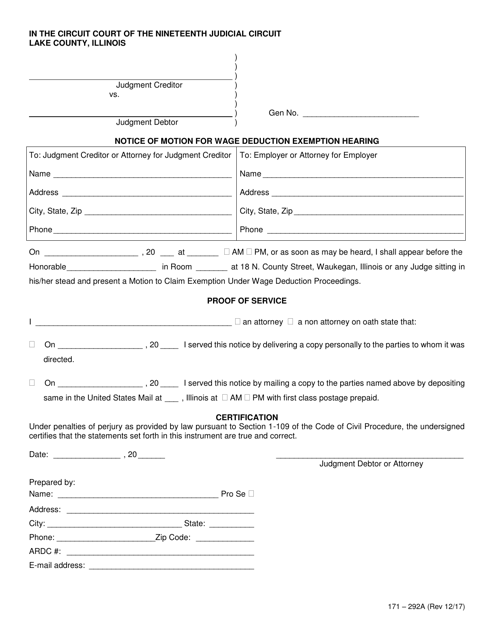

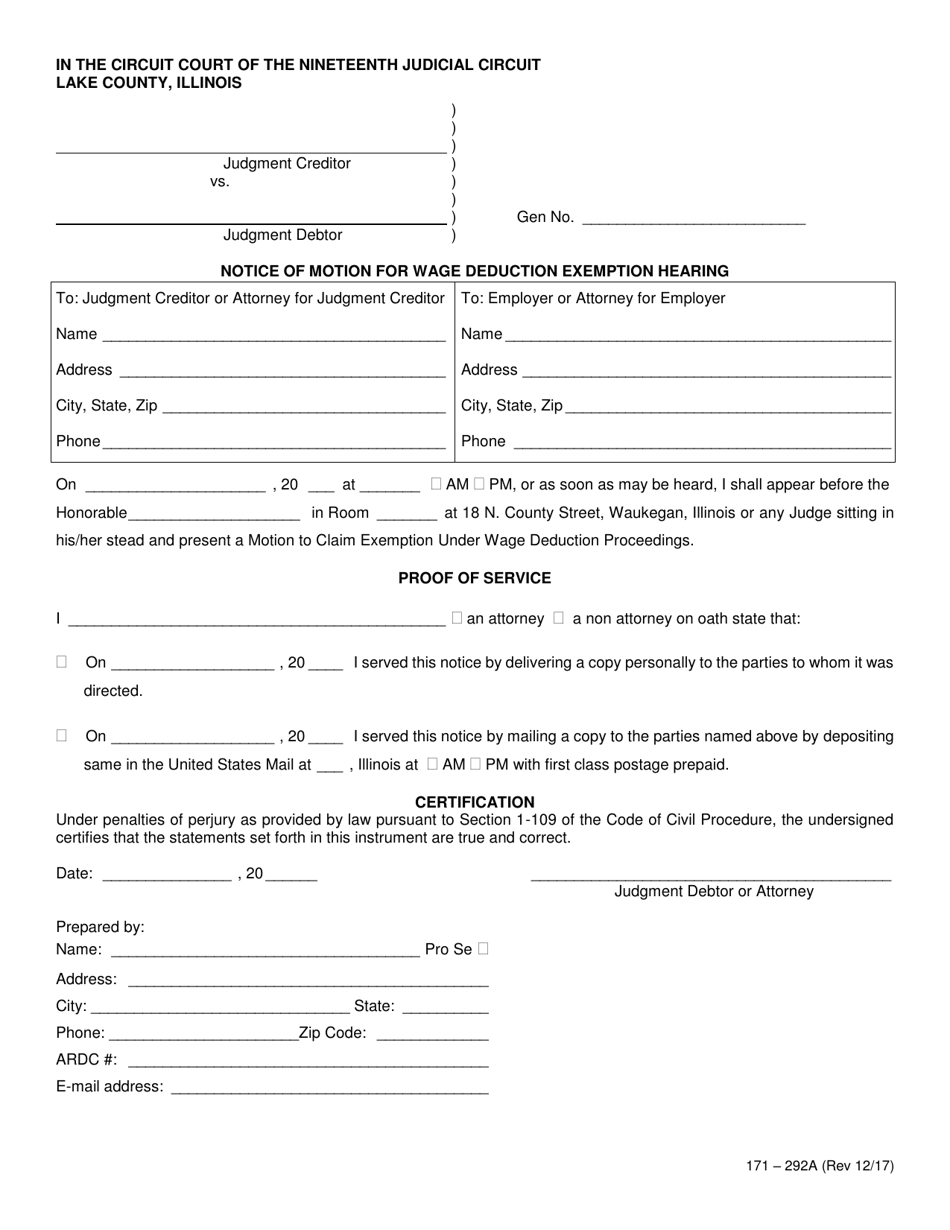

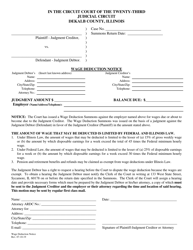

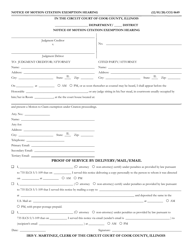

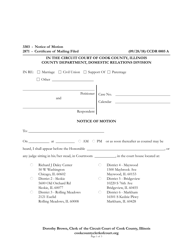

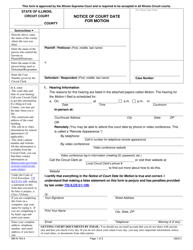

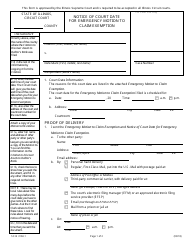

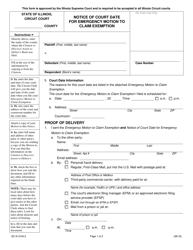

Form 171-292A Notice of Motion for Wage Deduction Exemption Hearing - Lake County, Illinois

What Is Form 171-292A?

This is a legal form that was released by the Circuit Court Clerk’s Office - Lake County, Illinois - a government authority operating within Illinois. The form may be used strictly within Lake County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

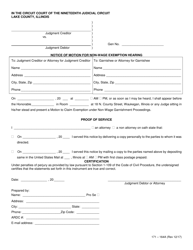

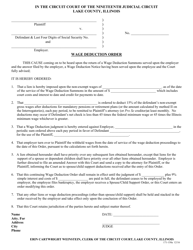

Q: What is a Notice of Motion for Wage Deduction Exemption Hearing?

A: A Notice of Motion for Wage Deduction Exemption Hearing is a legal document filed in Lake County, Illinois to request a hearing regarding the exemption of wages from wage garnishment.

Q: When should I use Form 171-292A?

A: You should use Form 171-292A when you are requesting a hearing to determine if your wages can be exempt from wage garnishment in Lake County, Illinois.

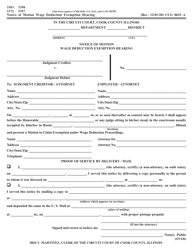

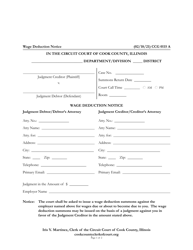

Q: What information do I need to provide in Form 171-292A?

