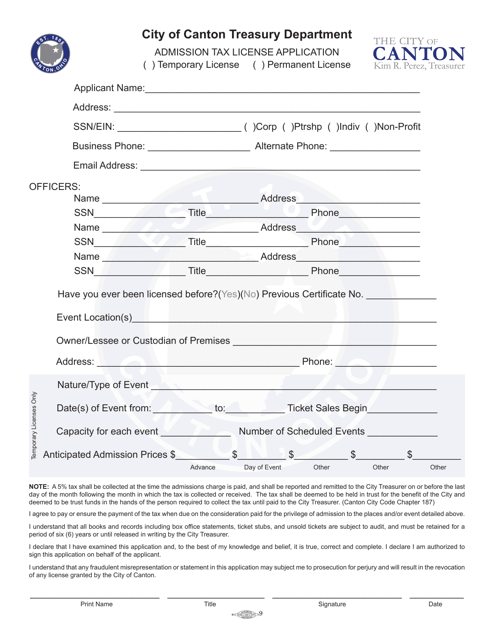

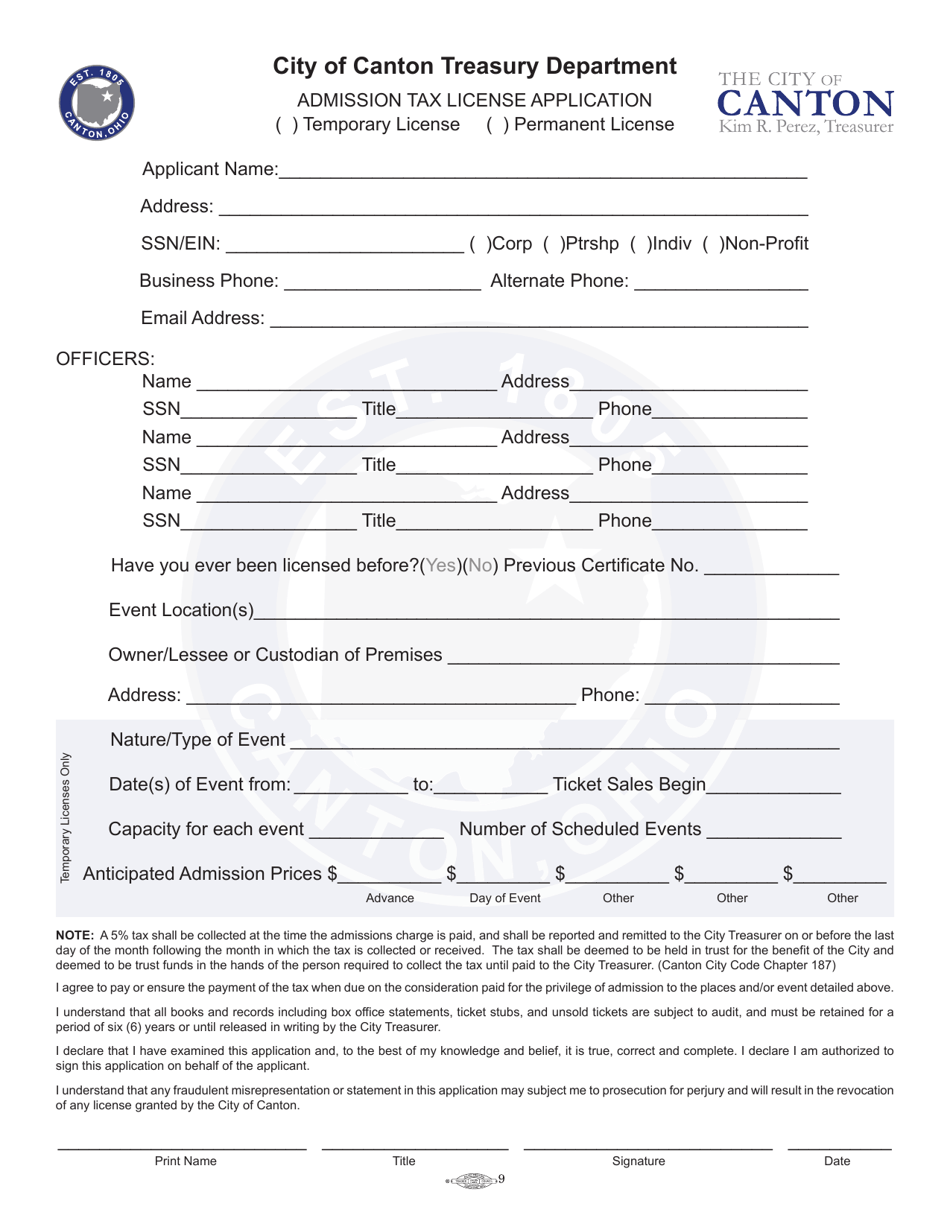

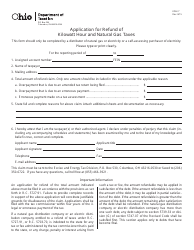

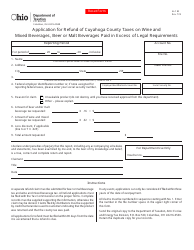

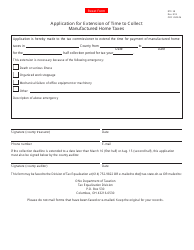

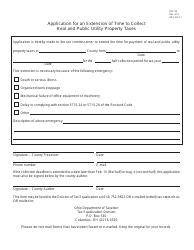

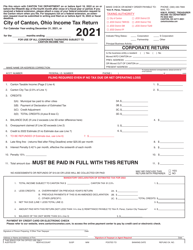

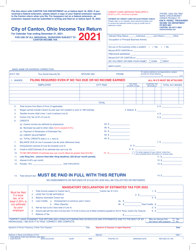

Admission Tax License Application - City of Canton, Ohio

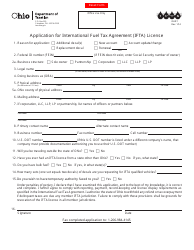

Admission Tax License Application is a legal document that was released by the Treasury Department - City of Canton, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Canton.

FAQ

Q: What is the Admission Tax License Application?

A: The Admission Tax License Application is a document required by the City of Canton, Ohio for businesses that operate in the city and charge admission fees.

Q: Why do businesses need an Admission Tax License?

A: Businesses need an Admission Tax License to comply with the local tax regulations and pay the applicable admission tax to the City of Canton.

Q: Who needs to apply for an Admission Tax License?

A: Any business operating in the City of Canton, Ohio that charges admission fees is required to apply for an Admission Tax License.

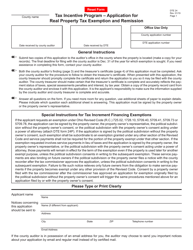

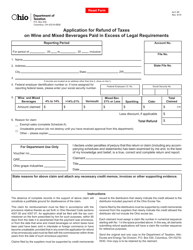

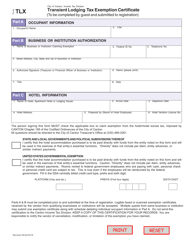

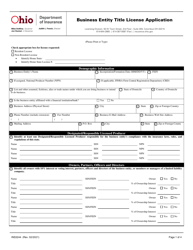

Q: What information is required on the Admission Tax License Application?

