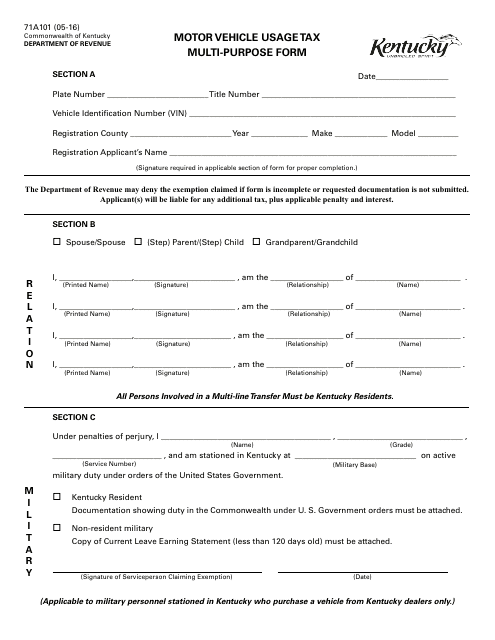

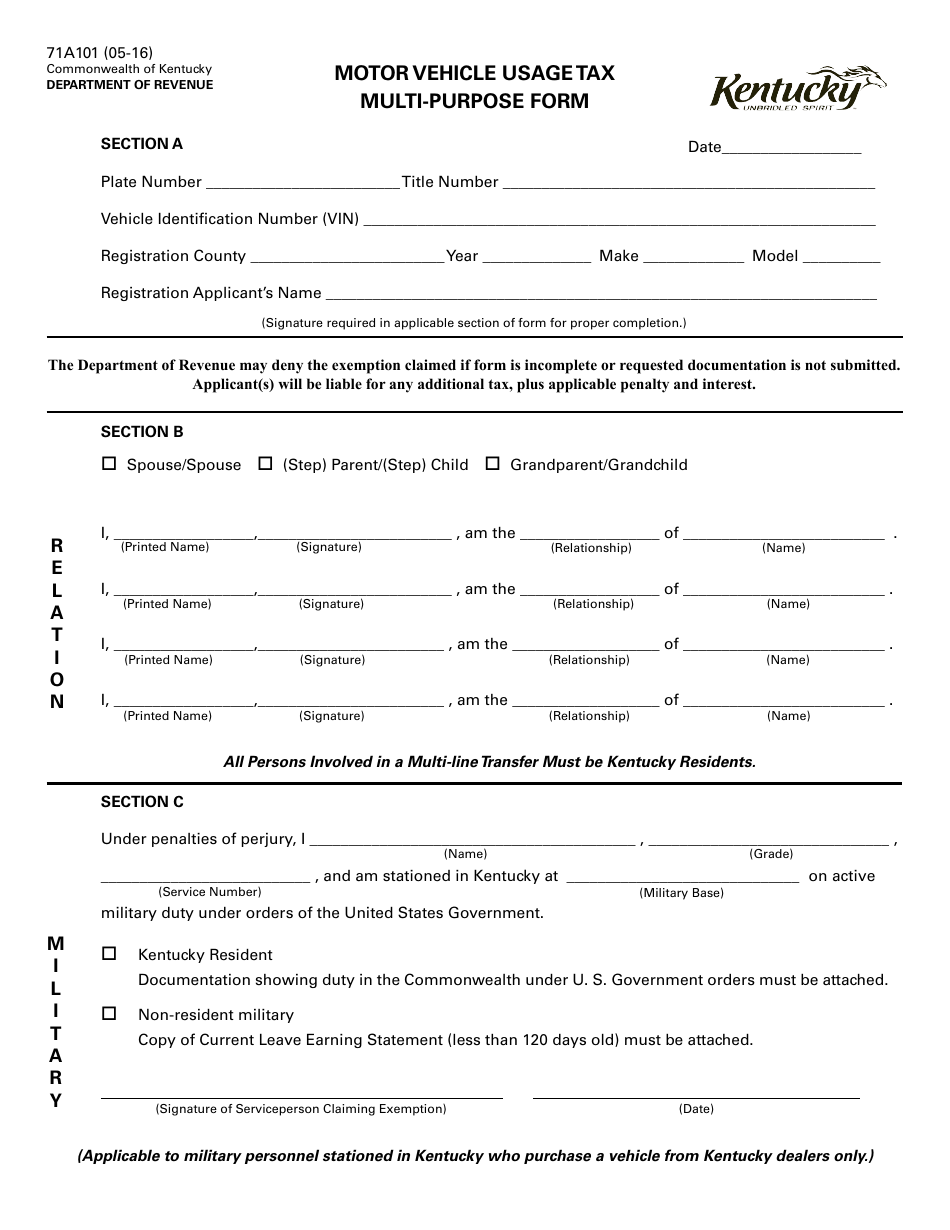

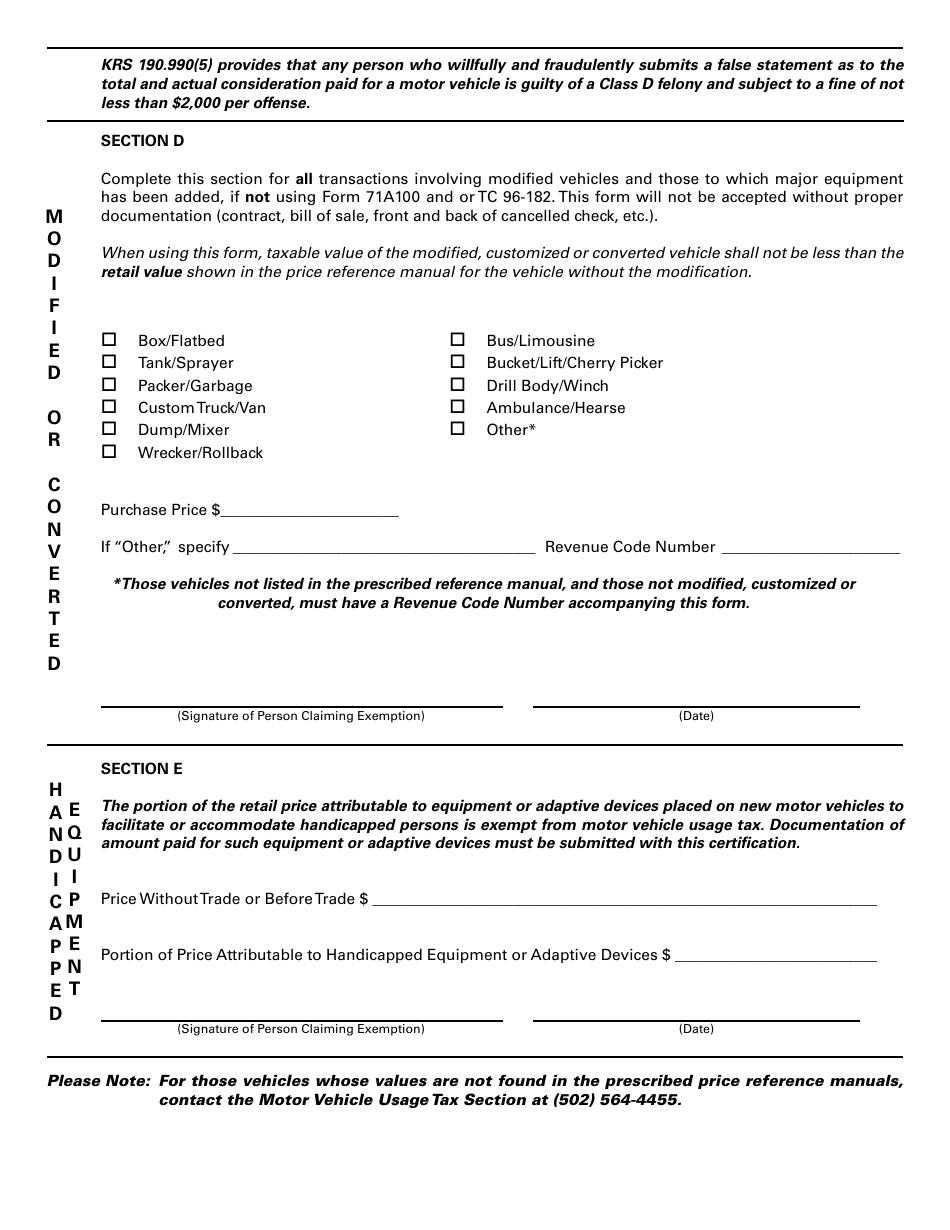

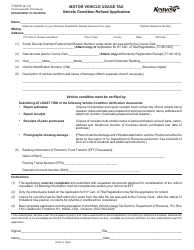

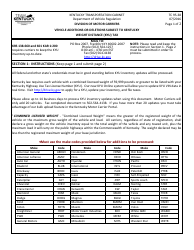

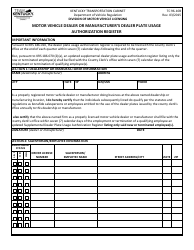

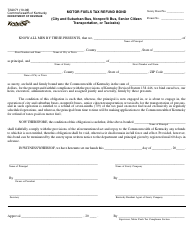

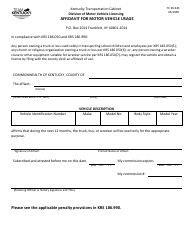

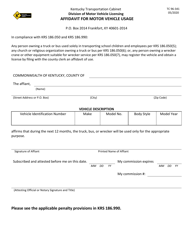

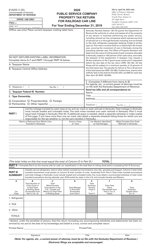

Form 71A101 Motor Vehicle Usage Tax Multi-Purpose Form - Kentucky

What Is Form 71A101?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 71A101?

A: Form 71A101 is the Motor Vehicle Usage Tax Multi-Purpose Form used in Kentucky.

