This version of the form is not currently in use and is provided for reference only. Download this version of

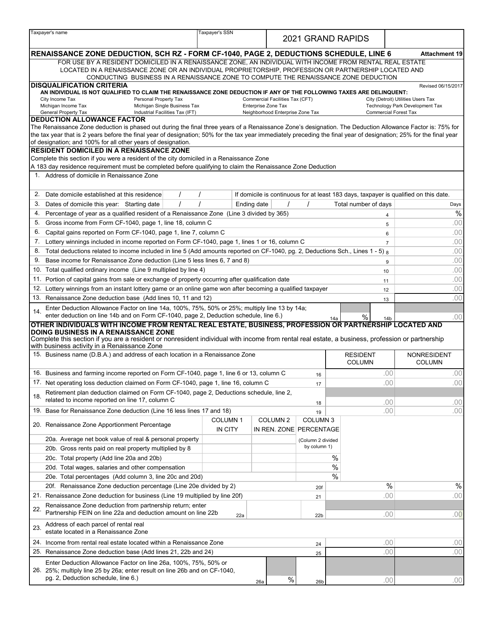

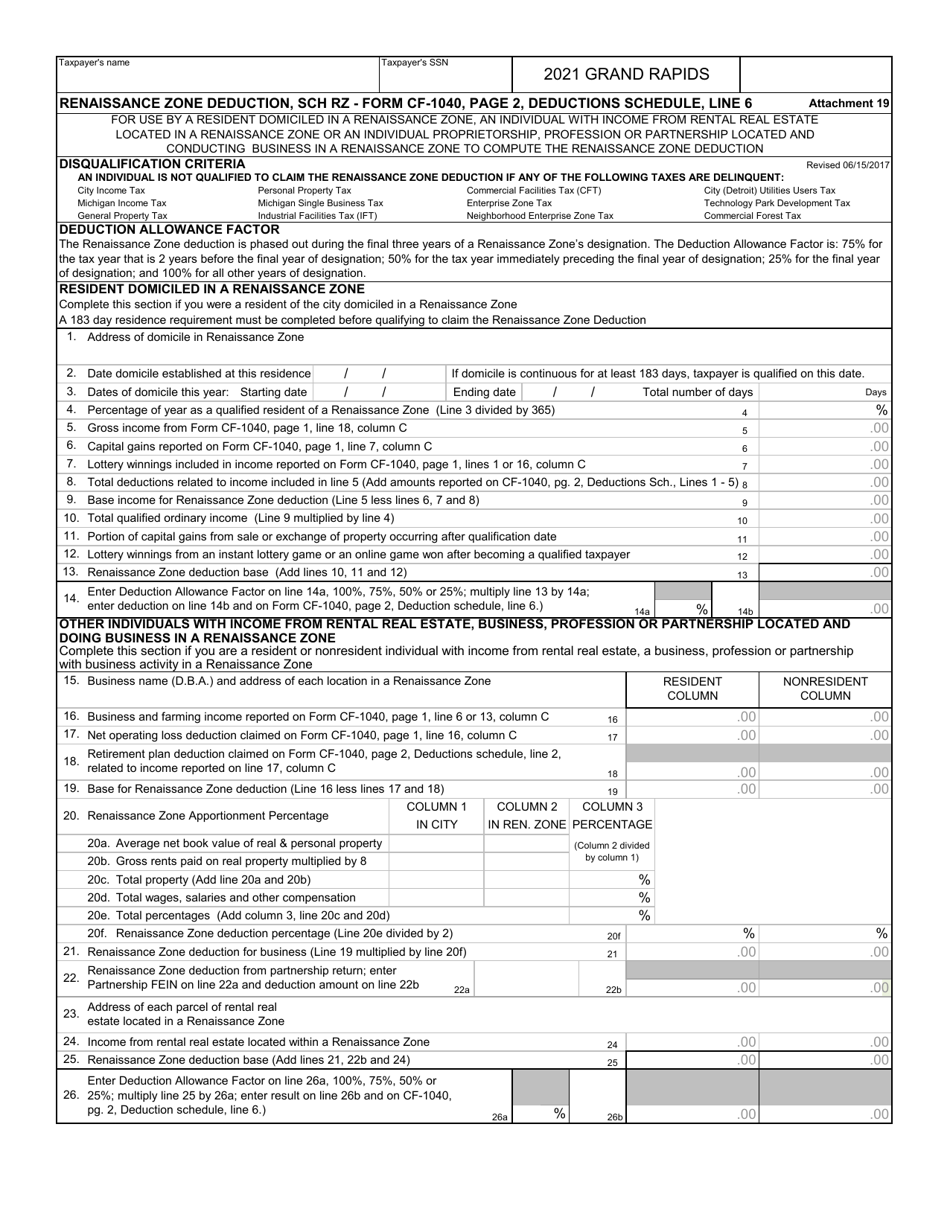

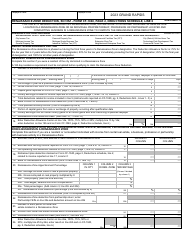

Form CF-1040 Schedule RZ

for the current year.

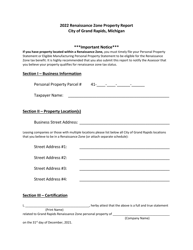

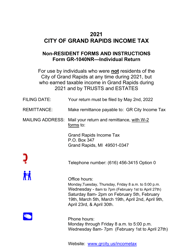

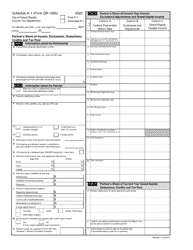

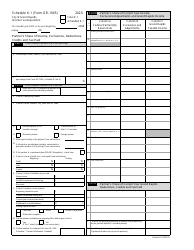

Form CF-1040 Schedule RZ Renaissance Zone Deduction - City of Grand Rapids, Michigan

What Is Form CF-1040 Schedule RZ?

This is a legal form that was released by the Income Tax Department - City of Grand Rapids, Michigan - a government authority operating within Michigan. The form may be used strictly within City of Grand Rapids. The document is a supplement to Form CF-1040, Individual Income Tax Return - Non-resident. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CF-1040 Schedule RZ?

A: Form CF-1040 Schedule RZ is a tax form used to claim the Renaissance Zone Deduction in the City of Grand Rapids, Michigan.

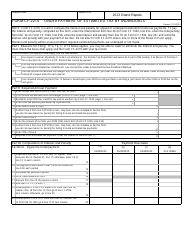

Q: What is the Renaissance Zone Deduction?

A: The Renaissance Zone Deduction is a tax incentive program that provides tax benefits to residents and businesses located within a designated Renaissance Zone.

Q: Who is eligible for the Renaissance Zone Deduction in Grand Rapids, Michigan?

A: Residents and businesses that are located within the designated Renaissance Zone in the City of Grand Rapids, Michigan may be eligible for the Renaissance Zone Deduction.

Q: How do I claim the Renaissance Zone Deduction?

A: To claim the Renaissance Zone Deduction, you need to complete Form CF-1040 Schedule RZ and include it with your annual tax return.

Q: Are there any specific requirements to claim the Renaissance Zone Deduction?

A: Yes, there are specific requirements to claim the Renaissance Zone Deduction, including residency or business location within the designated Renaissance Zone in Grand Rapids, Michigan.

Form Details:

- The latest edition provided by the Income Tax Department - City of Grand Rapids, Michigan;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CF-1040 Schedule RZ by clicking the link below or browse more documents and templates provided by the Income Tax Department - City of Grand Rapids, Michigan.