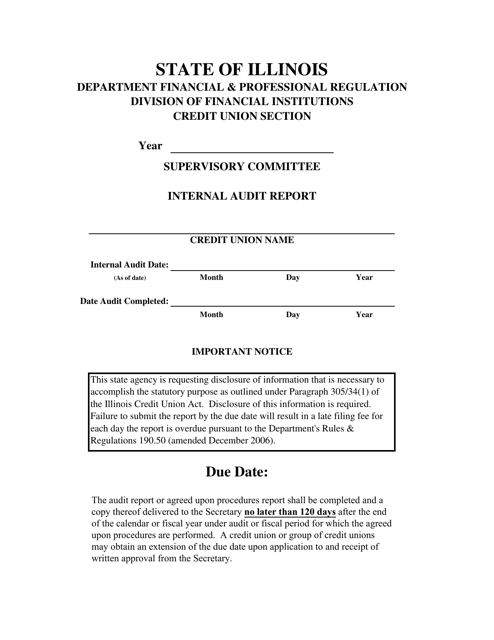

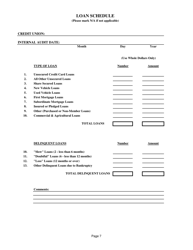

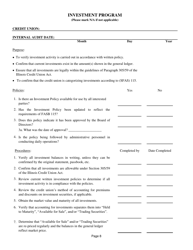

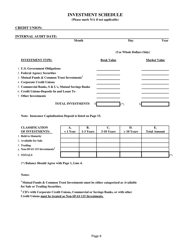

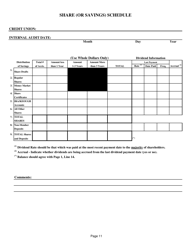

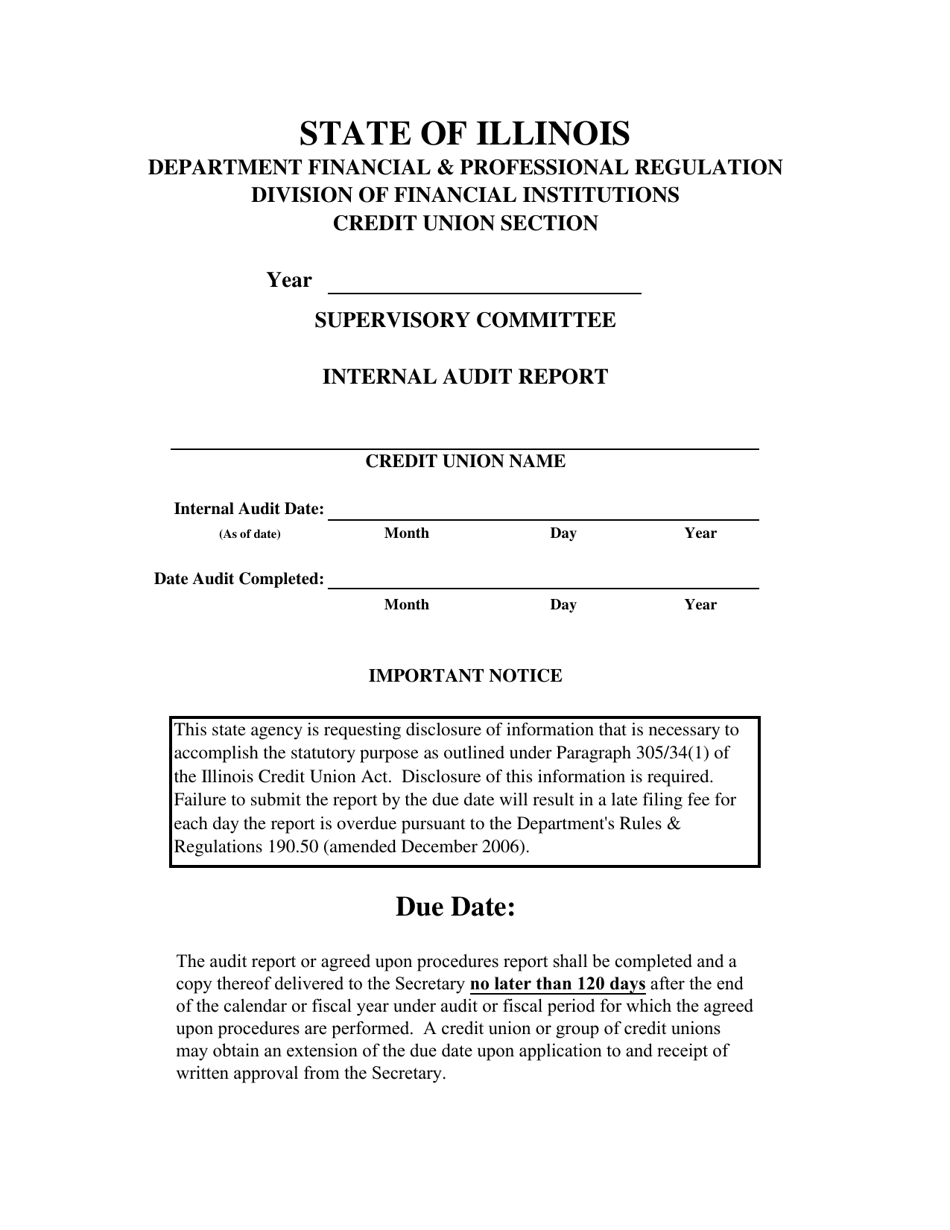

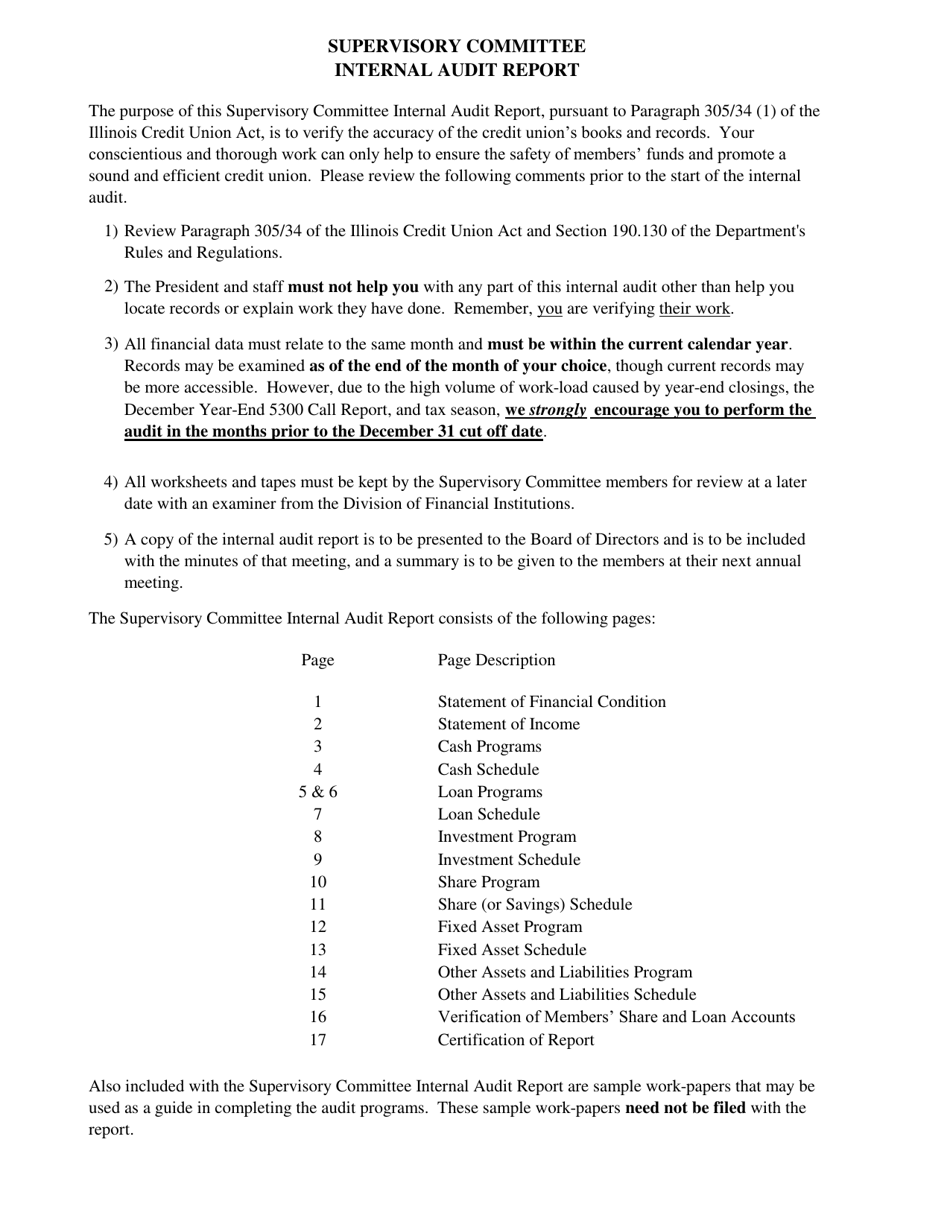

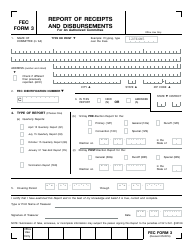

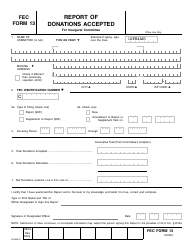

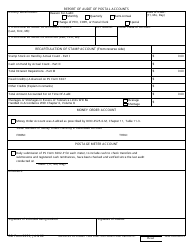

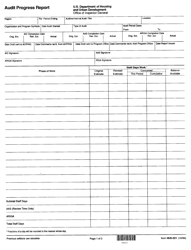

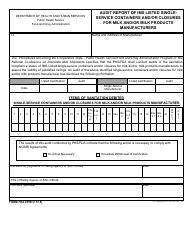

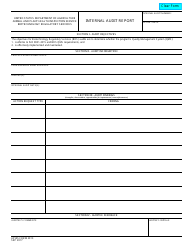

