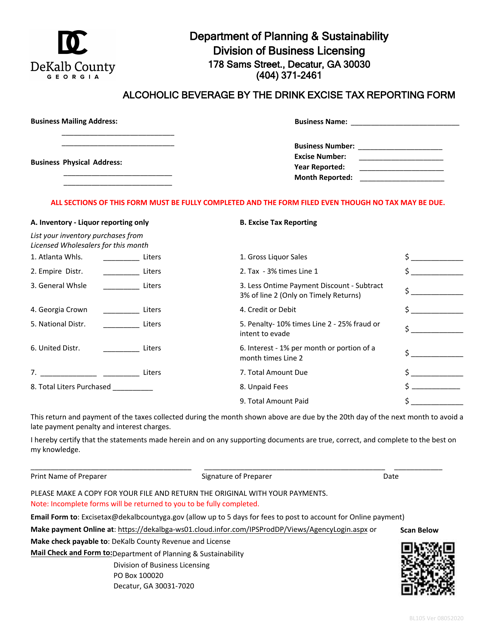

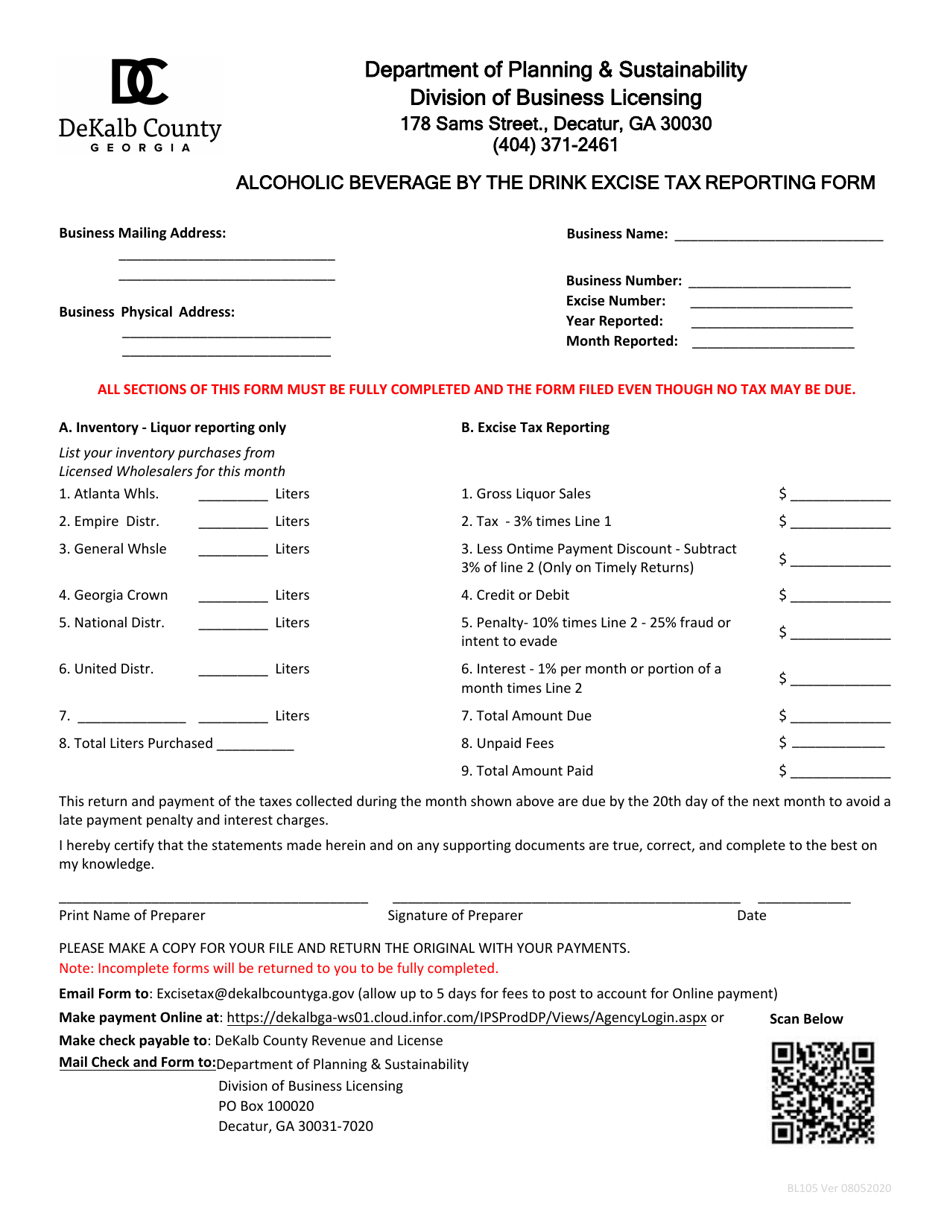

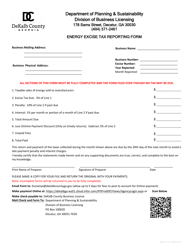

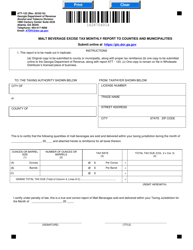

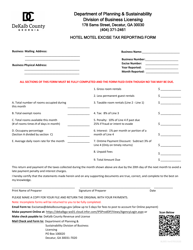

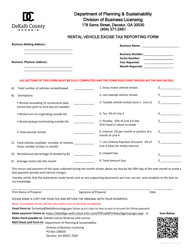

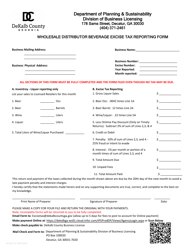

Form BL10S Alcoholic Beverage by the Drink Excise Tax Reporting Form - DeKalb County, Georgia (United States)

What Is Form BL10S?

This is a legal form that was released by the Department of Planning & Sustainability - DeKalb County, Georgia - a government authority operating within Georgia (United States). The form may be used strictly within DeKalb County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BL10S?

A: Form BL10S is the Alcoholic Beverage by the Drink Excise Tax Reporting Form.

Q: Who uses Form BL10S?

A: DeKalb County, Georgia (United States) uses Form BL10S for excise tax reporting.

Q: What is the purpose of Form BL10S?

A: The purpose of Form BL10S is to report excise taxes on alcoholic beverages sold by the drink.

Q: Is Form BL10S specific to a certain type of alcoholic beverage?

A: No, Form BL10S is used to report excise taxes on any type of alcoholic beverage sold by the drink.

Q: What information is required on Form BL10S?

A: Form BL10S requires information such as the type and quantity of alcoholic beverages sold, sales price, and tax amount.

Q: When is Form BL10S due?

A: The due date for submitting Form BL10S may vary, so it is important to check with the authorities in DeKalb County, Georgia.

Q: Are there any penalties for late submission of Form BL10S?

A: Penalties for late submission of Form BL10S may apply as per the regulations of DeKalb County, Georgia.

Form Details:

- Released on August 5, 2020;

- The latest edition provided by the Department of Planning & Sustainability - DeKalb County, Georgia;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BL10S by clicking the link below or browse more documents and templates provided by the Department of Planning & Sustainability - DeKalb County, Georgia.