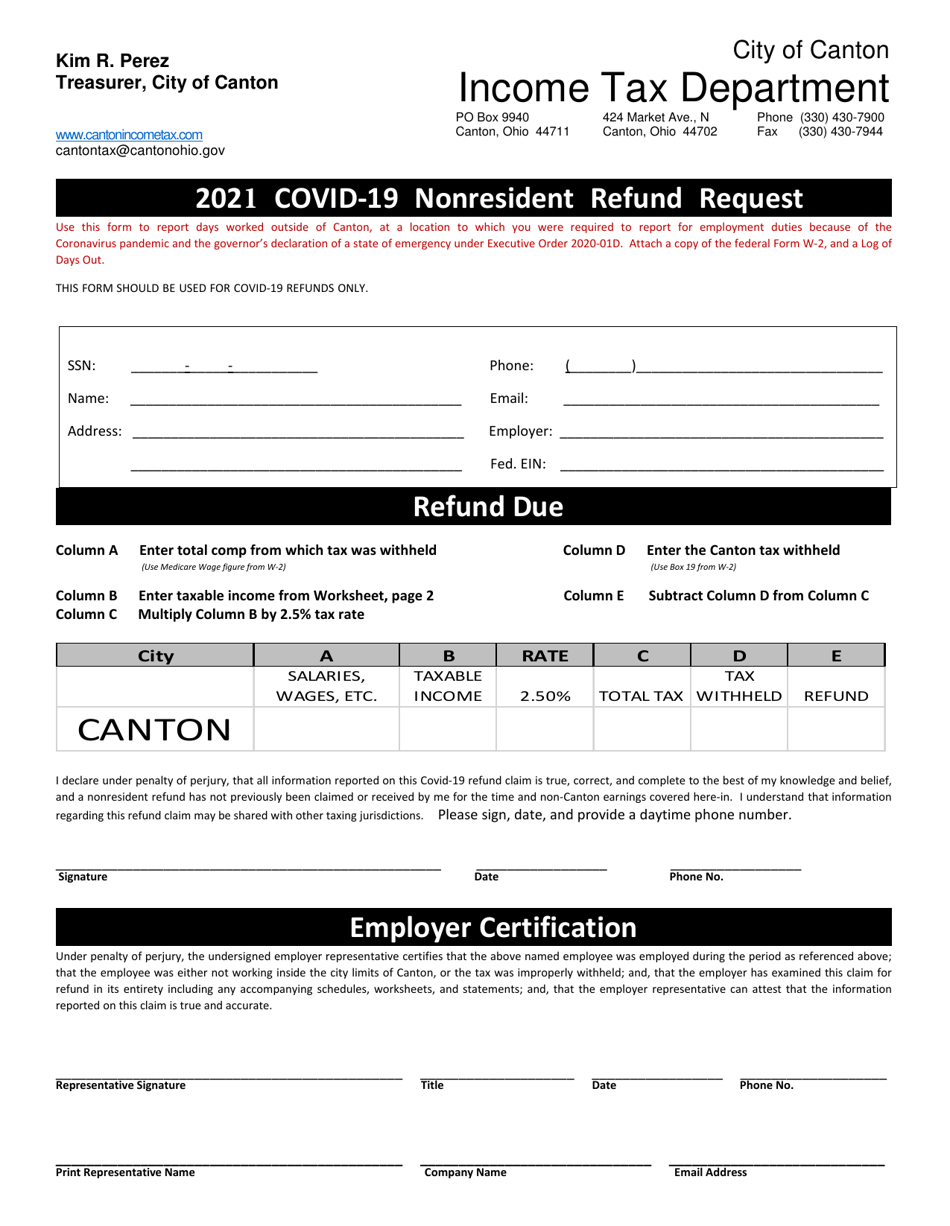

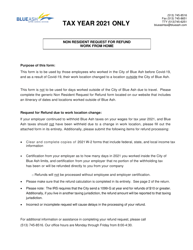

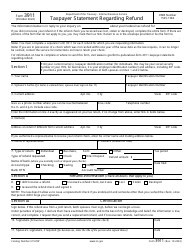

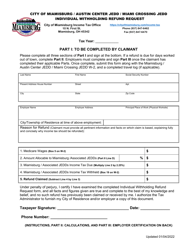

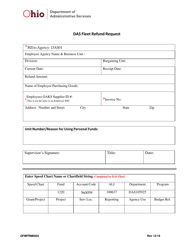

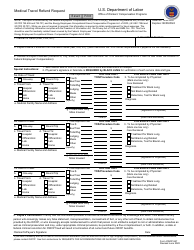

Covid-19 Nonresident Refund Request - City of Canton, Ohio

Covid-19 Nonresident Refund Request is a legal document that was released by the Treasury Department - City of Canton, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Canton.

