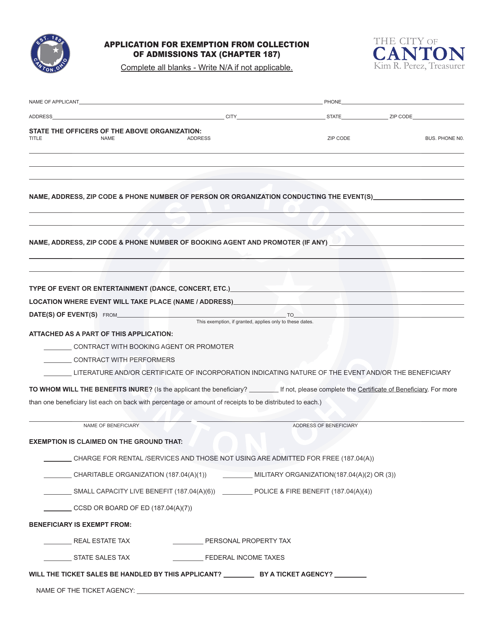

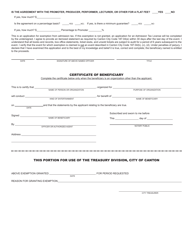

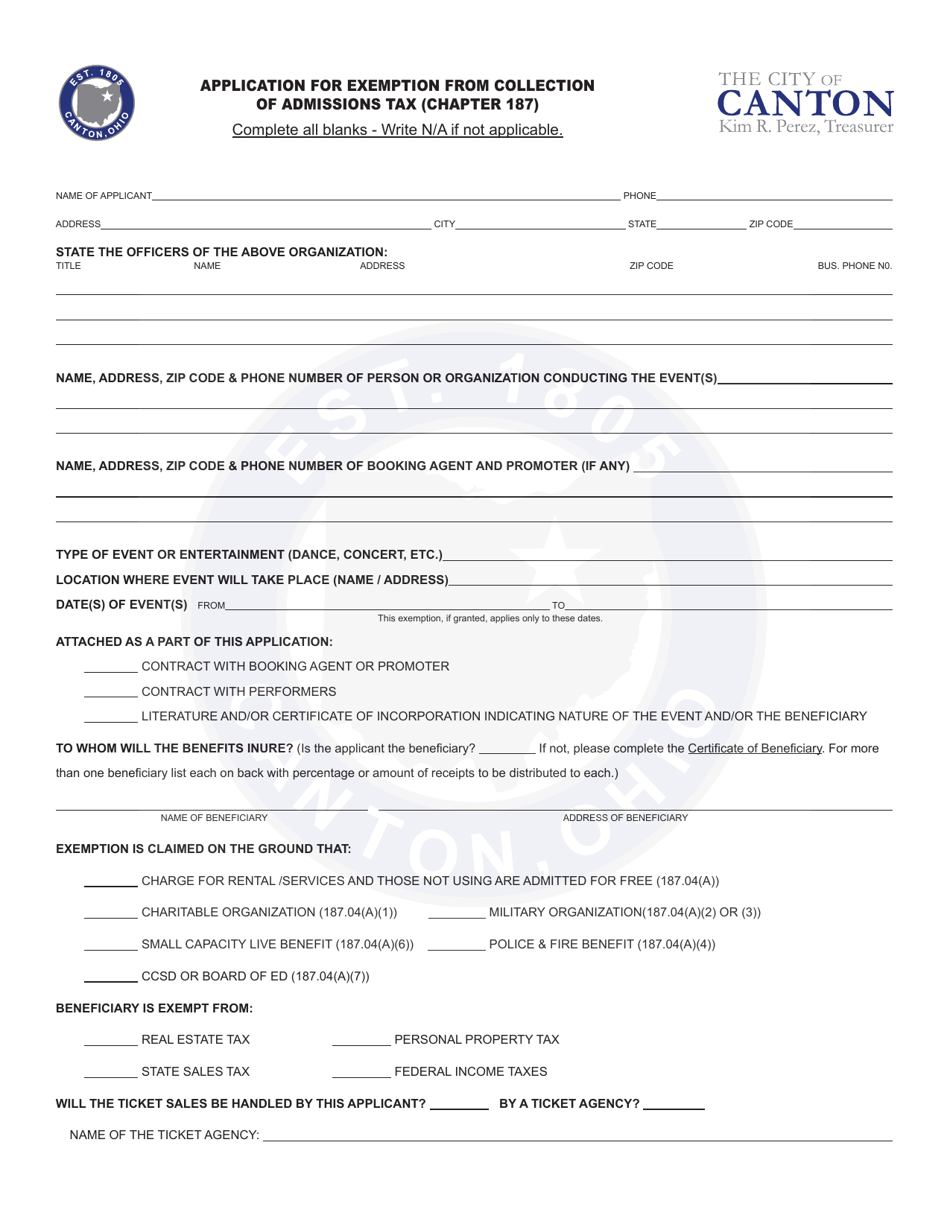

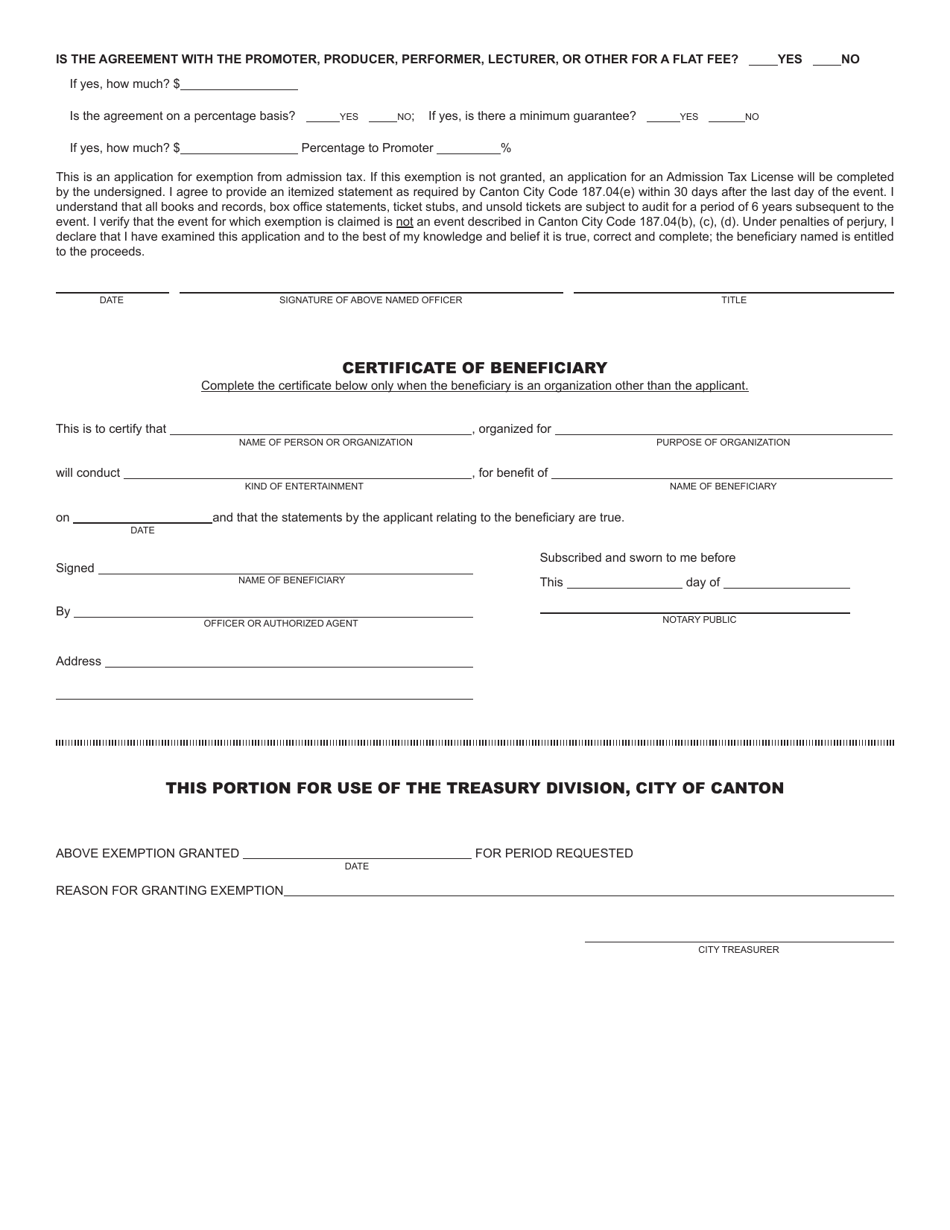

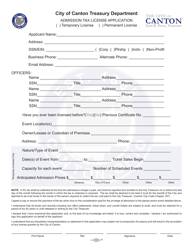

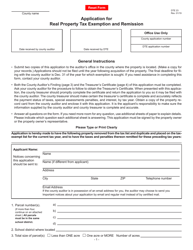

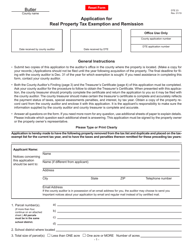

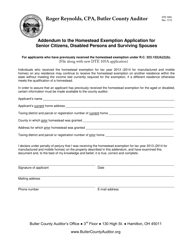

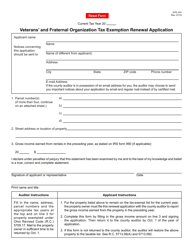

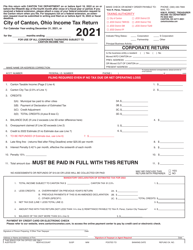

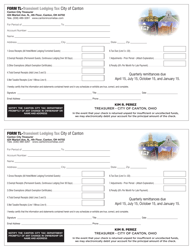

Application for Exemption From Collection of Admissions Tax (Chapter 187) - City of Canton, Ohio

Application for Exemption From Collection of Admissions Tax (Chapter 187) is a legal document that was released by the Treasury Department - City of Canton, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Canton.

FAQ

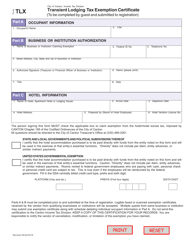

Q: What is the purpose of the Application for Exemption From Collection of Admissions Tax?