Supervisory Committee Internal Audit Report - Illinois

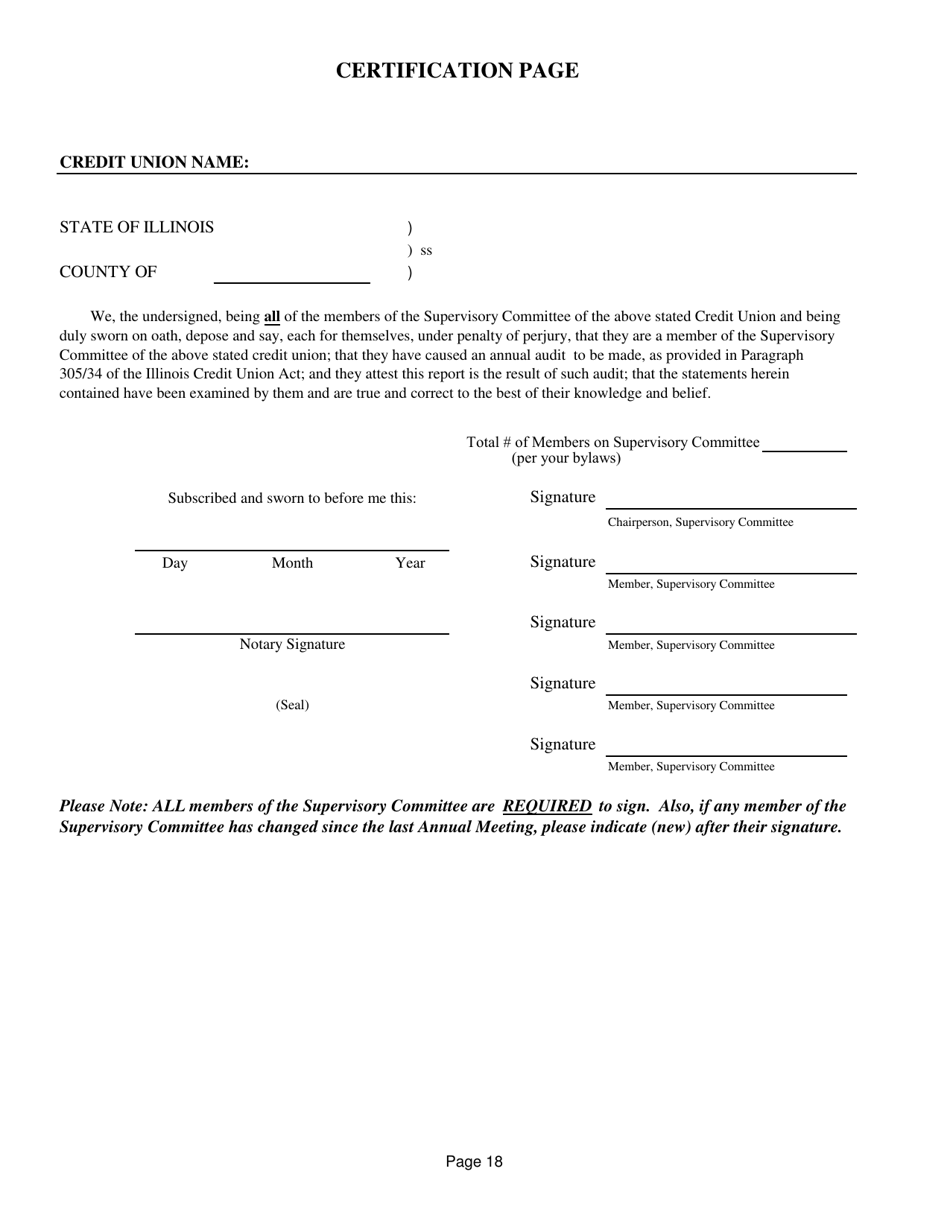

Supervisory Committee Internal Audit Report is a legal document that was released by the Illinois Department of Financial and Professional Regulation - a government authority operating within Illinois.

FAQ

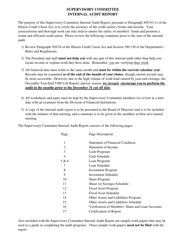

Q: What is the Supervisory Committee Internal Audit Report?

A: The Supervisory Committee Internal Audit Report is a report that assesses the internal controls and financial operations of an organization.