FAQ

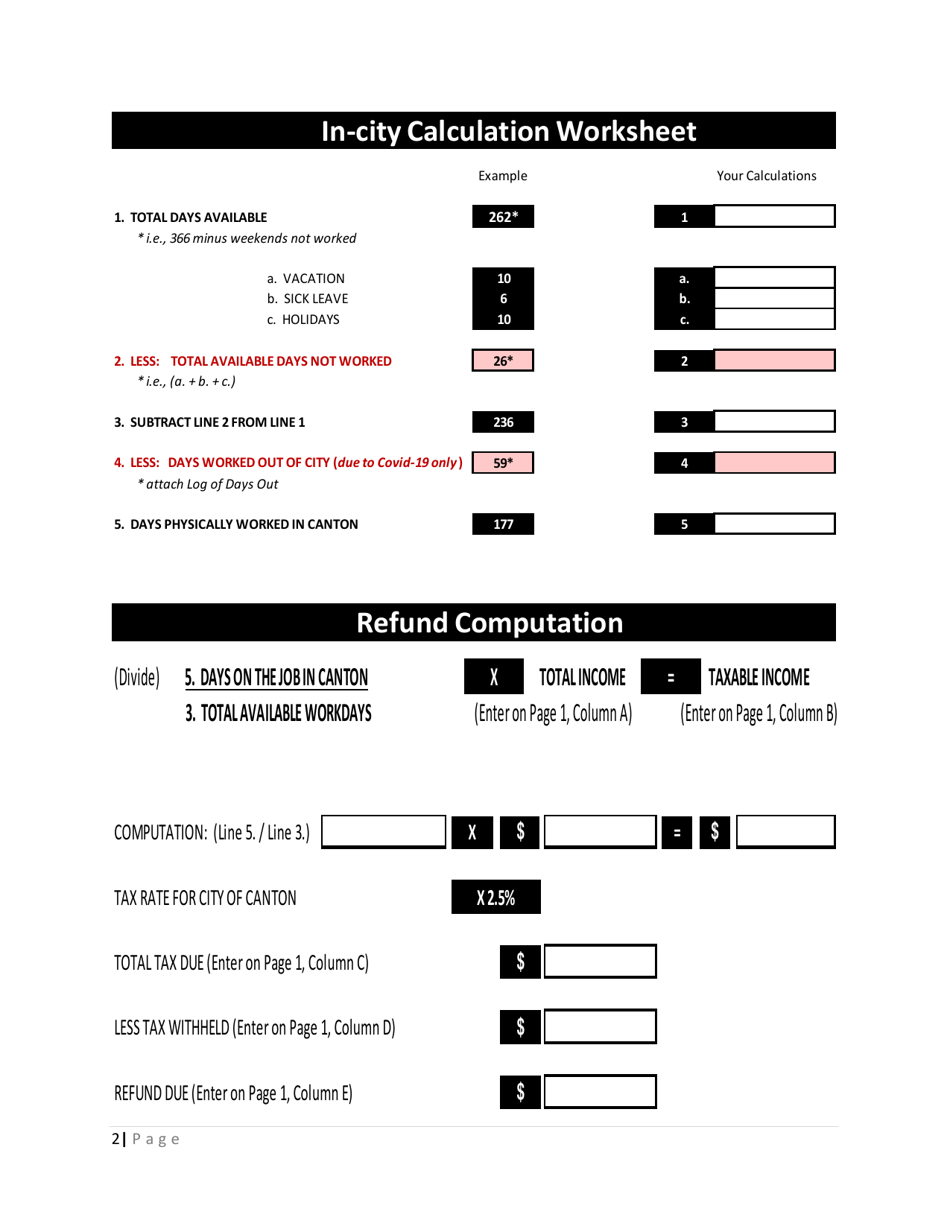

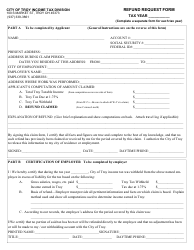

Q: What is the Covid-19 Nonresident Refund Request?

A: The Covid-19 Nonresident Refund Request is a request for refund of city income tax paid by nonresidents of Canton, Ohio.

Q: Who is eligible to submit a Covid-19 Nonresident Refund Request?

A: Nonresidents of Canton, Ohio who have paid city income tax are eligible to submit a Covid-19 Nonresident Refund Request.

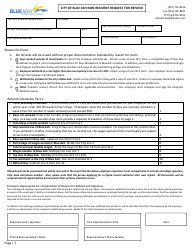

Q: How can I submit a Covid-19 Nonresident Refund Request?

A: You can submit a Covid-19 Nonresident Refund Request by filling out the form provided by the City of Canton, Ohio and mailing it to the designated address.