A: The Admission Tax License Application typically asks for details about the business, such as name, address, and contact information, as well as information about the nature of the business and its admission fees.

Q: Are there any fees associated with the Admission Tax License Application?

A: Yes, there may be fees associated with the Admission Tax License Application. The specific fees can vary, so it's best to check with the City of Canton, Ohio for the current fee schedule.

Q: What happens after I submit the Admission Tax License Application?

A: After you submit the Admission Tax License Application, it will be reviewed by the City of Canton, Ohio's authorities. If approved, you will receive your Admission Tax License.

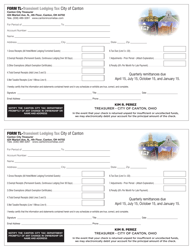

Q: Do I need to renew my Admission Tax License?

A: Yes, Admission Tax Licenses generally need to be renewed periodically. The specific renewal requirements and frequency can vary, so it's important to check with the City of Canton, Ohio for the renewal process.

Q: What are the consequences of not having an Admission Tax License?

A: Operating without a required Admission Tax License can result in penalties and fines imposed by the City of Canton, Ohio. It is important to comply with the local tax regulations to avoid any legal consequences.

Form Details:

- The latest edition currently provided by the Treasury Department - City of Canton, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Treasury Department - City of Canton, Ohio.