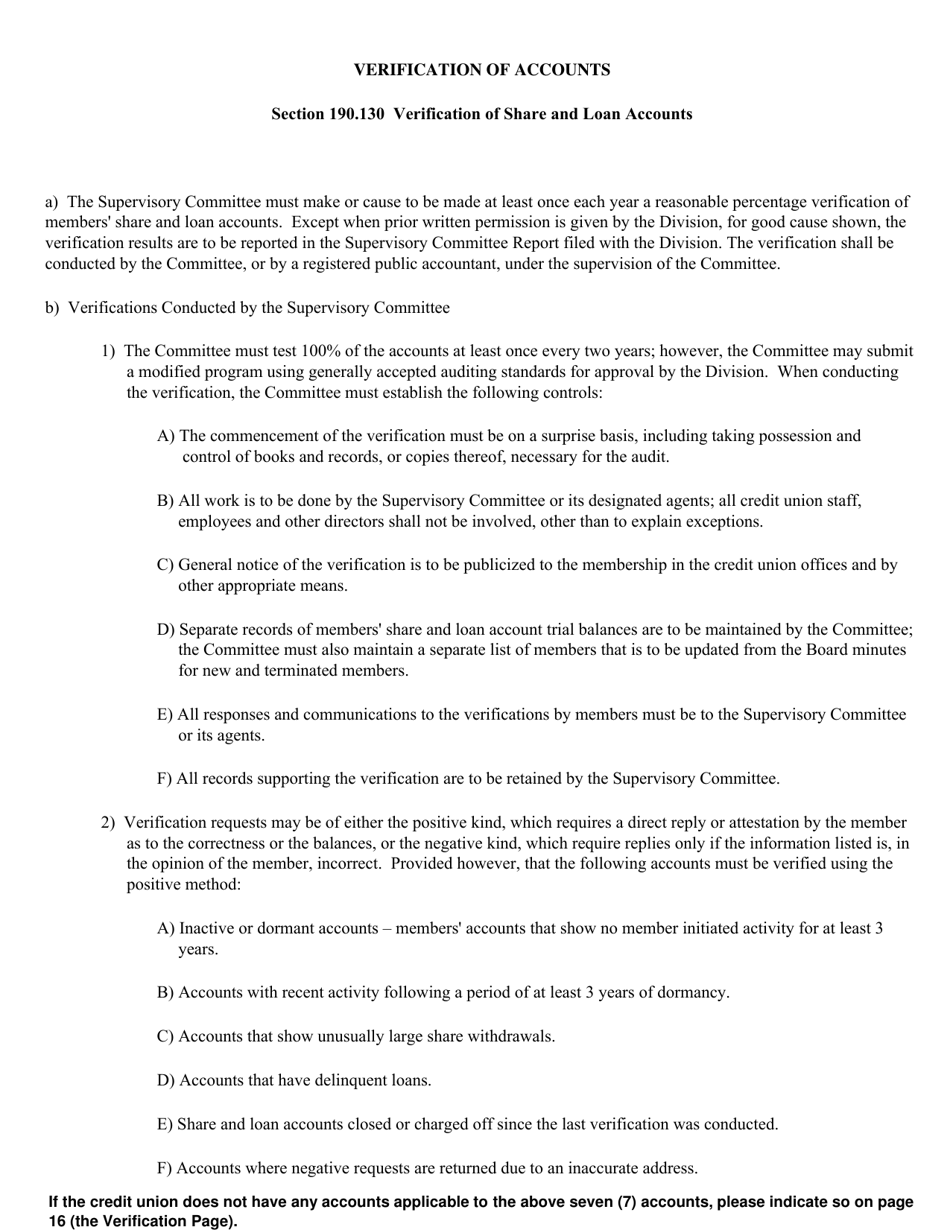

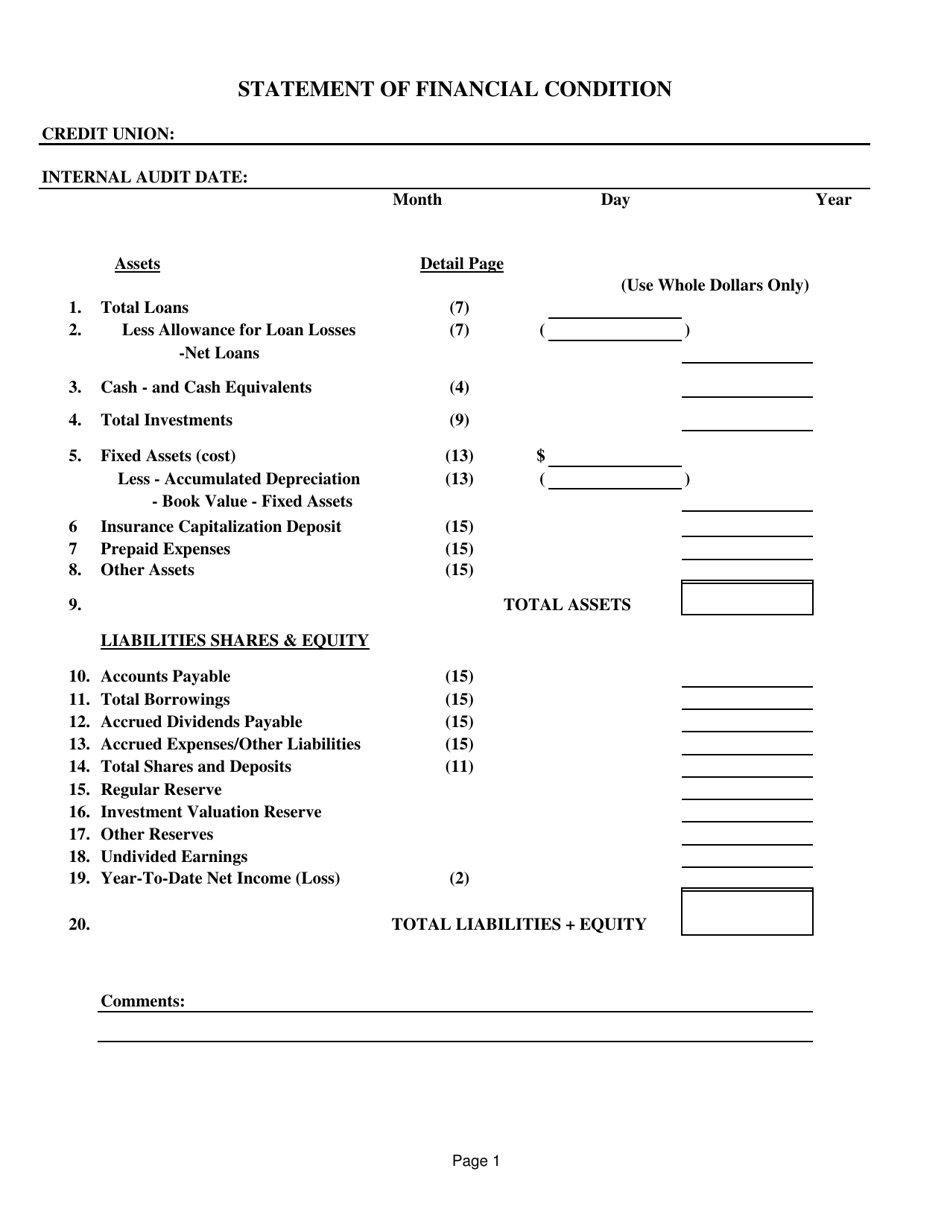

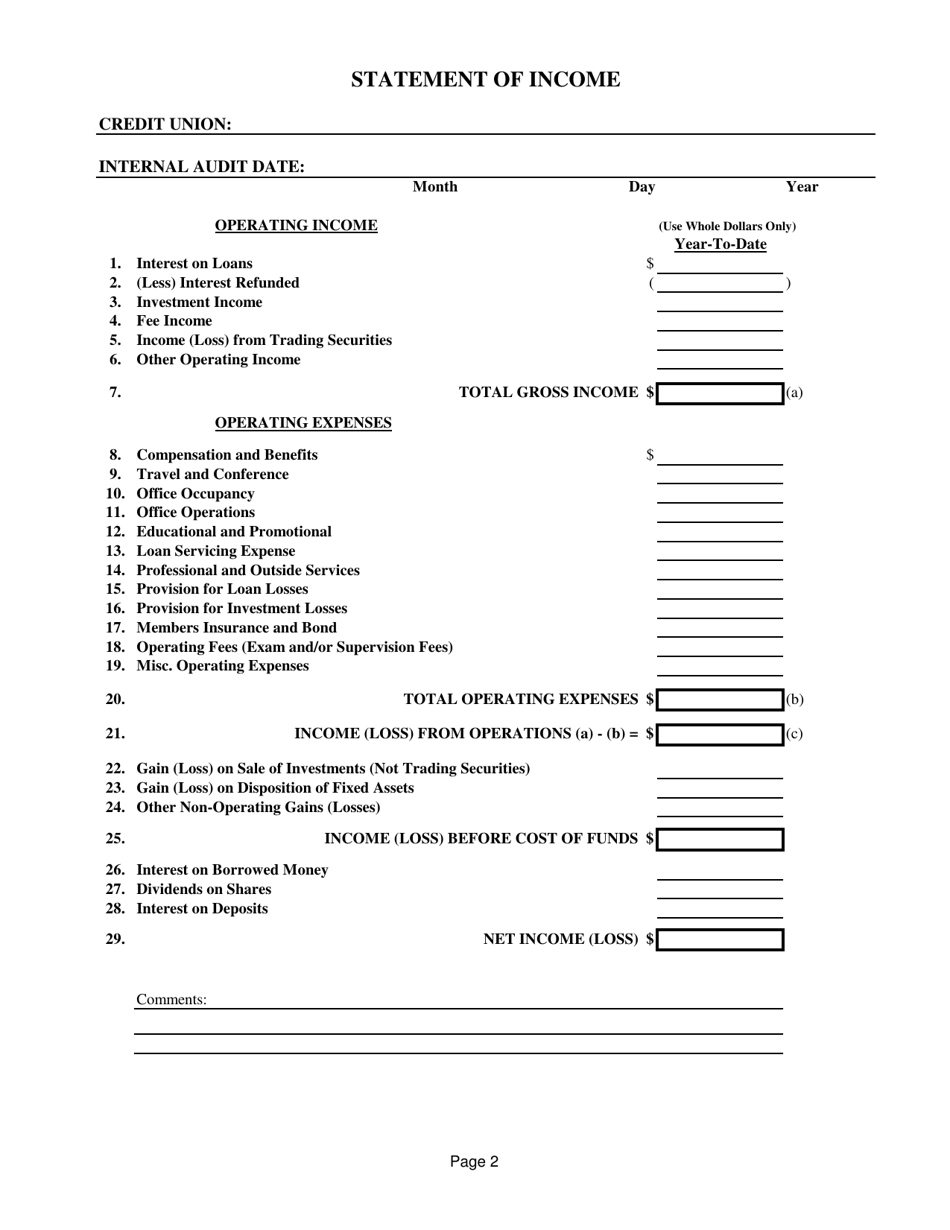

