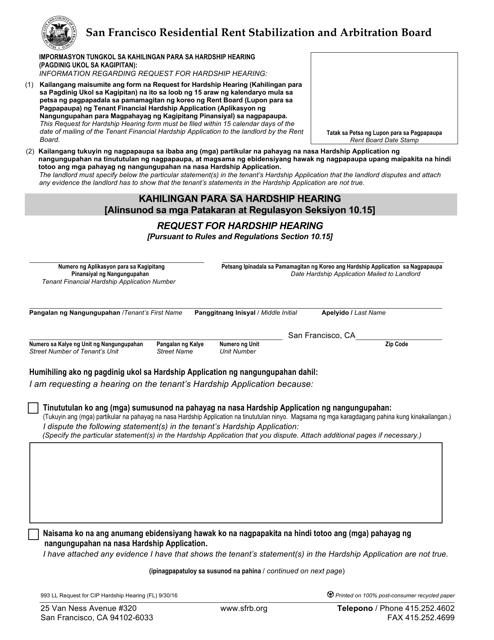

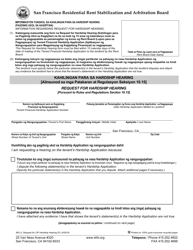

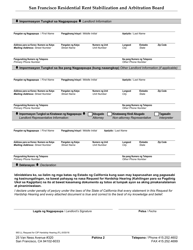

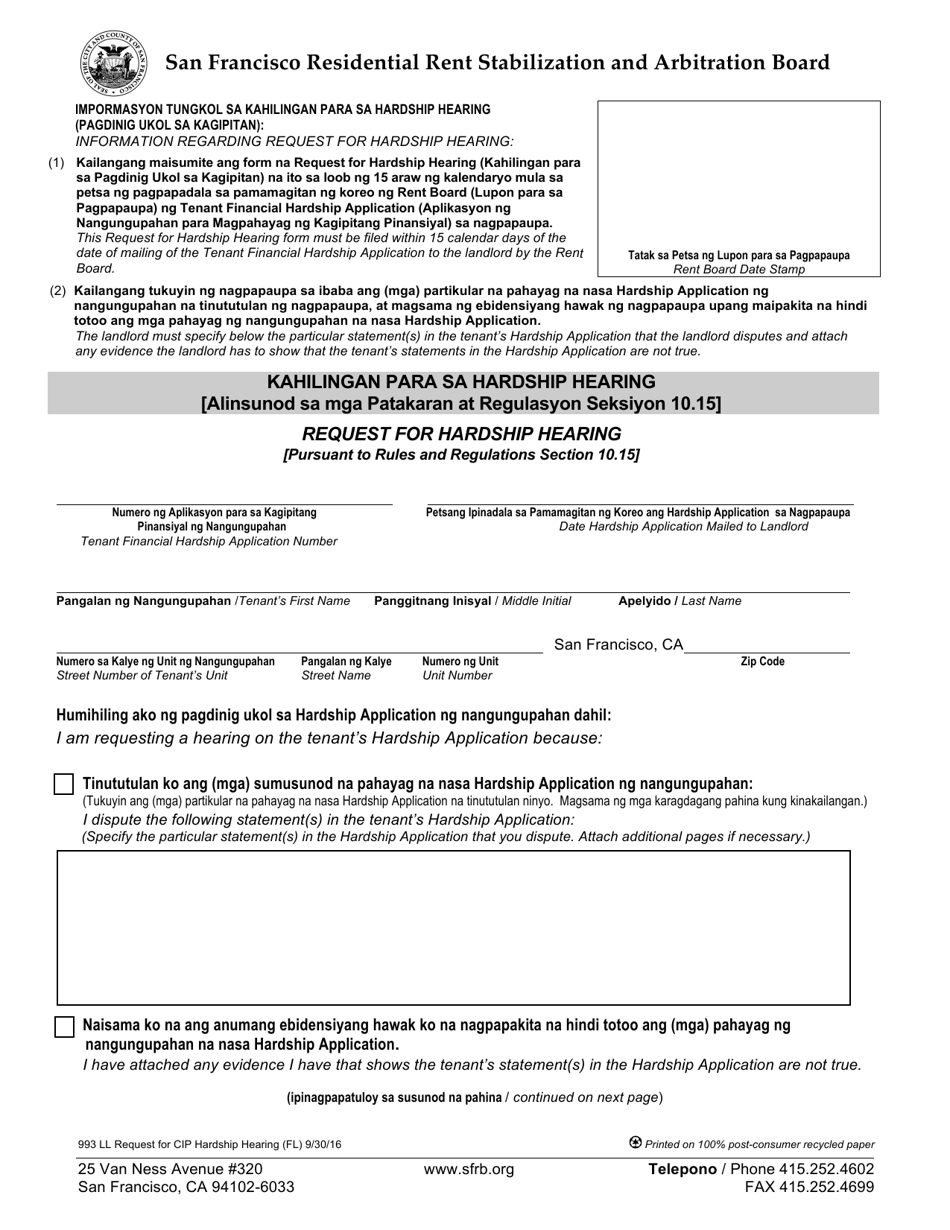

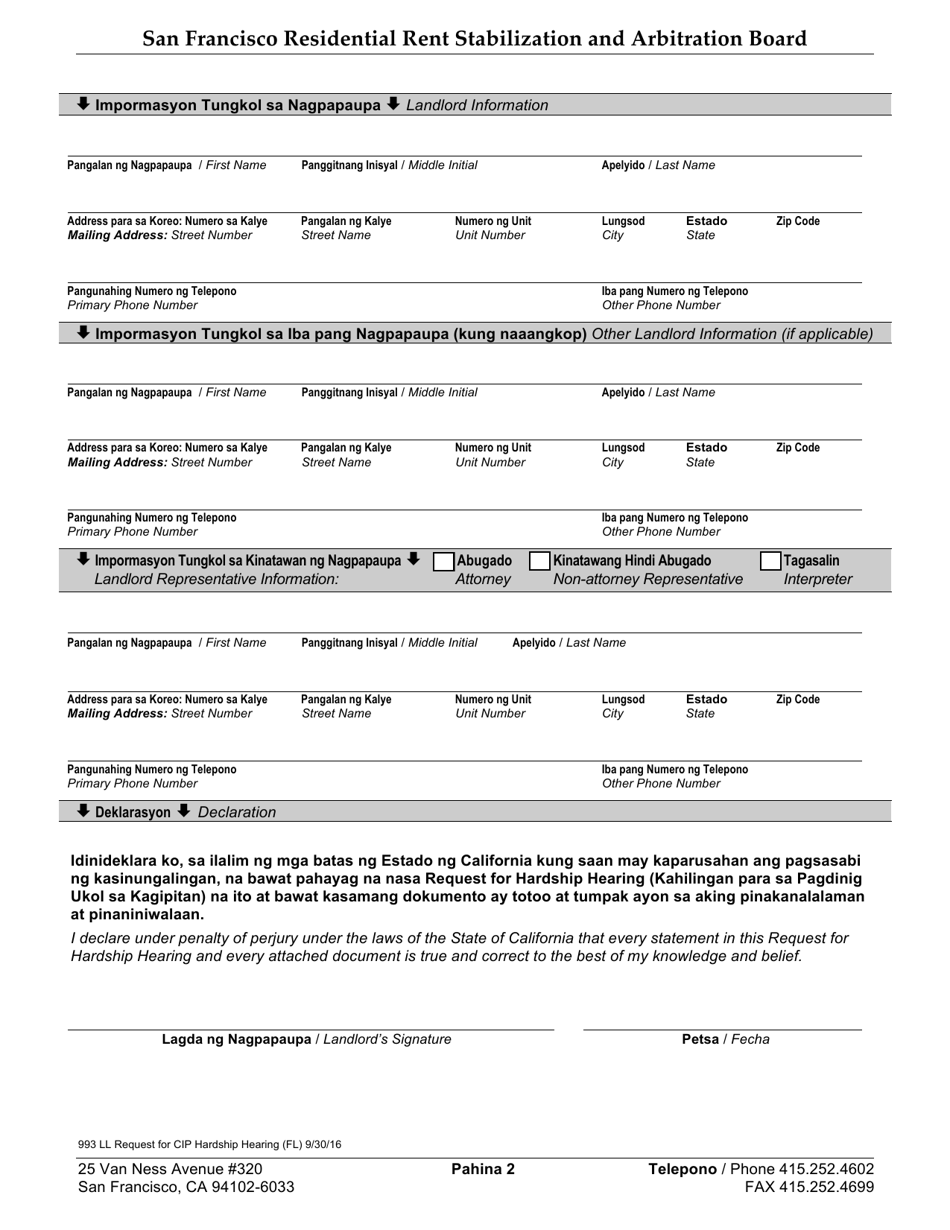

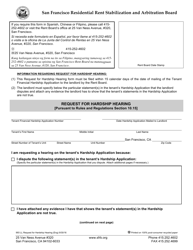

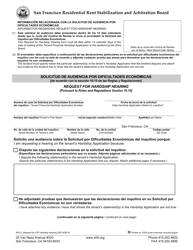

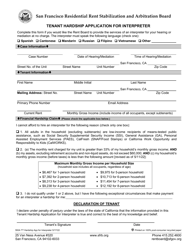

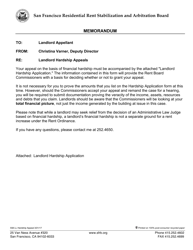

Form 993 Request for Hardship Hearing - City and County of San Francisco, California (English / Filipino)

What Is Form 993?

This is a legal form that was released by the Rent Board - City and County of San Francisco, California - a government authority operating within California. The form may be used strictly within City and County of San Francisco. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 993?

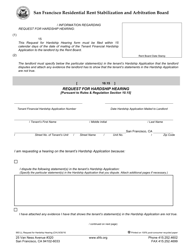

A: Form 993 is a request for a hardship hearing in San Francisco, California.