A: The purpose of the application is to request exemption from paying the admissions tax in the City of Canton, Ohio.

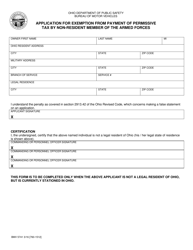

Q: Who needs to file this application?

A: Any individual or organization that believes they qualify for an exemption from the admissions tax in Canton, Ohio.

Q: What is the admissions tax in the City of Canton, Ohio?

A: The admissions tax is a local tax imposed on the sale of tickets or admissions to certain events or venues in Canton, Ohio.

Q: What information is required on the application?

A: The application requires information such as the applicant's name, contact information, event details, and explanation for why an exemption is being sought.

Q: Is there a fee for filing this application?

A: No, there is no fee for filing the Application for Exemption From Collection of Admissions Tax.

Q: How long does it take to process the application?

A: The processing time for the application may vary, but typically it takes a few weeks to receive a decision.

Q: What happens if my application is approved?

A: If your application is approved, you will be exempt from paying the admissions tax for the specified event or venue.

Q: What happens if my application is denied?

A: If your application is denied, you will still be required to pay the admissions tax for the specified event or venue.

Q: Can I appeal a denial of my application?

A: Yes, you have the right to appeal a denial of your application. Instructions for the appeal process will be provided with the denial notice.

Form Details:

- The latest edition currently provided by the Treasury Department - City of Canton, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Treasury Department - City of Canton, Ohio.