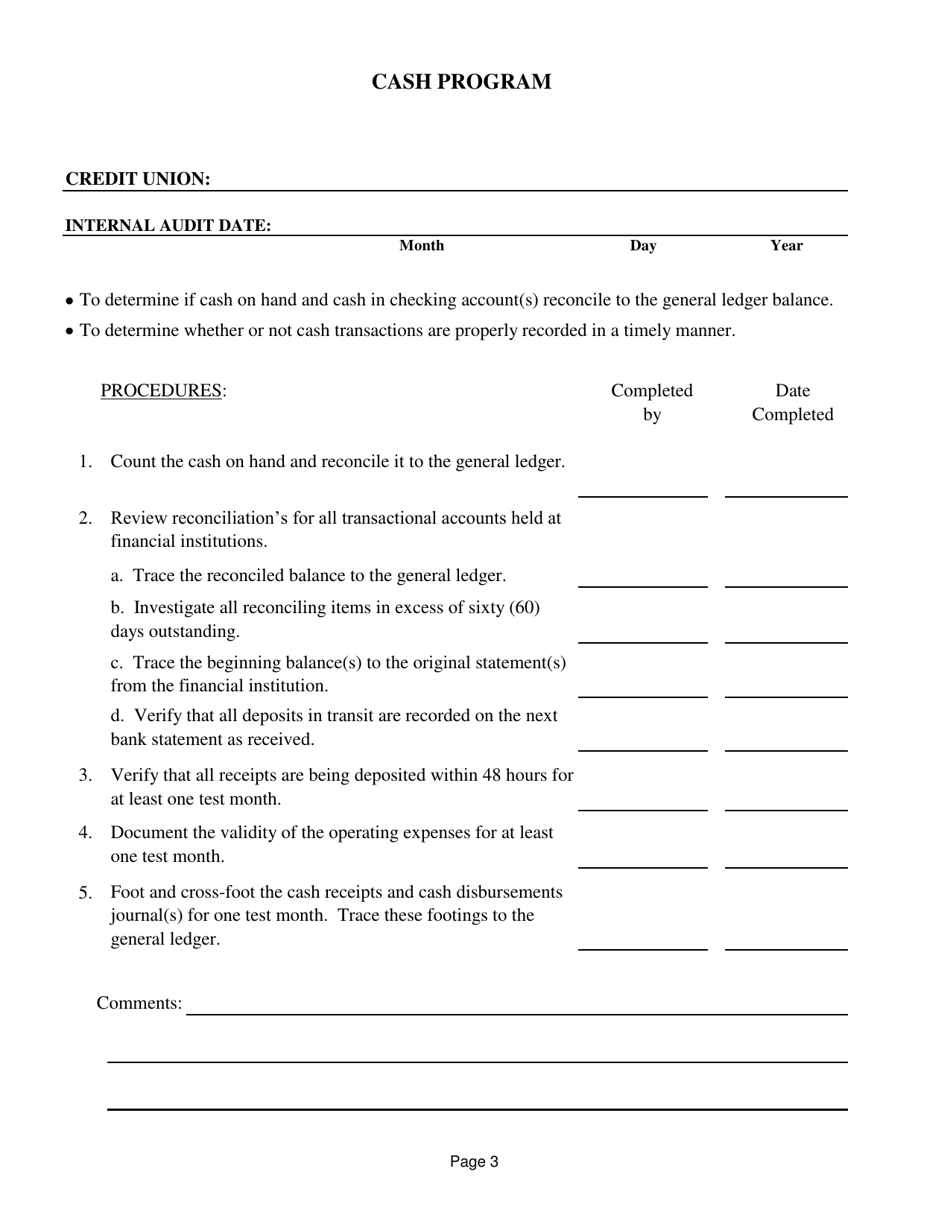

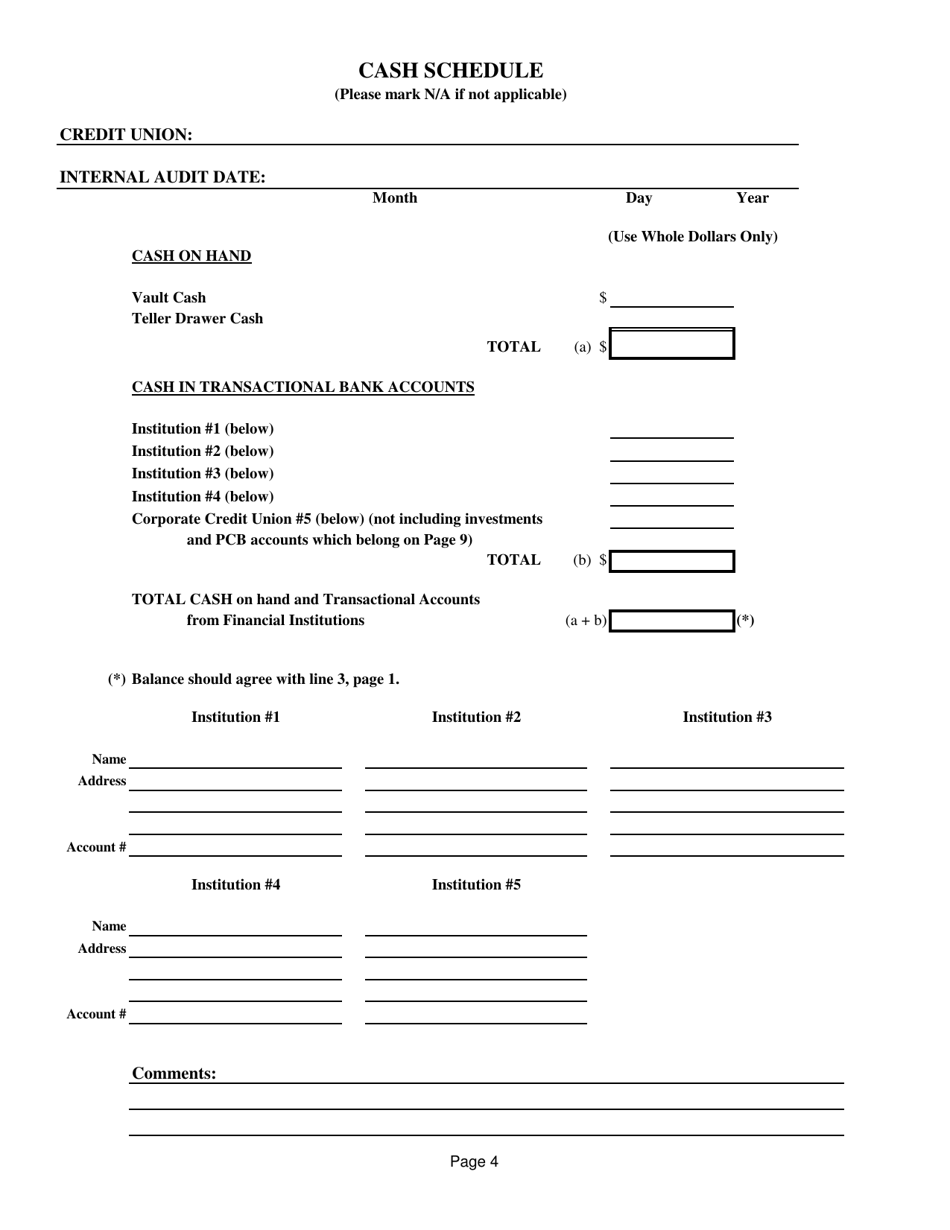