Q: Who can use Form 993?

A: Any individual who is unable to pay fines or fees imposed by the City and County of San Francisco may use Form 993 to request a hardship hearing.

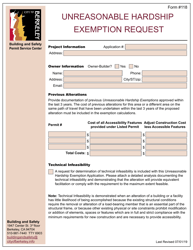

Q: What is a hardship hearing?

A: A hardship hearing is a chance for individuals to present their financial circumstances and ask for a reduction or alternative payment plan for fines or fees.

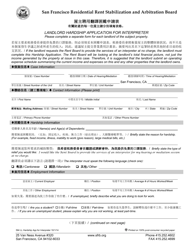

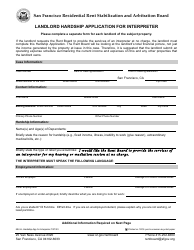

Q: What information do I have to provide on Form 993?

A: You will need to provide your personal information, details of the fines or fees you are requesting a hardship hearing for, and information about your financial situation.

Q: Is there a filing fee for Form 993?

A: No, there is no fee to file Form 993.

Q: When will I receive a decision on my hardship hearing request?

A: The San Francisco County Clerk will send you a notice with the date and time of your hardship hearing within 20 days of receiving your completed Form 993.

Q: What should I bring to the hardship hearing?

A: You should bring any supporting documentation of your financial hardship, such as pay stubs, bank statements, or proof of government assistance.

Q: What happens if my hardship hearing request is granted?

A: If your hardship hearing request is granted, the fines or fees may be reduced or you may be offered an alternative payment plan based on your financial circumstances.

Form Details:

- Released on September 30, 2016;

- The latest edition provided by the Rent Board - City and County of San Francisco, California;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 993 by clicking the link below or browse more documents and templates provided by the Rent Board - City and County of San Francisco, California.