A: You need to provide your name, case number, the name of the judgment creditor, the amount of the judgment, and the reason for claiming the exemption on Form 171-292A.

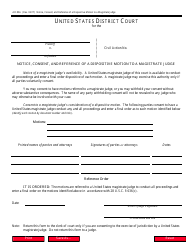

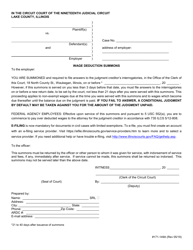

Q: How do I file Form 171-292A?

A: You must file Form 171-292A with the Lake County Clerk of the Circuit Court either in person or by mail.

Q: Is there a filing fee for Form 171-292A?

A: Yes, there is a filing fee for Form 171-292A. The current fee can be obtained from the Lake County Clerk of the Circuit Court.

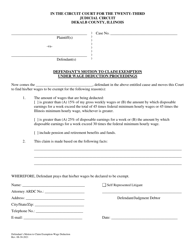

Q: Can I request a hearing if I already had a wage deduction hearing?

A: Yes, you can still request a hearing using Form 171-292A if you have already had a wage deduction hearing.

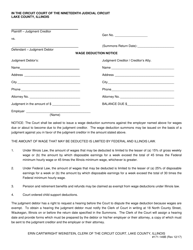

Q: What happens after I file Form 171-292A?

A: After you file Form 171-292A, the court will schedule a hearing to determine if your wages can be exempt from wage garnishment.

Q: How soon will the hearing be scheduled after filing Form 171-292A?

A: The timing for the hearing will depend on the court's schedule. It is best to contact the Lake County Clerk of the Circuit Court for specific information.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Circuit Court Clerk’s Office - Lake County, Illinois;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 171-292A by clicking the link below or browse more documents and templates provided by the Circuit Court Clerk’s Office - Lake County, Illinois.