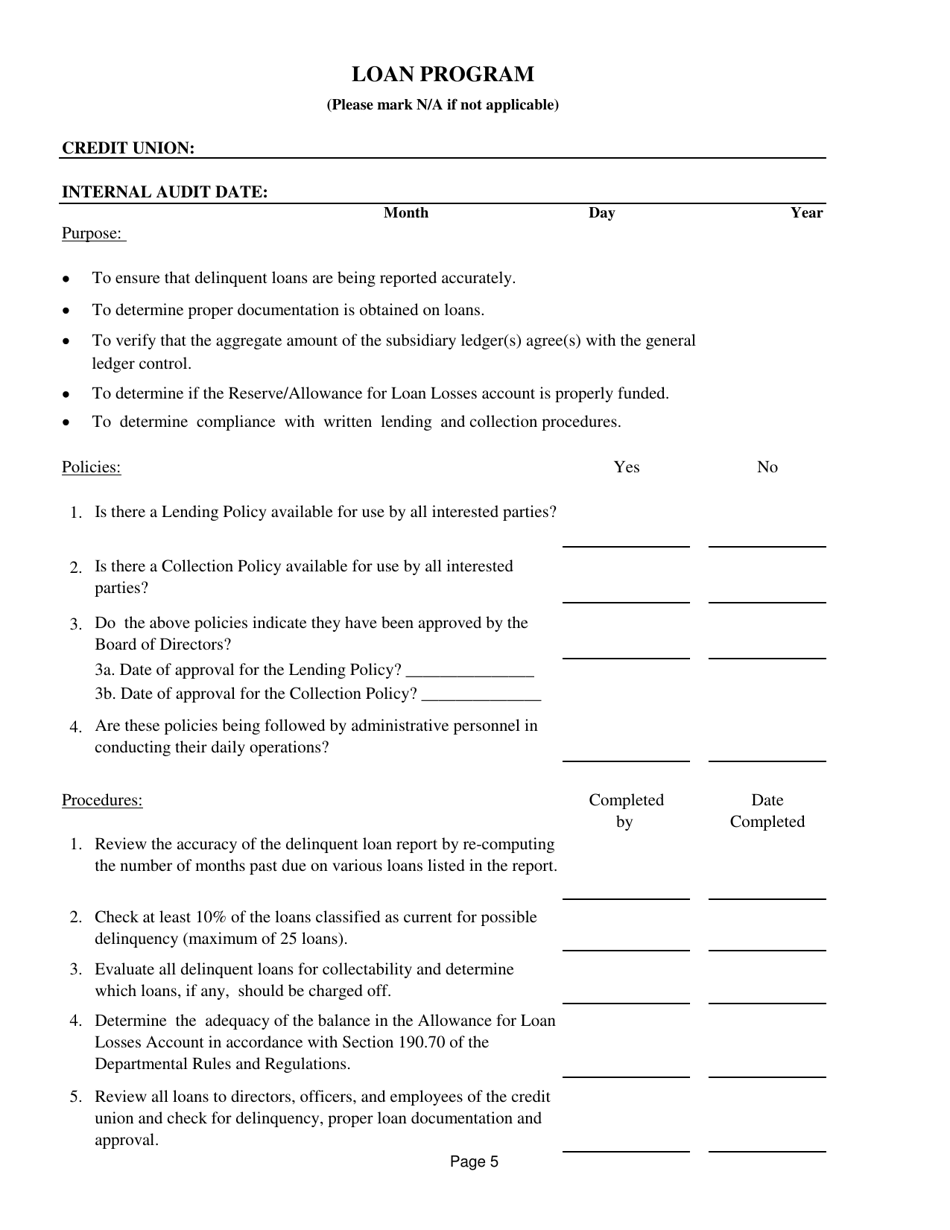

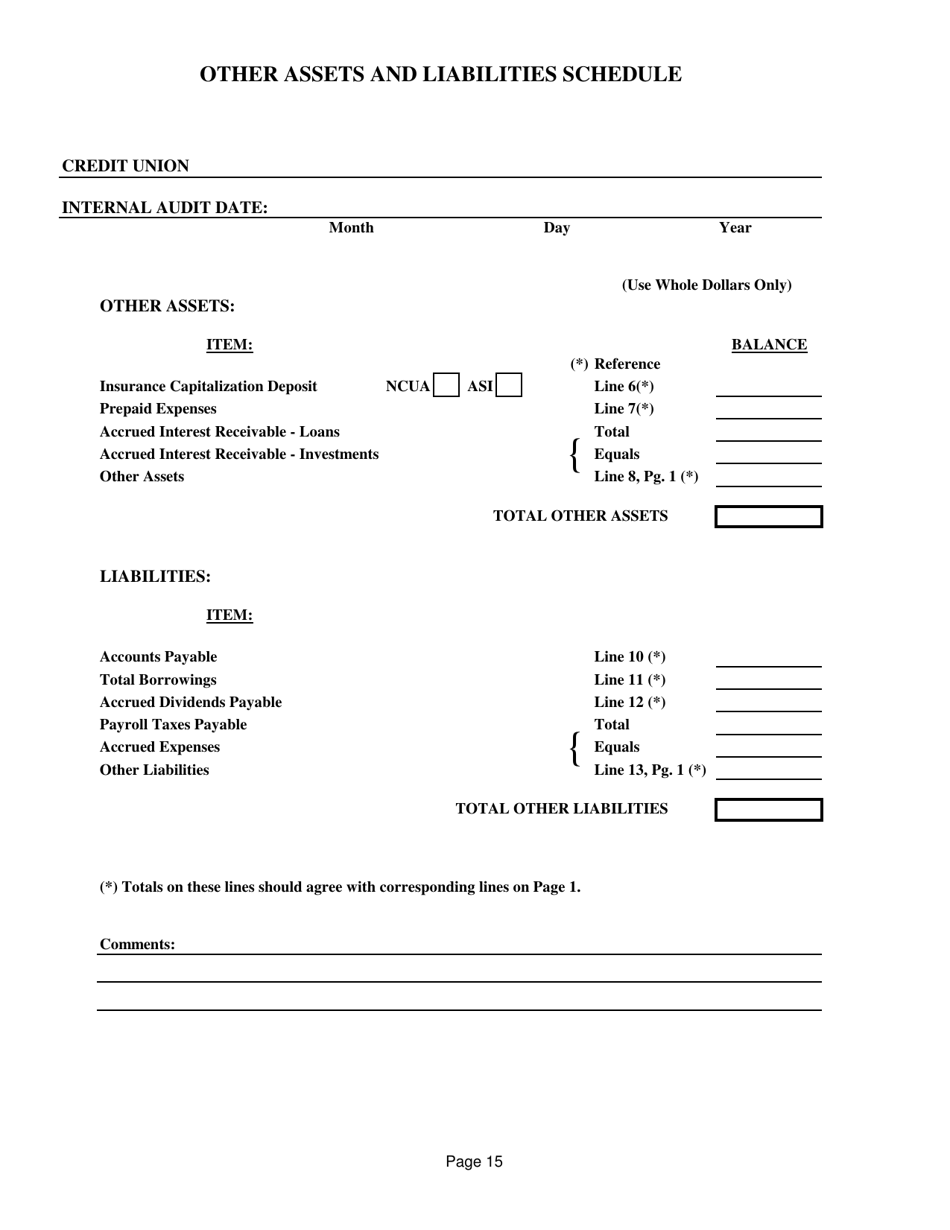

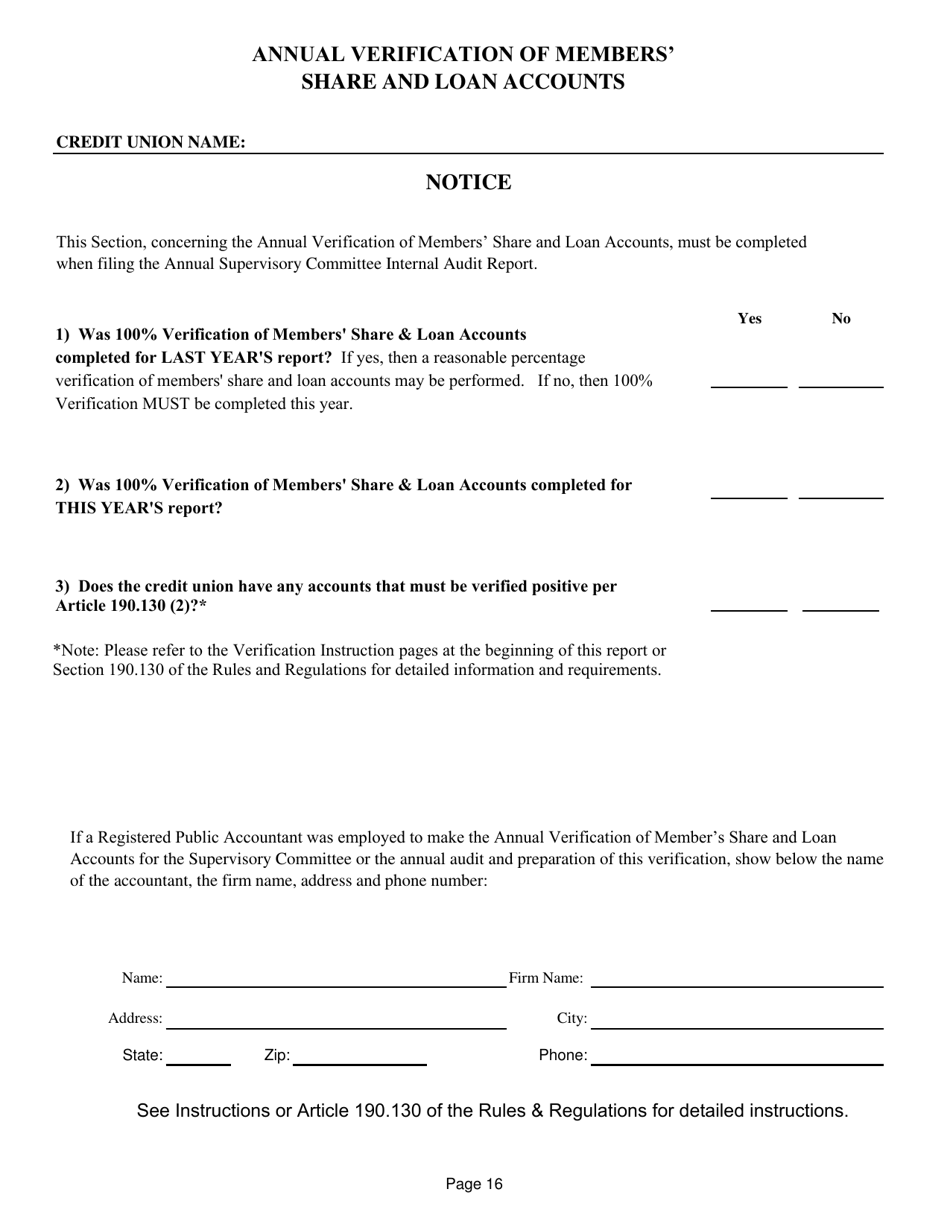

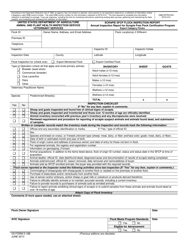

Q: What does the report cover?

A: The report covers the assessment of internal controls and financial operations.

Q: Who prepares the Supervisory Committee Internal Audit Report?

