This version of the form is not currently in use and is provided for reference only. Download this version of

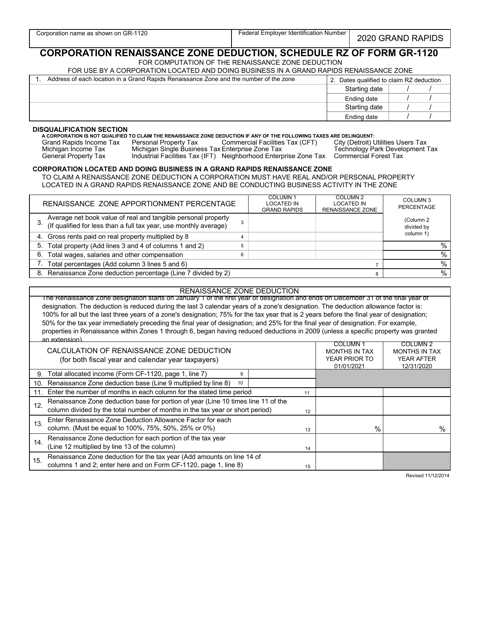

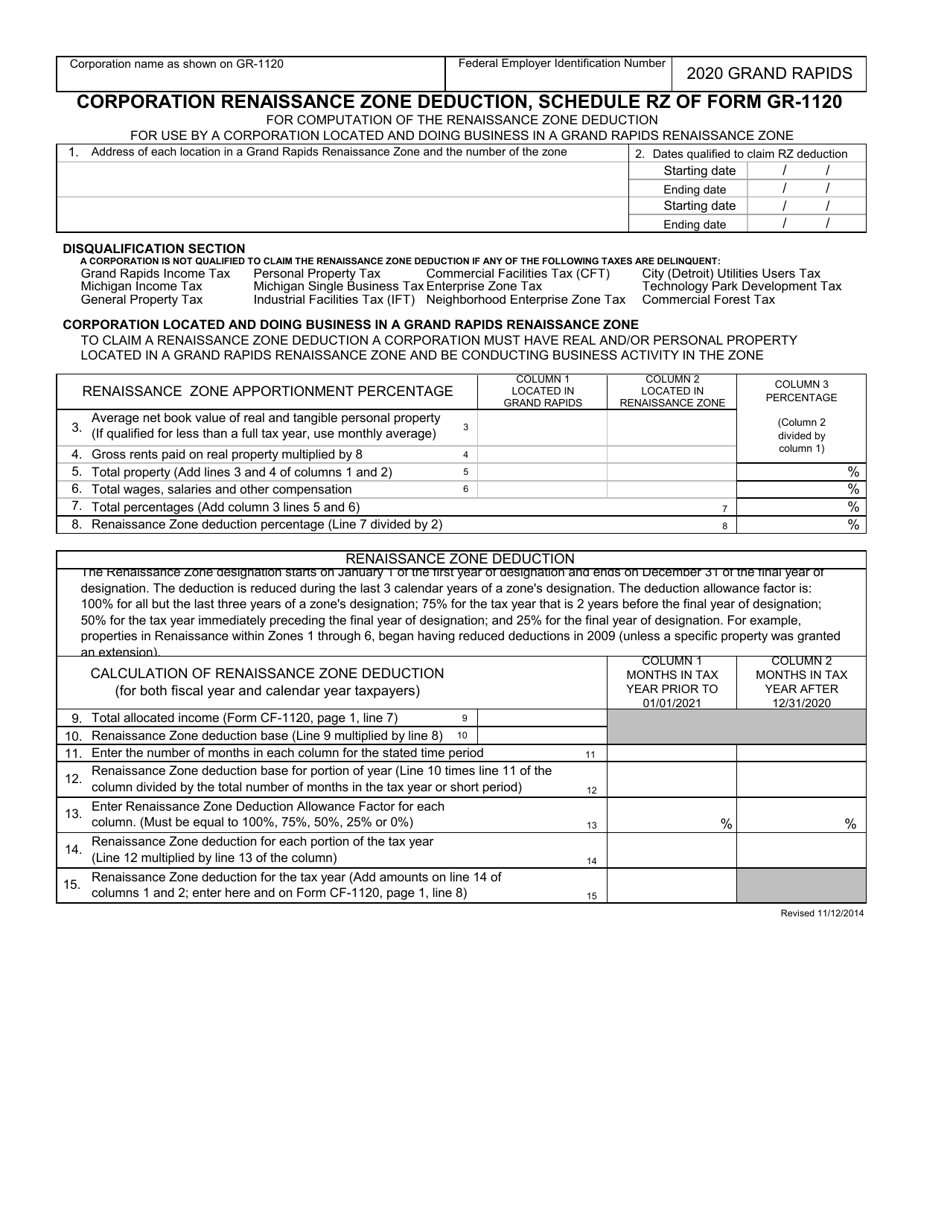

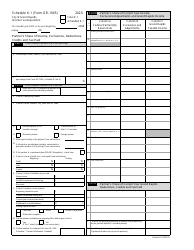

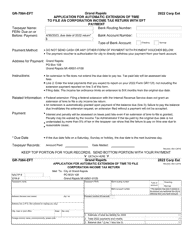

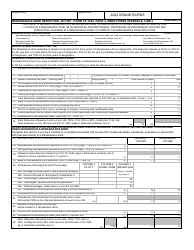

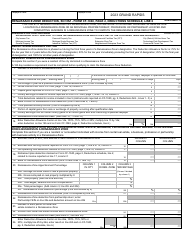

Form GR-1120 Schedule RZ

for the current year.

Form GR-1120 Schedule RZ Corporation Renaissance Zone Deduction - City of Grand Rapids, Michigan

What Is Form GR-1120 Schedule RZ?

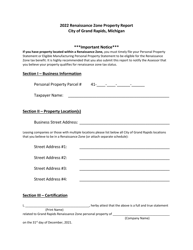

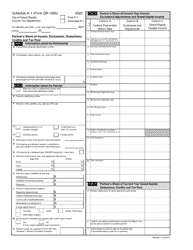

This is a legal form that was released by the Income Tax Department - City of Grand Rapids, Michigan - a government authority operating within Michigan. The form may be used strictly within City of Grand Rapids. The document is a supplement to Form GR-1120, Corporation Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GR-1120 Schedule RZ?

A: GR-1120 Schedule RZ is a form for claiming the Corporation Renaissance Zone Deduction for the City of Grand Rapids, Michigan.

Q: What is the Corporation Renaissance Zone Deduction?

A: The Corporation Renaissance Zone Deduction is a tax incentive program that provides tax benefits to businesses located in designated Renaissance Zones.

Q: Who is eligible for the Renaissance Zone Deduction in Grand Rapids?

A: Businesses that are located in designated Renaissance Zones within the City of Grand Rapids are eligible for the Renaissance Zone Deduction.

Q: What is the purpose of the Renaissance Zone Deduction?