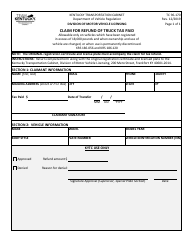

Q: What is the purpose of Form 71A101?

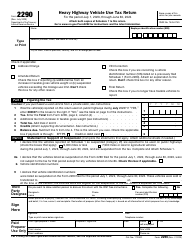

A: Form 71A101 is used to report and pay motor vehicle usage tax in Kentucky.

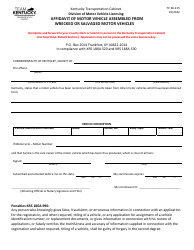

Q: Who needs to file Form 71A101?

A: Anyone who purchases a motor vehicle in Kentucky needs to file Form 71A101.

Q: When is Form 71A101 due?

A: Form 71A101 is due within 15 days of the purchase or acquisition of the motor vehicle.

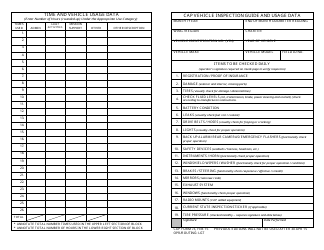

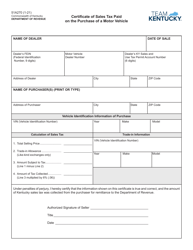

Q: What information is required on Form 71A101?

A: Form 71A101 requires information such as the vehicle identification number (VIN), purchase price, and proof of identification.

Q: Is there a fee for filing Form 71A101?

A: Yes, there is a fee for filing Form 71A101. The fee is based on the purchase price of the motor vehicle.

Q: What happens if I don't file Form 71A101?

A: Failure to file Form 71A101 may result in penalties and interest charges.

Q: Can I claim a tax credit for the motor vehicle usage tax paid?

A: No, there is no tax credit available for the motor vehicle usage tax paid in Kentucky.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 71A101 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.