A: The report is prepared by the internal audit department or the supervisory committee of the organization.

Q: Why is the report important?

A: The report is important as it helps to identify any weaknesses in the internal controls and financial operations, and suggests improvements to enhance efficiency and effectiveness.

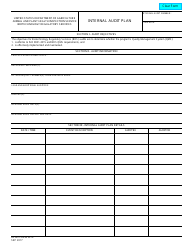

Q: What is the purpose of the internal audit?

A: The purpose of the internal audit is to provide independent and objective assurance and consulting services to the organization, to add value and improve its operations.

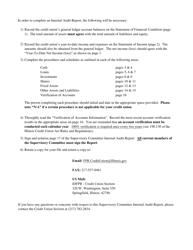

Q: How is the internal audit conducted?

A: The internal audit is conducted through a systematic and structured approach that includes planning, testing, and evaluating the organization's processes, controls, and risks.

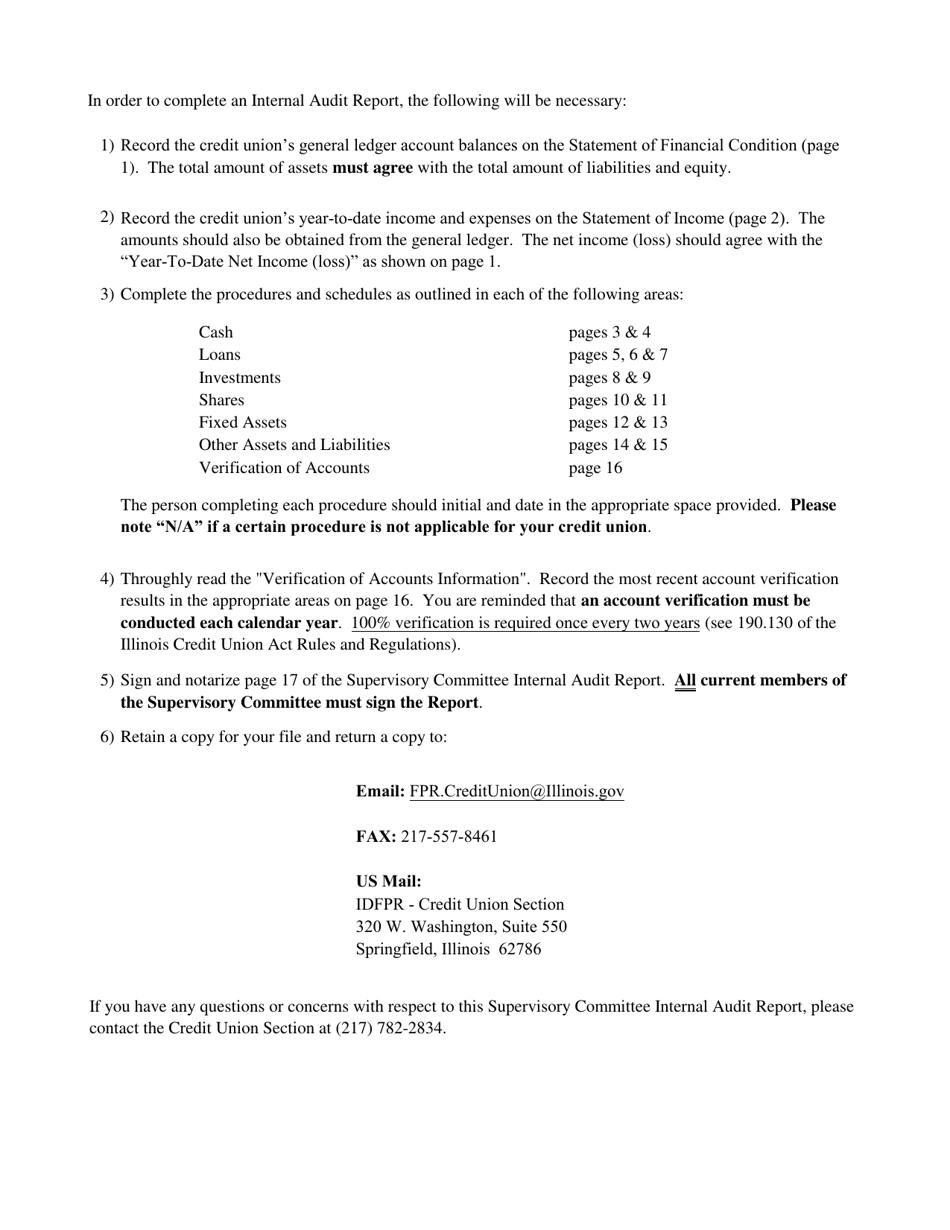

Q: Is the internal audit report shared with external stakeholders?

A: The internal audit report is generally not shared with external stakeholders, but it may be required to be disclosed to regulatory authorities or external auditors if necessary.

Q: Can the internal audit report be used for decision-making?

A: Yes, the findings and recommendations in the internal audit report can be used by management and the board of directors to make informed decisions and improve the organization's operations.

Q: Is the internal audit report legally binding?

A: The internal audit report itself is not legally binding, but it may lead to additional actions or investigations depending on the findings and recommendations.

Q: Who should review the internal audit report?

A: The internal audit report should be reviewed by the management, board of directors, and the audit committee of the organization.

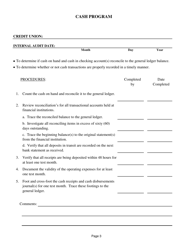

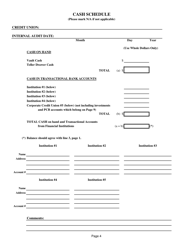

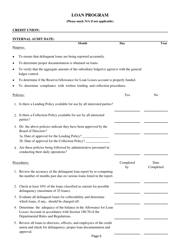

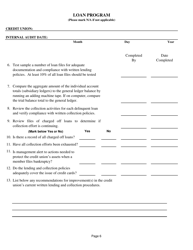

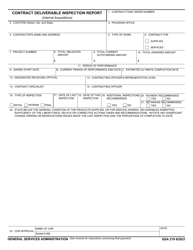

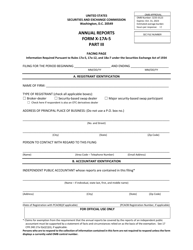

Form Details:

- The latest edition currently provided by the Illinois Department of Financial and Professional Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Illinois Department of Financial and Professional Regulation.