A: The purpose of the Renaissance Zone Deduction is to encourage economic development and investment in designated areas by providing tax incentives to businesses.

Q: Are there any deadlines for filing the GR-1120 Schedule RZ?

A: Yes, the deadlines for filing the GR-1120 Schedule RZ may vary, so it's important to check with the City of Grand Rapids or the local tax office for the specific deadlines.

Q: What documents do I need to file the GR-1120 Schedule RZ?

A: To file the GR-1120 Schedule RZ, you will need to provide information about your business, including the location within the designated Renaissance Zone.

Q: What are the benefits of the Renaissance Zone Deduction?

A: The benefits of the Renaissance Zone Deduction may include exemptions from certain taxes, such as property taxes, income taxes, and Michigan Business Tax.

Q: Can I claim the Renaissance Zone Deduction for multiple years?

A: Yes, businesses may be able to claim the Renaissance Zone Deduction for multiple years, depending on the specific rules and regulations of the program.

Q: Is the Renaissance Zone Deduction available in other cities in Michigan?

A: Yes, the Renaissance Zone Deduction may be available in other cities in Michigan, but the specific rules and regulations may vary.

Form Details:

- Released on November 12, 2014;

- The latest edition provided by the Income Tax Department - City of Grand Rapids, Michigan;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GR-1120 Schedule RZ by clicking the link below or browse more documents and templates provided by the Income Tax Department - City of Grand Rapids, Michigan.