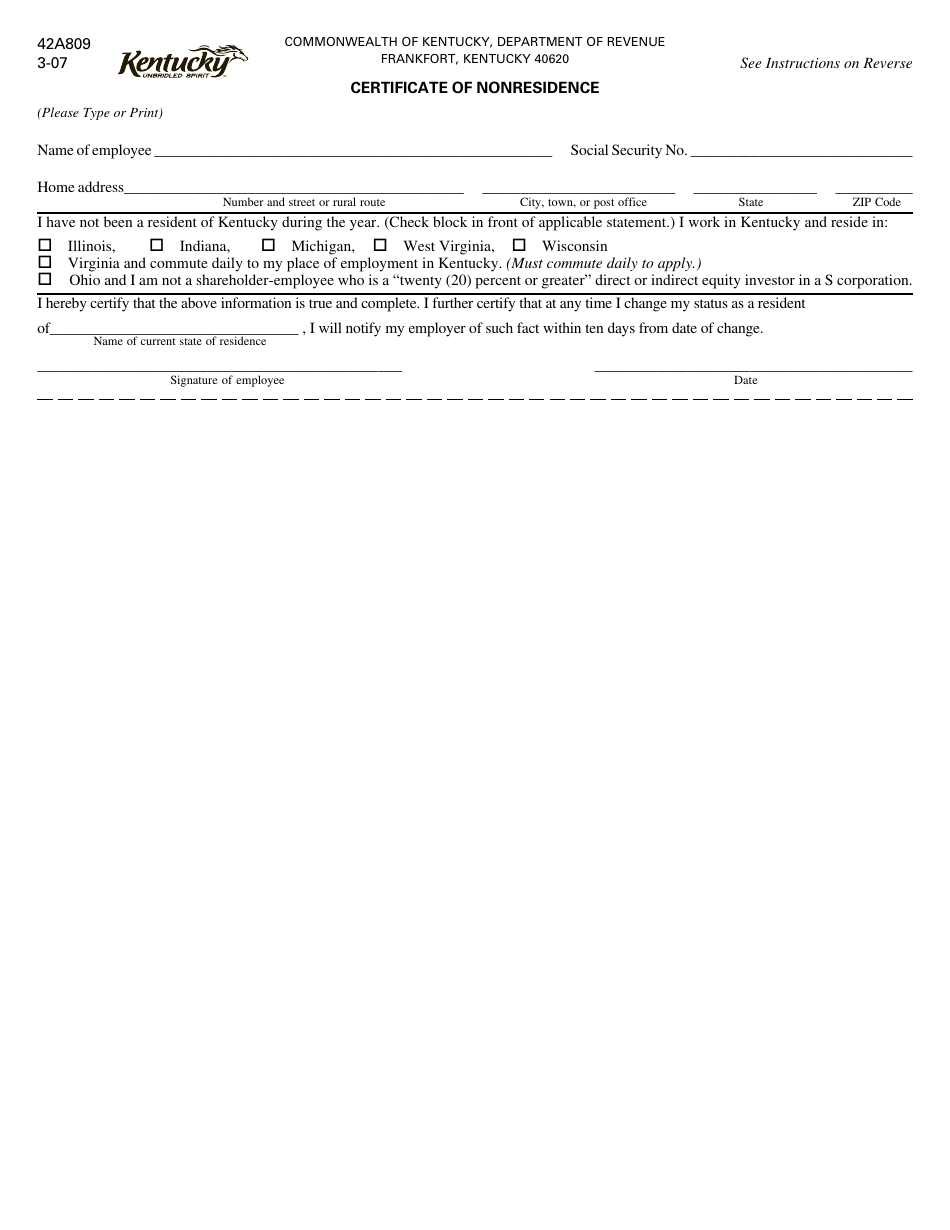

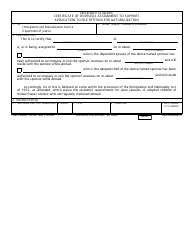

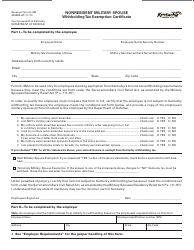

Form 42A809 Certificate of Nonresidence - Kentucky

What Is Form 42A809?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 42A809?

A: Form 42A809 is the Certificate of Nonresidence for the state of Kentucky.

Q: Who needs to fill out Form 42A809?

