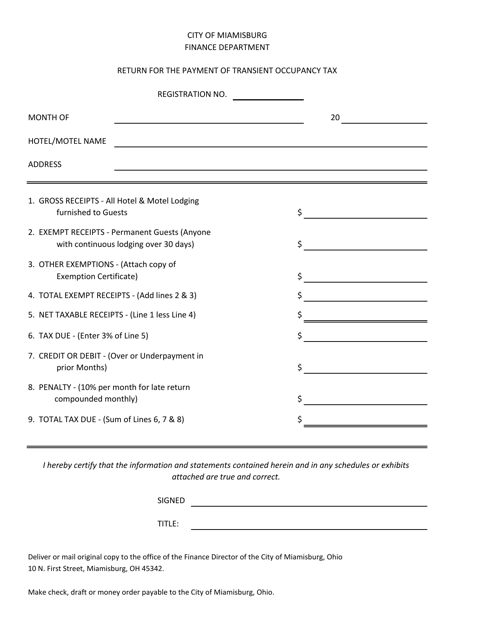

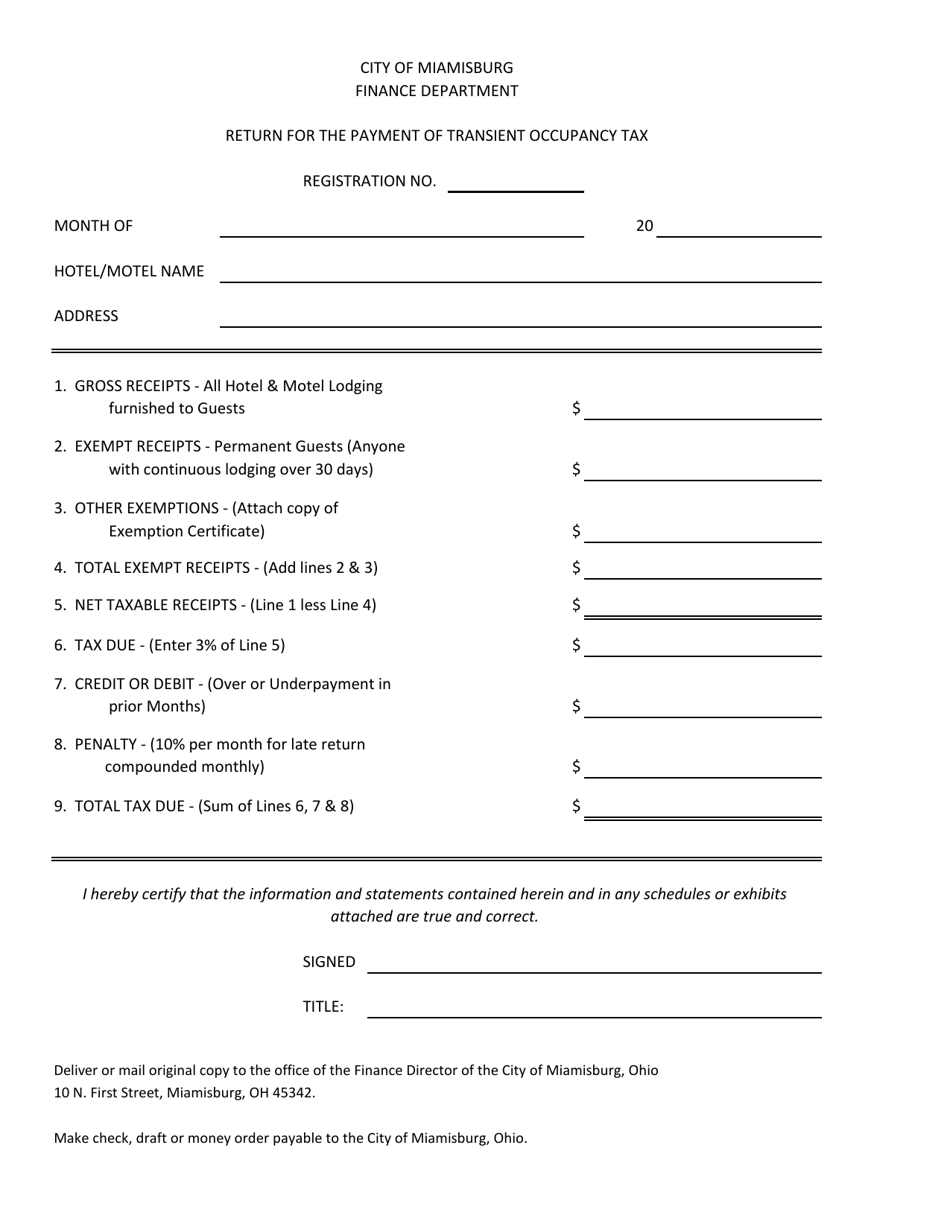

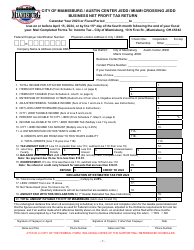

Return for the Payment of Transient Occupancy Tax - City of Miamisburg, Ohio

Return for the Payment of Transient Occupancy Tax is a legal document that was released by the Finance Department - City of Miamisburg, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Miamisburg.

FAQ

Q: What is the Transient Occupancy Tax?

A: The Transient Occupancy Tax is a tax imposed on guests who stay in hotels and other lodging facilities.

Q: Who is responsible for paying the Transient Occupancy Tax?

A: The responsibility of paying the Transient Occupancy Tax falls on the lodging provider or operator.

Q: How is the Transient Occupancy Tax calculated?

A: The Transient Occupancy Tax is typically calculated as a percentage of the room rate charged to guests.

Q: What is the purpose of the Transient Occupancy Tax?

A: The Transient Occupancy Tax is used to generate revenue for the city and support local tourism initiatives.

Q: Are there any exemptions or discounts for the Transient Occupancy Tax?

A: Exemptions or discounts for the Transient Occupancy Tax may vary by jurisdiction. It is advisable to check with the specific city or municipality for details.

Q: How and when should the Transient Occupancy Tax be paid?

A: The specific procedures and deadlines for paying the Transient Occupancy Tax are typically outlined by the city or municipality. Lodging providers should follow the guidelines provided.

Q: What are the consequences of not paying the Transient Occupancy Tax?

A: Failure to pay the Transient Occupancy Tax may result in penalties, fines, or legal consequences. It is important to comply with the tax regulations to avoid these issues.

Q: Is the Transient Occupancy Tax refundable?

A: Refundability of the Transient Occupancy Tax depends on the specific policies of the city or municipality. It is advised to inquire with the relevant authorities for more information.

Form Details:

- The latest edition currently provided by the Finance Department - City of Miamisburg, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - City of Miamisburg, Ohio.