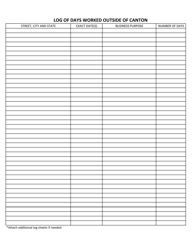

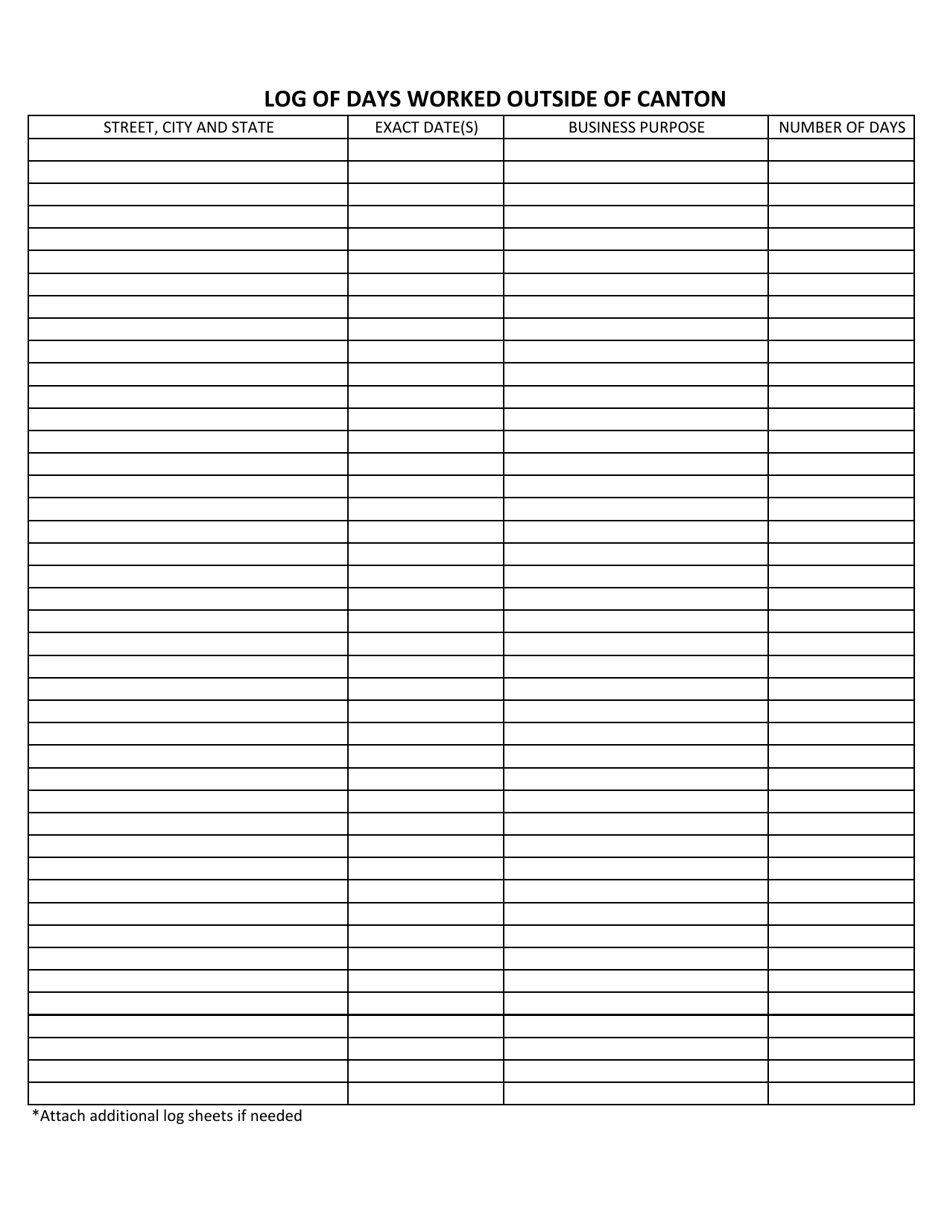

Q: What documentation do I need to include with my Covid-19 Nonresident Refund Request?

A: You may need to include copies of your tax returns and other supporting documents with your Covid-19 Nonresident Refund Request. The specific requirements will be outlined in the form provided by the City of Canton, Ohio.

Q: What is the deadline for submitting a Covid-19 Nonresident Refund Request?

A: The deadline for submitting a Covid-19 Nonresident Refund Request is typically specified by the City of Canton, Ohio. Check the form or contact the relevant city department for the deadline.

Q: How long does it take to process a Covid-19 Nonresident Refund Request?

A: The processing time for a Covid-19 Nonresident Refund Request can vary. Contact the City of Canton, Ohio for an estimate on the processing time.

Form Details:

- The latest edition currently provided by the Treasury Department - City of Canton, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Treasury Department - City of Canton, Ohio.