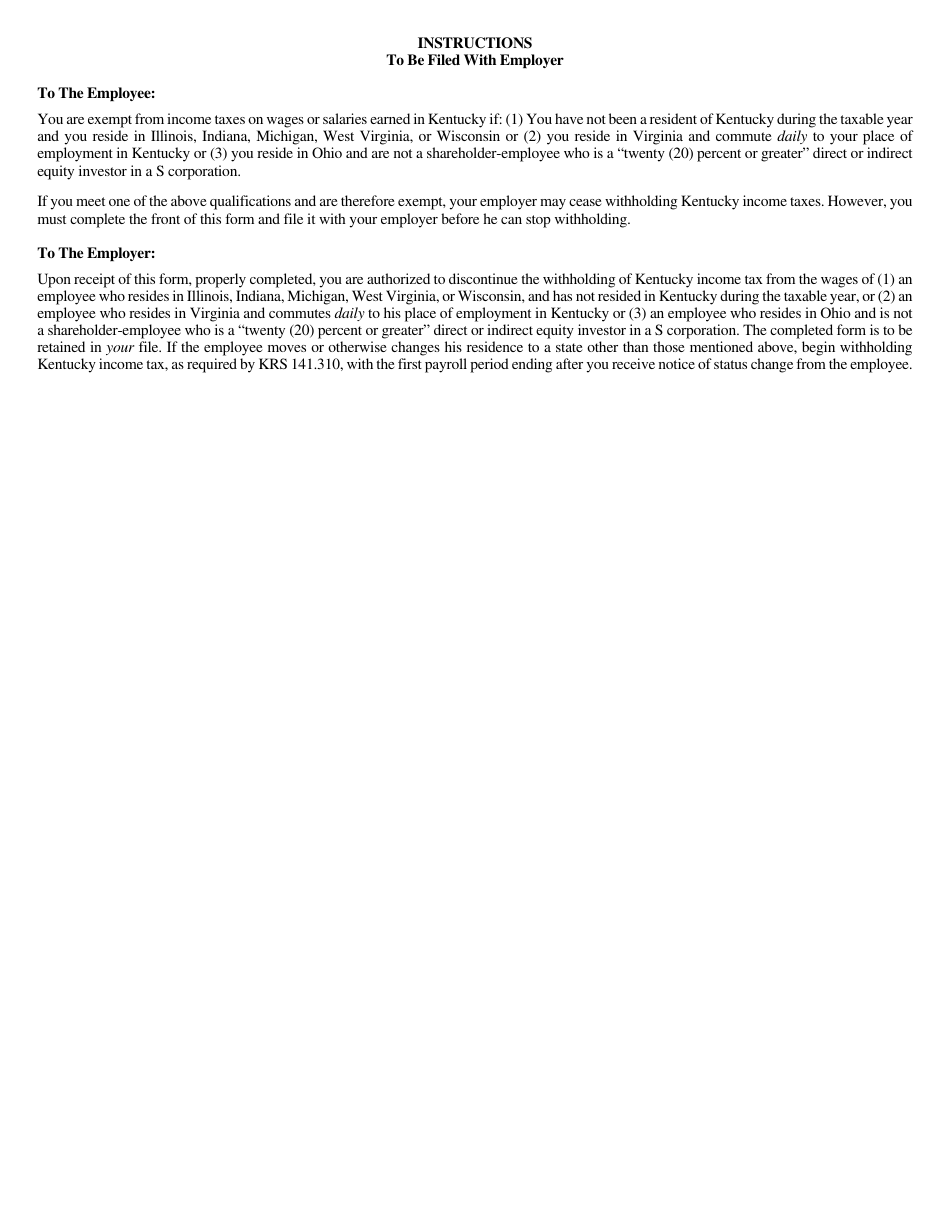

A: Form 42A809 needs to be filled out by individuals who are claiming to be nonresidents of Kentucky for tax purposes.

Q: What is the purpose of Form 42A809?

A: The purpose of Form 42A809 is to certify that an individual is a nonresident of Kentucky and is not subject to Kentucky state income tax.

Q: Is there a deadline for filing Form 42A809?

A: Yes, Form 42A809 must be filed by the due date of the individual's Kentucky income tax return.

Q: Are there any supporting documents required with Form 42A809?

A: Yes, individuals filing Form 42A809 may need to provide additional documentation to support their claim of nonresidence, such as proof of residency in another state.

Form Details:

- Released on March 1, 2007;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 42A809 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.