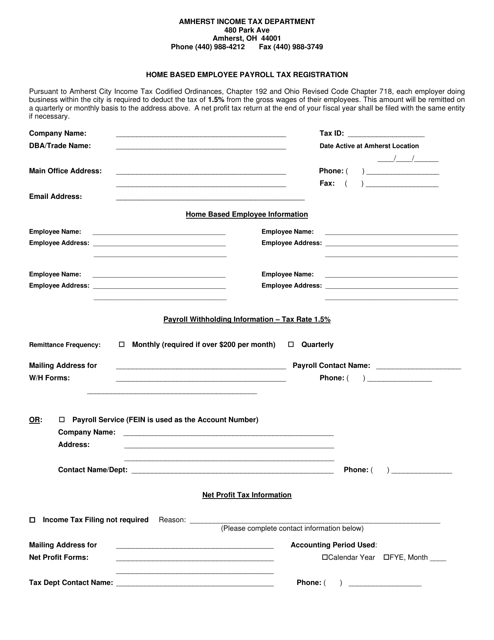

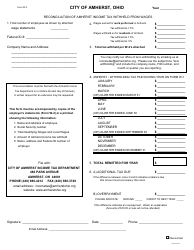

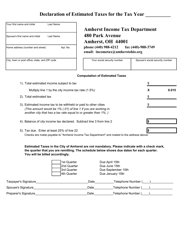

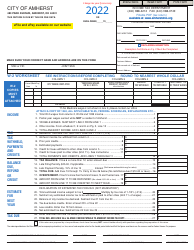

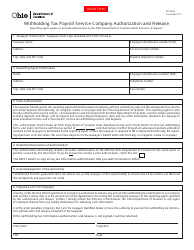

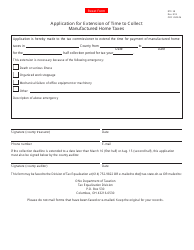

Home Based Employee Payroll Tax Registration - City of Amherst, Ohio

Home Based Employee Payroll Tax Registration is a legal document that was released by the Income Tax Department - City of Amherst, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Amherst.

FAQ

Q: What is the payroll tax registration process for home-based employees in Amherst, Ohio?

A: The payroll tax registration process for home-based employees in Amherst, Ohio is the same as for any other employee. They need to register for payroll taxes with the City of Amherst.

Q: Do home-based employees in Amherst, Ohio need to register for payroll taxes?

A: Yes, home-based employees in Amherst, Ohio are required to register for payroll taxes with the City of Amherst.

Q: Is there a specific registration form for home-based employees in Amherst, Ohio?

A: No, there is no specific registration form for home-based employees in Amherst, Ohio. They can use the regular payroll tax registration form provided by the City of Amherst.

Q: Are there any exemptions or special considerations for home-based employees in Amherst, Ohio?

A: No, there are no specific exemptions or special considerations for home-based employees in Amherst, Ohio. They are subject to the same payroll tax regulations as any other employee.

Form Details:

- The latest edition currently provided by the Income Tax Department - City of Amherst, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Income Tax Department - City of Amherst, Ohio.